Key takeaways

- The commercial real estate landscape in 2025 is shaped by structural uncertainty driven by geopolitical tensions, persistent inflation, and an unpredictable interest rate path.

- Traditional approaches – anchored in broad sector allocations and momentum-driven strategies – are proving insufficient in today’s environment.

- In an increasingly uncertain environment, we believe investors should be more selective, prioritizing investments that can offer durable income and seek to perform even in flat or faltering markets. We see sectors such as digital infrastructure, multifamily housing, student accommodation, logistics, and necessity-based retail as relatively more resilient today.

Until recently, commercial real estate appeared poised for a long-awaited rebound. However, 2025 has revealed a new reality: Uncertainty has become structural. Trade tensions, inflation, recession risks, and interest rate volatility have unsettled markets and slowed decision-making. Traditional strategies – broad, momentum-driven approaches, cap rate compression, rent growth – no longer provide a reliable foundation. A disciplined investment process, grounded in local insight and operational excellence, matters more than ever.

PIMCO’s recent Secular Outlook, “The Fragmentation Era,” depicts a world in flux, where shifting trade and security alliances create uneven regional risks. Geopolitical tensions and tariffs dominate in Asia, especially China, which is shifting to a lower growth path amid rising debt and worsening demographics. In the U.S., key headwinds include stubborn inflation, policy uncertainty, and political volatility. Europe contends with high energy costs and regulatory shifts, but rising defense and infrastructure spending may provide a tailwind.

Given diverse risks across sectors and regions, traditional return drivers have become less reliable, particularly in an environment of negative leverage. In our view, resilient income and robust cash yields increasingly require local insight and active management with expertise in equity, development, debt structuring, and complex restructurings. Investments should aim to perform even in flat or faltering markets.

Debt, a long-standing cornerstone of PIMCO’s real estate platform, remains highly attractive thanks to its relative value. As outlined in last year’s Real Estate Outlook, “Facing the Music: Challenges and Opportunities in Today’s Commercial Real Estate Market,” approximately $1.9 trillion in U.S. loans and €315 billion in European loans are expected to mature by the end of 2026.Footnote1

We believe this wave of maturities creates a number of debt investment opportunities. These range from senior loans providing downside mitigation to hybrid capital solutions such as junior debt, rescue financing, and bridge loans. These are designed for sponsors requiring additional time, as well as for owners and lenders addressing financing gaps.

We also see opportunity in credit-like investments, including land finance, triple net leases, and select core-plus assets with steady cash flow and resilience. Equity is reserved for exceptional opportunities where effective asset management, attractive stabilized income yields, and secular trends provide clear competitive advantages.

Student housing, affordable housing, and data centers are increasingly viewed by investors as safe havens,Footnote2 offering infrastructure-like qualities such as stable cash flows and the potential to withstand macroeconomic volatility.

In this cycle, we believe success will depend on disciplined execution, strategic agility, and deep expertise – not market momentum.

These takeaways reflect insights from PIMCO’s third annual Global Real Estate Investment Forum, held in May in Newport Beach, California. Similar to PIMCO’s Cyclical and Secular Forums, the event convened global investment professionals to assess the near- and long-term outlook for commercial real estate (CRE). As of 31 March 2025, PIMCO managed one of the world’s largest CRE platforms, with over 300 investment professionals overseeing approximately $173 billion in assets across a broad spectrum of public and private real estate debt and equity strategies.Footnote3Macro view: Regional divergence deepens, niches emerge

Diverging macroeconomic conditions are remapping the terrain of global commercial real estate. The key drivers – monetary policy, geopolitical risk, and demographic shifts – are no longer moving in sync. Strategy must be more regional, more selective, and more attuned to local nuance.

In the U.S., an uncertain path for interest rates casts a long shadow. Refinancing activity has slowed sharply, especially in the office and retail sectors. Transaction volumes remain subdued, and valuations have softened. With economic growth expected to stay sluggish, few expect a quick rebound. The $1.9 trillion in debt set to mature by the end of next year is a source of risk, but also a potential opening for well-capitalized buyers.

