- Monthly state income tax collections in April indicate that the municipal market credit cycle has likely peaked, but most state and local governments have strong fiscal positions with ample reserves to manage the decline.

- We believe the decline in tax revenue is driven less by a deteriorating economy and more by a return to normal trends following unsustainable revenue growth in recent years.

- Robust rainy day funds will help plug FY23 and FY24 budget gaps, and most states are in a strong fiscal position powered by the robust post-pandemic recovery and unprecedented federal pandemic aid.

- Negative media headlines in the coming months may generate fear but also investment opportunities. Selectivity is critical, and we are cautious around issuers more vulnerable to secular risks.

Monthly state income tax collections sank in April, indicating the municipal market credit cycle has likely peaked. Yet the decline – which follows record high tax collections in the previous April – will, in our view, slow dramatically and can be well managed by most state and local governments that have amassed ample reserves. While security selectivity is critical, we expect a recession and state and local budget cuts to fuel outsize fear, creating attractive investment opportunities.

Income tax collections shrink

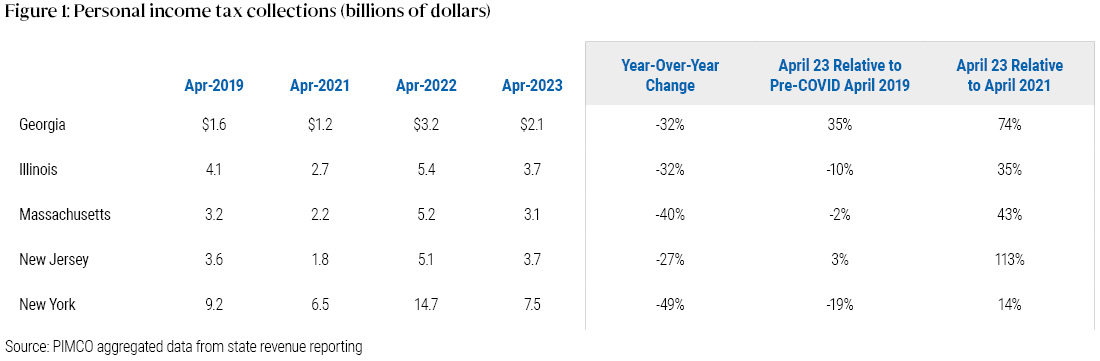

Almost all states saw income tax revenue shrink from April 2022, but the contraction was particularly noteworthy in Georgia, Illinois, Massachusetts, New Jersey, New York, and California. A drop in collections was widely anticipated amid a cooling economy and capital markets, yet the actual figures were worse than expected in several states, including California and New York. Both states are now forecasting current year or out-year budget deficits after enjoying large surpluses in recent years.

Yet it is important to put the recent slump in context. We believe current declines are driven less by a deteriorating economy, and more by a return to normal trends following unsustainable revenue growth in recent years. State revenues surged a record 20% in 2021 followed by nearly 14% growth in real terms early in 2022, with April 2022 collections representing a high-water mark for much of the sector.Footnote1 Figure 1 shows April 2023 collections shifted lower, bringing most states more in line with fiscal year 2019 and 2021 results.

Illinois, for example, reported that April 2023 personal income tax revenues fell by a record one-third from 2022 to $3.7 billion – still among the strongest months on record. And like most states, it also relies heavily on other revenue sources that continue to perform relatively well, including sales taxes. The state’s total revenue collection of $6.2 billion was the second highest on record after April 2022, despite falling 23% from the previous April’s record high.Footnote2

