Summary

- Canadian bond yields have remained largely unchanged in 2025 despite a rally in U.S. bonds, as investors have focused on the rise in inflation early in the year and the potential for fiscal expansion.

- However, Canada’s economy faces headwinds, and we expect inflation to ease, as the July inflation report indicates.

- With the labour market softening, the odds have risen that the Bank of Canada will resume rate cuts.

- This environment presents a compelling case for investing in high quality Canadian bonds, in our view.

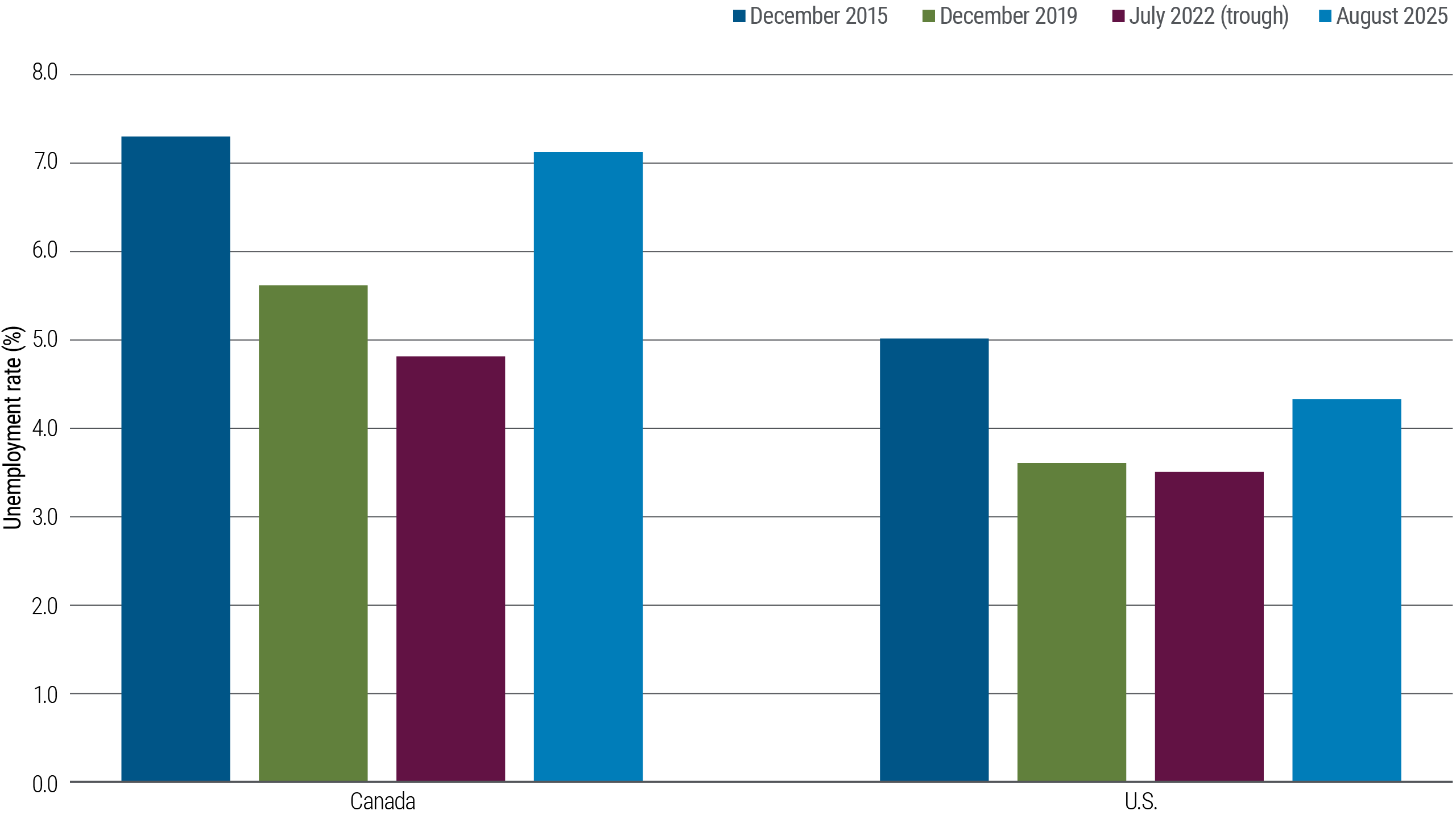

Significant headwinds have buffeted the Canadian economy in 2025, with U.S. tariffs having the greatest impact. The deteriorating trade relationship with the U.S. disrupted the economic momentum Canada had begun building at the end of 2024. A weak housing market and excess labour supply are also weighing on growth, pushing the unemployment rate to just above 7%, according to Statistics Canada (StatCan).