Europe faces a different set of challenges. Growth was already sluggish before the pandemic. Now, it’s slowing further, held back by aging populations and weak productivity. Inflation remains sticky, credit is tight, and the war in Ukraine continues to weigh on sentiment. Still, there are pockets of resilience; increased spending on defense and infrastructure could provide a boost in some countries.

In the Asia-Pacific region, capital is flowing toward more stable markets – including Japan, Singapore, and Australia – that are known for their legal clarity and macro predictability. China, however, remains under pressure. Its property sector is still fragile, debt levels are high, and consumer confidence is shaky. Across the region, investors are sharpening their focus on transparency, liquidity, and demographic tailwinds.

We are also seeing early signs of a reallocation of investment intentions that could benefit Europe at the expense of the U.S. and the Asia-Pacific region. This shift reflects a broader retrenchment from cross-continental strategies toward more regionally focused capital deployment.

While the global picture is fragmented, this complexity presents potential opportunities for discerning investors.

Sectoral outlook: Analysis over assumptions

What are the implications for commercial real estate? In a fragmented and uncertain environment, sweeping sector generalizations have lost their utility. Real estate cycles are no longer synchronized; they vary by asset class, geography, and even submarket. The implication is clear: Investors should adopt a granular approach.

Success depends on detailed asset-level analysis, hands-on management, and deep understanding of local market dynamics. It also means recognizing where macro shifts intersect with real estate fundamentals. Europe’s defense buildup, for instance, is likely to spur demand for logistics, R&D space, manufacturing facilities, and housing, especially in Germany and Eastern Europe.

For investors, the key is an approach focused on specific assets, submarkets, and strategies that can deliver durable income and withstand volatility. In this cycle, alpha opportunities will matter more than beta bets. Below, we explore sectors where that precision may pay off.

