The Worst Is Likely Behind for Emerging Markets

- We are increasingly positive on the outlook for emerging markets as conditions become more supportive.

- We currently favor EM assets denominated in local currency in markets with high inflation-adjusted interest rates such as Brazil.

- Much in EM still depends on the U.S. Federal Reserve’s ability to tame inflation and China’s ability to reactivate economic activity.

Despite a confluence of unprecedented shocks, emerging markets (EM) have shown resilience, with few signs of a broad-based crisis. As an asset class, EM appears to be positioned for stronger performance.

High EM real – or inflation-adjusted – rates buffer the spillover risks from further U.S. Federal Reserve (Fed) interest rate hikes and the effects of the strong U.S. dollar. China’s economic reopening provides a tailwind, and the peaks in inflation and fiscal pressures appear to have passed.

Structural forces such as deepening local markets and nearshoring support EM fundamentals. The magnitude of last year’s EM fund outflows suggests the asset class is now both structurally and cyclically under-owned, while EM valuations screen as historically cheap, in our view.

As a result, we are becoming increasingly positive on EM more broadly and select EM local debt in particular. Still, we remain cautious until the outlook for monetary policy becomes clearer, as much depends on the Fed’s ability to tame inflation and China’s ability to reactivate economic activity.

EM is resilient to the downside, and central banks have done their jobs

Pretty much everything that could go wrong for EM did in 2022, with pandemic pressures exacerbated by the war in Ukraine, the Fed rapidly hiking rates, high energy and food prices, China’s zero-COVID policy, the rise of populist regimes, and idiosyncratic climate problems.

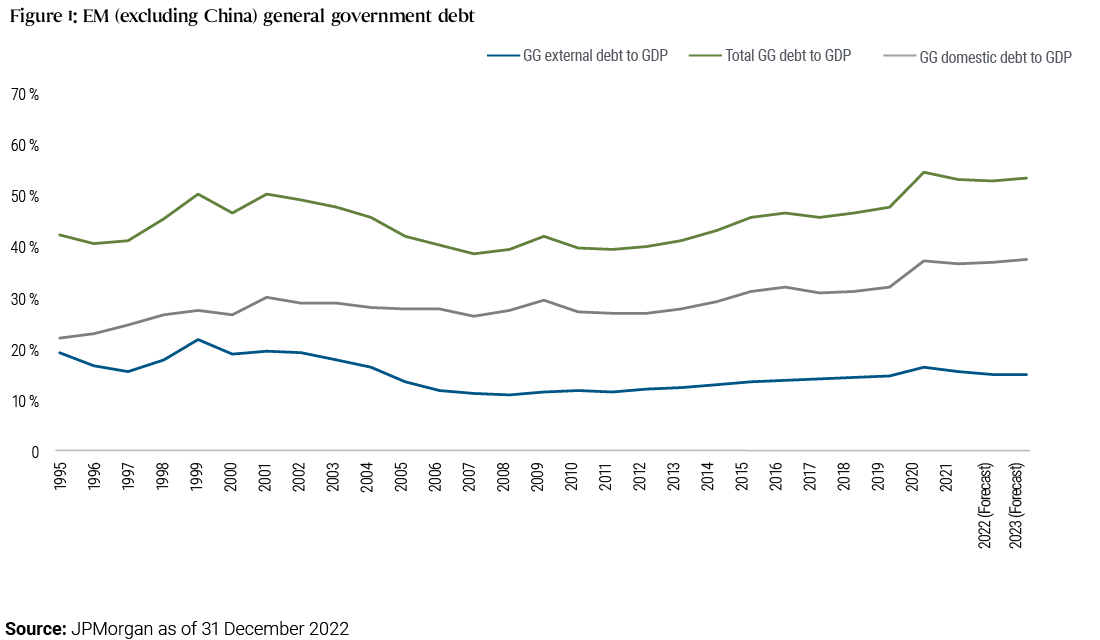

Yet the majority of EM countries have recovered to pre-pandemic GDP levels. Leverage in EM has remained in check, with debt broadly stable relative to GDP (see Figure 1).

That resiliency is likely to continue in 2023. EM benefitted from proactive central banks that – unlike in previous episodes – prioritized controlling inflation over growth and did so earlier than developed market (DM) peers, raising real rates well above neutral levels.

As a result, while headline inflation is still high, the peak looks to be behind us (for more, see our November blog post, “Peak Inflation May Hint at Peak Rates in Emerging Markets ”), with EM core inflation more in line with DM trends. Looking forward, the signal from high market-implied real rates in EM is that EM policymakers are likely to remain vigilant. This should keep inflation expectations anchored and below inflation targets into 2024.

