Opportunistic Credit: Weakening Credit and Tightening Lending Conditions Drive Compelling Value

Summary

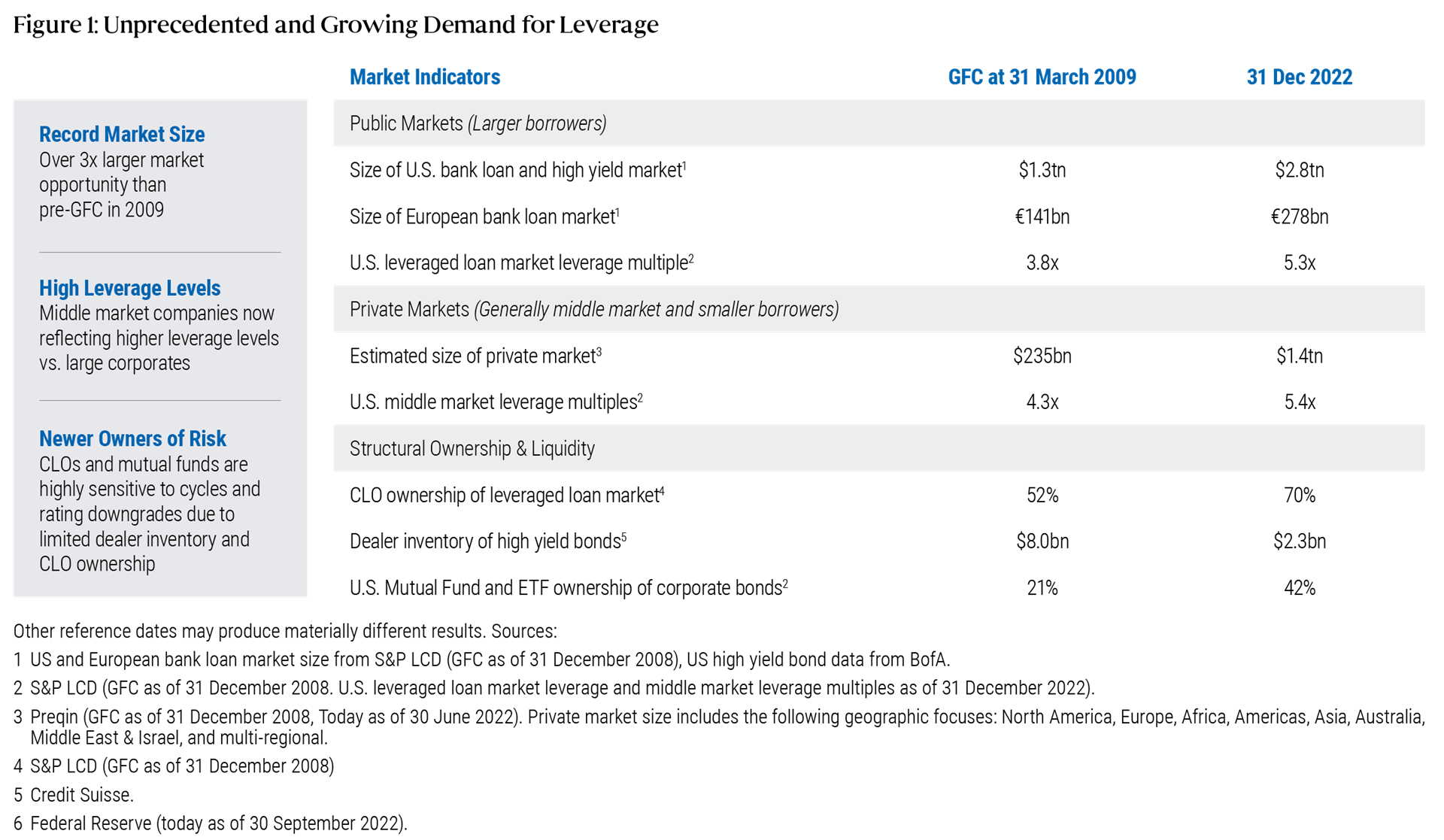

- Corporate leverage has soared, most notably in the market for senior floating rate loans, which has tripled since before the GFC to nearly $3 trillion.1

- With elevated debt levels, sharply higher interest rates leave many below investment grade borrowers struggling to meet higher debt-service costs at the same time the slowing economy squeezes profitability.