Digital infrastructure: Reliable demand, rising discipline

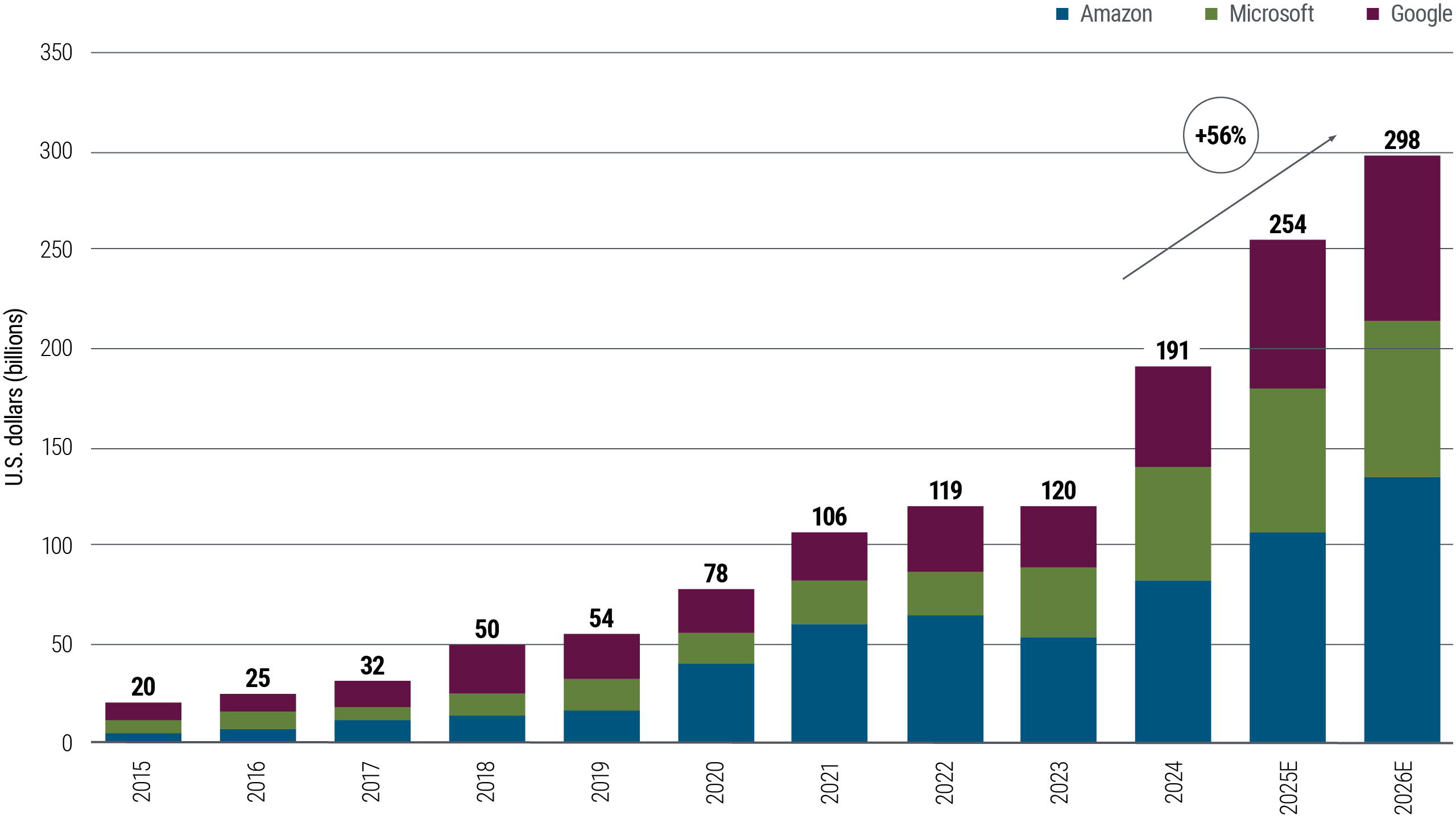

Digital infrastructure has become the backbone of the modern economy – and a focal point for institutional capital. The surge in artificial intelligence (AI), cloud computing, and data-intensive applications has transformed data centers from a niche asset class into strategic infrastructure. But this raises new issues: power constraints, regulatory hurdles, and rising capital intensity (see Figure 1).

Across global markets, the issue isn’t demand – it’s where and how to meet it. In mature hubs, such as Northern Virginia and Frankfurt, hyperscalers like Amazon and Microsoft are locking in capacity years in advance, particularly for facilities tailored to AI inference and cloud workloads. These assets may offer resilience and pricing power. But facilities focused on more computationally intensive AI training – often in lower-cost, power-rich regions – have risks related to grid reliability, scalability, and long-term cost efficiency.

As core markets strain under the weight of demand, capital is pushing outward. In Europe, power shortages and permitting delays, alongside low latency and digital sovereignty requirements, are forcing a pivot from traditional hubs to emerging Tier 2 and 3 cities such as Madrid, Milan, and Berlin. These centers offer growth potential, but infrastructure gaps, differing regulatory frameworks, and execution risk demand a more hands-on, locally attuned approach.

In the Asia-Pacific region, the emphasis is on stability and scalability. Markets like Japan, Singapore, and Malaysia continue to attract capital, underpinned by their strong legal frameworks and institutional depth. Here, investors are prioritizing assets that can support hybrid workloads and meet evolving environmental, social, and governance (ESG) practices, even as costs rise and policy oversight tightens.

As digital infrastructure becomes central to economic performance, success will hinge not just on capacity but on navigating regulatory and operational complexity, managing land and power constraints, and building systems that are resilient, scalable, and optimized for a distributed, data-driven, energy-efficient future.

Living: Durable demand, diverging risks

The living sector continues to offer income potential and structural demand. Demographic tailwinds – such as urbanization, aging populations, and evolving household structures – continue to support long-term demand. But the investment landscape is fragmented. Regulatory frameworks, affordability pressures, and policy interventions vary widely, requiring investors to proceed with caution.