Despite these headwinds and significant volatility, the Canadian 10-year government bond yield is largely unchanged this year, while the U.S. 10-year Treasury yield has declined by 50 basis points (bps).

In our view, underperformance in Canadian bonds reflects the market’s fears of increased fiscal spending and of tariff-driven inflation – concerns that to us seem a little overblown. We believe weaker growth and moderating inflation increase the likelihood that both the Bank of Canada (BOC) will resume easing and the Canadian bond market will rally. Canadian bonds have underperformed U.S. bonds this year, creating an attractive entry point for both domestic and international investors seeking high quality yields.

Bond investors price in fiscal spending

During the first quarter, Canadian fixed income markets rallied due to escalating trade tensions with the U.S., which cast doubt on the sustainability of the economic recovery. However, bond yields subsequently rose as the newly elected Liberal government pledged to expand the military and increase capital spending to address weak investment levels.

This shift reset expectations for Canadian deficits, at the same time that investors are grappling with fiscal expansion plans and elevated deficits across other developed markets. Although a formal budget has not yet been presented, the previous government's goal of reducing deficits to below 1% beginning in fiscal year 2027 now seems unlikely. Despite the increased risk of fiscal expansion in Canada, it is important to remember Canada maintains a very robust fiscal starting point, with a AAA sovereign credit rating from both Standard & Poor’s and Moody’s and the lowest general government deficit and net debt position among G7 nations, according to the IMF.

In addition, there are still significant regulatory challenges to executing large-scale capital projects, and the government is simultaneously pursuing plans to reduce operational spending by 7.5% next fiscal year. Together these could lead to a lower-than-expected fiscal impulse in the near term.

Inflation moderating leaves room for rate cuts

Canadian inflation accelerated in the spring of 2025, raising fears of cost-push inflation – a scenario where rising costs lead to even higher prices. By April, core inflation measures had increased an average of around 50 bps relative to year-end 2024, and the BOC’s preferred measures reached the upper bound of the BOC’s 1% to 3% target range, according to StatCan data. In response, the central bank paused its easing cycle less than a year after its first rate cut in June 2024.

However, recent data, including StatCan’s July Consumer Price Index (CPI) report, indicate a moderating trend:

- Core goods inflation affected by tariffs has eased.

- Services inflation excluding shelter has averaged about 2% annualized over the past three months.

- Shelter inflation continues to moderate, with further slowing expected due to previous rate cuts weighing on mortgage rates and asking rents falling as immigration is limited relative to recent years.

We believe that much of the core goods inflation during the first half of the year stemmed from the Canadian dollar weakening late last year and into the start of this year, and we expect this spike in inflation to fade with the currency bouncing back. In addition, the Canadian government’s recent decision to drop many reciprocal tariffs is likely to ease many fears of more tariff-driven inflation.

Growth headwinds remain

In addition to moderating inflation, we see continued downside risks to growth and employment in Canada. The ongoing reduction in immigration adds another headwind to the economy, stalling population growth in stark contrast to the nearly 3% annual population growth StatCan reported in 2023 and 2024. Despite this putting downward pressure on labour supply, the unemployment rate is still near its post-pandemic high of 7%, a level similar to the recessionary period of 2015 (see Figure 1).

