What you will learn

- The importance of asset allocation

- The impact of globalization on asset allocation

- How to manage asset allocation

What is asset allocation?

Asset allocation is the process of balancing risk and return in a portfolio by investing across different asset classes, which are investments often grouped together. The major asset classes include bonds, stocks and cash. Other asset classes include commodities, currencies, real estate, and alternatives.

Asset allocation matters for many investor to help them pursue their investment goals. It is likely to have a bigger impact on portfolio performance than individual investments, as explained below.

Maintaining a diversified portfolio can help investors prepare for shifts in the economy, providing potential to capture opportunities and minimize the risk of overconcentration.

Traditional asset allocation strategies seek to mitigate overall portfolio volatility by combining asset classes with low correlations to each other – that is, asset classes that don’t tend to move in the same direction at the same time.

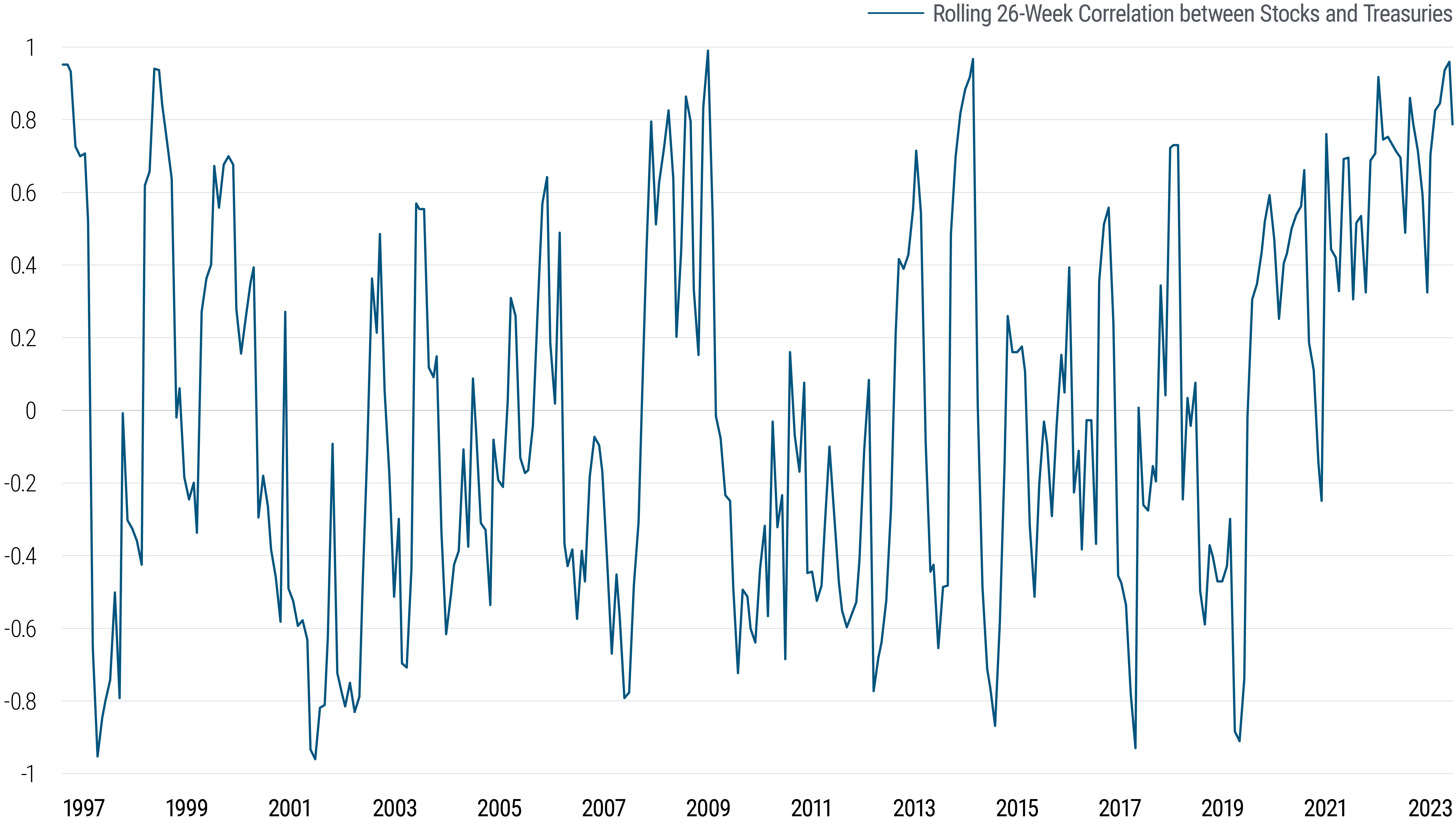

For example, the correlation between U.S. stocks and bonds has been mostly negative for the past 15 years, as shown in the chart below.