Rental housing demand remains strong across global markets, sustained by high home prices, elevated mortgage rates, and evolving renter preferences. These dynamics are extending renter life cycles and fueling interest in multifamily, build-to-rent (BTR), and workforce housing.

Japan stands out for its blend of urban migration, affordable rental housing, and institutional depth – offering a stable, liquid market for long-term residential investment (see Figure 2).

Yet markets are not monolithic. In some countries, institutional platforms are scaling rapidly. In others, affordability concerns have triggered regulatory issues. These include tighter rent regulations, zoning restrictions, and growing political scrutiny of institutional landlords, particularly where housing access has become a flash point in public discourse.

Student housing has emerged as an attractive niche, supported by enrollment growth and limited supply. Purpose-built student accommodation can benefit from predictable demand and a growing base of internationally mobile students. Structural undersupply, favorable demographics, and the enduring appeal of higher education, especially in English-speaking countries, continue to support the asset class.

Still, regional dynamics matter. In the U.S., demand remains strong near top-tier universities, though concerns are rising that tighter visa policies and a less welcoming political climate could curb future international student inflows. In contrast, countries like the U.K., Spain, Australia, and Japan are seeing rising demand, supported by more favorable visa regimes and expanding university networks.

Across the living sector, investors must pair global conviction with local fluency. Operational scalability, regulatory navigation, and demographic insight are increasingly important, as they are central to unlocking sustainable value in a sector that is essential, evolving, and complex.

Logistics: Still in motion

Industrial real estate, comprising warehouses, distribution centers, and logistics hubs, has emerged as a linchpin of the modern economy. Once a utilitarian backwater, the sector now sits at the nexus of global trade, digital consumption, and supply chain strategy. Its appeal reflects the rise of e-commerce, the reconfiguration of supply chains through nearshoring, and the relentless demand for faster delivery. Although the fast rent growth of recent years is slowing, landlords with leases rolling over remain in a strong position. Institutional capital continues to flow, particularly into such niche segments as urban logistics and cold storage.

Yet the sector’s outlook is increasingly shaped by geography and tenant profile. Across regions, a few themes recur. First, trade routes continue to evolve. In the U.S., for instance, East Coast ports and inland hubs are reaping the benefits of reshoring and shifting maritime routes. This reflects a broader global pattern: Assets near key logistics corridors – whether ports, railheads, or urban centers – command a premium. Even in these favored locations, however, leasing momentum has moderated, with tenants growing more cautious, decisions delayed, and new supply threatening to outpace demand in some corridors.

Second, urban demand is reshaping logistics. In Europe and Asia, tenants are prioritizing proximity to consumers and sustainability, fueling interest in infill and green-certified facilities. Yet regulatory hurdles, uneven demand, and rising construction costs are testing investor patience. While Japan and Australia continue to see healthy absorption, oversupply in cities like Tokyo and Seoul has tempered rent growth – even as long-term fundamentals remain intact.

Finally, capital is becoming more discerning. Core assets in prime locations continue to attract strong interest, while secondary assets face growing scrutiny. Trade policy uncertainty, inflation, and tenant credit risk are sharpening the focus on quality – of both location and lease. Industrial fundamentals remain solid, but as the sector matures, so does the investment calculus, becoming more nuanced and regionally specific.

Retail: Selective strength in a reshaped landscape

Retail real estate has entered a phase of selective resilience, defined by necessity, location, and adaptability. Once the weak link in commercial property, the sector has found firmer footing, buoyed by the enduring appeal of formats anchored by essential services. Grocery-anchored centers, retail parks, and high street sites in gateway cities now anchor the sector, offering potential income durability and inflation mitigation. Amid high interest rates and cautious capital, these assets are prized for reliability, not glamour.