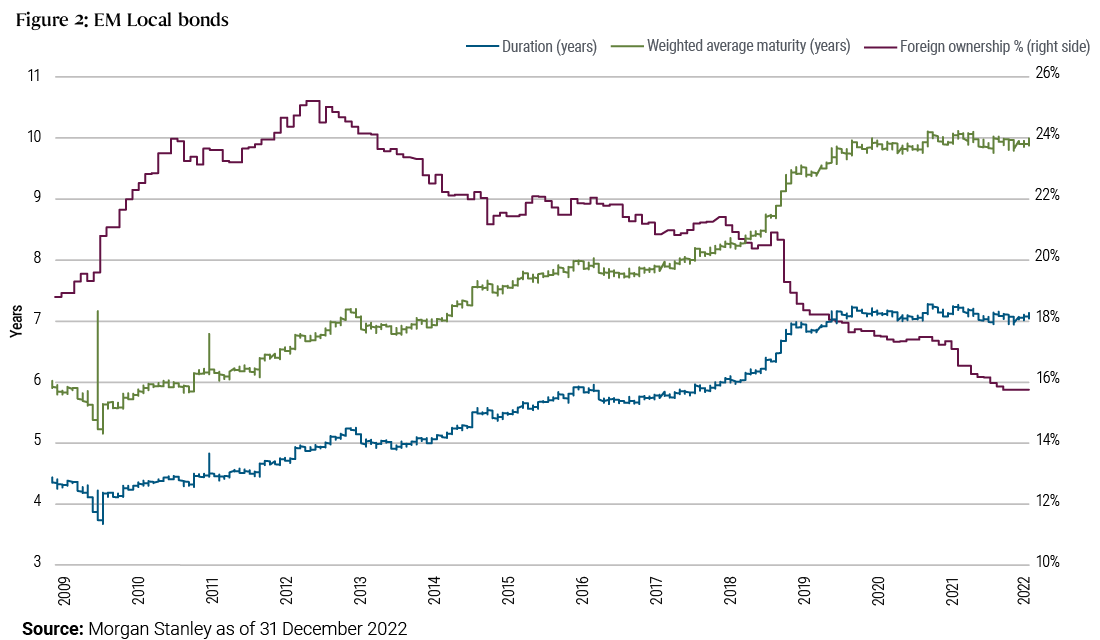

Today, EM borrows overwhelmingly in local currency and with longer-dated debt than ever before (see Figure 2). This, together with the growth of institutional EM savings, helps minimize external refinancing risks and the impact of rising U.S. rates on borrowing costs and debt sustainability.

Structural features are becoming cyclically relevant and supportive

EM external balances are predominantly financed by foreign direct investment (FDI) flows. These tend to be more stable than the volatile portfolio flows in the post-2008 global financial crisis (GFC) era of quantitative easing by global central banks. FDI flows are being driven by longer-term forces that have accelerated, such as nearshoring into countries like Mexico, the need for energy independence in DM, and climate-related investments in EM.

Lower external imbalances – in the form of fewer overvalued currency pegs and lower external leverage – offer an additional buffer, enabling EM foreign exchange to be a release valve from Fed cycle spillovers.

Furthermore, EM corporations have entered this rising rate environment with strong balance sheets after record levels of refinancing and liability management in recent years. The EM corporate default rate – excluding Russia, Ukraine, and the outsize impact of the China property sector – was just 1.8% in 2022, according to JPMorgan, broadly in line with DM.