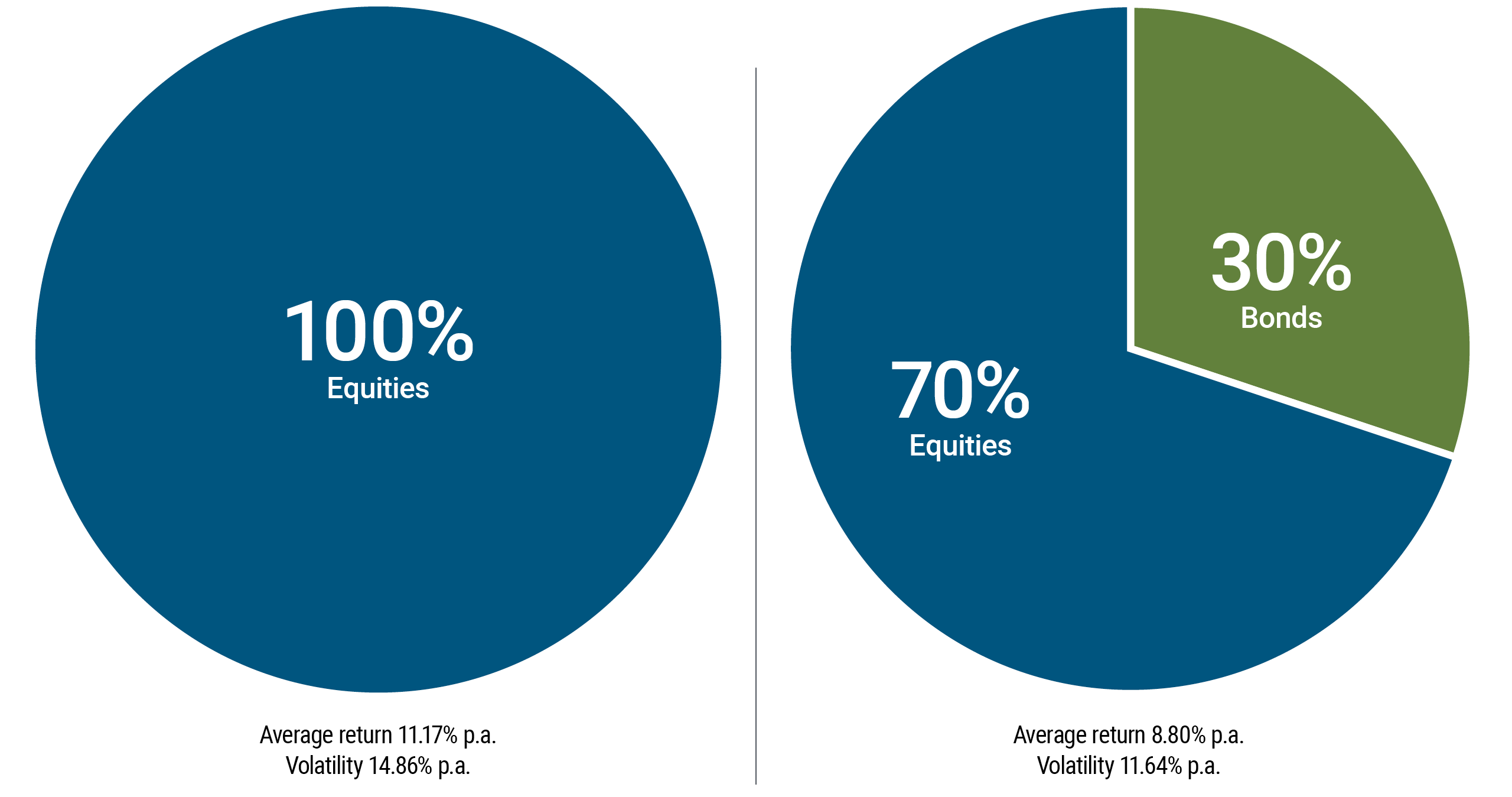

The portfolio examples below help illustrate the potential benefits of combining asset classes with low or negative correlations. The portfolio in scenario 1 is invested entirely in U.S. equities, while the portfolio in scenario 2 has a 70% allocation to equities and a 30% allocation to bonds. As shown in the average return and volatility (used as a measure of risk) data below the pie charts, having more than one asset class with low or negative correlations to each other (equities and bonds) can help lower volatility while still achieving solid growth.

