Interest Rate Swaps

- Credit risk: The risk of loss of principal or loss of a financial reward stemming from a borrower’s failure to repay loan or otherwise meet a contractual obligation.

- Central Counterparty (CCP): A clearing house that interposes itself between counterparties to contracts traded in one or more financial markets, becoming the buyer to every seller and the seller to every buyer and thereby ensuring the future performance of open contracts.

- Counterparty risk: The risk to each party of a contract that the counterparty will not live up to its contractual obligations.

- Derivative: A security which derives its value from movements in an underlying security, such as stocks, bonds, commodities, currencies and interest rates.

- Duration: A measure of the sensitivity of the price of a bond to a change in interest rates.

- Fixed-rate bonds: A bond that pays the same amount of interest for its entire term.

- Fixed-rate payments: Interest payments that remain the same amount for the entire term of the security or contract.

- Floating-rate payments: Interest payments that periodically change according to the rise and fall of a certain interest rate index or a specific fixed income security which is used as a benchmark.

- Inter-dealer broker: A broker who acts as an intermediary between dealers in government securities.

- Interest: An amount charged to a borrower by a lender for the use of money, expressed in terms of an annual percentage rate upon the principal amount.

- Interest rate risk: When interest rates rise, the market value of fixed income securities (such as bonds) declines. Similarly, when interest rates decline, the market value of fixed income securities increases.

- Interest Rates: The percentage paid as a fee for the use of money, expressed as an annual percentage of the principal amount. Interest rates are influenced by a variety of factors, including economic growth, inflation and supply/demand.

- Liability Driven Investing: A form of investing in which the main goal is to gain sufficient assets to meet all liabilities, both current and future.

- London Interbank Offered Rate (LIBOR): The posted rate at which prime banks offer to make Eurodollar deposits available to other prime banks for a given maturity which can range from overnight to five years.

- Over-the-counter: A security traded in some context other than on a formal exchange such as the New York Stock Exchange (NYSE) and London Stock Exchange (LSE).

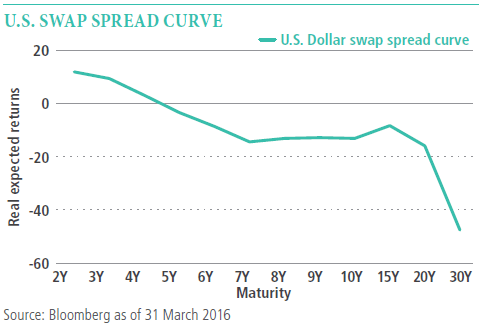

- Swap spread: The spread paid by the fixed-rate payer of an interest rate swap over the rate of the relevant sovereign bond with the same maturity as the swap.

What is an interest rate swap?

An interest rate swap is an agreement between two parties to exchange one stream of interest payments for another, over a set period of time. Swaps are derivative contracts and trade over-the-counter.

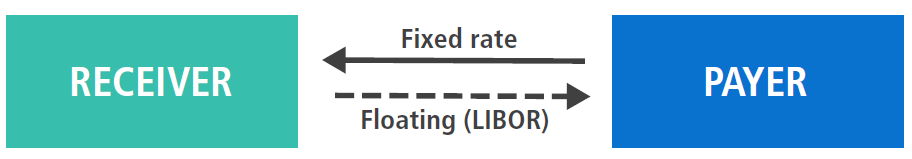

The most commonly traded and most liquid interest rate swaps are known as “vanilla” swaps, which exchange fixed-rate payments for floating-rate payments based on LIBOR (London Inter-Bank Offered Rate), which is the interest rate high-credit quality banks charge one another for short-term financing. LIBOR is the benchmark for floating short-term interest rates and is set daily. Although there are other types of interest rate swaps, such as those that trade one floating rate for another, vanilla swaps comprise the vast majority of the market.

Investment and commercial banks with strong credit ratings are swap market makers, offering both fixed and floating-rate cash flows to their clients. The counterparties in a typical swap transaction are a corporation, a bank or an investor on one side (the bank client) and an investment or commercial bank on the other side. After a bank executes a swap, it usually offsets the swap through an inter-dealer broker and retains a fee for setting up the original swap. If a swap transaction is large, the inter-dealer broker may arrange to sell it to a number of counterparties, and the risk of the swap becomes more widely dispersed. This is how banks that provide swaps routinely shed the risk, or interest rate exposure, associated with them.

Initially, interest rate swaps helped corporations manage their floating-rate debt liabilities by allowing them to pay fixed rates, and receive floating-rate payments. In this way, corporations could lock into paying the prevailing fixed rate and receive payments that matched their floating-rate debt. (Some corporations did the opposite – paid floating and received fixed – to match their assets or liabilities.) However, because swaps reflect the market’s expectations for interest rates in the future, swaps also became an attractive tool for other fixed income market participants, including speculators, investors and banks.

What is the swap rate?

The “swap rate” is the fixed interest rate that the receiver demands in exchange for the uncertainty of having to pay the short-term LIBOR (floating) rate over time. At any given time, the market’s forecast of what LIBOR will be in the future is reflected in the forward LIBOR curve.

