Understanding Premium Municipal Bonds

What is a Premium Municipal Bond?

A premium municipal bond is priced above par, or more than its face value, when its coupon rate – the interest paid to bondholders – is higher than the prevailing market rate. With interest rates at historically low levels, many municipal bonds trade at a premium due to coupon rates that are higher than current interest rates.

What Benefits do Premium Municipal Bonds Offer?

Because premium bonds have higher coupon rates, they provide investors with higher interest payments, returning cash at a faster rate. A primary benefit of premium bonds is the ability to reinvest larger sums of interest income semiannually. This is especially advantageous in a rising rate environment, where higher cash flows can be reinvested at higher yields.With higher coupon rates than the current market rate, premium bonds tend to have lower sensitivity to rising interest rates relative to similarly structured par bonds. The “cushion,” or difference, between their coupon and the market rates can help reduce the interest rate sensitivity of a bond portfolio. As a result, they have the potential to offer additional downside protection.

In rising rate environments, premium bonds also tend to have better liquidity than par bonds, which are apt to depreciate at a faster pace, leaving investors with bonds priced below par, or discount bonds. When selling discount bonds, investors may receive a lower price due to the tax implications of bonds that are sold below the “de minimis” cutoff.

A municipal bond purchased below the “de minimis” cutoff may be subject to ordinary income tax for the entire gain between its purchase price and par value. Conversely, bonds purchased below par but above the cutoff are subject to capital gains taxes between purchase price and par. These tax implications often result in a weaker price vs. premium bonds comparable in quality and structure. For more on de minimis, read our educational piece here.

Because of these advantages, much of today’s municipal market is issued at a premium, with a majority of investment grade municipal bonds offering 5% coupons.

Premium vs. Par Bonds – Comparing Cash Flows and Returns

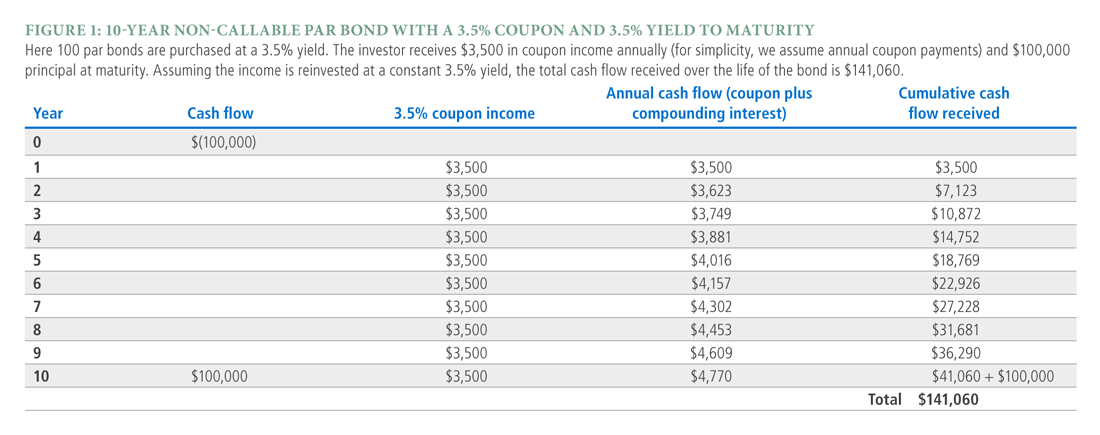

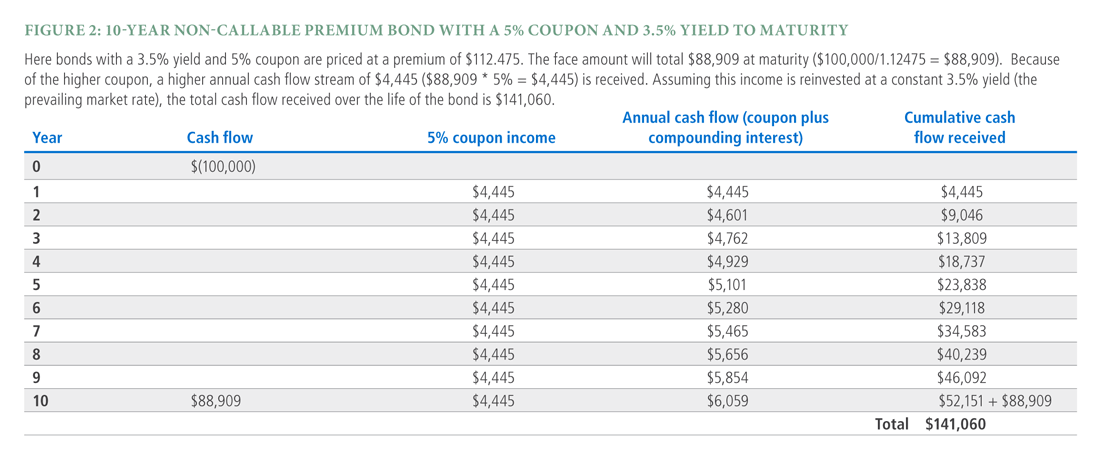

Figures 1 and 2 compare two hypothetical 10-year municipal bonds purchased at a 3.5% yield. One is a par bond with a 3.5% coupon and the other is a premium bond with a 5% coupon.

These examples show that the premium bond and par bond returns are the same in a scenario where we hold interest rates constant. You can also see that the premium bond returns more of its cash flow over the life of the bond versus the par bond. In a rising rate environment, we can reinvest this higher cash flow at higher yields, and we would expect the premium bond to outperform the par bond.

Key Advantages of Premium Municipal Bonds

Higher income distributions: Because of their higher coupon rates, cash flow tends to return faster than par bonds, meaning investors may receive higher income distributions – in a rising rate environment this increased cash flow can be reinvested at higher rates.

Less sensitivity to interest rate changes: The cushion between the higher coupon rate of a premium bond and the marketrate may help reduce interest rate sensitivity, and when rates are rising, premium bonds tend to have better liquidity than par bonds.

Tax benefits: Municipal bonds purchased below the “de minimis” cutoff are often subject to ordinary income tax for the entire gain between purchase price and par. Because premium bonds are farther from the cutoff than par and discount bonds, they tend to retain their value.

Disclosures

A word about risk: Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk; investments may be worth more or less than the original cost when redeemed. The value of most bond funds and fixed income securities is impacted by changes in interest rates. Bonds and bond funds with longer durations tend to be more sensitive and more volatile than securities with shorter durations; bond prices generally fall as interest rates rise. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax; a strategy concentrating in a single or limited number of states is subject to greater risk of adverse economic conditions and regulatory changes.

PIMCO does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns. Investors should consult their investment professional prior to making an investment decision.

This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. and Pacific Investment Management Company LLC, respectively, in the United States and throughout the world. © 2017 PIMCO

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.