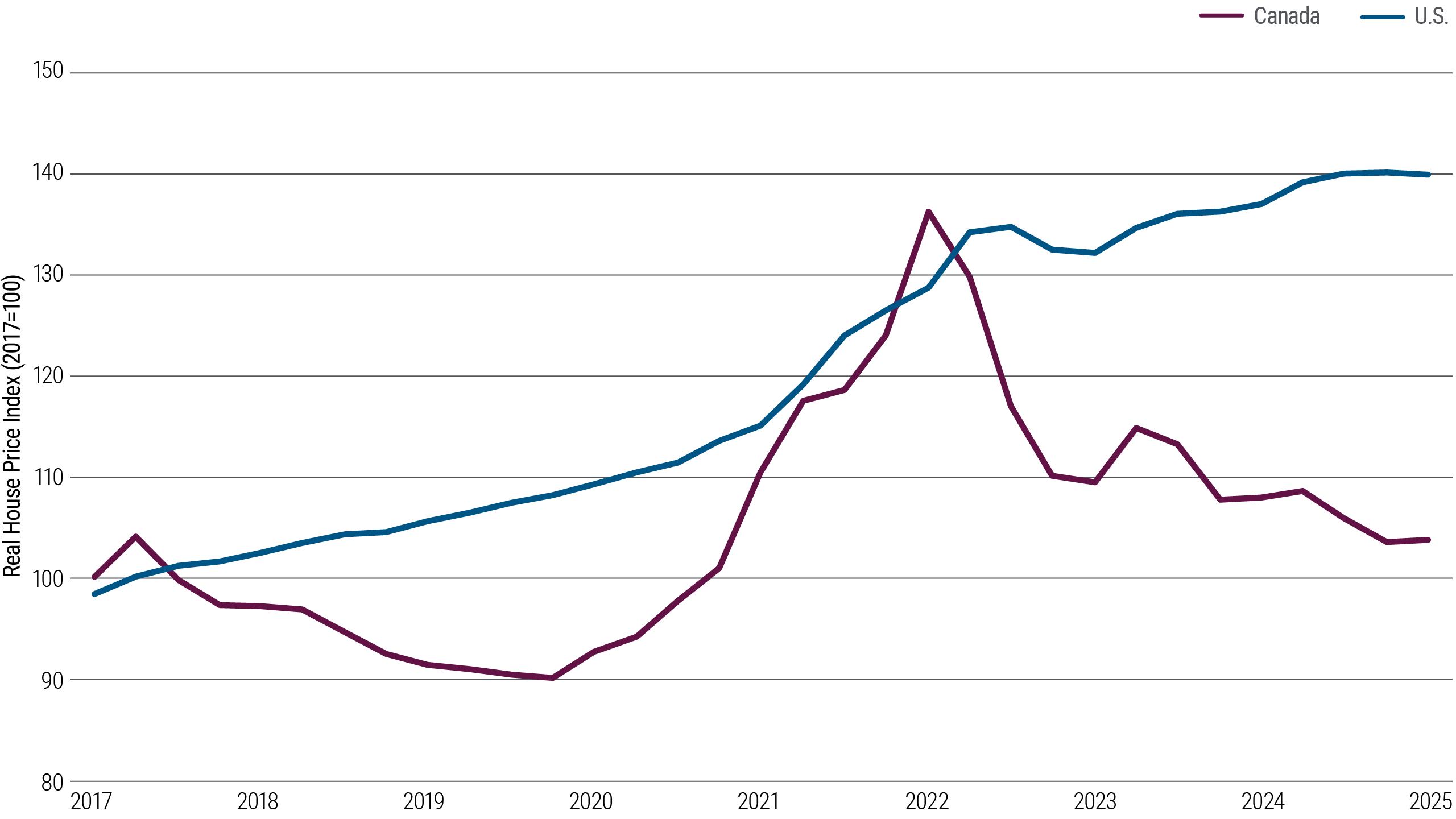

Finally, despite over 200 bps of policy rate cuts to date, Canadian households face financial strain with the debt service ratio over 14% (versus 11.25% in the U.S.), and almost 35% of outstanding mortgages poised to see payments increase by the end of 2026, according to a Bank of Canada Staff Analytical Note. The housing market, particularly in Ontario, remains under pressure, and we worry about the negative wealth effects of softer house prices in an economy that has tied consumer wealth to housing equity (see Figure 2).

While stronger fiscal spending may offer some support to Canada’s economy, the persistent drag from U.S. tariffs and the ongoing restructuring of trade routes continue to weigh heavily on an economy already facing substantial headwinds. As the temporary momentum in inflation subsides, we anticipate the BOC will lower its policy rate further to help support the economy through this transitional phase.

Investment implications

Despite a volatile path, bond yields remain largely unchanged in Canada this year, creating in our view an attractive entry point into high quality bonds. Whether investors seek a pickup in yield from cash and money markets or diversification from equities, we believe the Canadian bond market could be well-positioned to provide attractive long-term return potential.