- In particular, we expect to see growing stress in the private segment of the loan market. Many of these borrowers are smaller companies that are more vulnerable to economic downturns.

- Recent bank failures have created additional challenges for leveraged companies as banks and direct lenders further tighten lending standards and constrain available financing capital.

- The pullback by traditional sources of liquidity is creating a very attractive environment for opportunistic credit managers to fill large liquidity gaps and demand wider spreads and strict covenants.

Sharply rising interest rates, a slowing economy, and tighter lending conditions are leaving many highly leveraged borrowers straining to service their debts. Here, Dan Ivascyn, group chief investment officer, Christian Stracke, global head of credit research, and Adam Gubner, corporate special situations portfolio manager, review PIMCO’s market perspective with Neal Reiner, alternative credit strategist. They discuss the challenges facing public and private credit markets and why they see a better value and risk profile in opportunistic corporate credit strategies than in traditional private equity.

Q: A sharp interest rate reversal has ended one of the longest bull markets in corporate credit. How does PIMCO look at corporate credit markets today?

Ivascyn: Corporate debt, particularly in the United States, has soared, fueled by a decade of low interest rates. U.S. corporate debt-to-GDP exceeds levels reached before the global financial crisis (GFC) in 2008. This excess has been most noticeable in senior corporate loans: The market for these floating-rate instruments – which are purchased by public and private institutional debt funds – has tripled since before the GFC to nearly $3 trillion. With elevated debt levels, sharply rising interest rates leave many borrowers struggling to meet higher debt-service costs at the same time the slowing economy squeezes profitability. As a result, PIMCO’s base case view is that cumulative three-year default rates for these loans across public and private markets could reach 10%–15% over the next several years, which translates into at least $300 billion of potential distressed opportunities.

Q: Where are we seeing stress – and strength – that differs from past credit cycles and dislocations?

Ivascyn: In past cycles, junior high yield debt and securitized mortgage holdings were the stress points. Today the challenges are coming from the unprecedented volume of senior loans issued over the last decade in the public leveraged loan market (syndicated bank loans to large companies) and in the new private senior lending space (loans issued by investment funds to smaller companies). Together, these loans account for essentially all sub-investment-grade net issuance over the last seven years.

The private segment of the market has grown rapidly since the global financial crisis – when large commercial banks stepped away from lending to small and midsize companies – and now rivals the public loan market in annual issuance. We believe private loans will be a growing source of stress – and opportunities. These borrowers are more vulnerable to economic downturns: Many are smaller companies that have narrow business strategies, less-resourced management teams, high leverage relative to assets, and little access to the broader capital markets. As the Fed raises interest rates and a recession looms, these borrowers face both sharply rising debt service costs and earnings headwinds.

Credit risk in these senior loans is further heightened by the issuers’ weak investor covenants. Amid the last several years’ historically low interest rates, investors poured capital into both public and private markets, leading lenders to compete and issue deals with some of the highest leverage in history – often anticipating big future cost savings – alongside weakened covenants.

Not every corporate credit suffers weak fundamentals, though, and some areas of the market look reasonably healthy in our view. These include many areas of the high yield bond market, particularly larger issues rated BB or B that have weathered multiple cycles. We think these borrowers’ high yield ratings are appropriate for their balance sheets, but they could still be fairly resilient. There's been very little net issuance in the high yield market in the last several years, which also should help support prices.

Q: Regulation enacted after the great financial crisis created disincentives for banks to lend to midsize companies, but now they lend to private lenders. What stresses does this create at the private lenders?

Gubner: It is with some irony that the banks themselves are not making middle market loans, but they will lend to direct lenders against these same loans in a loan-on-loan type of structure.

