From Libor to SOFR: Demystifying the USD Swap Discounting Transition

The transition from the London Interbank Offered Rate (Libor) to alternative reference rates is slated for completion by the end of 2021, and market participants are busy preparing. As of 16 October 2020, centrally cleared derivatives will be valued with reference to those successor rates – including Secured Overnight Financing Rate (SOFR) in the U.S. – marking an important milestone in the overall move away from Libor. Here is a brief overview of changes investors can expect.

Investors with U.S. dollar-denominated (USD) interest rate swap positions are preparing for a transition in the swap discounting rate from the Effective Federal Funds Rate (EFFR) to the SOFR, the official successor rate to Libor chosen by the U.S. Federal Reserve and the Alternative Reference Rate Committee (ARRC).

This follows a similar transition in the euro-denominated interest rate swap (EUR) market in July. Yet there are some unique features to the USD market transition. Most notably, the transition process for the USD market will incorporate an additional exchange of new swaps with a SOFR-linked leg. These new swaps, which are intended to minimize the impact of the transition process to investors, may be end-users’ first direct exposure to SOFR-based derivatives.

What instruments are affected, and when is the change happening?

This change will only affect USD-denominated interest rate swap products centrally cleared at LCH, CME or EurexFootnote1 (the central counterparties, or CCP) and is effective as of 16 October 2020.

What exactly is changing?

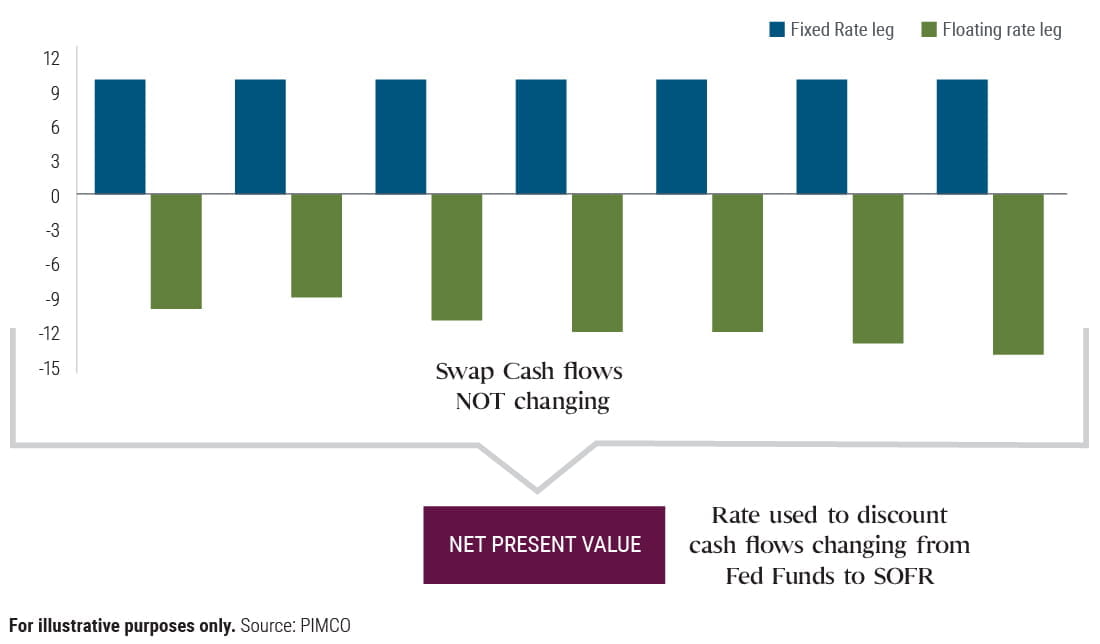

First, it is important to note what is not changing. There will not be any changes to the reference rates and future cash flows of existing swap positions. For example, an interest rate swap position, which receives a fixed rate in exchange for paying Libor, will continue to reference Libor on the floating rate leg.