At the time of the swap agreement, the total value of the swap’s fixed rate flows will be equal to the value of expected floating rate payments implied by the forward LIBOR curve. As forward expectations for LIBOR change, so will the fixed rate that investors demand to enter into new swaps. Swaps are typically quoted in this fixed rate, or alternatively in the “swap spread,” which is the difference between the swap rate and the equivalent local government bond yield for the same maturity.

A similar principle applies when looking at money itself and considering interest as the price for money. If the real return (adjusted for inflation) on a financial asset differs between two countries, investors will flock to the country with the higher returns. Interest rates have to change to stop this movement. The theory behind this relationship is called the interest rate parity theory. (When looking at interest rates, it is important to distinguish between real rates and nominal rates, with the difference reflecting the rate of inflation. The higher the expected inflation in a country, the more compensation investors will demand when investing in a particular currency.)

What is the swap curve

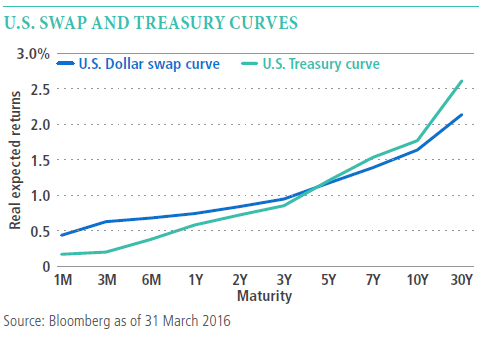

The plot of swap rates across all available maturities is known as the swap curve, as shown in the chart below. Because swap rates incorporate a snapshot of the forward expectations for LIBOR, as well as the market’s perception of other factors such as liquidity, supply and demand dynamics, and the credit quality of the banks, the swap curve is an extremely important interest rate benchmark.

Although the swap curve is typically similar in shape to the equivalent sovereign yield curve, swaps can trade higher or lower than sovereign yields with corresponding maturities. The difference between the two is the “swap spread”, which is shown in the chart below. Historically the spread tended to be positive across maturities, reflecting the higher credit risk of banks versus sovereigns. However, other factors, including liquidity, and supply and demand dynamics, mean that in the U.S. today the swap spread is negative at longer maturities.

Because the swap curve reflects both LIBOR expectations and bank credit, it is a powerful indicator of conditions in the fixed income markets. In certain cases, the swap curve has supplanted the Treasury curve as the primary benchmark for pricing and trading corporate bonds, loans and mortgages.

How does a swap contract work?

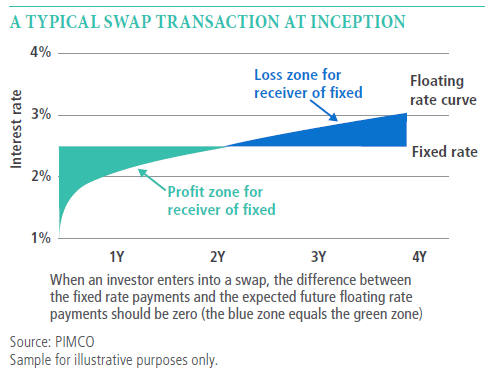

At the time a swap contract is put into place, it is typically considered “at the money,” meaning that the total value of fixed interest rate cash flows over the life of the swap is exactly equal to the expected value of floating interest rate cash flows. In the example below, an investor has elected to receive fixed in a swap contract. If the forward LIBOR curve, or floating-rate curve, is correct, the 2.5% he receives will initially be better than the current floating 1% LIBOR rate, but after some time, his fixed 2.5% will be lower than the floating rate. At the inception of the swap, the “net present value,” or sum of expected profits and losses, should add up to zero.

However, the forward LIBOR curve changes constantly. Over time, as interest rates implied by the curve change and as credit spreads fluctuate, the balance between the green zone and the blue zone will shift. If interest rates fall or stay lower than expected, the “receiver” of fixed will profit (green area will expand relative to blue). If rates rise and hold higher than expected, the “receiver” will lose (blue expands relative to green).

If a swap becomes unprofitable or if a counterparty wishes to shed the interest rate risk of the swap, that counterparty can set up a countervailing swap – essentially a mirror image of the original swap – with a different counterparty to “cancel out” the impact of the original swap.

How to invest in interest rates swaps?

Interest rate swaps became an essential tool for many types of investors, as well as corporate treasurers, risk managers and banks, because they have so many potential uses. These include:

- Portfolio management. Interest rate swaps allow portfolio managers to adjust interest rate exposure and offset the risks posed by interest rate volatility. By increasing or decreasing interest rate exposure in various parts of the yield curve using swaps, managers can either ramp-up or neutralize their exposure to changes in the shape of the curve, and can also express views on credit spreads. Swaps can also act as substitutes for other, less liquid fixed income instruments. Moreover, long-dated interest rate swaps can increase the duration of a portfolio, making them an effective tool in Liability Driven Investing, where managers aim to match the duration of assets with that of long-term liabilities.