In a buoyant economy and improving credit environment, those loans perform well and most private lenders use this leverage to deliver higher returns to their investors. The problem is that banks will only lend to managers against their performing loans. Once a performing loan starts to weaken, private lending managers are typically required to remove that loan from the borrowing base and pay down the bank facility debt associated with the position.

Ordinarily, that is not a problem. There's cash coming into the system through interest payments or paydowns of existing loans. Private debt fund managers (direct lenders) can use that cash to pay down the leverage. In the current higher-interest-rate environment, however, loan paydowns from refinancings are shrinking considerably and at the same time, banks’ tighter lending standards will constrain liquidity for these managers As a result, we anticipate a growing number of managers will be compelled to consider selling existing positions and be forced to receive a discount from their current net asset value (NAV) carrying values.

Q: How would you characterize the current market for private and public loans and high yield debt?

Gubner: Traditional markets for public and private loans are largely shut and liquidity remains thin. As recession looms, investors have rushed to reduce exposure to more economically sensitive assets. For example, more investors are redeeming shares of private closed-end funds – known as business development corporations (BDCs) – that invest in debt of midsize private companies. Redemptions have been so high at some of the largest non-traded BDCs that they hit preset limits, forcing managers to restrict investors’ liquidity. Similarly, investors have sold shares in public BDCs, pushing those shares far below their managers’ current NAV’s, which alludes to the disconnect between public and private valuations.

An increasing number of these private funds are seeking to sell their underperforming credits at a significant discount in an effort to upgrade credit quality, maintain a target yield distribution to investors, and avoid a lengthy and time-consuming restructuring processes. We expect this trend will accelerate as banks increasingly tighten lending standards, forcing private debt funds to sell underperforming positions that can no longer be included in their leverage facilities. PIMCO anticipates increased opportunities to either purchase these loans at a discount or refinance companies directly with more flexible capital solution structures.

The clamor for liquidity as also hit the broader high yield market with investment banks suddenly unable to sell debt issued to finance mergers and leveraged buyouts, (known as “hung” loans or bonds). Banks committed to financing these transactions, expecting to sell the financings to investors. But investor demand has weakened considerably amid the sharp rise in interest rates, weaker earnings, and rising risk aversion. In turn, banks have retrenched and many remain overextended.

Q: The capital markets in Europe have been showing considerably more stress than in the U.S. Do they offer a unique opportunity relative to the U.S.?

Stracke: European capital markets present a different set of opportunities. The energy crisis and the war in Ukraine have put Europe under greater economic stress. Similar to the U.S., core inflation in Europe remains elevated, yet interest rates are lower than in the U.S., leaving the European Central Bank (ECB) to confront a steeper tightening curve as it moved off negative interest rates. We believe the steep tightening cycle will remain particularly challenging for European credit markets: It has sapped investor demand and, in turn, public credit issuance fell more than 70% in 2022.Footnote1 As in the U.S., the collapse in investor appetite has left banks saddled with billions of dollars of hung deals where funding was committed to borrowers but the banks were unable to place the debt.

As investors and banks retreat and spreads widen, we see opportunities for investors like PIMCO with fresh capital to plug the liquidity gap. Yet investors need to be quite selective and mindful of the vagaries of Europe’s restructuring laws. An on-the-ground broad, highly experienced restructuring team is critical in our view, with the resources and networks to bring a restructuring either through the courts or through an out-of-court consensual agreement.

Q: How do you view investment prospects in the opportunistic credit space?

