Across the Spectrum: Understanding Public and Private Credit

When you think of “credit,” bonds may not be the first thing that springs to mind. Yet, credit is actually a major component of the bond markets, accounting for $13 trillion of the global fixed income universe.1 That’s a lot of opportunity for investors to tap into.

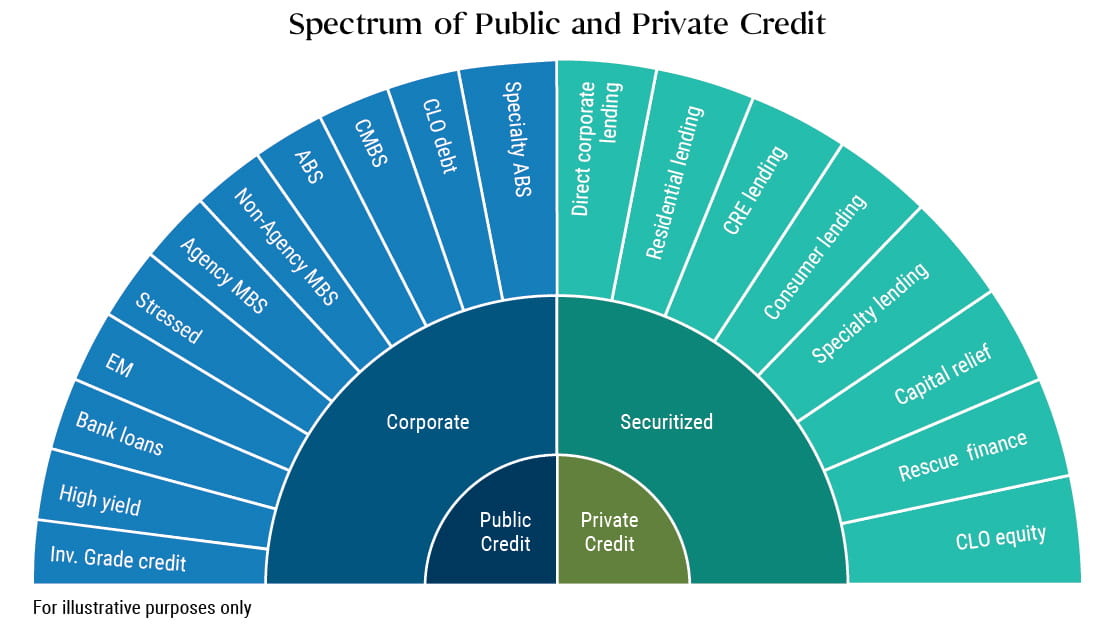

Broadly, an allocation to credit can enhance return potential, boost diversification and provide income, which is why it’s so important to for investors to understand this rich opportunity set. Credit is much more than one type of bond or investment - it encompasses a spectrum of different categories, each with its own risk/return profile, across the public and private markets.

The visual below divides the types of credit investments into public credit (those that trade in public markets) and private credit (negotiated outside of the public markets), to help you get a sense of the scope of the market and possible investment opportunities.

How are these markets related?

The public and private credit markets are tightly knit, and it is important to understand both in order to better value opportunities across the spectrum.

Here we provide examples of some public and private credit investments to give you a sense of what they look like in practice:

Corporate credit example:

- Public transaction: Purchase a new issue bond from a major retailer that has assets to use as collateral for issuing new debt into the marketplace

- Private transaction: Structure a term loan to major retailer that faces liquidity challenges

RMBS and residential whole loan example:

- Public transaction: Purchase a non-agency RMBS bond, backed by a pool of residential home loans

- Private transaction: Purchase a pool of individual residential loans from a mortgage lender. In this case, the buyer holds the individual loans directly, versus a bond backed by a pool of individual loans

CMBS and CRE lending example:

- Public transaction: Purchase an MBS bond, secured by a portfolio of commercial real estate assets.

- Private transaction: Purchase a commercial real estate first mortgage lien on a single property, secured by a commercial building that has underlying equity in the building

ABS and consumer lending example:

- Public: ABS backed by graduate student loans of high-quality borrowers

- Private: ABS backed by private short-term consumer loans sourced from a non-bank lender

Overview of each category

To help you better understand the types of opportunities offered within credit, we’ve provided a brief overview of each category across the spectrum:

Public credit: Debt issued or traded on the public markets.

Private credit: Privately originated or negotiated investments, comprised of potentially higher yielding, illiquid opportunities across a range of risk/return profiles. They are not traded on the public markets.

Corporate: Bonds issued by a corporation in order to raise financing for a variety of reasons such as for ongoing operations, mergers and acquisitions, or to expand business.

Securitized: When cash flows from various types of loans, such as car payments, credit card payments and mortgage payments, are bundled together and resold to investors as bonds. The largest securitized sectors are mortgage-backed securities and asset-backed securities.

