Asia Market Outlook 2022: Diversified Opportunities Amid Volatility

Our latest Cyclical Outlook, “Investing in a Fast-Moving Cycle” describes our view that the global economy appears to be rapidly progressing toward late-cycle dynamics. Monetary policy in most regions has shifted towards normalization, with global inflation likely to peak by 1Q 2022 before moderating closer to central bank targets by year-end.

Broadly speaking, our 2022 outlook suggests above-trend (albeit slowing) growth and moderating inflation prompting a still gradual tightening in developed market monetary conditions. Nevertheless, our base case faces three key risks: persistently elevated inflation, a tightening of financial conditions more abruptly than expected, and COVID variants.

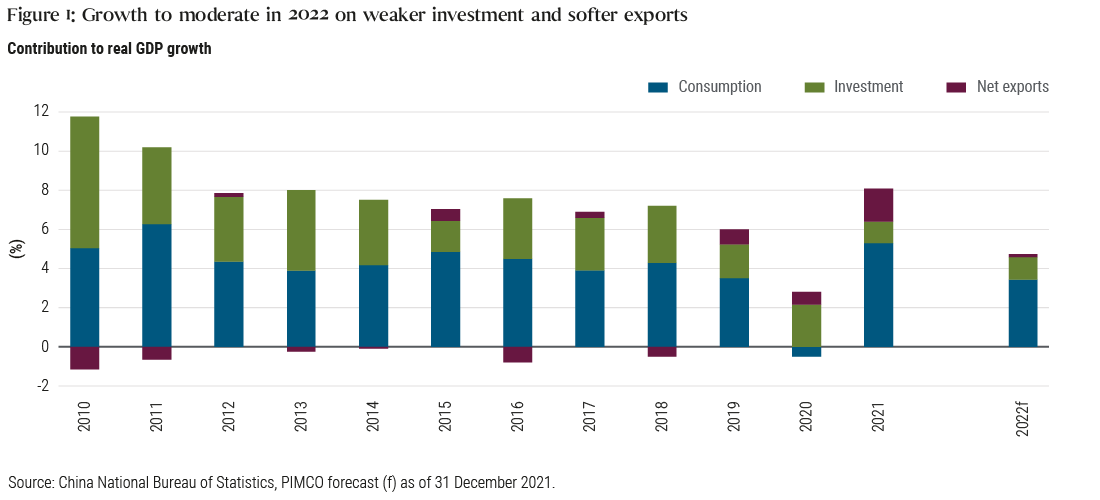

The latter is already unsettling China, with new delta and omicron waves unfolding against a macroeconomic environment that is now worse than 1Q last year: Energy constraints and the property market are weighing on growth, while exports are expected to moderate in coming quarters due to the high base and softening external demand for manufactured goods. In our base case, we expect China’s GDP growth to moderate to about 5% year-over-year in 2022 from 8.1% in 2021.

In contrast, the dynamic emerging markets of India and Indonesia are seeing nascent growth recovery, which will likely require continued policy support. While it is challenging for the Reserve Bank of India (RBI) to prevent inflation expectations from de-anchoring and to facilitate fiscal financing, Bank Indonesia (BI) appears to be in a better position given subdued inflation and improved external balances. Both these markets should offer attractive investment opportunities and India also could play a bigger role in emerging market (EM) portfolio management after Indian bonds are included in global bond indices.

Overall for the Asia region, we believe multiple factors have the potential to influence the investment outlook – in particular the speed, depth, and evolution of central bank efforts to reduce their extraordinary monetary accommodation. We expect to take currency positions based more on intra-regional pairings given that the U.S. dollar will be driven largely by the actions of the U.S. Federal Reserve.

In terms of credit, we expect the China property segment to be volatile as companies are likely to have to fight to survive. We also expect specific credit performance to continue to diverge as these companies navigate their debt maturity profiles and pace of balance sheet de-risking. The Indian and Indonesian credit markets could continue to trade at above-average valuations as they become destinations with a steadier risk profile for Asia credit investors.

China: Difficult policy choices as stability takes the spotlight

Energy constraints will likely ease after the first quarter as the government steps up supply and industrial demand weakens amid a slowing economy, likely dampening PPI (producer price index) inflation. However, the outlook for the housing market remains gloomy, and export strength will likely fade. Meanwhile, the lingering pandemic continues to interrupt the domestic service and consumption recovery.

Our base case has growth moderating to about 5% year-over-year in 2022 (see Figure 1), assuming moderate macro policy support, regulatory policy fine-tuning, and the government bringing the latest COVID wave under control. At the Central Economic Work Conference (CEWC) in December 2021, stabilizing growth was declared the top priority for 2022, sending a strong signal for further policy easing. Going forward, the property sector and recurring COVID outbreaks remain the key headwinds, while policy support may surprise on the upside if economic conditions deteriorate more quickly.

