We Believe

- Looking to 2022, we expect positive global economic growth and elevated inflation that moderates over the course of the year, though we see upside risks to our inflation forecast. As we believe the global economy is mid-cycle, we remain overweight overall risk.

- We remain broadly constructive on equity market risk in particular and favor companies driving long-term disruptions via technological and sustainable initiatives.

- Our views on interest rates, credit, and currencies are more nuanced. We expect government bond yields to trend higher as central banks raise rates, but in a multi-asset portfolio context, we believe duration can be a diversifier. We see emerging market currencies offering more value than developed ones.

- We have a modest overweight to credit markets. We believe securitized credit still offers attractive value, particularly in non-agency U.S. mortgages.

Asset Allocation Outlook

We expect the next decade to look a lot different from the past one.

As PIMCO detailed in our recent Secular Outlook, “Age of Transformation” we believe several key trends – including technological innovation, green energy initiatives, and more inclusive socioeconomic policies – will create disruptions and lead to compelling investment opportunities. This has several important implications for multi-asset portfolios as the risks and opportunities presented by this new paradigm offer fertile ground for active management.

Looking ahead to 2022, our base case is positive for the global macroeconomy. We expect growth to be positive and inflation to remain elevated in the near term and then eventually moderate as we move through 2022, though it is difficult to have high conviction around the timing of any eventual moderation and there are upside risks to our inflation forecast. Still, we believe growth assets, such as equities and credit, will tend to deliver positive returns over the next year. However, as we noted in our mid-year outlook, we expect greater dispersion in performance across sectors and regions. Higher return dispersion is a common feature of mid-cycle periods, but we believe the transformative secular trends noted earlier have the potential to magnify outcomes.

Who are going to be the “winners” and “losers” in the new cycle, and most importantly, how can investors identify these opportunities for differentiated returns? This piece explores some fundamental shifts occurring at the “ground level” of the economy that we believe will have implications for top-line growth and inflation, but also create distinct investment opportunities in a number of sectors and regions. Specifically, we discuss trends in labor, technology, transportation, and energy.

Evolving labor market

Investors are grappling with the pandemic’s structural effects on the global economy, and nowhere is this more relevant than in the labor market, where both temporary and more persistent factors have led to labor shortages. Ongoing COVID-19 fears, government assistance, and heightened childcare challenges are among the shorter-term constraints that have pressured labor supply in 2021. These should be the first to ease provided vaccines continue to demonstrate their efficacy, the economic effects of variant viruses are managed, schools stay open, and evidence gathers that the rolling off of unemployment benefits is encouraging more workers to return to the workforce. In the medium term, restrictions on immigration appear likely to weigh on the outlook.

Many of those shorter-term constraints should ease over time, but more structural changes to the labor market may present lasting or permanent challenges to businesses and economies. Most early retirements are unlikely to reverse, while lifestyle and behavioral shifts sparked by a year in quarantine could become entrenched. The pandemic also catalyzed domestic migration flows, which exacerbated skills mismatches that were already forming due to shifts in consumer demand. Despite rising wages in affected sectors, firms continue to report an inability to fill open jobs (see Figure 1), with some businesses in heavily afflicted sectors such as restaurants being forced to close as a result. With labor participation having largely rebounded in the 16–24 age group yet showing no signs of recovery in the 55+ cohort, these structural factors may be here to stay. Sensing a generational tilt in bargaining power, workers around the world are demanding higher pay and better conditions. This suggests upside risk to our expectation that inflation will moderate sometime in 2022.

Technological acceleration, and chip shortages

COVID has exposed the fragility of global supply chains as well as longer-term mismatches created by the ongoing digital transformation. The semiconductor industry has been at the center of this with both near-term COVID and long-term structural factors driving imbalances. Demand for chips spiked as consumer purchases of electronic goods exploded during lockdowns. Meanwhile, supply was severely constrained as myriad factors hampered production, including shortages of labor, weather events, and a COVID-led supply slowdown. Over the next six to nine months, we expect pressures on the chips supply chain to ease as output and capacity utilization now appear back to full capacity.

