Investors enjoyed broad gains across major asset classes in the first half of this year, but they endured considerable market swings to earn those returns. Expect a similar landscape for the rest of 2025, with strategies emphasizing global diversification and risk mitigation continuing to benefit from this year’s major themes, including a weaker dollar and a steeper yield curve.

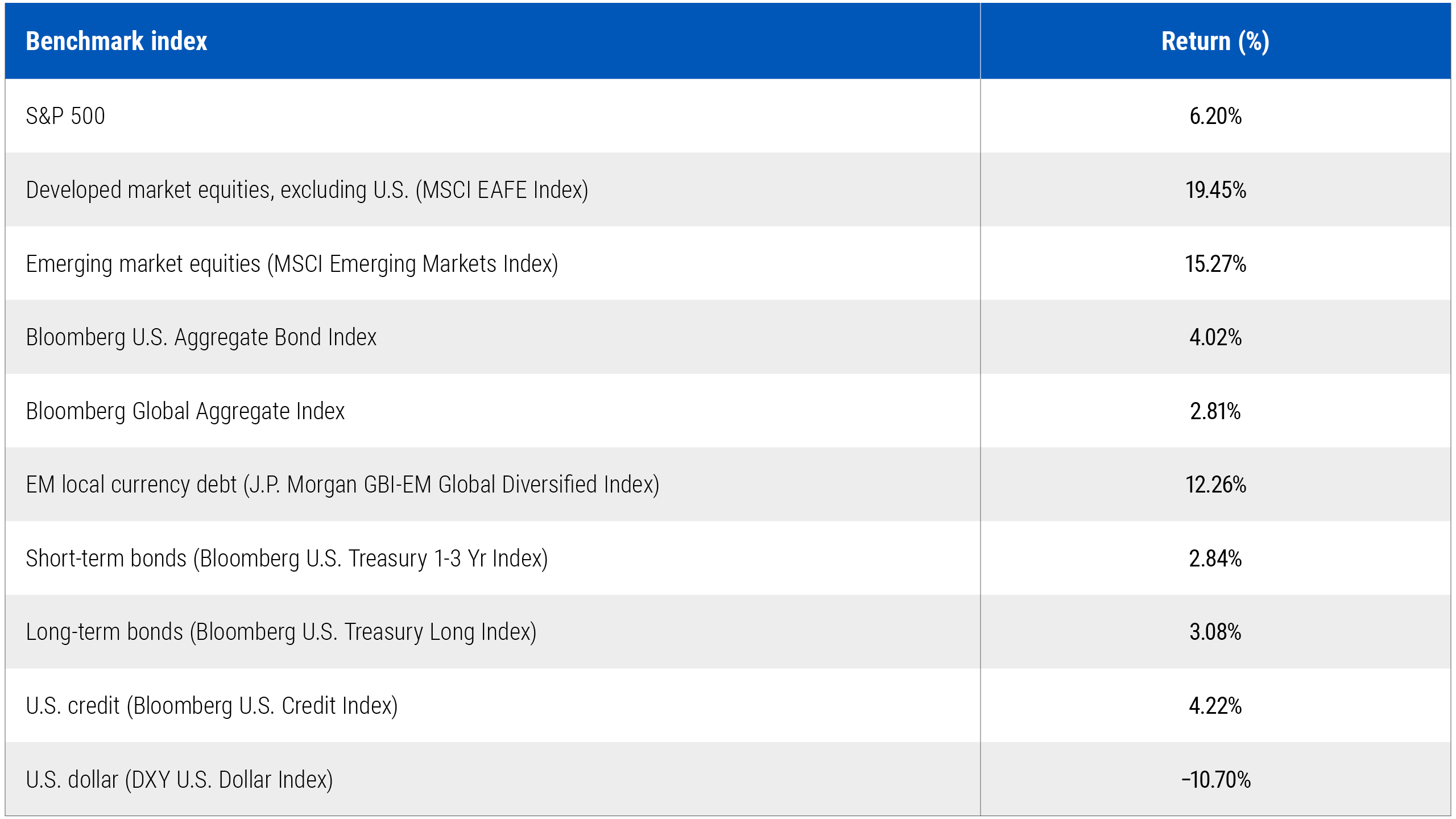

For context, Table 1 highlights performance for some major benchmarks in 2025 through June:

While U.S. assets performed well, international markets – both developed and emerging – often did significantly better. Equities whipsawed on their way to healthy returns, while bonds flexed their own strengths and did so with less volatility. EM local currency bonds almost matched the exceptional returns of EM equities, underscoring the breadth of global investment opportunities.

We believe a few underlying themes stand out for their ongoing relevance:

- A shift away from U.S. assets. Following years of U.S. economic and financial market outperformance, investor money has flowed elsewhere in the wake of sharp U.S. policy pivots. The U.S. dollar posted its worst first half performance since 1973, signaling both diminished confidence in U.S. assets and the attractiveness of investments abroad.

- A steepening of yield curves. The term premium – the extra yield investors demand to hold longer-term bonds – has continued to climb. Concerns about government deficits, particularly in the U.S., have pushed longer-dated yields higher relative to shorter maturities.

- A risk asset rebound erased a rout while leaving valuations stretched. An April sell-off across equity and credit markets, sparked by U.S. tariff announcements, gave way to a rally that has pushed the S&P 500 above past peaks. The downside: Equity and credit valuation gauges are again near historical highs.

The continued case for global diversification

Signs of moderating inflation and economic growth have fueled expectations that central banks will continue cutting interest rates later in 2025. This could support a variety of assets, while exposing the opportunity cost of holding cash as rates decline. The ability to differentiate investments based on pricing, valuations, and risk compensation will be essential.

The private sector – think companies and consumers – has remained resilient, supporting equities and credit markets. But valuations remain historically stretched.

Conversely, the public sector – governments – remains burdened by elevated debt levels. In the U.S., this has driven a rising term premium, a rising risk premium to own dollar-based assets, and the relative underperformance of U.S. credit and equities. Yet bond yields stand out as attractive relative to historical norms, offering return potential across a range of potential scenarios and risks.

We expect the investment playbook from the first half of 2025 to remain relevant in a variety of ways:

- We continue to expect U.S. dollar depreciation and yield curve steepening, particularly given the potential for the One Big Beautiful Bill Act to add to U.S. deficits regardless of growth outcomes.

- We believe global markets can continue to outperform the U.S. (for more, see our latest Secular Outlook, “The Fragmentation Era”).

- We continue to favor short- and intermediate-term bonds across global markets.

- We continue to believe central banks may cut rates more than expected.

- We remain cautious about equities and corporate credit at current valuations.

For investors, there are many positive takeaways from the first half of this year. We’ve seen the most punitive tariffs in recent history, as well as a large-scale conflict in the Middle East that has shaken commodity markets. And yet solid, broad-based returns have highlighted the resilience of financial markets.

But early 2025 was also a wake-up call, especially for U.S. investors, as the rapid snapback in domestic markets masked ongoing risks and the opportunity cost of being underexposed to global markets. In an increasingly fragmented geopolitical and economic environment still rife with risk, investors should continue to prioritize diversification to help strengthen portfolios.