- In 2021, we expect the early cycle recovery of the global economy to provide a tailwind for risk assets.

- We remain overweight equities and have added selective exposure to more cyclically oriented sectors including industrials, materials, semiconductors, housing, and consumer durables. We continue to seek opportunities in sectors that may benefit from longer-term disruption, such as technology companies.

- We see pockets of opportunity in certain segments of the credit markets. We continue to favor housing-related credits given strong fundamentals, along with select higher-quality investment grade issuers and sectors.

- We believe it remains critical to build resilient and diversified portfolios that can withstand a range of economic scenarios. We see two primary risks to our positioning – lower growth and higher inflation – and we are focused on hedging against these.

Asset Allocation Outlook

Despite a challenging year in 2020, for financial markets the year has been extraordinary. The global pandemic was a black swan event that caused the biggest quarterly drop in global GDP and increase in unemployment since the Great Depression. The drawdown in equity and credit markets was one of the fastest on record. There were many other firsts: Oil prices temporarily became negative, volatility (VIX) surpassed levels observed during the depth of the global financial crisis, and already robust central bank balance sheets ballooned $7 trillion more.

Yet, if the market meltdown was unprecedented, so has been the recovery that followed. In short, nothing about 2020 was normal. We believe 2021, in contrast, will feature a slow and steady return to normalcy. With further advancements in COVID testing, contact tracing, and vaccine deployment diminishing the need for social distancing, economic growth should recover further. The improvement in fundamentals should bode well for risk markets and cyclical assets in particular.

Looking back over the year, we have gone – rather abruptly – from a late cycle environment in December 2019 to an early cycle environment in December 2020. Back in late 2019, we were concerned about slowing growth, rich valuations, and high levels of corporate leverage. While almost no one, including us, predicted how the pandemic would unfold in different parts of the world, its aftermath has left the global economy in a completely different place in less than a year. As the global economy transitions to an early cycle phase, we expect profit growth to accelerate, although a high degree of uncertainty remains on the speed and strength of recovery given the opposite forces of slow economic activity and record monetary and fiscal stimulus.

In 2021, we expect the global economic recovery to provide a tailwind for risk assets. We remain overweight equities in our multi-asset portfolios and select areas of the credit markets and have added exposure to more cyclically oriented sectors and regions. However, we continue to focus on portfolio diversification and resiliency given the path of potential outcomes remains unusually wide amid the unresolved health crisis.

State of the economic recovery

The recovery appears well underway as global economic activity rebounded sharply during the third quarter. To be sure, the global economy is not out of the woods just yet and the trajectory of the pandemic will undoubtedly influence the speed of the economic recovery. Recent surges in new COVID cases underscore the precarious nature of the crisis, but promising news on the development and deployment of multiple vaccines could accelerate the timeline for containment.