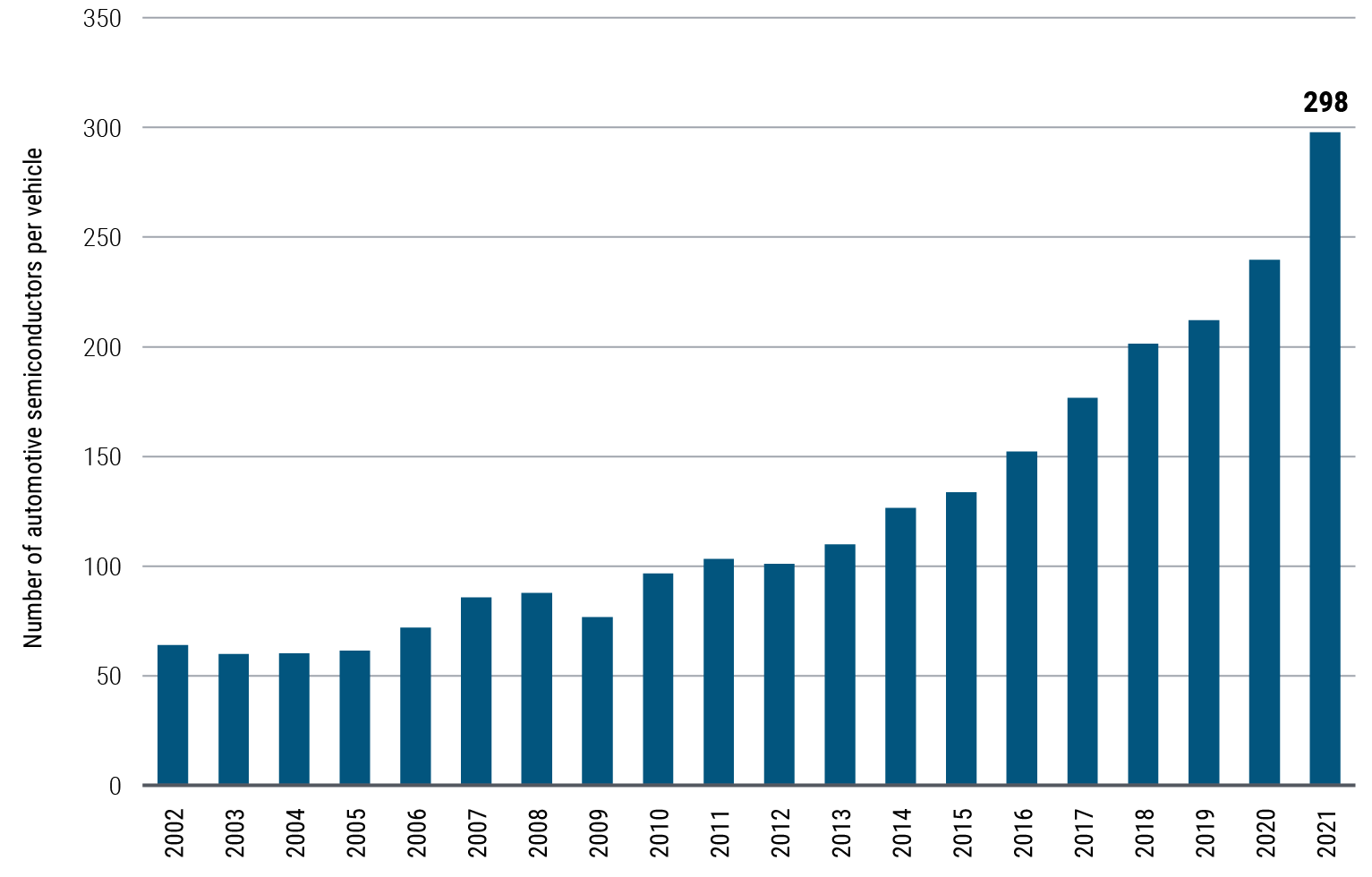

However, the structure of the semiconductor industry was brittle before COVID struck. The exponential pace at which people have adopted new cars (including electric vehicles), new phones (5G), and other connected devices has fueled a massive demand wave, which many industry leaders and observers underestimated. Figure 2, for example, highlights the significant increase in the average number of semiconductors in new vehicles. Pandemic challenges aside, we expect demand will continue to accelerate at a healthy clip while additional chip capacity will increase at a slower pace. The largest foundry in the world shares this view of an endemic tight market due to growing demand from new applications, including green power, the metaverse, and automation. We do not believe the market is appropriately pricing in the changes that we expect to occur over the next several years, and we believe companies across the semiconductor supply chain are poised for differentiated returns.

