Commodities: Time to Shine

Commodities have typically performed well late in the business cycle – and during periods of global turmoil – offering a potential hedge against inflation and disruption. In the decade since the global financial crisis, low inflation persisted and commodities performed poorly. Until recently. Over the past year, pandemic-induced supply shortages and demand spikes have driven inflation higher, and commodities are beginning to shine. In addition, the correlation between equities and bonds has been turning positive as inflation rises, further making the case for increasing commodity allocations. Three key pillars support our view, low oil inventories, high roll yields and diversification:

Low oil inventories: Inventories have hit low levels amid surging COVID-reopening demand and lagging supply. This imbalance is most acute in energy markets, where producers, faced with environmental restrictions and poor returns, have underinvested in drilling new wells -- both shale oil and conventional. In turn, prices have escalated. And the sting of higher energy costs can be felt in the rising prices of other commodities. Producing base metals – central to the world’s move away from fossil fuels – is highly energy intensive. Similarly, natural gas is used to make ammonia fertilizer – a key cost of agricultural products. To meet current and projected demand, energy producers will need to invest in new capacity. But we think they will wait to bring more rigs online until they are confident that price strength will last.

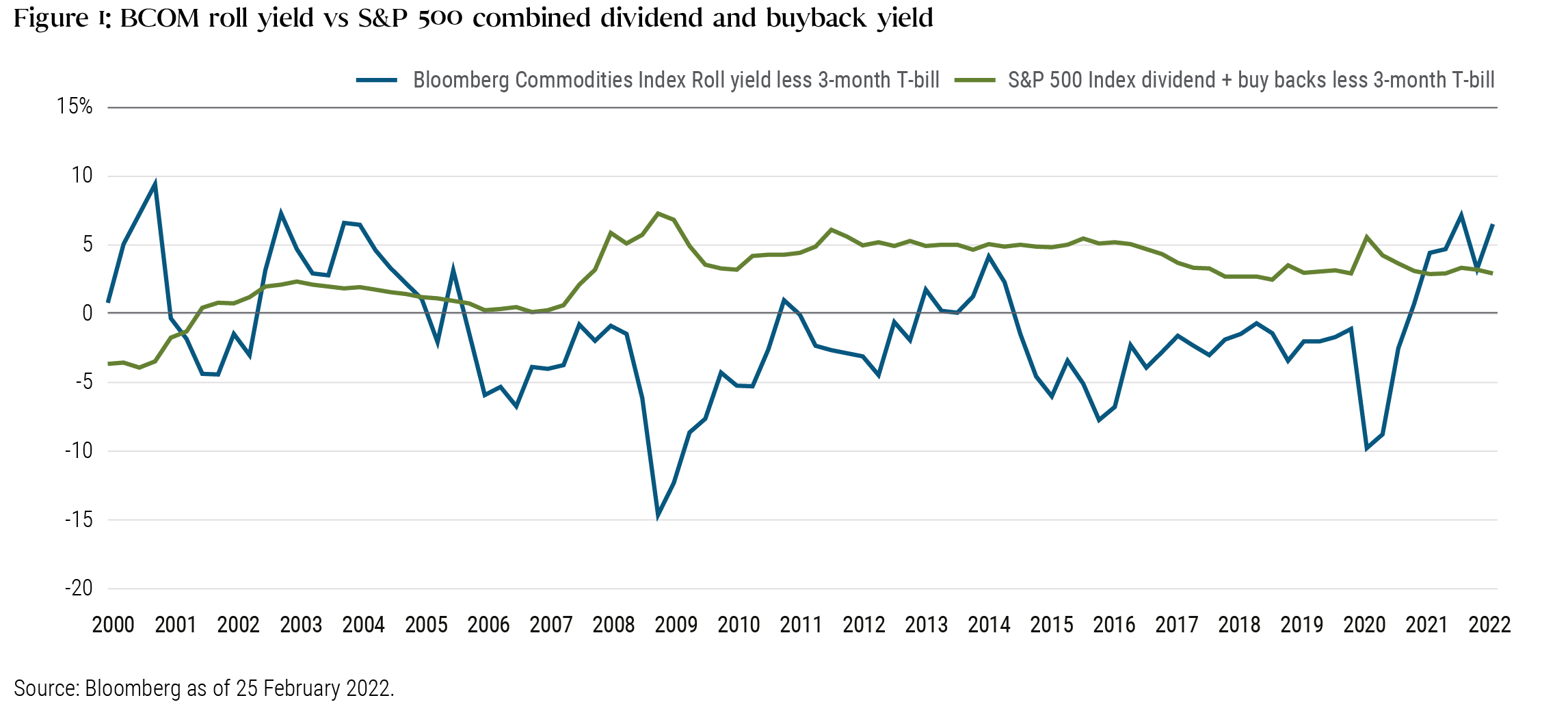

High roll yields: Consistent with lower inventories, most major commodity markets are in a state of backwardation (forward prices are lower than spot prices), which is the single strongest historical predictor of forward returns. The “roll yield” (derived from rolling a lower-priced longer-term contract into a higher-priced short-term contract) for the Bloomberg Commodity Index (BCOM) is averaging over 5% positive, exceeding the combined buyback and net dividend yield for the S&P 500. This is the highest level of backwardation after adjusting for short term rates since the early 2000s, which preceded the last commodities supercycle. While we think it is premature to call a supercycle, as higher prices will ultimately beget more supply, holding commodities to hedge inflation risks is more attractive when carry provides a tailwind.

Diversification amid inflation: Commodities have historically provided critical diversification for investors as the business cycle advances, and inflation becomes a dominant driver of asset prices rather than growth. To be sure, while nominal asset classes such as equities and fixed income have had a negative response to inflation surprises, real assets such as commodities have historically tended to be effective as inflation hedges. For a 1% unexpected change in inflation, commodities have historically delivered excess returns of over 8%.Footnote[i]