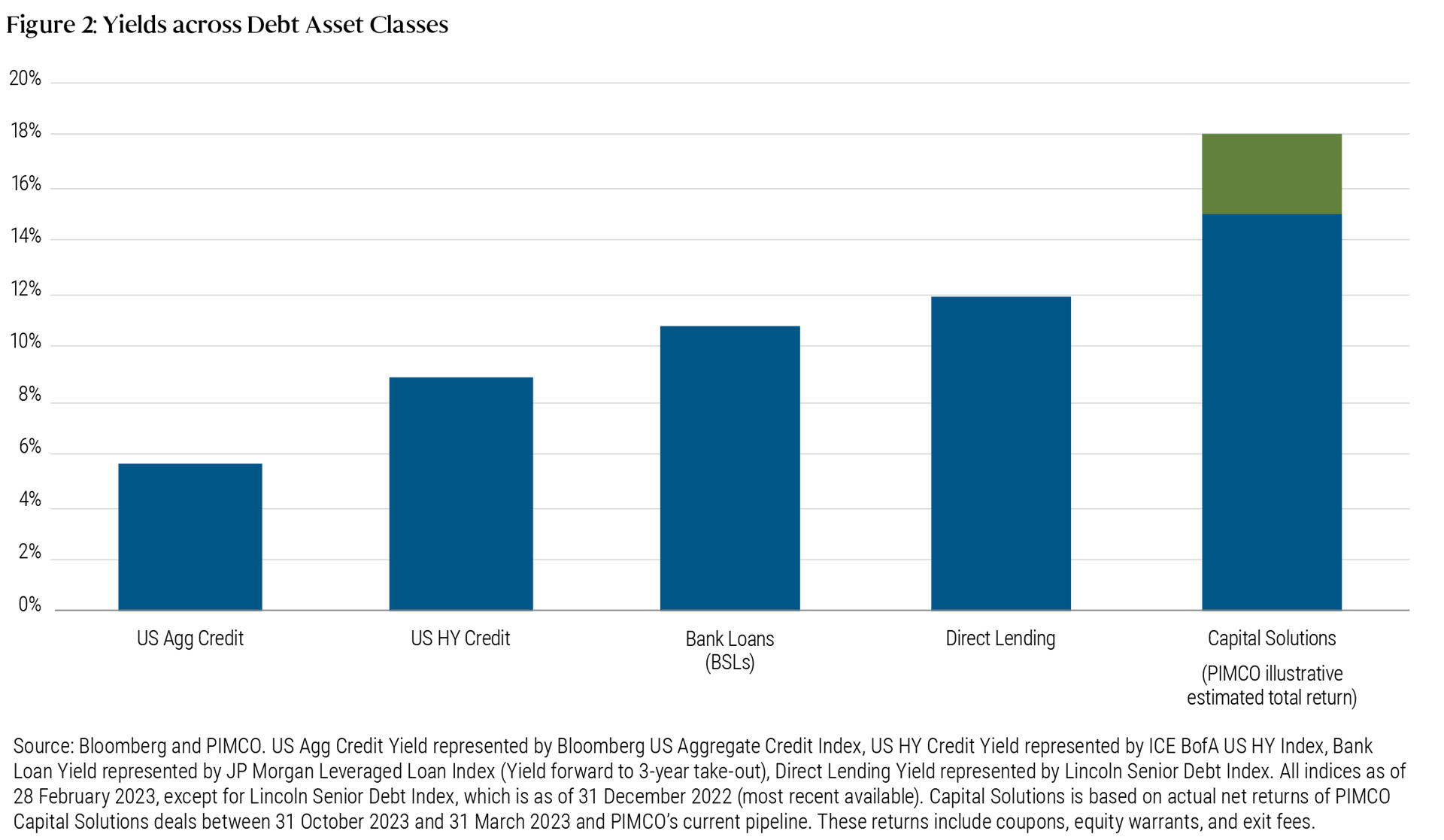

Ivascyn: In crisis comes opportunity. The pullback by traditional lenders is creating very attractive opportunities for new entrants with fresh capital to demand wider lending spreads and better structured deals with more downside risk mitigation and less reliance on leverage. Yields have climbed to enticing levels and the risk-adjusted return profile has considerably improved from just nine months ago.

Gubner: With private direct lending firms, syndicated bank loan markets, and commercial banks now all quite constrained, borrowers are increasingly seeking private capital solutions transactions. These bespoke one-stop financings can provide more flexible capital to borrowers with customized terms and structures. That often means loans structured with both a cash and a “paid in kind” interest component (under which the loan amount grows in lieu of cash interest)Footnote2, upfront fees, and equity warrants or exit fees. We believe demand for bespoke capital solutions will mushroom over the next several years as borrowers face increasingly acute liquidity needs and the lending environment becomes challenged.