Transportation volatility

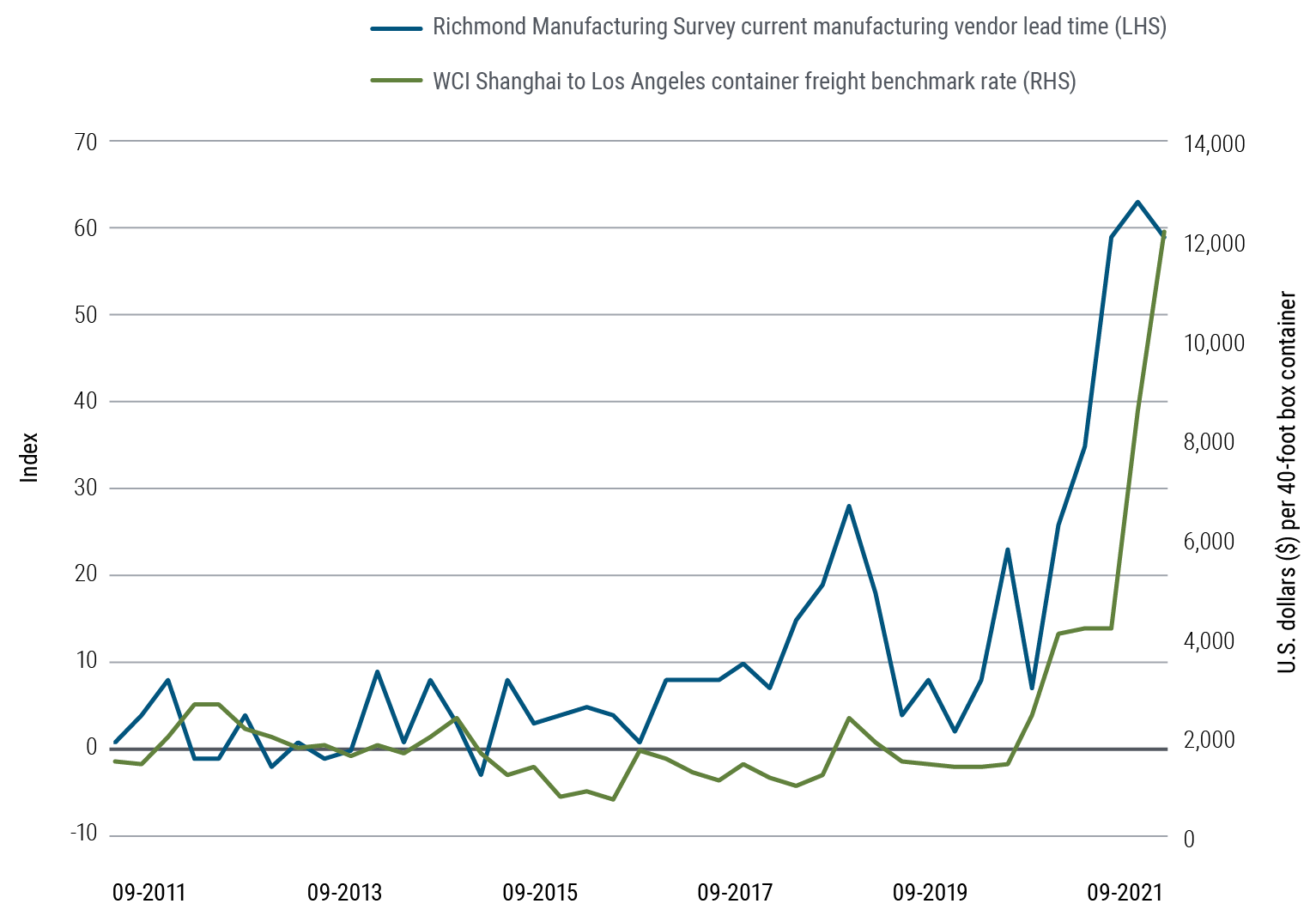

Shipping has been another impediment to supply meeting demand this year. The shift in consumer spending from services to goods during lockdowns ignited a strong upsurge in demand, with traffic volumes on the transpacific route 28% above pre-pandemic levels. The spread of the coronavirus congested many routes, and incidents unfolded on a global scale as the heavily publicized Suez Canal accident showcased. Zero-COVID policies in China and several climate disasters led to severe disruptions as the largest terminals in the world were forced to close. These events have overlapped and exacerbated shipping bottlenecks, resulting in an unprecedented tenfold increase in freight rates from Shanghai to Los Angeles (see Figure 3).

We expect congestion to ease beginning this winter, especially after the Chinese New Year period alleviates some of the pressure with its seasonal low exportation levels. But goods demand should remain supported by strong secular forces. Moreover, the green transition will require strong capital expenditure in infrastructure, while the shift toward online shopping, which is more import-intensive and Asia-focused, continues. Consequently, we expect pressure on freight rates and delivery times to only gradually come down and we anticipate the market will normalize and balance around 2023, further benefiting global shipping companies.

