Asia Market Outlook 2023: Regional Resilience Amid Strained Global Markets

Despite global economic headwinds, including a likely recession in developed markets, we believe economic growth in many Asian markets will remain resilient in 2023 as the recovery from COVID-19 continues.

We think China’s faster-than-expected reopening – which began with the end of its zero-COVID strategy in early December – may also boost both the global and regional economies, in particular for tourism-reliant Thailand and China-growth-sensitive Malaysia. Our baseline 2023 annual GDP growth forecast for China is above 5%, which we expect to be led by pent-up consumer demand, up from 3% in 2022.

Overall, while global economic activity has been more resilient than expected in 2022, the outlook has deteriorated. Financial conditions have tightened as central banks continue to battle inflation. Our baseline view is for modest recessions and moderating inflation across developed markets (read more in our latest Cyclical Outlook, “Strained Markets Strong Bonds ”).

Emerging Asian markets appear poised to perform well down the road, but we believe much still depends on the U.S. Federal Reserve’s ability to tame inflation and China’s ability to reactivate economic activity.

China outlook: The faster the reopening, the earlier the recovery

We are constructive on China’s recovery in 2023 because its economic cycles tend to be policy-driven. As President Xi Jinping and his team explained at the Central Economic Work Conference in December, China’s economic agenda will be focused on one thing this year: growth. Key policy focus areas include expanding domestic consumption, attracting and deploying foreign capital, stabilizing the property market, and revamping the tech sector.

Our projection for China’s 2023 growth factors in 2022’s low base and strong rebound in consumption, especially in the service sector, and a drag from net exports of -0.6 percentage points (ppt). Travel and mobility indicators such as intra-city traffic and subway journeys, which tend to be closely linked to retail sales, bounced back strongly across the country in January 2023, suggesting solid momentum in consumption.

We expect China’s consumer inflation will rise from 2% in 2022 to 2.7% in 2023 – below the official target of 3% – though pork prices could push headline inflation above 3% around mid-2023, before pork inflation falls in the second half of the year.

Overall, Chinese households’ excess savings should be able to support the growth rebound, but the strength and sustainability of the recovery will rely on a stable job market and rising wages.

We believe macroeconomic policy will likely remain supportive in the first half of the year and then begin to normalize. We expect the government will continue to relax regulations in sectors such as housing, education, tech, and gaming in order to stabilize growth.

Fiscal policy will be front-loaded in the first half of the year to support infrastructure, but will likely be gradually phased out in the second half of 2023 after the organic recovery begins. Monetary policy, in the form of credit easing, should continue to support small to medium-sized enterprises, the property market, manufacturing, and green investment. We do not expect cuts to the 2.75% policy rate, as spiking inflation in the first half of 2023 could constrain monetary easing, but policy should normalize in the second half as the economy gets back on track.

Potential headwinds to China Outlook

The export sector, which was a key growth driver for China during the pandemic, poses a potential headwind. Exports have seen a sharp decline in some of the major developed markets, as consumer demand switches from manufactured goods to services. In U.S. dollar terms, Chinese exports fell 9.9% in December from a year earlier, the third straight month of decline, according to the General Administration of Customs.

While housing-related indicators remain weak, we expect the property market to stabilize over the course of this year after a raft of coordinated policy measures (see our recent Viewpoint, “China Steps up Property Support: Is This the Turning Point for the Struggling Sector?“), particularly for the better-run private developers who have not defaulted. In terms of growth contribution, housing investment is likely to be flat in 2023 versus a major drag in 2022.

We see some upside risks to our over 5% growth projection for China. We think 6% growth is achievable, but will require more policy support, a quicker property market recovery, and a more favorable external environment. However, several downside risks remain in the medium term, including geopolitics and the tradeoff between China’s structural reform and short-term growth.

Emerging Asia ex China outlook: Divergence from rest of the world to continue, but reversing last year’s trend

Post-pandemic, emerging Asia was slower to recover than the rest of the world and didn’t experience much in the way of demand-driven inflationary pressure. In 2023, we expect this divergence in growth-inflation dynamics to continue, but in reverse.

