As investors, we believe fixed income – or bonds – could soon rise to a place of leadership in sustainable investing. There is growing recognition in the marketplace that integrating ESG (environmental, social and governance) factors into traditional credit analysis adds a holistic and long-term perspective that aligns well with bond investing. Moreover, issuers often return to the bond market – unlike the stock market – in order to refinance old debt or seek new funding, giving bond investors a unique opportunity to identify risks, engage issuers and build relationships that can influence change.

Common approaches to sustainable investing in fixed income

Sustainable investing is a spectrum of approaches that consider ESG factors in portfolio construction and management. These include:

- Negative/positive screening: exclude or include sectors or securities based on pre-defined ESG criteria

- ESG integration: the addition of ESG considerations alongside traditional financial analysis when buying or selling securities

- Thematic: aligning asset allocations with a particular ESG theme, such as clean energy

- Impact investing: seeking to deliver positive societal outcomes as a key investment objective

- Issuer engagement: engage issuers to influence sustainable behavior and practices

Source: Global Sustainable Investment Alliance (GSIA)

PIMCO’s three-step approach to building ESG portfolios

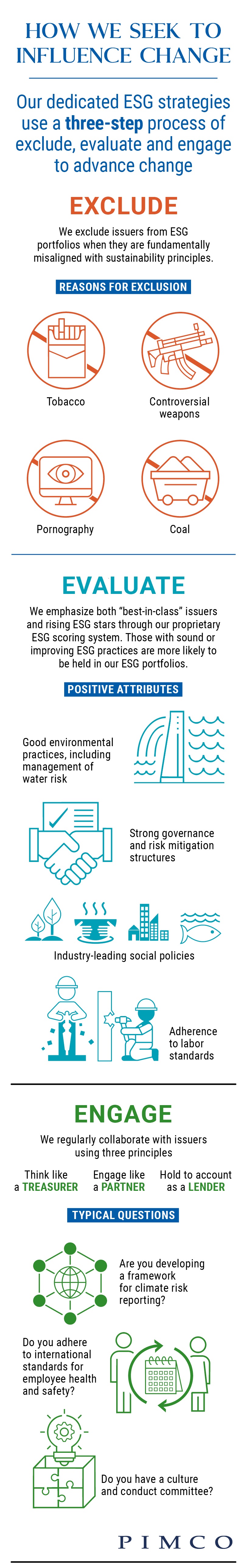

PIMCO’s dedicated ESG strategies combine a number of approaches. They follow our time-tested investment process, applied to every portfolio, while using three additional buildings blocks: exclusion, evaluation and engagement. We call this our three-E process. Here’s what that means:

- We exclude issuers that are fundamentally misaligned with sustainability principles.

- We evaluate issuers through our proprietary ESG scoring system to identify “best-in-class” ESG issuers and candidates for engagement.

- We engage with issuers that demonstrate a clear willingness to move toward better ESG-related practices. We believe that allocating capital toward issuers willing to improve the sustainability of their business practices can generate a greater impact than simply excluding issuers with poor ESG metrics and favoring those with strong metrics.