Regulatory policy is unlikely to reverse course, but adjustments may be necessary. Growth moderation is a short-term pain policymakers likely believe is worth bearing as the government pushes forward its long-term agenda, including decarbonization, deleveraging, and common prosperity (see our Viewpoint on common prosperity). But over-tightening could amplify such pains, a possibility that the government has acknowledged, pledging corrective action.

We expect Beijing will take a measured approach to adjusting its housing market strategy this year. Some easing measures have been taken, including high-level guidance for banks to support reasonable funding to developers, normalization of mortgage loan extensions, and adjustments in transaction restrictions and mortgage rates at the city level. However, the old housing market development model (featuring highly-leveraged developers and rapid price increases) is now deemed unsustainable and in conflict with the government’s long-term agenda. In addition, housing demand is expected to diminish in the long term due to the aging population.

It will likely take a while for funding to fully normalize and sentiment to recover, and we expect China’s property market to remain weak in 1Q 2022 before starting to improve as the year progresses. In the meantime, the government could take further measures to restore market confidence and continue to relax funding constraints for developers. State-owned enterprises could step up in terms of land purchases, property development (particularly affordable housing) and providing funding to troubled private developers via mergers and acquisitions. Relaxing purchase and sale restrictions in cities with strong demand could also help. In addition, Hukou reforms, which grant migrants equal rights and benefits as city dwellers, could accelerate urbanization and unleash urban housing demand.

On-budget fiscal policy will likely turn more accommodative, including front-loaded fiscal issuance, accelerated government spending, and tax cuts (albeit a modest package). This should provide some support to infrastructure investment and relief to households and corporates. However, we believe the overall fiscal impulse will be modest, as weakening off-budget financing will undermine on-budget stimulus – land sale revenue and local government financing vehicle (LGFV) lending will likely remain constrained by the government’s efforts to deleverage property developers and local governments.

We expect credit growth to accelerate, resulting in a modest positive credit impulse for 2022. Credit growth – the key monetary instrument for GDP growth – bottomed out in November 2021 at 10.1% year-over-year, and will likely continue ticking up in the near term. The acceleration of infrastructure projects in 1Q 2022, recent green loan issuance, and easing of funding constraints for property developers could help improve credit demand.

Interest rate policy will likely be data-dependent. The People’s Bank of China’s recent 10 basis point policy rate cut reflects the government’s growing concern regarding the growth outlook. In our view, the key swing factors going forward will include the effectiveness of pandemic control and the recovery of the housing market. China will likely stick to its “COVID-zero” strategy in 2022, given its governance philosophy and relatively insufficient healthcare resources compared with developed markets. With the more contagious COVID variants, this policy could become costly and might even disrupt local and global supply chains should local containment measures fail, triggering larger-scale lockdowns. Following the March 2022 National People’s Congress (NPC) meeting, both rate and reserve requirement ratio (RRR) cuts may become more likely if the housing market does not show any signs of recovery, consumption is hit heavily by the pandemic controls, and credit growth disappoints due to weak demand.

Indonesia: Resilient rupiah may outperform historical multi-factor betas

Indonesia’s economic recovery slowed in 2021 due to the delta variant wave in 3Q, leaving GDP growth in the low 3% range for the full year. Weak growth prospects and strained household financials have kept loan growth very low, despite the continued rise in monetary base and accommodative policy from BI.

For 2022, we expect Indonesia’s GDP to grow in the mid-4% range due to continued activity normalization, partly offset by the drag from fiscal consolidation. Given the structural improvements from reform-oriented governance, Indonesia should continue to enjoy re-rating by global investors and in our view, should no longer be seen as a fragile emerging economy.

The nation’s external balances benefited in 2021 from high commodity prices and the slow recovery of domestic demand. However, as cyclical factors wane, structural improvements, such as export diversification, increased capacity, and a trade surplus in base metals, should help lower the current account deficit from the 2013–2019 average of 2.5%–3%. For 2022, we expect a current account deficit of around 1% after seeing a surplus in 2021.

Unlike emerging market peers, Indonesia has not had to deal with an inflation problem. Inflation has remained below the 2%–4% target range due to weak domestic demand and administered prices. Continued demand recovery and the impending VAT hike in April 2022 should drive inflation gradually higher to the middle of the target range. We expect the government will continue to gradually push domestic fuel consumption towards higher-grade fuels to reduce cost overrun and avoid fuel price hikes.

