Principled Populism

In the years before retiring from PIMCO in 2010, I often interviewed candidates for professional positions here, usually at the end of the process,after they had been thoroughly vetted through several rounds of interviews. My task was not so much to test candidates’ qualifications as to “taketheir measure” – and for them to take mine!

I had two unusual questions I would frequently ask, neither with necessarily a right or wrong answer. I wasn’t looking for answers, rather for listeningand answering style.

The first question was:

“I don’t trust a person without at least one foible or vice. Are you trustworthy?”

Here, what I was “testing” foremost was the candidate’s listening skills under pressure.

Note, the question I was asking is: “Are you trustworthy?”

I wasn’t putting the job seeker on a couch, seeking deep, dark personal secrets, which would be against legal protocol.

I was simply asking: “Are you trustworthy?”

Obviously, there is a wrong answer to that question, which would be “no.” But there really wasn’t a right answer, though a simple one-word “yes” reveals adeep appreciation for Occam’s Razor.

I heard many funny answers. As well as many evasive ones. All to a question that I didn’t ask!

The second question:

“What is your favorite chapter in Keynes’ The General Theory?”

I trust that the legal mavens would not even think about the propriety of that question.

Here, too, I was testing the candidate’s listening skills under pressure. But foremost, I was seeking the interviewee to self-identify as either a macro ora micro person. Neither is right or wrong, as they are distinctly different disciplines. And investment managers need robust skills in both spaces.

I was simply seeking the candidate’s visceral reaction to the question.

And a straightforward “I don’t know, I’ve never read it” was a perfectly fine answer. Especially if the candidate had also answered a simple “yes” to myfirst question – trustworthy!

I always hoped that I would hear a loud: “Chapter 12!” But I never did, not once. Almost always, including from those with Ph.D.s in economics, I wouldhear some version of “I’ve never actually read The General Theory, but …”

And here, there was one wrong answer on the other side of the “but,” which I actually heard several times: “… isn’t Keynes a disproved economic theory anyway?” The interviews didn’t last long thereafter.

More frequently, what I would hear was “… but I’m very familiar with Keynesian economics.” Fair enough; there are many scholars and theorists who I know and understand, but I have never actually read their original scribbling.

In response to that trustworthy reply, I would proceed with questions to test “very familiar.” My workhorse follow-up: “What is the role of the paradox ofaggregation in Keynes’ work?”

I had many delightful conversations thereafter. Regrettably, however, very few candidates actually grasped that macroeconomics is not simply the “summingof” microeconomic outcomes, that macro is a distinctly different discipline from micro, grounded in many paradoxes of aggregation.

By the end of my grilling, many candidates acknowledged their lack of fluency in this existential essence of Keynes. Others simply thought me daft, I suspect.

New question

Since taking up my new role as Chief Economist here, I haven’t been asked to interview any job-seeking candidates. But I’m sure I will.

And in the spirit of transparency, I will have a new question to ask:

“How does a nation’s productivity growth become real wage growth for ordinary citizens, in the context of low inflation and moderate long-term interestrates?”

For newly-minted graduates, the “A” answer, revealing and confirming the scholastic achievement warranting the job interview, will be:

“Real wage growth can be achieved if and when productivity growth pulls unit labor costs below the rate of price inflation, such that capital can grantnominal wage increases to labor in excess of price inflation for goods and services, without inducing either profit margin compression and/or cost-pushinflationary pressures.”

Yep, that’s the textbook answer, usually adorned with platitudes about how wonderful productivity growth really is, the secret sauce of rising livingstandards for all.

Which, of course, will beget an obvious follow-up question:

“How has the real world lived up to that textbook answer in your lifetime?”

I don’t expect to hear many robust answers from candidates, because my profession doesn’t like to research or teach matters related to the distribution of a nation’s income – messy matters fraught with political overtones, many professors mumble from ivory towers.