What is the impact of globalization on correlation?

In today’s market, asset class correlations have become less stable than many investors realize. Long-term trends such as globalization have driven correlations higher.

In addition, correlations may increase during periods of market turbulence. As a result, seemingly distinct asset classes appear likely to behave more similarly than many investors expect.

This environment makes it more challenging to construct a truly diversified and resilient portfolio because assets that were previously unrelated can now represent exposure to the same risk factors.

How can investors implement asset allocation?

Professional investment managers help investors implement asset allocation using two methods – strategic asset allocation and tactical asset allocation. By using both in combination, the manager sets the long-term course for the portfolio and responds to short-term market drivers.

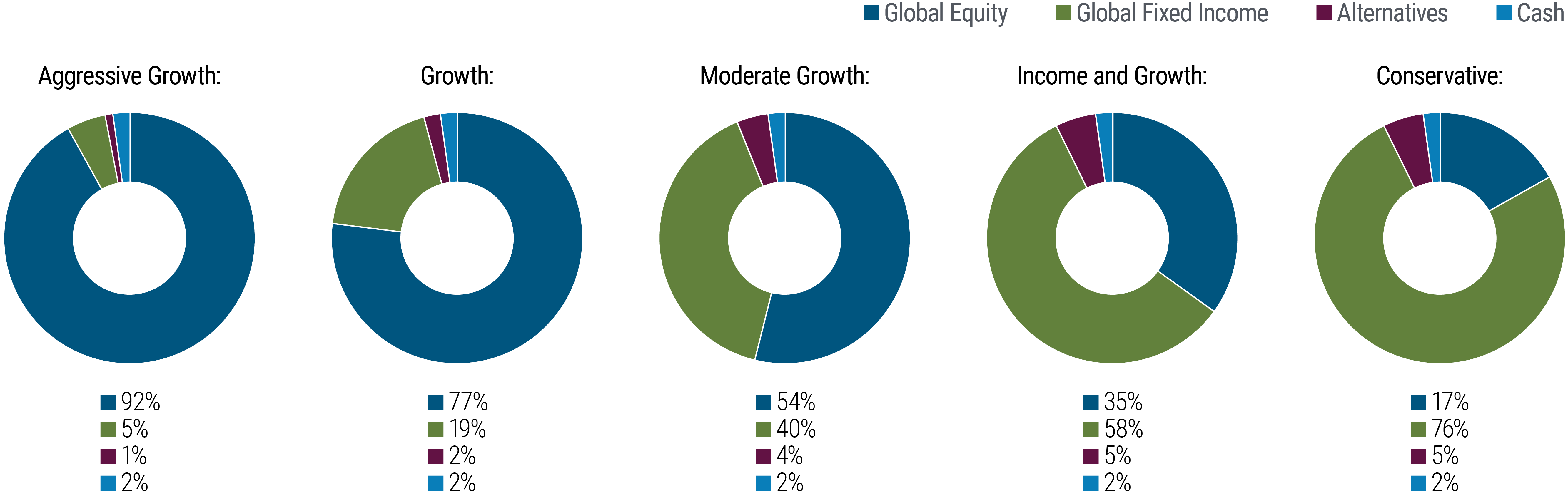

Strategic asset allocation, which provides the long-term focus for a portfolio, is based on three key factors: investment objectives, risk tolerance, and time horizon. Depending on the return targets and the level of risk that investors can tolerate, portfolios may be labeled as conservative, income and growth, growth, or high growth. Below are examples of hypothetical portfolios showing percentage of allocation targets for different asset classes.

Given that markets constantly change, maintaining strategic asset allocation in a portfolio requires periodic rebalancing to maintain target allocations. In addition, an investor’s strategic asset allocation will likely change over time to reflect changing investment objectives, risk tolerance, and time horizons.

Tactical asset allocation, on the other hand, uses active management to increase or decrease exposure to a certain asset class based on macroeconomic fundamentals, valuations and market movements. Tactical asset allocation takes advantage of short-term opportunities, complementing the strategic asset allocation direction.

A well-diversified portfolio may also invest in different investments within each asset class. For example, the equity allocation in a portfolio may include domestic and international equities across a number of sub-sectors within those markets.

Download 5 Things You Need to Know About: Asset Allocation for more information.