Fixed Income: Low Yields Don’t Tell the Whole Story

It’s tempting these days for some investors to question the role of fixed income in portfolios. After all, real yields have plunged, potentially leading to less income today and smaller capital gains tomorrow.

But yields are far from the full story. Despite low yields, bonds can continue to diversify risk in broad portfolios. Interest rates may fall further, boosting valuations. And some segments of the fixed income market – credit in particular – remain attractive relative to equities, in our view.

We believe active management remains the key to realizing this potential, as our research indicates that active management is more adept in fixed income than in equities. For a deep dive into our views, read our Research paper, “The Discreet Charm of Fixed Income .” Here are the key takeaways:

Bonds can continue to serve as a potent diversifier in broad portfolios

Although the stock-bond correlation has been weak in recent decades, fixed income returns have been positive in nearly all recessions since 1952, even in periods when stock-bond correlations were positive. In fact, the relationship between these two asset classes depends critically on the level of market valuation, as we wrote last year in “Stocks, Bonds, and Causality,” in the Journal of Portfolio Management.

Interest rate fundamentals remain broadly supportive

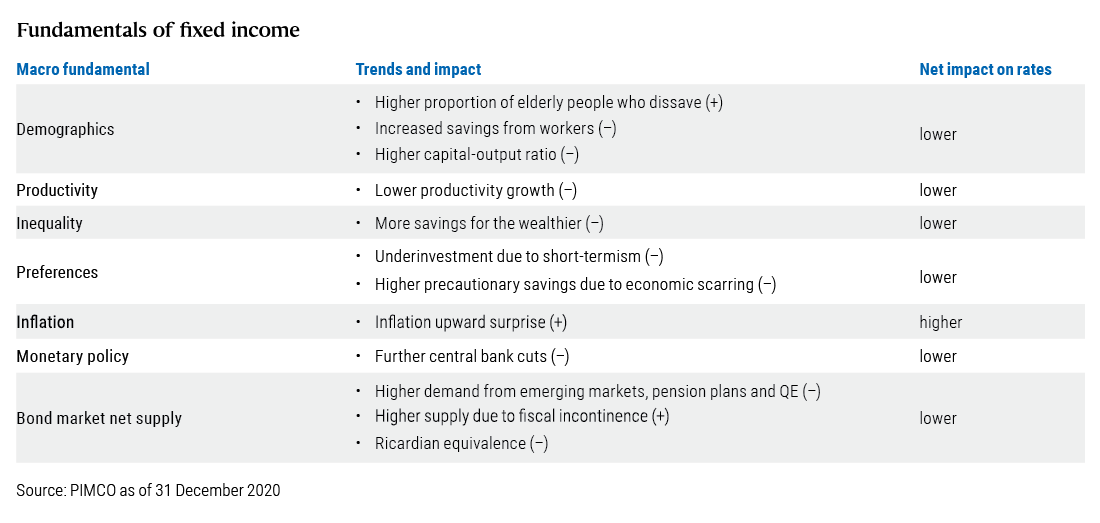

Think rates couldn’t possibly fall further? Think again. Demographic and productivity trends, rising inequality, higher savings rates, and accommodative monetary policy argue for lower yields. Although inflation remains a long-term risk, low rates tend to beget even lower rates. As rates fall, incentives for leverage rise; risk assets often rally; the economy becomes more dependent on wealth effects; and portfolios with greater leverage become more sensitive to higher rates and subsequent sell-offs. It’s a dynamic that’s played out in various incarnations – from U.S. equity markets to real estate in China and southern Europe, to industrial metals in Australia (see chart). Furthermore, with central banks mulling digital currencies, there is a real possibility (although it’s not our main scenario) that rates go into deeply negative territory.

Fixed income, particularly credit, remains attractively priced relative to equity values that are near historical highs

To be sure, yields on sovereign bonds are near all-time lows in all G7 economies. But based on a long time series, Treasuries appear to be fair to cheap relative to equities. Credit valuations are relatively normal in a world of compressed risk premia. For those investors able to bear the additional risk, private credit appears particularly attractive, in our view. It continues to outperform public high yield, a trend likely to be supported by continued bank regulation that incentivizes prudent lending. Ironically, this has left many would-be borrowers without access to traditional bank lines of credit. It’s a void that careful investors can step into. Of course, taking the leap from public to private markets adds to liquidity risk. However, research by PIMCOFootnote[i] and others suggests that investors have generally been rewarded with excess returns of 2%–4% for locking up capital between five and 10 years (although there are no guarantees and investors could lose out).

Active management is key

As discussed in our 2017 paper, “Bonds Are Different,” the majority of active bond mutual funds and ETFs in the U.S. beat their median passive peers after fees in two of three major Morningstar categories over the previous 10 years. Footnote[ii], Footnote[iii]

By contrast, most active equity strategies in all three categories failed to beat their median passive counterparts.

Among other reasons, central banks, insurance companies, and other noneconomic investors – for whom maximizing returns is not the primary objective – make up almost half of the $100 trillion global bond market. That leaves alpha on the table for active managers who can deploy structural tilts such as duration extension, yield curve steepeners, and volatility sales. Active managers also can target higher-yielding currencies and securities such as high yield bonds, emerging market bonds, and non-agency mortgages.

To learn about the importance of active management in navigating the complex global fixed income market, visit our landing page, “The Advantages of Active Bond Management. ”

Featured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. High yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Private credit involves an investment in non-publically traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government-agency or private guarantor, there is no assurance that the guarantor will meet its obligations. Diversification does not ensure against loss.

Management risk is the risk that the investment techniques and risk analyses applied by an investment manager will not produce the desired results, and that certain policies or developments may affect the investment techniques available to the manager in connection with managing the strategy.

The terms “cheap” and “rich” as used herein generally refer to a security or asset class that is deemed to be substantially under- or overpriced compared to both its historical average as well as to the investment manager’s future expectations. There is no guarantee of future results or that a security’s valuation will ensure a profit or protect against a loss.

Alpha is a measure of performance on a risk-adjusted basis calculated by comparing the volatility (price risk) of a portfolio vs. its risk-adjusted performance to a benchmark index; the excess return relative to the benchmark is alpha.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.