The landscape is clearly bifurcated. On one side are prime assets with stable foot traffic, long leases, and limited new supply – qualities that continue to attract capital and offer scope for value creation through tenant repositioning or mixed-use redevelopment. On the other side are secondary assets weighed down by structural obsolescence, tenant churn, and dwindling relevance.

This divergence plays out across regions. In the U.S., grocery-anchored centers and retail parks remain resilient, supported by consistent consumer demand and defensive lease structures. Department-store-reliant malls and weaker suburban formats, by contrast, continue to face secular decline. Yet signs of reinvention are emerging as luxury brands reclaim flagship high street locations in select urban markets.

Europe, too, is seeing a flight to quality. Retail centers anchored by grocery stores and other essential businesses are outperforming, while discretionary formats remain under pressure. The region has embraced omni-channel retail more fully, with some landlords converting underused space into last-mile logistics hubs.

In Asia, tourism has revived high street retail in Japan and South Korea, but suburban malls have seen more muted performance amid inflation and fragile discretionary spending. Trade tensions add complexity.

Office: A sector still searching for a floor

The office sector continues to undergo a slow and uneven recalibration. Elevated interest rates and tighter credit have compounded the challenges of underutilized space and evolving workplace norms. While leasing and utilization show early signs of stabilization, the recovery remains fragmented. The divide between prime and secondary assets has hardened into a structural fault line.

Class A buildings in central business districts continue to attract tenants, supported by back-to-office mandates, talent competition, and ESG priorities. These assets offer flexibility, efficiency, and prestige. Older, less adaptable buildings risk obsolescence unless they are repositioned with significant capital investment.

This bifurcation is global. In the U.S., leasing has picked up in coastal cities like New York and Boston, while oversupply weighs on the Sun Belt. The looming wall of maturing debt threatens weaker assets, and refinancing capital remains cautious. The outlook: slow absorption, selective repricing, and continued distress in noncore holdings.

In Europe, shortages of class A space are emerging in cities such as London, Paris, and Amsterdam. But new development is constrained by regulation, construction costs, and rising ESG standards. Investors have shifted from broad-brush strategies to asset-specific underwriting.

The Asia-Pacific region shows relative resilience. Capital continues to flow into Japan, Singapore, and Australia – jurisdictions prized for transparency and stability. Office reentry is improving, supported by cultural norms and competition for talent. Demand remains concentrated in high quality assets.

Still, the sector faces a structural overhang. Institutional portfolios remain heavily allocated to office, an inheritance from earlier cycles. This legacy exposure may constrain price recovery, even for top-tier assets. As the very idea of “the office” is being redefined, success depends less on macro trends and more on execution.

Navigating real estate’s next phase

As commercial real estate enters a more complex and selective cycle, the focus is shifting from broad market exposure to targeted execution across both equity and debt. Macroeconomic divergence, sectoral realignment, and capital discipline are reshaping how investors assess opportunity and manage risk.

In this environment, we believe success hinges on integrating local insight with global perspective, distinguishing structural trends from cyclical noise, and executing with consistency. The challenge is not simply to participate in the market but to navigate it with clarity and purpose.

While the path forward may be narrower, it remains accessible to those who adapt with agility. Investors who align strategy with enduring demand and navigate complexity with discipline may still find opportunities for long-term, thoughtful performance.

For more on PIMCO’s real estate solutions, click here.

1 Mortgage Bankers Association as of March 2025 Return to content

2 A “safe haven” is an investment that is perceived to be able to retain or increase in value during times of market volatility. Investors seek safe havens to limit their exposure to losses in the event of market turbulence. All investments contain risk and may lose value. Return to content

3 PIMCO Prime Real Estate is a PIMCO company. PIMCO Prime Real Estate LLC is a wholly-owned subsidiary of PIMCO LLC, and PIMCO Prime Real Estate GmbH and its affiliates are wholly-owned by PIMCO Europe GmbH. PIMCO Prime Real Estate GmbH operates separately from PIMCO. PIMCO Prime Real Estate is a trademark of PIMCO LLC and PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. Return to content