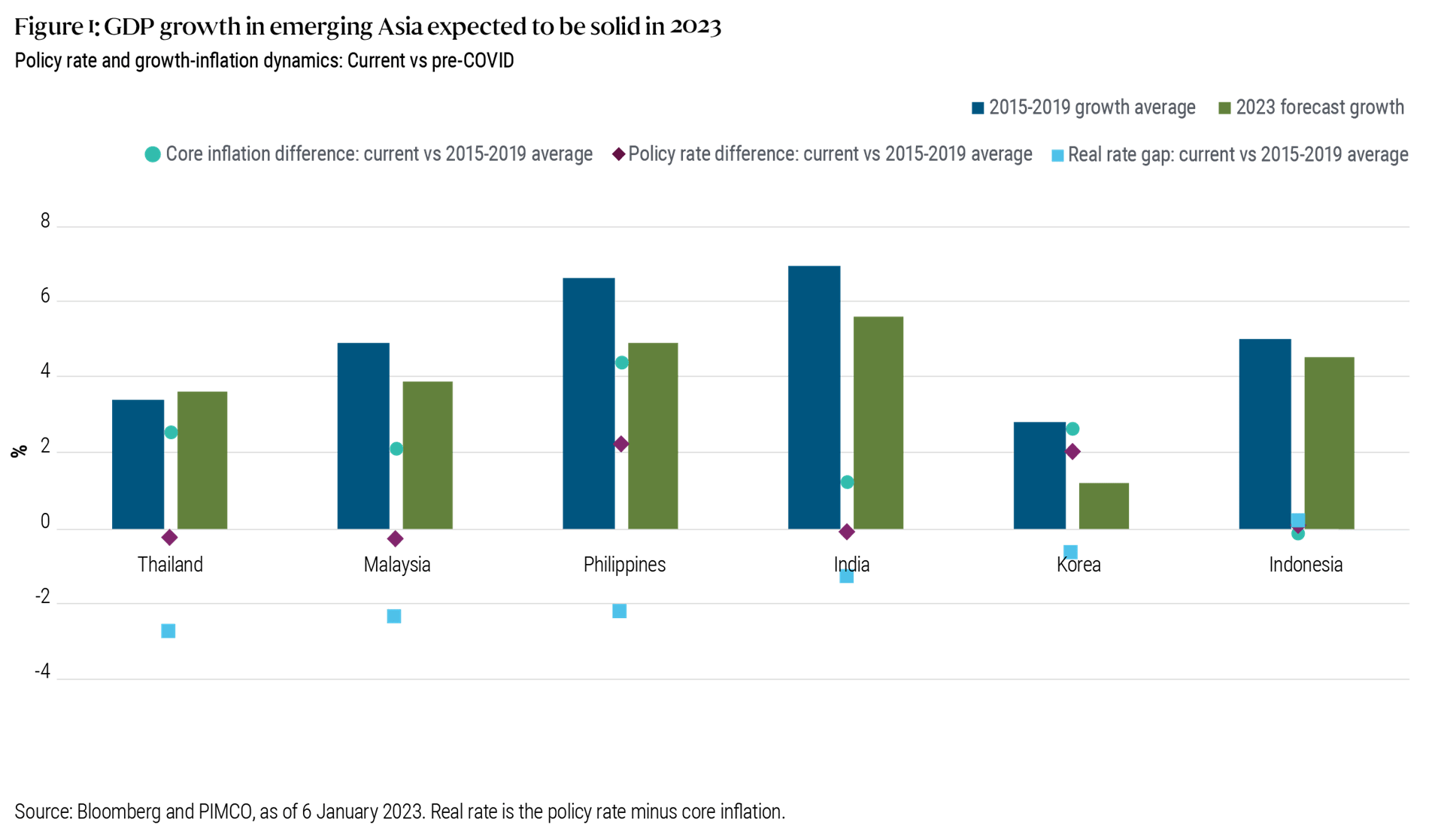

While the rest of the globe faces slowing growth and inflation, we believe emerging Asia is likely to see resilient growth and mounting core inflationary pressures as the COVID recovery continues amid accommodative monetary and fiscal policies (see Figure 1). China’s reopening will likely be incrementally supportive for the broader Asian region, especially Thailand and Malaysia.