EM set to benefit from China reopening

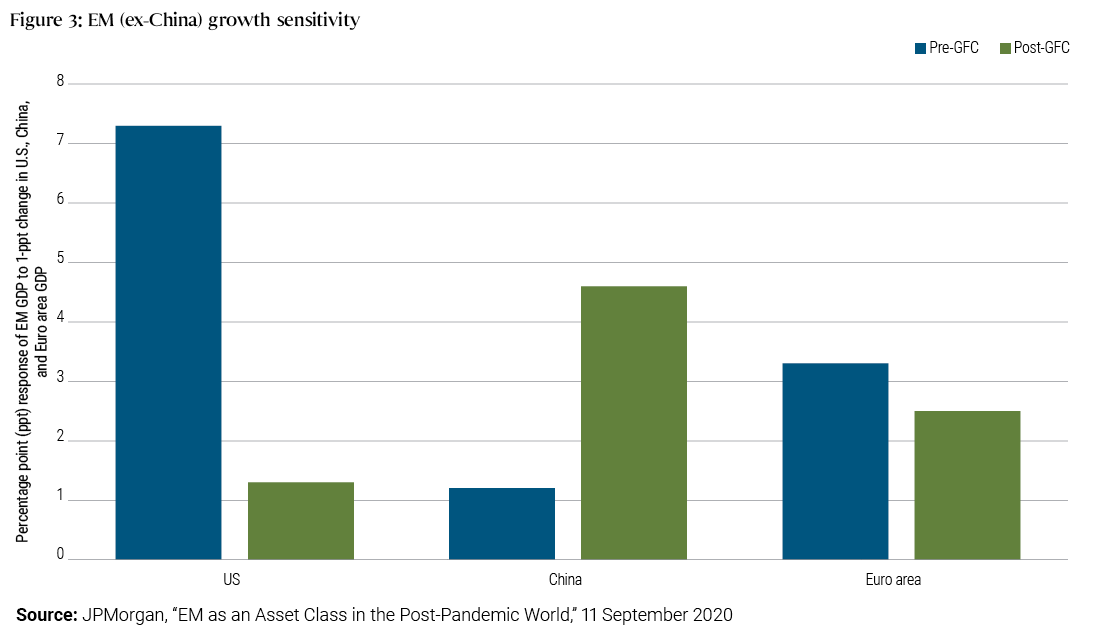

Since the GFC, China has taken over from the U.S. and Europe as the main driver of EM growth (see Figure 3), as China has evolved from an end user of commodities, to a cog in global production, to a consumer of EM goods and services such as tourism.

EM growth has thus far been resilient in spite of China’s slowing. A successful China reopening would disproportionately benefit EM, even if demand shifts from commodities to services in this cycle.

With Chinese growth rising 5%–5.5% year-over-year in 2023 in PIMCO’s base case, EM will likely remain resilient even in the event of a DM recession (which we expect would be mild – for more, see our latest Cyclical Outlook, “Strained Markets Strong Bonds ”).

Our baseline is for EM growth to slow to 3.5%, from 5.5% as the DM economic slowdown bites and EM output gaps close. Yet this does not fully reflect benefits from China’s reopening, which we expect to take hold in the first half of 2023 and accelerate in the second half.

Value is back in fixed income and EM is underinvested

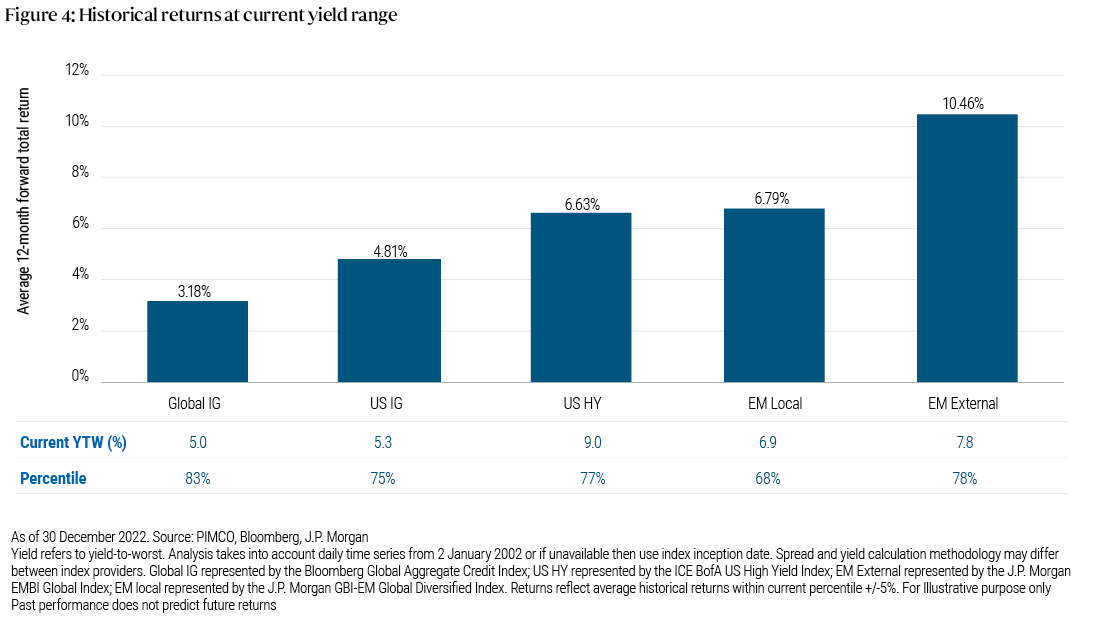

The repricing in 2022 has restored value in EM, with yields rising to pre-GFC levels. By several metrics, EM valuations look cheap (see Figure 4), and historically EM returns have been in the high single digits at similar yields.

The technical backdrop has also improved. Last year saw the largest-ever annual outflow from EM funds – about $89 billion across external and local debt, according to JPMorgan, which is close to 16% of the asset class – resulting in a sharp cyclical underinvestment into EM.