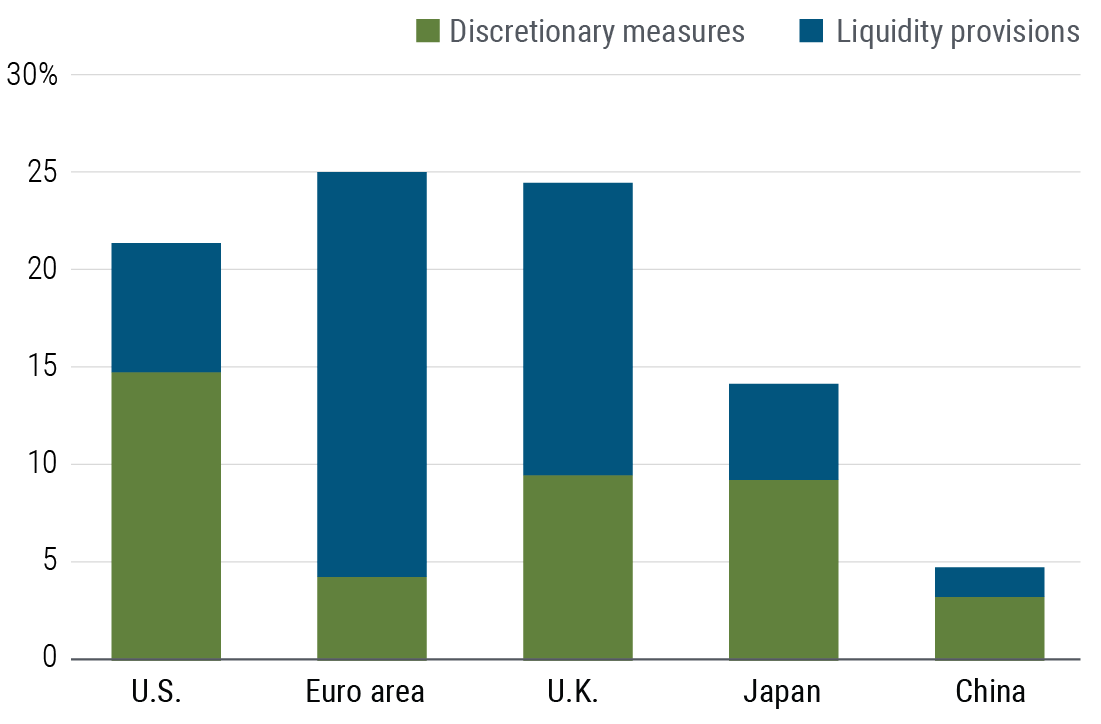

Economic policy is another key swing factor that could lead to both upside and downside surprises. Significant monetary and fiscal support has already been unleashed as policymakers were quick to respond earlier in 2020 (see Figure 1). These timely accommodation and liquidity injection measures, as we discussed in our mid-year outlook, helped calm the markets and catalyzed a sharp rebound in asset prices.

We believe additional policy stimulus will be needed to support what is still a fragile recovery. With monetary policy constrained by near-zero interest rates in most of the developed world, fiscal policy will need to do the heavy lifting. The handoff from monetary to fiscal policy is well underway, and the size and the scope of fiscal response is bound to have critical implications for both the economic recovery and asset prices.

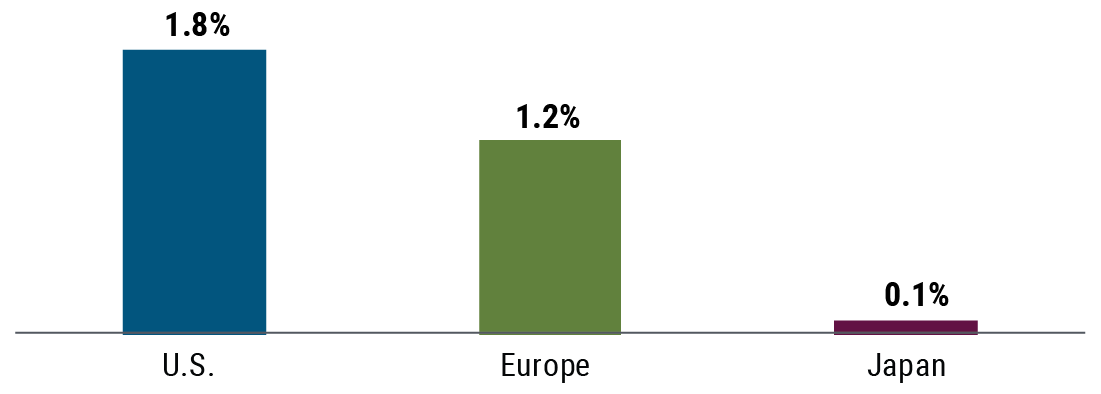

We expect fiscal policy responses to vary markedly across regions and countries given different needs, capacity, and political appetite. In the U.S., the election results point to a divided government in 2021 with Republicans likely retaining the Senate majority, pending a runoff election in Georgia in early January. Whichever party controls the Senate will have a very thin majority, meaning compromise will still be crucial to passing legislation. The election outcome reduces the possibility of a large deal, and our expectation is that fiscal policy will likely focus on relatively modest COVID relief and infrastructure legislation.

In Europe, we expect fiscal policy to remain stimulative versus pre-pandemic, though governments are expected to let many of the discretionary COVID-related measures roll off in 2021. Note this is very different from the procyclical austerity-oriented policy adopted in the euro area following the 2008–2009 and 2011–2012 recessions. Recovery Fund payments should also provide some boost next year, especially across the euro area periphery and Eastern Europe.

In Japan, fiscal policy will likely remain accommodative, and we expect additional stimulus of approximately 3% of GDP equivalent discretionary spending to focus on service sector/public investment over a 15-month budget (January 2021 to March 2022). In a downside scenario, additional fiscal stimulus could be enacted to support growth.

Our global base case expectation is that economic recovery is poised to continue in 2021 and will gain strength once vaccines are broadly deployed and the world starts to return to normal social distancing. However, PIMCO expects it to be a “long climb” with hiccups along the way, and it could take up to two years to reach pre-COVID levels of global output. The two key swing factors – virus containment and fiscal policy support – will greatly influence the recovery process.

Asset allocation themes for 2021

In our mid-year asset allocation outlook, we observed that despite the massive shock to the real economy, valuations of risk assets appeared close to fair after taking into account the impact of lower discount rates and extraordinary policy support. Moreover, we advocated a modest risk-on posture in multi-asset portfolios with emphasis on higher-quality, resilient sectors given a wide range of potential outcomes. This continues to be a key theme in our multi-asset portfolios given near-term uncertainties and ongoing secular disruptions.