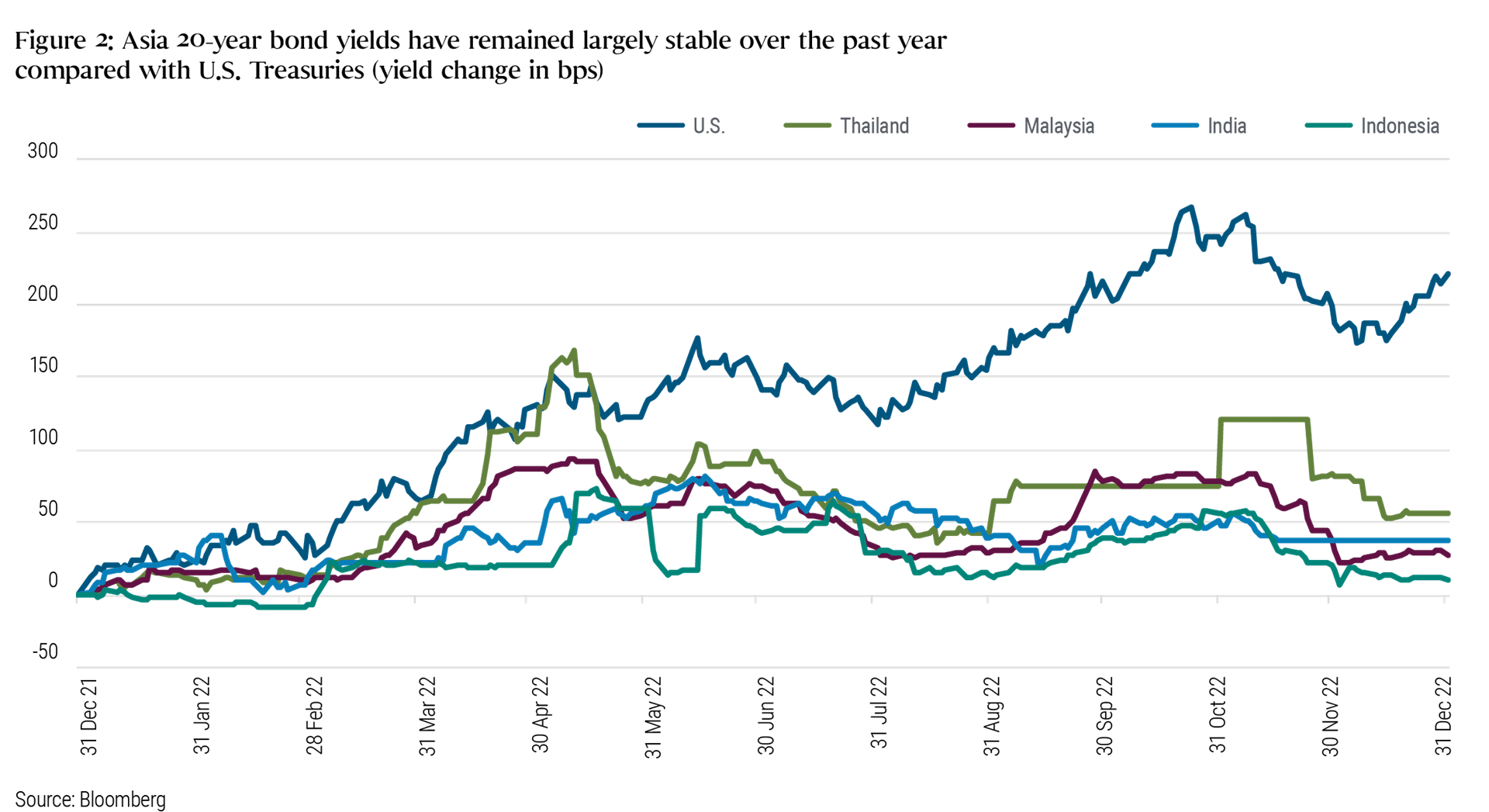

We expect some countries, such as Thailand and Malaysia, to continue with their policy normalization given the growth-inflation risks they face in 2023 and relatively accommodative policy. With the exception of Indonesia, most countries in the region have shown no sign of fiscal consolidation. Long-end duration demand from pension funds, insurance and portfolio inflows could keep interest rate curves flat in 2023, and we largely don’t expect rate cuts within the region. Long-term bond yield spreads over Treasuries are trading significantly tighter, allowing central banks in the region greater latitude to continue normalizing interest rates, given the growth-inflation dynamics (see Figure 2).

Investment considerations for broader Asia markets

In 2023, we expect duration (interest-sensitive securities) to underperform across the region, while currencies should outperform core markets (adjusted for historical betas) and emerging market peers – reversing last year’s trend – as the region’s growth-inflation dynamics diverge from the rest of the world.

Overall, we see significant opportunities in Asia credit for investors who employ an active and selective investment approach. Thematically, we believe there is an opportunity to capitalize on the cyclical recovery of the COVID reopening, such as investing in select transportation sector companies across the region. The technology, media and telecommunications (TMT) sector is an area where scalable credit trades can be made for investors who anticipate that current regulatory corrective actions may be largely completed, with growth set to resume. Gaming is another area that exhibits the theme of resumed travel and consumption, although we should caution that valuations now appear to reflect much of the normalization, with a notable retracement of the spread widening seen last year.

Significant opportunities, but careful portfolio positioning required

Within the context of global headwinds and a likely recession in developed markets, we are cautious in more economically sensitive areas of financial markets, but remain relatively constructive on the macroeconomic picture in Asia. China’s reopening and its growth focus have helped brighten the outlook for the region, and especially for the nations that have stronger economic links with China.

However, rigorous risk management and careful security selection will be crucial for investors in the region. We believe alpha can be captured for selective country allocation and credit rotation, while keeping a keen eye on developed market central bank actions, geopolitical developments, and policy evolution over the course of this year.

For our global economic outlook in 2023 and its investment implications, please read our Cyclical Outlook, “Strained Markets Strong Bonds .”

Featured Participants

Disclosures

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets.

Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio.

The credit quality of a particular security or group of securities does not ensure the stability or safety of an overall portfolio. The quality ratings of individual issues/issuers are provided to indicate the credit-worthiness of such issues/issuer and generally range from AAA, Aaa, or AAA (highest) to D, C, or D (lowest) for S&P, Moody’s, and Fitch respectively.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.