Indonesia’s fiscal deficit narrowed in 2021 due to strong revenue growth, and we expect it to narrow further to around 4% in 2022, aided by tax reform, and be on track to reach 3% by 2023. We expect BI to continue to support growth, with a pro-stability stance to promote foreign exchange stability and support fiscal financing.

With the backdrop of a hawkish Fed, benign domestic growth and inflation conditions, and less vulnerable external balances, we expect BI to gradually absorb liquidity, hike the overall reserve requirement levels, and steepen the open market operations (OMO) curve before modestly raising interest rates by the end of 2022.

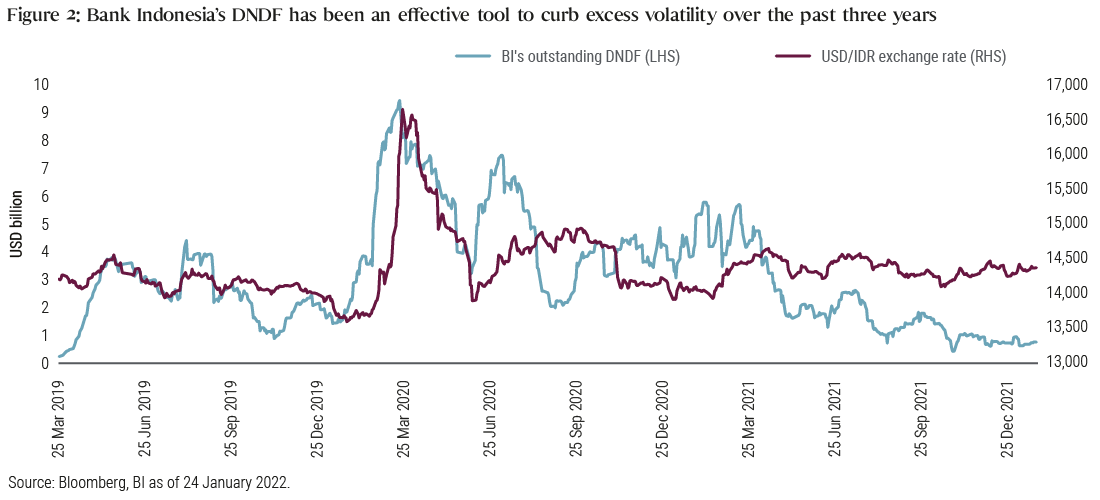

We are constructive on the Indonesian rupiah on the back of structural developments in external balances, reforms that could bring in more foreign direct investment (FDI), changes that could result in more equity in-flows, and record low foreign ownership of local currency bonds. BI’s spot and DNDF (domestic non-deliverable forward transactions) intervention should curb any excess volatility (see figure 2).

While we expect front-end local currency bond yields will be under pressure, demand/supply and positioning dynamics are still supportive of long-end bond yields in 2022. However, given valuations and an uncertain 2023 outlook, we favor a neutral portfolio stance on Indonesian local currency bonds and external duration.

A stronger-than-expected recovery in domestic demand, leading to high double-digit loan growth, would be the inflection point for our macro outlook on Indonesia. Meanwhile, revising the Job Creation Law without significant delay could allay investors’ concerns about investing in Indonesia. However, the COVID resurgence and aggressive China growth slowdown pose downside risks in our view.

India: Bond index inclusion should be a game changer

India recovered quickly from the devastating second pandemic wave in mid-2021, but by 4Q 2021 economic activity was showing early signs of slowdown, even before the omicron outbreak. We expect India’s GDP to expand by around 9% in FY2022 (April 2021 – March 2022), and moderate to around 7% in FY2023.

Despite disappointing divestment receipts, the RBI’s dividend and strong tax revenues appears to leave some fiscal space for India to cut fuel excise duties and spend more on tackling COVID while staying close to its budgeted deficit target. Fiscal policy should remain supportive of growth in FY2023 ahead of major state elections.

Since India emerged from the second wave lockdown, its trade deficit has been widening aggressively due to the rise in both import volumes and prices. As demand gradually shifts away from goods to services and prices normalize, India should return to seeing 1%-2% current account deficits. While the nation continues to attract FDI, its negative basic balance (current account + FDI) for FY2023 requires portfolio investments for external stability. India has an impressive IPO line-up for Q1 2022, but we believe bond index inclusion would be the game changer.

Over the past few years, the Indian government has taken incremental measures, albeit at a slow pace, to address the concerns around index inclusion. Now, with the ambiguity around taxation expected to be fixed in the upcoming budget, Indian government bonds are likely to be included first in J.P. Morgan’s emerging market bond index (GBI-EM), and then gradually in global indices, bringing an estimated $30 billion – $40 billion (USD) of inflows.