Robust rainy day funds will help plug FY23 and FY24 budget gaps

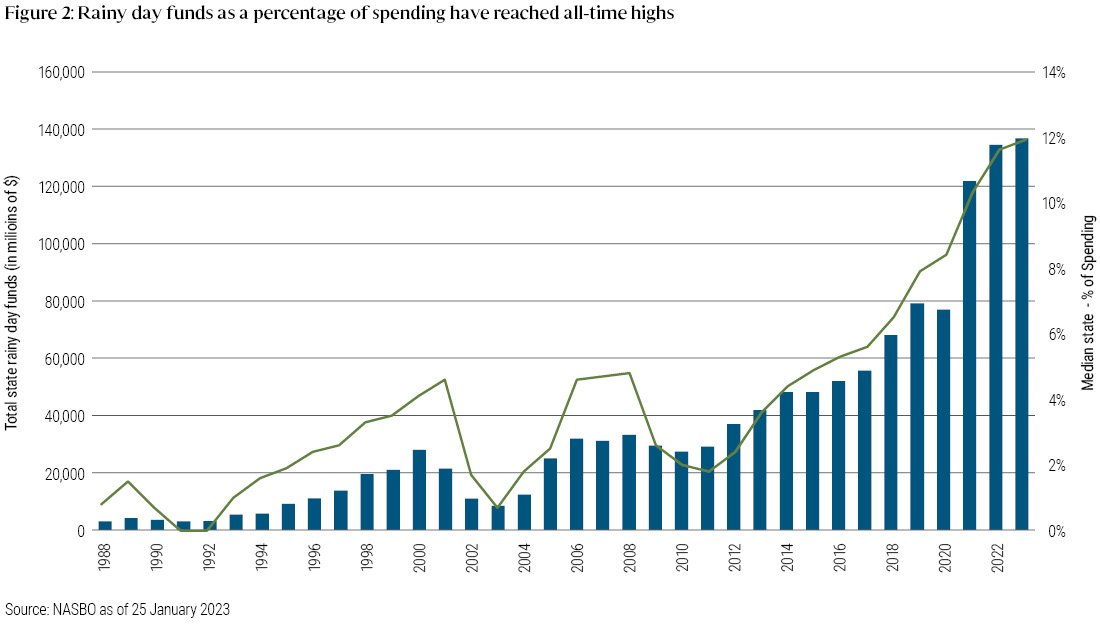

Most states are in a strong fiscal position, powered by the robust post-pandemic recovery and unprecedented federal pandemic aid. Budget reserves are at an all-time high. As such, states enter a possible recession better prepared than at any point in recent history, with reserves more than four times levels carried into the global financial crisis or GFC (see Figure 2). Rainy day funds are projected to reach 12% of spending in fiscal 2023 – a stark difference from past years when the median fell as low as 0%. These reserves create a sizable buffer against revenue volatility and will provide states time to enact changes (to revenues or expenditures) to balance their budgets.

Doubting the elevated 2021/22 tax revenues would last, many states built budgets that included large discretionary one-time spending capable of being pulled back if needed. Last year, California included more than $40 billion of its projected 2023 $100 billion budget surplus for new one-off spending; this included accelerated capital spending, pilot projects, and grant programs that can be cut more easily than structural spending such as public education or correctional programs. Trimming from these more discretionary areas enabled the state to close its projected budget deficits with little or no planned use of its $42 billion in rainy day reserves, keeping them intact for what could be stormier days ahead.

We expect rating upgrades to slow, but no meaningful acceleration of downgrades for investment grade credit

With solid fiscal positions, we don’t expect recent declines in tax revenue will trigger a meaningful acceleration of credit rating downgrades for state or local governments. Instead, we think the recent wave of upgrades will plateau. In the first quarter of 2023, Moody’s upgraded three times as many U.S. public finance credits than it downgraded, including those of lower-rated states such as New Jersey and Illinois. The upgrades across rating agencies for many states are only now petering out. While Moody’s did move the State of California’s outlook to negative in May, we expect it to be slow to downgrade the state as they monitor revenues and budget gaps. We also expect California to be somewhat of an outlier for the sector given its notoriously volatile revenues that are heavily correlated to capital gains performance.