- Speculation. Because swaps require little capital up front, they give fixed income traders a way to speculate on movements in interest rates while potentially avoiding the cost of long and short positions in Treasuries. For example, to speculate that five-year rates will fall using cash in the Treasury market, a trader must invest cash or borrowed capital to buy a five-year Treasury note. Instead, the trader could “receive” fixed in a five-year swap transaction, which offers a similar speculative bet on falling rates, but does not require significant capital up front.

- Corporate finance. Firms with floating rate liabilities, such as loans linked to LIBOR, can enter into swaps where they pay fixed and receive floating, as noted earlier. Companies might also set up swaps to pay floating and receive fixed as a hedge against falling interest rates, or if floating rates more closely match their assets or income stream.

- Risk management. Banks and other financial institutions are involved in a huge number of transactions involving loans, derivatives contracts and other investments. The bulk of fixed and floating interest rate exposures typically cancel each other out, but any remaining interest rate risk can be offset with interest rate swaps.

- Rate-locks on bond issuance. When corporations decide to issue fixed-rate bonds, they usually lock in the current interest rate by entering into swap contracts. That gives them time to go out and find investors for the bonds. Once they actually sell the bonds, they exit the swap contracts. If rates have gone up since the decision to sell bonds, the swap contracts will be worth more, offsetting the increased financing cost.

What are the risks

Like most non-government fixed income investments, interest-rate swaps involve two primary risks: interest rate risk and credit risk, which is known in the swaps market as counterparty risk.

Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk. Put simply, a receiver (the counterparty receiving a fixed-rate payment stream) profits if interest rates fall and loses if interest rates rise. Conversely, the payer (the counterparty paying fixed) profits if rates rise and loses if rates fall.

Swaps are also subject to the counterparty’s credit risk: the chance that the other party in the contract will default on its responsibility. This risk has been partially mitigated since the financial crisis, with a large portion of swap contacts now clearing through central counterparties (CCPs). However, the risk is still higher than that of investing in a “risk-free” U.S. Treasury bond.

Disclosures

A “risk-free” asset refers to an asset which in theory has a certain future return. U.S. Treasuries are typically perceived to be the “risk-free” asset because they are backed by the U.S. government. All investments contain risk and may lose value.

Past performance is not a guarantee or a reliable indicator of future results.

A word about risk: Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Swaps are a type of derivative; swaps are increasingly subject to central clearing and exchange-trading. Swaps that are not centrally cleared and exchange-traded may be less liquid than exchange-traded instruments. Sovereign securities are generally backed by the issuing government. Obligations of U.S. government agencies and authorities are supported by varying degrees, but are generally not backed by the full faith of the U.S. government. Portfolios that invest in such securities are not guaranteed and will fluctuate in value. Floating rate loans are not traded on an exchange and are subject to significant credit, valuation and liquidity risk.

There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Investors should consult their investment professional prior to making an investment decision. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO provides services only to qualified institutions and investors. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Investments LLC, U.S. distributor, 1633 Broadway, New York, NY, 10019 is a company of PIMCO. | PIMCO Europe Ltd (Company No. 2604517), PIMCO Europe, Ltd Amsterdam Branch (Company No. 24319743), and PIMCO Europe Ltd - Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (25 The North Colonnade, Canary Wharf, London E14 5HS) in the U.K. The Amsterdam and Italy branches are additionally regulated by the AFM and CONSOB in accordance with Article 27 of the Italian Consolidated Financial Act, respectively. PIMCO Europe Ltd services and products are available only to professional clients as defined in the Financial Conduct Authority’s Handbook and are not available to individual investors, who should not rely on this communication. | PIMCO Deutschland GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany) is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie-Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 32 of the German Banking Act (KWG). The services and products provided by PIMCO Deutschland GmbH are available only to professional clients as defined in Section 31a para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2), Brandschenkestrasse 41, 8002 Zurich, Switzerland, Tel: + 41 44 512 49 10. The services and products provided by PIMCO (Schweiz) GmbH are not available to individual investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (501 Orchard Road #09-03, Wheelock Place, Singapore 238880, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862 (PIMCO Australia) offers products and services to both wholesale and retail clients as defined in the Corporations Act 2001 (limited to general financial product advice in the case of retail clients). This communication is provided for general information only without taking into account the objectives, financial situation or needs of any particular investors. | PIMCO Japan Ltd (Toranomon Towers Office 18F, 4-1-28, Toranomon, Minato-ku, Tokyo, Japan 105-0001) Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association and The Investment Trusts Association, Japan. Investment management products and services offered by PIMCO Japan Ltd are offered only to persons within its respective jurisdiction, and are not available to persons where provision of such products or services is unauthorized. Valuations of assets will fluctuate based upon prices of securities and values of derivative transactions in the portfolio, market conditions, interest rates and credit risk, among others. Investments in foreign currency denominated assets will be affected by foreign exchange rates. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Edifício Internacional Rio Praia do Flamengo, 154 1o andar, Rio de Janeiro – RJ Brasil 22210-906. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2016, PIMCO.