What is changing is the rate used to calculate the net present value of the future cash flows. Effective 16 October, SOFR is used to calculate the interest earned on the margin asset, known as the price alignment interest (PAI).

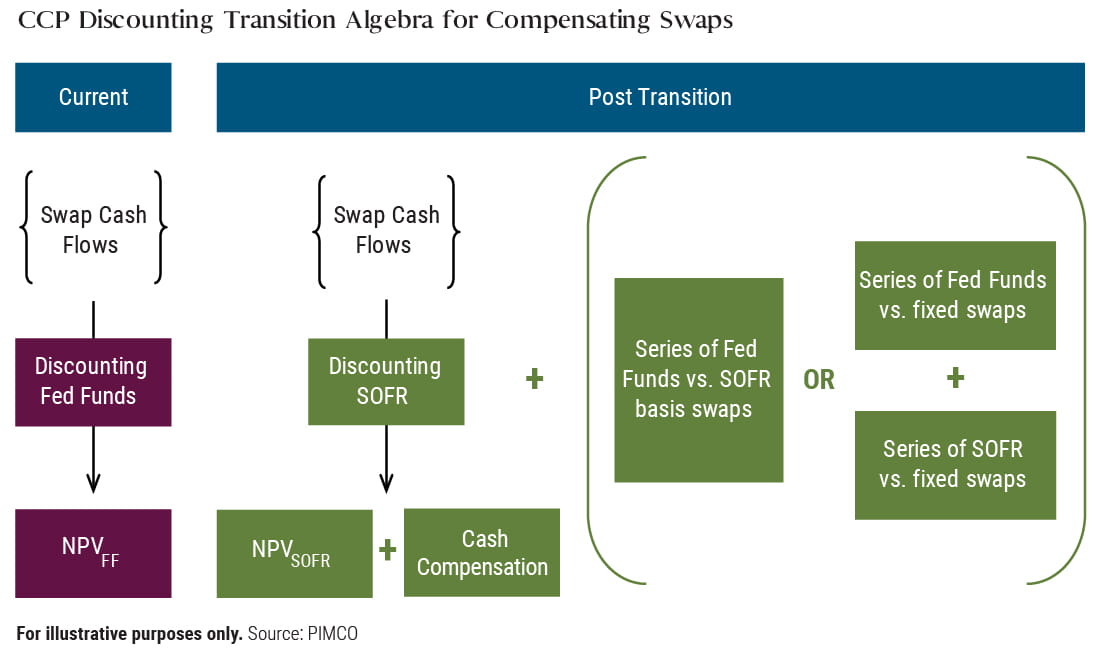

This transition in the discounting rate away from EFFR to SOFR creates a one-day valuation change in existing swap positions, and the CCPs arranged an exchange of compensation and the delivery of swaps to minimize the impact of this one-day valuation change on the market.

Compensating swaps provide a market-value-neutral transition

At the time of the transition, the CCPs value the swap portfolios of each market participant under both an EFFR and SOFR discounting approach. The valuation differences are compensated back to accounts as an equal offsetting cash adjustment.

Once the change is implemented, the swap valuation has risk sensitivity to the SOFR rate. There is a price impact, which can result from movements in the discount rate used to calculate a net present value of the swap cash flows, even if the expectation for the floating rate leg of the swap is unchanged. In order to neutralize the impact of this change, the CCPs are issuing a series of swaps to market participants. This combination of cash adjustment and basis swaps seeks to ensure there is no economic impact to market participants; the overall transition being market value neutral and the risk profile unchanged.

Takeaways for investors

Investment managers, CCPs, and custodians are all coordinating to ensure to ensure a smooth transition. The July changeover for EUR derivatives was an important dry run for the even larger transition of Libor to SOFR swaps.

We believe it is key for investors to understand how their managers are preparing for changes driven by the Libor exit, such as this swap discounting transition, as well as their readiness in other areas like operations, analytics, technology, and risk management.

Disclosures

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2020, PIMCO

CMR2020-0929-1347734