What you will learn

- Potential benefits of alternative investment strategies

- Why alternatives have become popular with investors

- How to incorporate alternatives in a portfolio

Three potential benefits of alternative investment strategies

As part of a well-diversified portfolio comprised of different asset classes, alternative investments can help investors pursue attractive returns. Traditional equity and fixed income investments have long been considered the key components of a well-diversified portfolio. While this approach to asset allocation can deliver satisfactory performance, investors may be able to strengthen their returns and enhance diversification by incorporating a broader range of investments that include alternatives. Below are three potential benefits.

-

Diversification

Diversification is key to many successful investment portfolios. Since alternative investments typically have a low or negative correlation to traditional investments, meaning they typically do not move in lockstep with stocks and bonds, they can help diversify a portfolio.

By spreading capital across multiple investment types, investors may be able to reduce the risk of losing overall portfolio value in times of a market downturn or when a particular investment underperforms. It is important to note that diversification does not ensure against loss. It is a tool to help manage risk.

-

Higher potential returns

Because alternative investments may be more complex and less frequently traded, they offer the potential for higher long-term performance than traditional investments.

However, alternatives’ returns are highly dependent on the type of alternative investment chosen. Return targets differ across investment types, and performance across funds of the same strategy can even vary significantly. This disparity underscores the importance of due diligence when investing in any alternative strategy. Leveraging specialists who have the resources to scale, source, and evaluate opportunities globally, as well as a proven performance track record, can be a valuable approach.

-

Downside risk mitigation

The events of 2008-2009 demonstrated that conventional diversification strategies are not enough to protect against market volatility. Because alternative investments typically don’t follow the same performance path as traditional stocks and bonds, they may provide investors with a hedge or way to mitigate risks when public markets are volatile if those investors are sufficiently diversified and uncorrelated. For example, alternative strategies may employ techniques designed to profit when an asset depreciates in value, such as short-selling, or hedging strategies which may offset the risk of unexpected price movements.

During periods of economic and market uncertainty, many investors may find it beneficial to look beyond traditional asset classes for new sources of diversification and returns.

Many types of alternatives have historically helped to minimize downside risk while delivering the potential for attractive returns in challenging equity and fixed income markets. For this reason, many investors have been supplementing their core stock and bond allocations with alternative investments as a way to potentially enhance portfolio stability and pursue their return objectives.

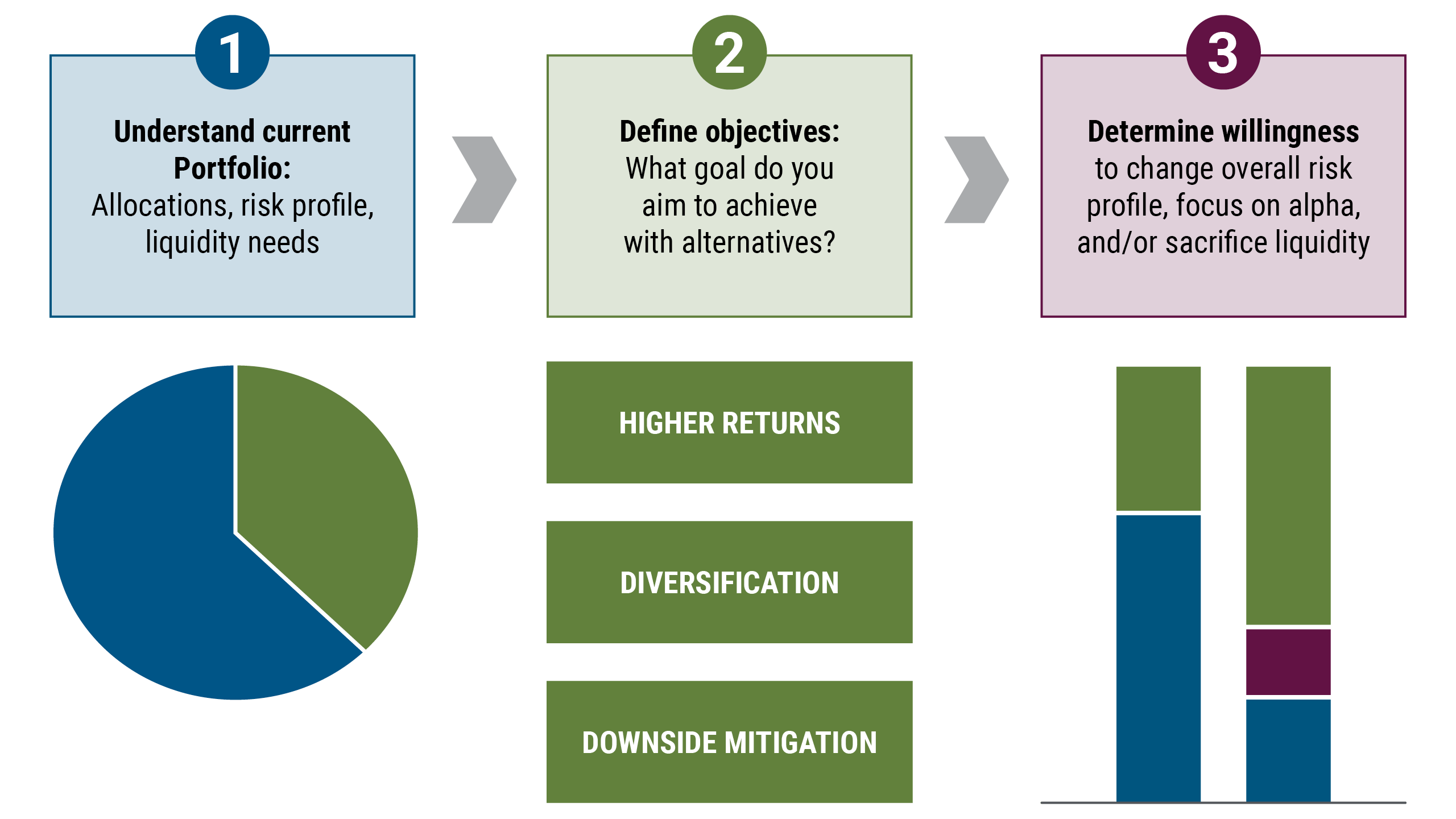

The three steps below can help investors allocate to alternatives:

How much should an investor allocate to alternatives?

The thoughtful integration of alternatives into a traditional portfolio requires a focus on an investor’s specific goals and risk tolerance, as well as his or her comfort with long-term, illiquid investments.

Looking at High-Net-Worth (HNW) investors (those with $5 million or more in total investable assets) showed an average of 9.1% of assets allocated to alternative investing options in 2022, up from 7.7% in 2020, and financial advisors expect this to increase to 9.6% in 2024, according to a report by research firm Cerulli Associates.1

1 The Cerulli Report – U.S. High Net Worth and Ultra High Net Worth Markets 2022: Shifts in Alternative Allocations January 17, 2023 ↩