What you will learn

- What Tail risk is and the impact on a portfolio

- The frequency of left tail events

- How tail risk hedging can help to mitigate risk and enhance potential returns

What is tail risk?

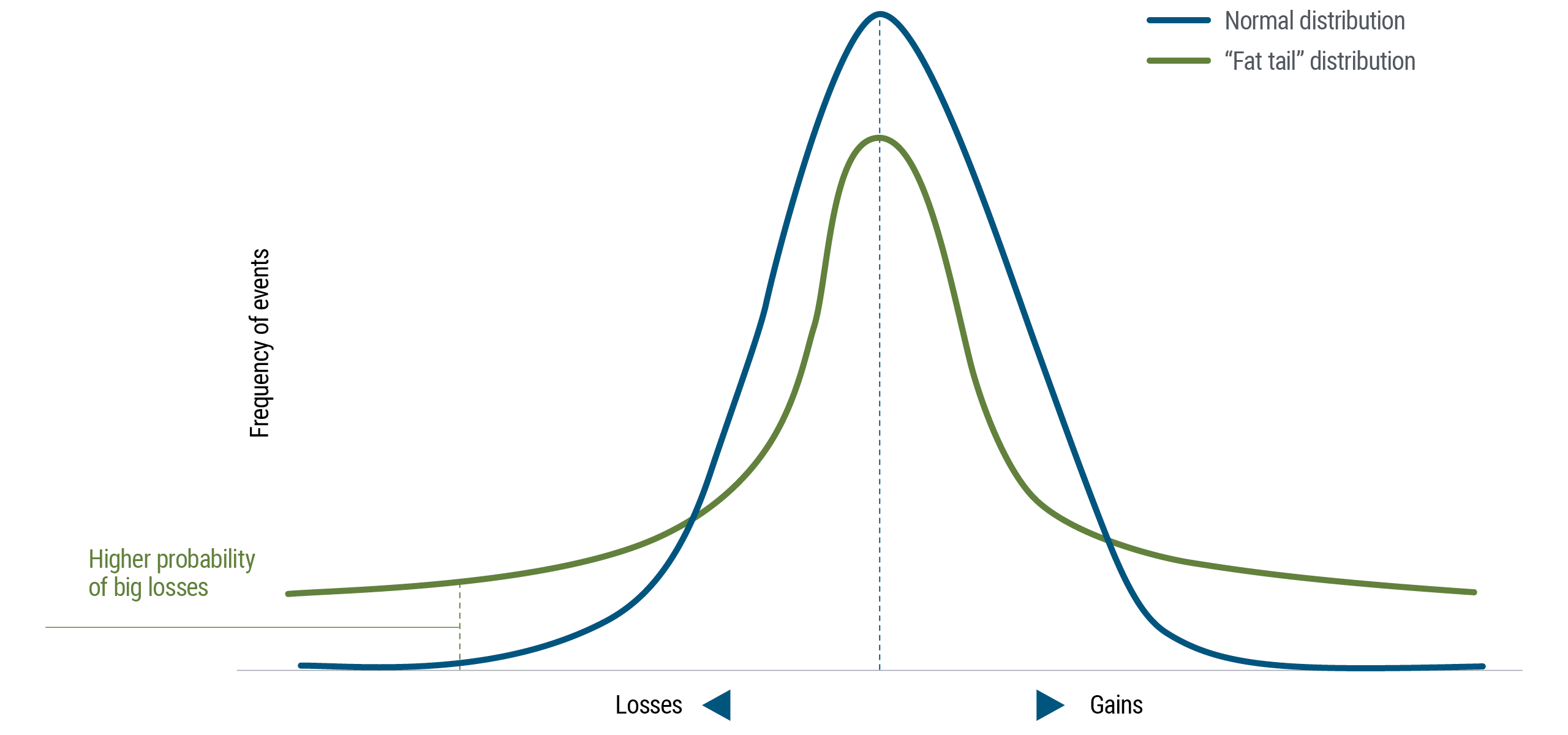

The term “tails” refers to the end portions of distribution curves – the bell-shaped diagrams that show statistical probabilities for a variety of outcomes. In the case of investing, bell curves plot the likelihood of achieving different investment returns over a specified period.

As shown in the diagram below, the most probable returns are concentrated in a bulge near the center, which is the average expected return, or the mean. The less probable, more extreme returns, on the other hand, taper away towards the left and right edges. The tails on the far left and far right represent the least likely, most extreme outcomes with lowest returns on the left and highest returns on the right. For long-term investors, the ideal portfolio strategy will seek to minimize left tail risk without curtailing the right tail growth potential.