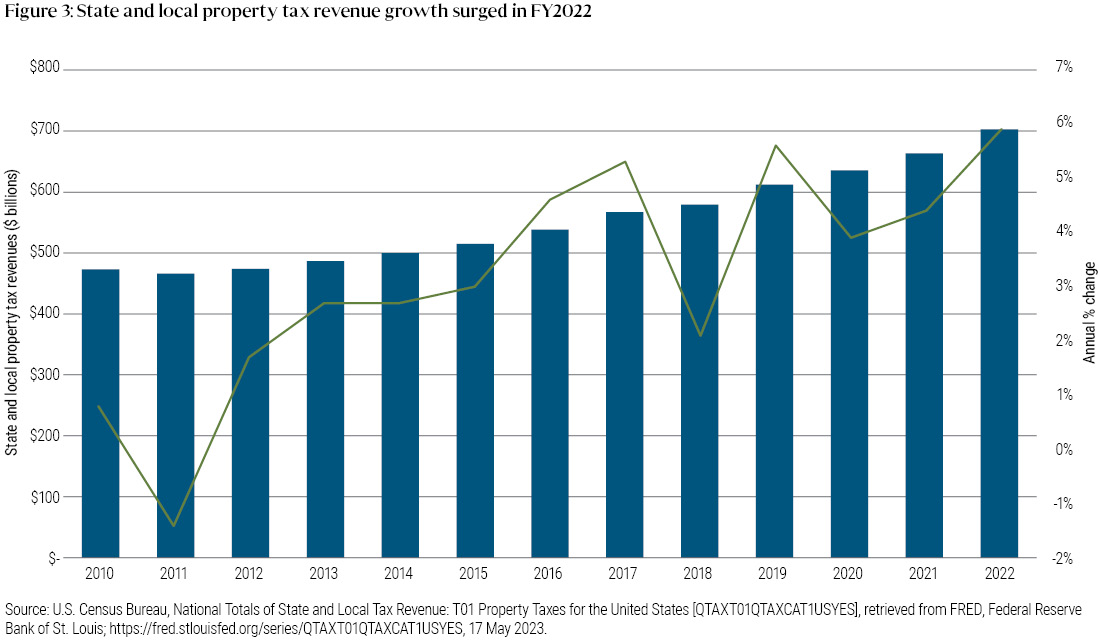

Local governments have seen similar upgrade momentum, even in cities like New York and Chicago that have projected budget deficits. Many have used unprecedented federal fiscal relief and better-than-expected tax collections to boost their reserves, and will likely benefit from the relative stability of property tax revenues.

Additionally, rating stress tends to lag the onset of a recession, partly because downgrades tied to audited financial results are typically released six to 12 months after the close of a fiscal year. Looking back at the GFC, public finance downgrades did not hit their peak until 2012, well after a broader economic recovery had begun.

Negative headlines may drive opportunities

Though credit fundamentals remain broadly strong for municipals, we expect negative media headlines in the coming months may generate fear and, in turn, investment opportunities. Unlike corporate credit issuers, municipalities must publicly debate their fiscal choices. As budget austerity takes hold, governors and mayors will come under pressure to make cuts in popular areas like education, healthcare, and transportation. Talks of budget cuts often spark debates in the media that fan investor fears and spur selling, which we believe will lead to investing opportunities.

Selectivity is critical, however. While we believe that the vast majority of high-grade municipals will weather our baseline forecast for a recession, we remain cautious around issuers whose credit quality may be hurt by secular risks including demographic shifts, stagnating return to office trends, and uncertain commercial property valuations.

1 Tax Policy Center: State and Tax Economic Review, 2022 Quarter 4: https://www.taxpolicycenter.org/publications/state-tax-and-economic-review-2022-quarter-4 Return to content

2 State of Illinois, Commission on Government Forecasting and Accountability: April Monthly Briefing: https://cgfa.ilga.gov/Upload/423%20Monthly.pdf Return to content