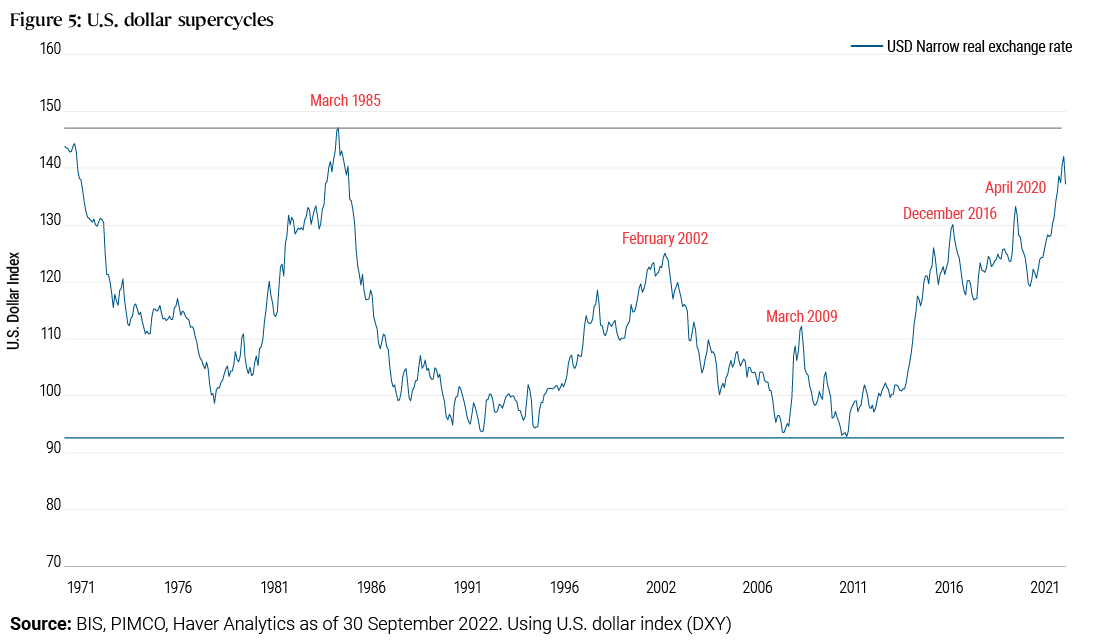

If the decade-long supercycle of U.S. dollar strength (see Figure 5) finally ends, it could also attract inflows into EM local debt from investors who want to express a short-dollar view (for more, read our recent blog post, ?Dollar Strength: Sum of All Fears.? )

Challenges necessitate focus on downside protection

Geopolitics and internal politics will remain drivers of policies and market perceptions of EM. The war in Ukraine remains a key source of uncertainty, with questions about Russia’s energy leverage as Europe gets better prepared on gas supplies. Markets will continue to digest the implications of recent elections in countries such as Brazil, but the 2023 election calendar in EM is relatively light, with Turkey and Argentina being the notable exceptions.

Frontier markets appear vulnerable, with some countries locked out of capital markets. The sovereign default rate for this subset of EM is moving higher, with several countries likely to restructure their debt over the next few years.

A focus on the potential downside, and having systematic frameworks for navigating these risks, is therefore imperative. (For more on PIMCO’s risk framework in EM, see our blog post, “Spotting Opportunities and Risks Across the EM Investment Universe.”)

We would caution against being tempted by low-quality EM credits trading at high yields, and would instead focus on the investment grade and BB portion of the asset class, which offers a lower risk profile and where forced sales have created value.

We think the worst is likely behind for EM, with investors likely to find improved opportunities across the EM landscape this year. Specifically, we currently favor EM local assets in markets with high real rates such as Brazil; corporate credit in commodity-exporting countries; select EM financials; and currency long positions in countries such as Thailand that we believe are well positioned for the upside in China.

To learn more, visit PIMCO’s Emerging Markets site.

Featured Participants

Disclosures

The terms “cheap” and “rich” as used herein generally refer to a security or asset class that is deemed to be substantially under- or overpriced compared to both its historical average as well as to the investment manager’s future expectations. There is no guarantee of future results or that a security’s valuation will ensure a profit or protect against a loss.

Past performance is not a guarantee or a reliable indicator of future results.

Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio.

The credit quality of a particular security or group of securities does not ensure the stability or safety of an overall portfolio. The quality ratings of individual issues/issuers are provided to indicate the credit-worthiness of such issues/issuer and generally range from AAA, Aaa, or AAA (highest) to D, C, or D (lowest) for S&P, Moody’s, and Fitch respectively.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2023, PIMCO.