India’s headline inflation briefly rose above the central bank’s target range (2%–6%) during 2Q 2021 amid supply disruptions, but the government’s measures helped to drive volatile food inflation gradually lower. However, core inflation remains elevated, raising concerns about de-anchoring of inflation expectations. We expect inflation to moderate in FY2023 to a low 5% level, but with upside risks.

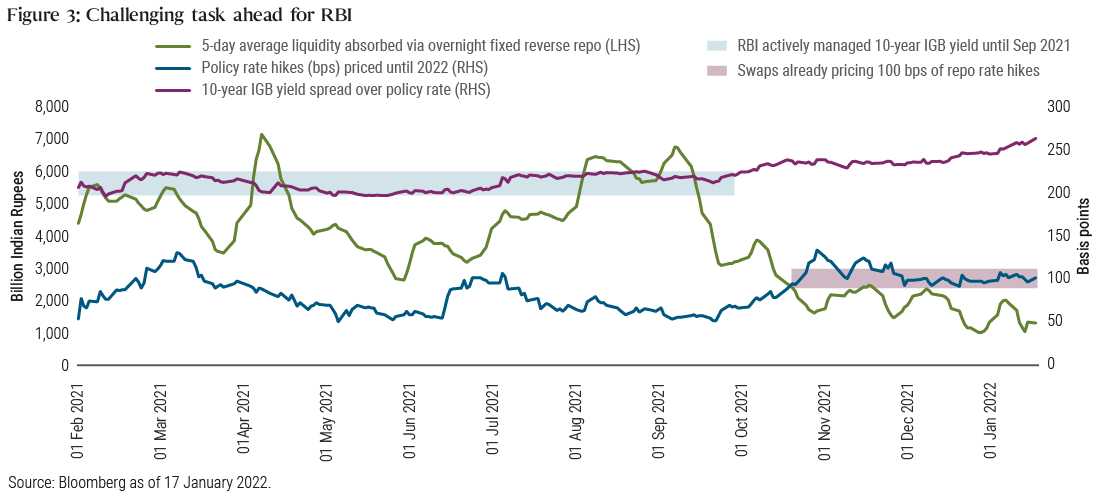

The RBI has resisted calls for policy normalization on inflation concerns, as it has prioritized the growth recovery and appears willing to tolerate higher inflation, with a glide path strategy for reducing inflation to 4% over the next few years. However, the central bank has discontinued its Government Securities Acquisition program and the explicit target for the 10-year bond yield, as it has commenced surplus liquidity absorption via the Variable Reverse Repo Rate auctions (see Figure 3). With the ongoing omicron outbreak, we expect the RBI to have a delayed and more gradual policy rate normalization than the market is currently pricing in.

Higher crude oil prices and second-order inflation effects could test the RBI’s resolve to remain accommodative again in 2022, while reducing durable liquidity and supporting bond yields. In portfolios, we are neutral the Indian rupee and expect it to continue to trade within the 73–77 range in 2022 versus the U.S. dollar. We also favor a neutral stance on duration given the low real yields, inflation risks, and challenging demand/supply outlook, especially as the RBI is now taking a less active stance in managing bond yields.

Overall, we believe India offers attractive diversification opportunities given the relatively low volatility of its risk assets compared with other high-yield emerging market sovereigns.

A long-term focus and rigorous approach to portfolio construction are key

We expect the major Asian markets will experience different dynamics in 2022. Coupled with the fast-changing global economy, market adjustments will likely be rapid and investors will likely face greater volatility. We will be on the lookout for relative value opportunities in macro markets and buying opportunities in Asia credit where valuations appear to be more compelling than spreads in other parts of the world.

We believe rigorous risk management and careful security selection will be crucial for investors in the region. With the backdrop of a more uncertain and volatile macroeconomic environment, we continue to believe that active management is especially important during this fast-moving cycle where dislocations are likely and capturing resulting opportunities can be key to producing alpha.

For more details on our outlook for the global economy in the year ahead and the investment implications, please read our latest Cyclical Outlook, “Investing in a Fast-Moving Cycle”.

Featured Participants

Disclosures

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be appropriate for all investors. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Sovereign securities are generally backed by the issuing government. Obligations of U.S. government agencies and authorities are supported by varying degrees, but are generally not backed by the full faith of the U.S. government. Portfolios that invest in such securities are not guaranteed and will fluctuate in value. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Diversification does not ensure against loss.

Alpha is a measure of performance on a risk-adjusted basis calculated by comparing the volatility (price risk) of a portfolio vs. its risk-adjusted performance to a benchmark index; the excess return relative to the benchmark is alpha. Beta is a measure of price sensitivity to market movements. Market beta is 1.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.