Investment grade: Corporate bonds with a high-quality credit rating (BBB or higher) by established rating agencies.

High yield: Corporate bonds with a lower credit quality rating (below BBB- or Baa3) by established rating agencies.

Bank loans: Where commercial banks or other financial institutions lend specified sums of money to companies in exchange for repayment of the loan principal amount plus interest.

EM (Emerging Markets): Bonds issued by companies domiciled in emerging market countries.

Stressed: Debt issued by quality companies that are facing short-term business complications where their bonds are trading at a significant discount to par.

Agency Mortgage-Backed Securities (MBS): Securities comprised of bundles of home loans issued by one of these three agencies: Government National Mortgage Association (known as GNMA or Ginnie Mae), Federal National Mortgage (FNMA or Fannie Mae), and Federal Home Loan Mortgage Corp. (Freddie Mac).

Non-Agency Mortgage-Backed Securities (MBS): Mortgage-backed securities issued by private entities like financial institutions. These non-agency MBS or private-label securities are not guaranteed by any government-sponsored enterprise.

Asset-Backed Securities (ABS): Bonds created from car payments, credit card payments or other loans. As with mortgage-backed securities, similar loans are bundled together and sold. ABS are typically “tranched” into high and lower-quality classes of securities.

Commercial mortgage-backed securities (CMBS): Bundles of mortgages on commercial properties, rather than residential real estate. The underlying securities may include a number of commercial mortgages of varying terms, values, and property types — such as multi-family dwellings, office and industrial.

Collateralized Loan Obligation (CLO Debt): Single securities backed by a pool of debt. They are often corporate loans with lower credit ratings or leveraged buyouts made by a private equity firm to take a controlling interest in an existing company.

Specialty ABS: Specialty, or nonfinancial assets, that may include ranches, farms, real estate interests or natural resources rights.

Direct corporate lending: Unsecured lending to a company that relies primarily on the company’s future cash flows, not on specific collateral.

Residential lending: Loans for personal, family or household use secured by a mortgage, deed of trust or other equivalent consensual security interest on a dwelling or on land on which a person intends to build a dwelling.

CRE (Commercial Real Estate) lending: Lending toward income-producing property used solely for business, including shopping centers and mall, office buildings and complexes, and hotels. Financing is typically gained through commercial real estate loans: mortgages secured by liens on the commercial property.

Consumer lending: Loans for personal, family, or household purposes, which can come from a variety of sources, including financial institutions or lending platforms. These loans are typically unsecured (with some exceptions), meaning they don’t require collateral.

Specialty finance: Financing activity that takes place outside the traditional banking system. Specialty finance firms are thought of as non-bank lenders that make loans to consumers and small to midsize businesses that cannot otherwise obtain financing

Capital relief: Deals put together by banks to sell on to investors to reduce the bank's regulatory capital requirements. These transactions enable banks to use the capital markets to shed some of their risk by buying credit protection on a portfolio of loans.

Rescue finance: Financing provided to a company that urgently requires it to avoid default, provide liquidity, or comply with applicable capital requirements.

To learn more about alternatives, visit Understanding Alternative Investments.

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

A word about risk: All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee, there is no assurance that private guarantors will meet their obligations. U.S. agency mortgage-backed securities issued by Ginnie Mae (GNMA) are backed by the full faith and credit of the United States government. Securities issued by Freddie Mac (FHLMC) and Fannie Mae (FNMA) provide an agency guarantee of timely repayment of principal and interest but are not backed by the full faith and credit of the U.S. government. Bank loans are often less liquid than other types of debt instruments and general market and financial conditions may affect the prepayment of bank loans, as such the prepayments cannot be predicted with accuracy. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower’s obligation, or that such collateral could be liquidated. Private credit involves an investment in non-publically traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Investments in Private Credit may also be subject to real estate-related risks, which include new regulatory or legislative developments, the attractiveness and location of properties, the financial condition of tenants, potential liability under environmental and other laws, as well as natural disasters and other factors beyond a manager’s control. Collateralized Loan Obligations (CLOs) may involve a high degree of risk and are intended for sale to qualified investors only. Investors may lose some or all of the investment and there may be periods where no cash flow distributions are received. CLOs are exposed to risks such as credit, default, liquidity, management, volatility, interest rate and credit risk. Corporate debt securities are subject to the risk of the issuer’s inability to meet principal and interest payments on the obligation and may also be subject to price volatility due to factors such as interest rate sensitivity, market perception of the creditworthiness of the issuer and general market liquidity. Diversification does not ensure against loss.

This is neither an offer to sell nor a solicitation of an offer to buy interest in any product or strategy in any jurisdiction. Alternative investments may be suitable only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment. Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This presentation contains the current opinions of the manager and such opinions are subject to change without notice. This presentation has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this presentation may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark or registered trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.

CMR2020-0901- 1320056