This is particularly the case for monetary mavens, who cleave to the doctrine of the “neutrality of money,” arguing that the only thing that monetarypolicy can influence in the long run is the nominal price level (or inflation), not “real” variables, including the rate of employment and the relativereturn to labor versus capital.

Thus, I will forgive future job interviewees if they stumble in answering how the secret sauce of productivity growth translates empirically into risingstandards of living for the middle class.

Here’s the right answer: A prolonged economic boom.

Yes, that is the answer of history: Labor only gets its “fair share” of productivity growth – meaning a rising share of national income not associated withrecessions, which poleaxe profits, among other things – when the Federal Reserve “allows” the economy to rip for a long, long time.

Rich’s Ratio

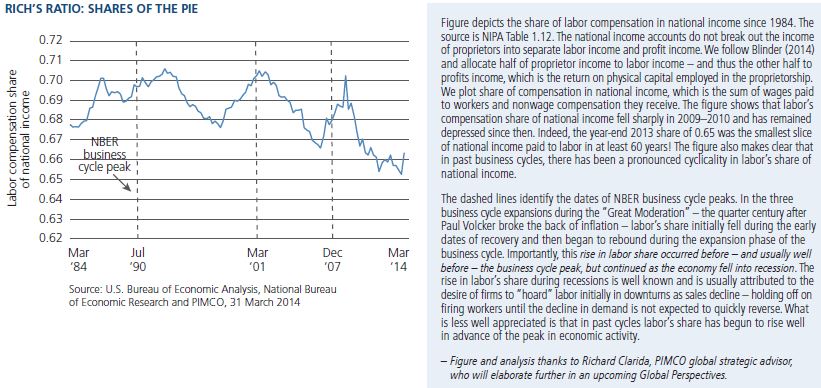

The chart below says it all, introducing what I dub Rich’s Ratio, created by my colleague Rich Clarida (a rare ivory-tower guy who lives in the realworld): Only in the later days of economic expansions – before they are murdered by anti-inflation Fed rate hikes (and/or the bursting of asset bubbles) –does labor gain sufficient pricing power to capture from capital a bigger piece of a bigger economic pie.

Thus, my textbook question for future newly-minted MBAs and Ph.D.s is actually a here-and-now pocketbook question for market participants:

“What will be the Fed’s attitude, and thus policy stance, toward accelerating wages as the U.S. economy emerges from its Minsky Moment-inspired liquiditytrap?”

Fed Chair Janet Yellen spoke to this issue earlier this month:

My own expectation is that as the labor market begins to tighten, we will see wage growth pick up some to the point where real wage growth, wherecompensation or nominal wages, are rising more rapidly than inflation, so households are getting a real increase in their take-home pay.

And within limits – well, that might be signs of a tighter labor market. Within limits, it’s not a threat to inflation because consistent with the level ofinflation we have for our 2 percent inflation objective, we could see wages growing at a more rapid rate and – a somewhat more rapid rate – and, indeed,that would be part of my forecast of what we would see as the labor market picks up.

If we were to fail to see that, frankly, I would worry about downside risk to consumer spending. So I think part of my confidence in the fact that we’llsee a pickup in growth relates to the fact that I think consumer spending will continue to grow at a healthy rate. And, in part, that’s premised on somepickup in the rate of wage growth so that it’s rising greater – more than inflation.

Bluntly put: Chair Yellen wants labor to get a fairer share of the fruits of the economy’s productivity: nominal wage gains greater than inflation – realwage gains. She wants Rich’s Ratio to go up!

In response to her testimony, nattering nabobs of Wall Street have lambasted her for either being, or planning to be, “behind the curve” of priceinflation, on the presumption that capital will refuse to eat real wage gains in shrinking profit margins, unleashing cost-push pressures that will takeprice inflation cyclically beyond its long-term 2% objective.

Yes, that’s what the bond market vigilantes of my youth have become: nattering nabobs, presuming that the Fed’s long-term inflation objective is also acyclical ceiling. It is not!