About energy

In many ways, 2021 has been a very supportive environment for energy markets. Weather events – Hurricane Ida, widespread droughts, unusually weak winds in Europe – along with curbs on coal mining in China have led to surging energy prices. In Europe, record-breaking natural gas prices have led to a continent reliant on Russian supply and at the mercy of climate gyrations. A cold winter could lead to more demand destruction, particularly among energy-intensive industries, which threatens to extend a price surge in other commodities such as metals and fertilizer. Further, double-digit increases in heating bills could sour consumer sentiment and discretionary spending. The reaction to the energy crisis is likely to have deep consequences on the investment landscape. So far, the overall reaction by energy-importing countries has been to view renewables as the solution to cutting energy dependency, and accordingly most have cut costs dramatically. As such we are likely to see an acceleration in renewable investments, all the more since lead times can be very short for solar and wind projects (three to 12 months) and there is plenty of low-hanging fruit in China, India, and southern Europe.

Implications for multi-asset portfolios

PIMCO’s dynamic factor model reaffirms our view that the economy is mid-cycle. But with fuller valuations, risk assets are more vulnerable to exogenous shocks and policy missteps.

In our view, the risk of a policy mistake has increased as monetary and fiscal stimulus recedes and authorities attempt to engineer a growth handoff to the private sector. This creates the potential for “fatter tails” (more divergent positive and negative outcomes). In the left tail, inflation is more persistent, forcing central bankers to tighten policy sooner than planned, hampering economic growth in highly indebted economies. In the right tail, a high personal savings rate creates room to support consumption, while the push for physical infrastructure can drive investment and productivity gains, creating a virtuous cycle that would likely be a boon for economic growth. This fat-tail backdrop highlights the importance of selection – within and across asset classes – and the ability to adapt to changes in the macro environment.

In terms of portfolio positioning, as we look toward 2022, we remain broadly constructive on equity market risk. In line with our secular views, we expect to see substantial differentiation across regions and sectors going forward, which warrants a more selective and dynamic approach. We focus on relative value between regions and sectors and on retaining the flexibility to add risk to high-conviction areas as market volatility presents opportunities.

Within developed markets, we remain overweight U.S. equities, where we have positioned our equity overweight in cyclical growth sectors. We also have exposure to Japanese equities, which tend to have a valuation cushion along with beta to cyclical growth. We view European equities as more challenged: A combination of unfavorable sector composition, energy price headwinds, and growing unease around the COVID outlook during the winter months presents meaningful downside risk for European markets in the near term.

In emerging markets, we continue to be constructive on select exposures within Asia. Simultaneously, we are closely monitoring regulatory developments in China and evolving geopolitical tensions in the region. We remain overweight emerging Asia, with an emphasis on hardware technology and equipment that will be foundational to regional as well as global growth.

From a sector perspective, we retain a preference for secular growth trends like digitalization and sustainability. In particular, we believe that semiconductor manufacturers, factory automation equipment providers, and green energy and mobility suppliers all stand to benefit, and we expect these sectors to be an important part of our portfolio construction. We complement this with exposures that may benefit from a more inflationary environment; these are companies that we believe have significant barriers to entry and strong pricing power that can potentially harvest inflation through price increases, such as global shipping companies.

Turning to other asset classes, the standalone views on interest rates, credit, and currencies are more nuanced at this part of the cycle. We expect government bond yields to trend higher over the cycle as central banks raise rates, but in a multi-asset portfolio context, we believe in the role duration can play as a diversifier. Consequently, we continue to maintain some duration exposure. We maintain a modest overweight position in U.S. TIPS (Treasury Inflation-Protected Securities) in multi-asset portfolios. Although inflation breakevens have moved significantly higher, in our view they still do not fully price in an appropriate inflation risk premium given the potential for a right tail outcome over the months to come.

On spread sectors, we find corporate credit appears fully valued and at this stage of the cycle, residual economic performance will tend to accrue to equities over credit. As such, we see little opportunity for spread compression outside of unique opportunities identified by our credit analysts. Securitized credit, on the other hand, still offers attractive value in our view, particularly in non-agency U.S. mortgages, where a strong consumer balance sheet and housing market underpin improving credit quality at spreads that we see as cheap relative to corporate bonds. Lastly, on foreign exchange, the U.S. dollar still screens rich on our valuation models, particularly against emerging market (EM) currencies, but we should not presume the dollar is destined to weaken in an environment where EM economies and central bankers continue to face challenges.

We expect to remain neutral on commodities broadly, but we continue to monitor the markets for opportunities. We acknowledge the positive roll yield in commodities such as oil as a supportive factor for potential returns, but the overall outlook depends heavily on the near-term supply-demand balance. On precious metals, we believe gold is fairly valued in relation to real yields.