As a result, PIMCO sees opportunities to provide liquidity across the middle market to performing companies that face challenges funding working capital needs, closing on acquisition targets or refinancing existing debt maturities. We think the landscape of opportunities will get more attractive with increased maturities in 2025 and 2026, and as higher-than-expected financing costs and earnings headwinds drain liquidity.

We also expect to see private debt funds and banks seek to sell private loans held in their portfolios. Private debt funds will likely face curtailed lending from banks, forcing them to improve their overall credit quality and sell weaker positions. Similarly, banks are likely to continue reducing their illiquid exposure on their balance sheets and pivot to higher-liquidity assets.

PIMCO is ideally situated to be a buyer of these assets as our broad industry research coverage, deep capital and ability to act rapidly makes us an ideal buyer. As we evaluate the market, we see a meaningful mismatch in the supply of private capital to address these opportunities. According to industry sources, only approximately $200 billion of capital was available for more bespoke private capital solutions financings at year-end. As a result, we expect strong return opportunities for managers with clean balance sheets to provide liquidity to these vehicles.

Q: Recognizing the renewed attractiveness now for opportunistic credit strategies, how does PIMCO compare the return prospects between opportunistic credit and private equity for investors seeking absolute return strategies?

Stracke: A primary source of private equity returns over the past decade has come from leverage and its declining cost. Alongside falling interest rates, private equity benefited from steady corporate earnings growth and a buoyant equity market where exit valuation multiples for asset sales were consistently higher than the initial purchase multiples. Looking forward, we think earnings growth will likely remain challenged, specifically in some of the high growth sectors that private equity has been favoring in recent years, including healthcare and technology. Finally, traditional leverage is less available now and considerably more expensive than it has been, creating headwinds for private equity performance.

Over the next several years, we believe the median returns for opportunistic credit investors will be similar to those in traditional private equity but with lower volatility and improved risk profile. And should we enter a more prolonged distressed period, opportunistic credit returns for managers skilled in restructurings could be quite favorable, as they should be able to buy at a material discount to par.

Gubner: More broadly, slowing M&A activity, weak valuations, and rising interest rates are material headwinds to traditional private equity in our view – both in terms of putting capital to work and attractive realizations at the back end. To be sure, we have evaluated the significant dispersion in private equity fund returns and see possibilities for materially lower returns in the current vintages.

In contrast, opportunistic credit benefits from collateral and is less dependent on multiple expansion or earnings growth. Returns are expected to mostly materialize in the form of coupons and cash payments, and benefit from debt maturities which can create a shorter weighted-average life for capital deployment – all of which seem like a defensive way to invest in this environment.

Featured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Private credit involves an investment in non-publically traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Alternatives involve a high degree of risk and prospective investors are advised that these strategies are suitable only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment.

The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio. The quality ratings of individual issues/issuers are provided to indicate the credit-worthiness of such issues/issuer and generally range from AAA, Aaa, or AAA (highest) to D, C, or D (lowest) for S&P, Moody’s, and Fitch respectively.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

This material contains the current opinions of the manager and such opinions are subject to change without notice. This material is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission| PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, Corso Vittorio Emanuele II, 37/Piano 5, 20122 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited Unit 3638-39, Phase II Shanghai IFC, 8 Century Avenue, Pilot Free Trade Zone, Shanghai, 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other) | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is an independently operated and managed company. The reference number of business license of the company approved by the competent authority is (110) Jin Guan Tou Gu Xin Zi No. 020 . The registered address of the company is 40F., No.68, Sec. 5, Zhongxiao East Rd., Xinyi District, Taipei City 110, Taiwan (R.O.C.), and the telephone number is +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Av. Brigadeiro Faria Lima 3477, Torre A, 5° andar São Paulo, Brazil 04538-133. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

CMR2023-0327-2815835