Goodbye zero

Yet, despite wanting to see labor capture real wage gains, Chair Yellen would also very much like to get off the zero lower bound (ZLB) for the Fed’spolicy rate, not because it has been ineffectual in nurturing the U.S. economy out of a liquidity trap, as so many natterers argued in recent years, butbecause it has worked.

There is nothing natural and neutral about zero; it is a rate that the Fed never wants to see, because it never wants to be in a Liquidity Trap. But whenone hits, the Fed should embrace zero without reservation. Such has been the case since late 2008, with the power of zero turbocharged by forward guidanceas to its longevity, buttressed by the commitment credibility of large-scale asset purchase programs, known as quantitative easing programs (QEs). The Fedwent all in, not because it wanted to, but because it was the right macroeconomic thing to do.

And it worked! The Fed will be ending QE3 this fall, freeing itself from its commitment to remain pinned against the ZLB. Lift off from zero looms in 2015.Appropriately!

But the legacy of getting out of the liquidity trap with all-in monetary policy alone (that is, without proper fiscal expansion) will remain: Such a policyhas favored those who have both capital and labor to bring to the economic party over those with labor only. This is not a dirty little secret, butreality, plain for all to see, painfully so for the Fed. Just look at Rich’s Ratio!

Accordingly, the Fed has no interest whatsoever in listeningto calls from Wall Street to view accelerating wages as a problem that needs to be solved.

Rather, it is a delight to be celebrated. The Fed would love to see a long bull market in Rich’s Ratio. The war on inflation was won long ago, and the timehas come for a peace dividend paid to labor.

Yes, to labor, not capital.

Two percent ain’t a ceiling

Achieving this outcome means that the Fed should – and thus, will! – remain “behind the curve” of the nattering nabobs for a long, long time after liftofffrom zero. The curve that matters is Rich’s Ratio. If a rising return to labor (which Wall Street insists on calling “inflation”) involves some pickup forprice inflation to and beyond the Fed’s long-term 2% objective, so be it.

Fed officials will never be so blunt as I am here, and I wouldn’t be either, if I was in their seat. Political correctness and all that.

But the truth of the matter is that 2% would be a nefariously low place for price inflation to be at the onset of the economy’s inevitable “next”recession. Thus, if nurturing a long bull market in Rich’s Ratio has the collateral consequence of taking inflation cyclically above the Fed’s 2% seculartarget, that would be a delightful outcome: building a buffer against deflationary pressures in the “next” recession.

Parting question: What’s your definition of “moderate?”

This scenario implies a slow but long grind up for bond yields in the years ahead. I do recognize that. But the Fed’s mandate doesn’t include a bull marketin bonds. Rather, the Fed’s mandate reads:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and creditaggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment,stable prices and moderate long-term interest rates.”

Yes, the Fed has not just a dual mandate of full employment and low inflation, but also a mandate of “moderate long-term interest rates.” In wonk space, this third mandate usually gets no more than a hand wave, on the presumption that if the Fed meets the first two mandates, particularly the low inflation mandate, the third will “naturally” be met: long-term interest rates will be “moderate.”

Right now, long-term interest rates are not “moderate” by anybody’s reading, but “low,” anchored by as-low-as-they-can-go Fed policy rates.

Once the Fed lifts off the ZLB for its policy rate, an act already discounted in prevailing “low” long-term interest rates, there is ample room for the Fedto let Rich’s Ratio climb for a long time, before fostering a breach of its inflationary mandate so egregious as to warrant immoderately high long-terminterest rates.

And that’s exactly what I expect the Fed to do in the years ahead: Let Rich’s Ratio run.

Disclosures

This material contains the opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO and YOUR GLOBAL INVESTMENT AUTHORITY are trademarks or registered trademarks of Allianz Asset Management of America L.P. and Pacific Investment Management Company LLC, respectively, in the United States and throughout the world. ©2023, PIMCO.