What is the frequency of left-tail events?

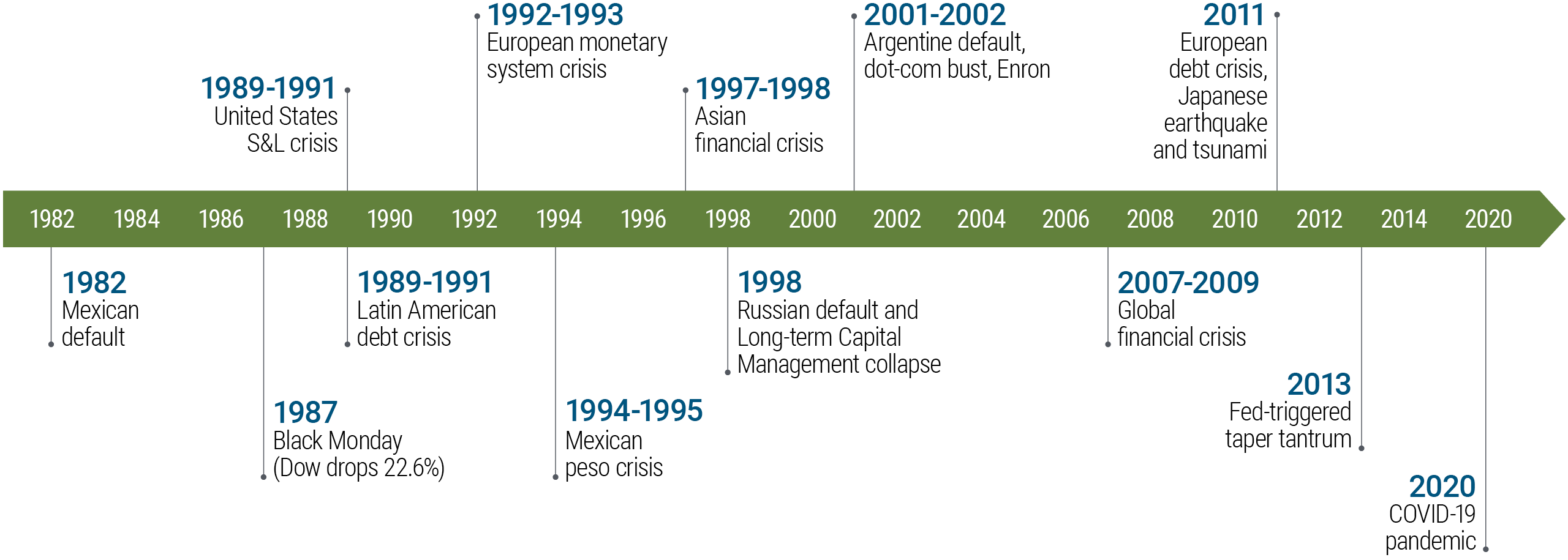

Traditional strategies often rely on normal bell curves to make market assumptions, but in reality, markets do not always behave “normally.” Contrary to investor expectations, periods of financial stress have appeared with stepped-up frequency and on an increasingly global scale.

By some estimates, over the past three decades significant market shocks have occurred every three to five years resulting in “fatter” tails than a normal curve would predict, as shown in the chart below.

These unexpected systemic shocks frequently have quickly triggered panic across markets, creating a downward spiral of declines across a broad spectrum of investments. Because they tend to be widespread and difficult to predict, left tail events have often had a negative impact on portfolio returns.

How can tail-risk hedging help mitigate risk?

Tail risk hedging can be an appropriate strategy that enables investors to pursue their objectives without having to significantly adjust their risk and/or return expectations after a market crisis.

Professional investment managers employ tail-risk hedging in a number of ways. One method is to limit portfolio risk by weighting asset allocation to less volatile sectors.

Another method is keeping asset allocation constant, while complementing it with strategies such as equity puts, credit protection, currency options and interest rate options.

The cost of hedging can vary significantly over any given timeframe, and “just in time” hedging is nearly impossible. This is because by the time an investor decides to hedge, the market correction may have already begun and hedging may have already become expensive.

Hedges can be included as a permanent part of an asset allocation and hence would be in place when needed. Even in a rising market, tail risk hedging can potentially add value, providing a “trailing stop” to the portfolio that may give investors more conviction in maintaining their allocations to risk assets when markets rally.