PIMCO's Investment Process

Tested by Markets and Time

Our clients rely on an investment process built on our decades of experience navigating complex debt markets. Over the years, our process has helped millions of investors manage risks and pursue returns through every market environment.

Active Management in Action

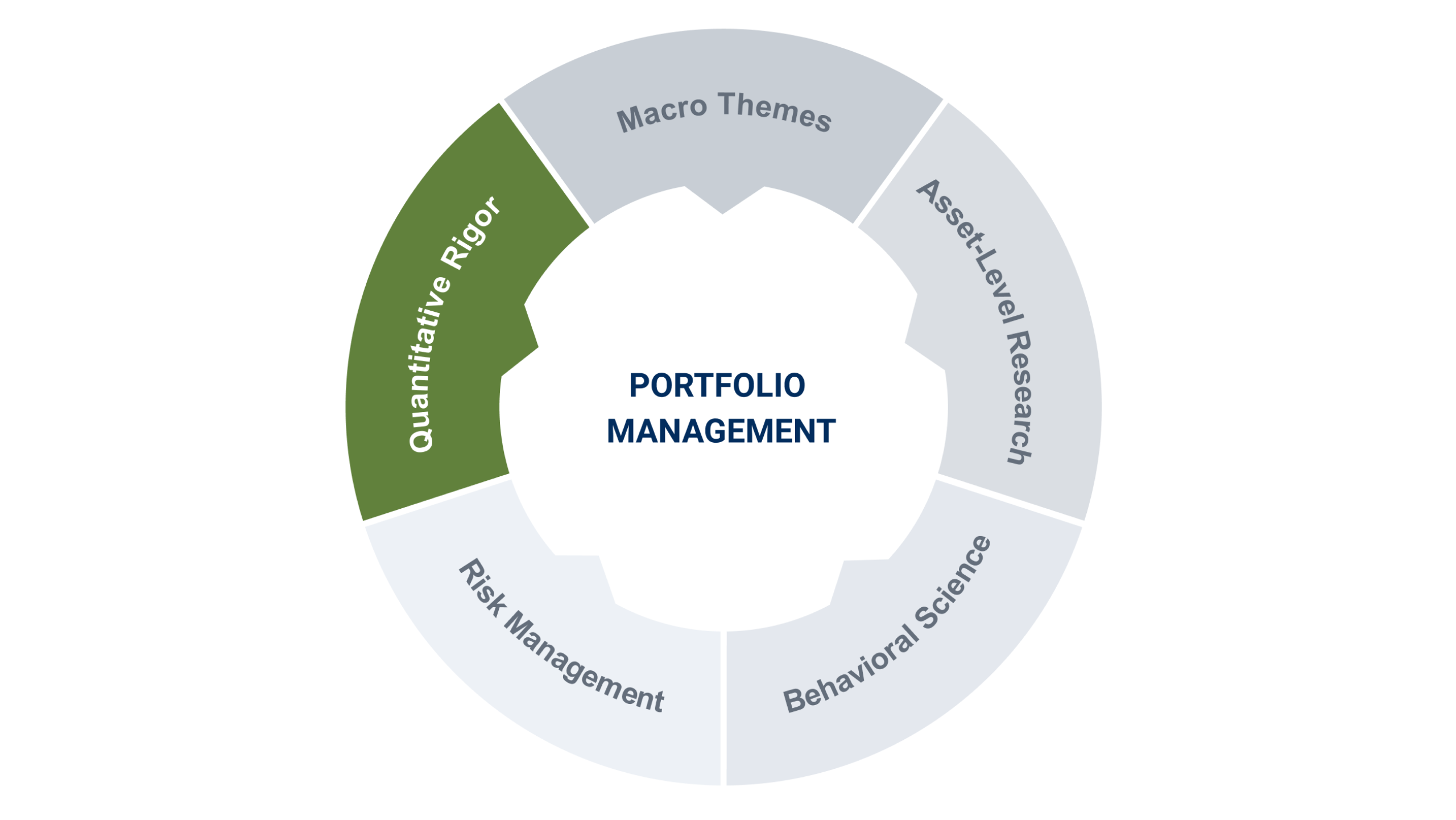

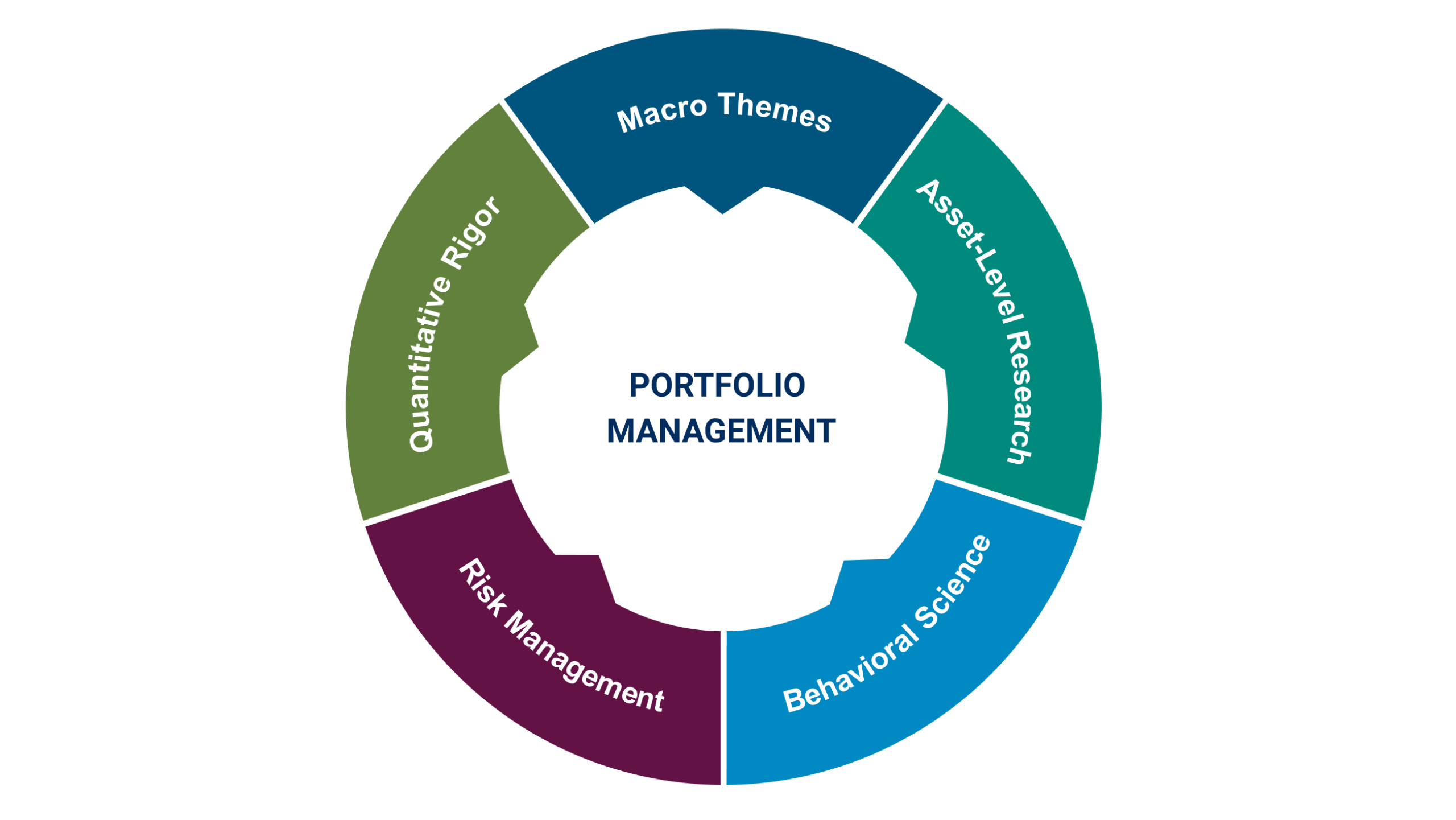

Powered by five key drivers, PIMCO’s investment process is designed to give portfolio managers a 360 degree view of risks and opportunities, enabling them to draw on the best ideas from our team around the world.

Macro Themes

Our annual Secular Forum helps us cultivate longer-term investment themes while our three Cyclical Forums refine those views against more timely market and economic conditions.

PIMCO’s Investment Committee distills our macro views into specific risk targets that serve as parameters for every PIMCO strategy.

Asset-Level Research

PIMCO’s global team of credit analysts and asset specialists conduct independent, in-depth analysis to uncover relative value across public and private markets globally.

Behavioral Science

Our investment process employs behavioral science practices to maximize the exchange of ideas, challenge biases, and continuously evaluate our practices and thinking.

Risk Management

Our robust risk management framework is central to our process, using targeted tools to surface, manage and diversify portfolio and firm-wide risks.

Quantitative Rigor

PIMCO’s quantitative investment professionals are integrated into all aspects of portfolio management, leveraging technology and proprietary analytics to uncover data-driven insights.

Portfolio Management

Our portfolio managers draw on all of these inputs to construct portfolios that emphasize multiple sources of value, targeting exposures with the best risk-adjusted return potential while positioning for various scenarios.

Expanding Our Perspective

Global Advisory Board

Chaired by former U.K. Prime Minister Gordon Brown, this team of world-renowned experts meets several times a year and contributes to our economic forums while providing our Investment Committee with ongoing insights into their spheres of expertise.

How Can PIMCO Help You?

For helpful resources, account assistance, and general contact, visit our Contact & Support Center. For more, access the additional links below.