The last central bank hiking cycle in 2018 was an exception. Commodities didn’t lead asset returns largely. At that time, the relentless rise in shale oil production deflated costs, providing a headwind to all commodity returns. We think this time historical commodity price trends will return and that the commodity cycle has begun. In January and February, as markets grappled with repricing a faster pace of central bank tightening, both equities and bonds generally struggled while most commodity indices climbed 15% to 22%.

Geopolitical risk

It is against this backdrop that the recent events concerning Russia and Ukraine are playing out. While current energy production has not been disrupted thus far, and sanctions, as of yet, are designed to prevent disruption of current supplies, exports are being negatively impacted by concerns around shipping, insurance, and credit. As such, it did not require sanctions on Russian exports to lead to declining availability. In addition, sanctions are likely to limit the flow of capital and technology to Russian oil, gas, and mineral extraction companies. We believe this is directionally supportive of long-term energy and materials prices. With Germany halting the review of the Nordstream 2 natural gas pipeline, it is likely that much of the volatility we have experienced in natural gas this past year will continue into the foreseeable future. A return of Iranian oil to the markets, should a nuclear deal be completed in the coming weeks, would likely lead to a near-term retracement of oil prices, but shouldn’t derail the bigger secular issues at play.

Investment takeaways

We see a strong case for a heavier commodities allocation in investor portfolios. Investors and equity indices are currently under-allocated to commodities relative to historical averages. Yet we expect, high and volatile inflation – rather than growth – may be the biggest driver of equity and fixed income returns over the coming year, making commodities a valuable potential hedge to the traditional 60/40 portfolio. Moreover, the current supply-demand imbalance and high roll yields provide supportive tailwinds, positioning commodities to shine.

Greg E. Sharenow and Andrew DeWitt are portfolio managers focusing on commodities and real assets. Both are regular contributors to the PIMCO Blog.

For more insights on commodities and inflation, please visit our Inflation and Interest Rates page.

Featured Participants

Disclosures

All investments contain risk and may lose value. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be appropriate for all investors. Derivatives and commodity-linked derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Commodity-linked derivative instruments may involve additional costs and risks such as changes in commodity index volatility or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

The continued long term impact of COVID-19 on credit markets and global economic activity remains uncertain as events such as development of treatments, government actions, and other economic factors evolve. The views expressed are as of the date recorded, and may not reflect recent market developments.

It is not possible to invest directly in an unmanaged index.