With the U.S. election behind us and positive developments on the vaccine front, we are beginning to position multi-asset portfolios to benefit from a cyclical recovery. Of course, scaling of positions needs to be approached with caution as economic conditions could worsen if virus containment efforts are not as successful as hoped for, or the timeline for mass availability of vaccines gets pushed out.

Equity versus credit

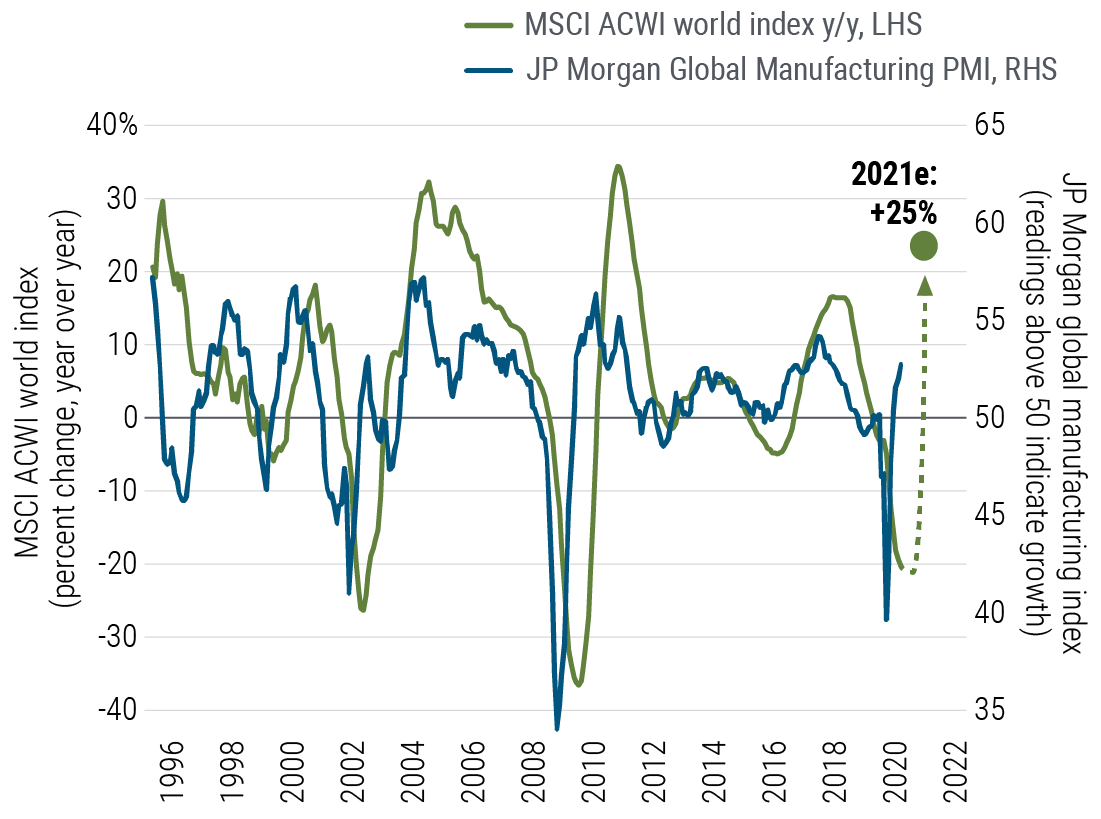

As business activity picks up in 2021, we anticipate a strong rebound in corporate profits (see Figure 2). Increased earnings growth is positive for both equities and credit, but it provides a more significant tailwind for equity markets. This is why, historically, equity markets have generated higher risk-adjusted returns during the early stages of a business cycle.

Given the macro backdrop, we believe that equity valuations are cheap versus corporate credit. One way to measure this is via the relative spread between the earnings yield on equities and the spread on corporate bonds. The earnings yield should generally trade at a premium versus credit spreads: Equity investments are more sensitive to earnings volatility and therefore investors should be compensated for the risk that earnings could decline. The current earnings yield spread, for both U.S. and global equities, is close to the average level over the past five years. However, with earnings growth poised to accelerate as the global recovery continues, equities look more attractive than credit in this environment.

While we expect global growth to rebound in 2021, we also expect that developed market central banks will be gradual in their response to the improving macro backdrop. Earlier this fall the U.S. Federal Reserve completed a review of its policy framework, and concluded that the unemployment rate alone will no longer be a sufficient driver to raise interest rates. Going forward, the Fed will also require inflation to be at or above the 2% inflation target in order to raise rates. The Fed’s commitment to overshoot its inflation target is supportive for equities, which look attractive given what is likely to be an extended period of negative or low real yields.

Equity themes

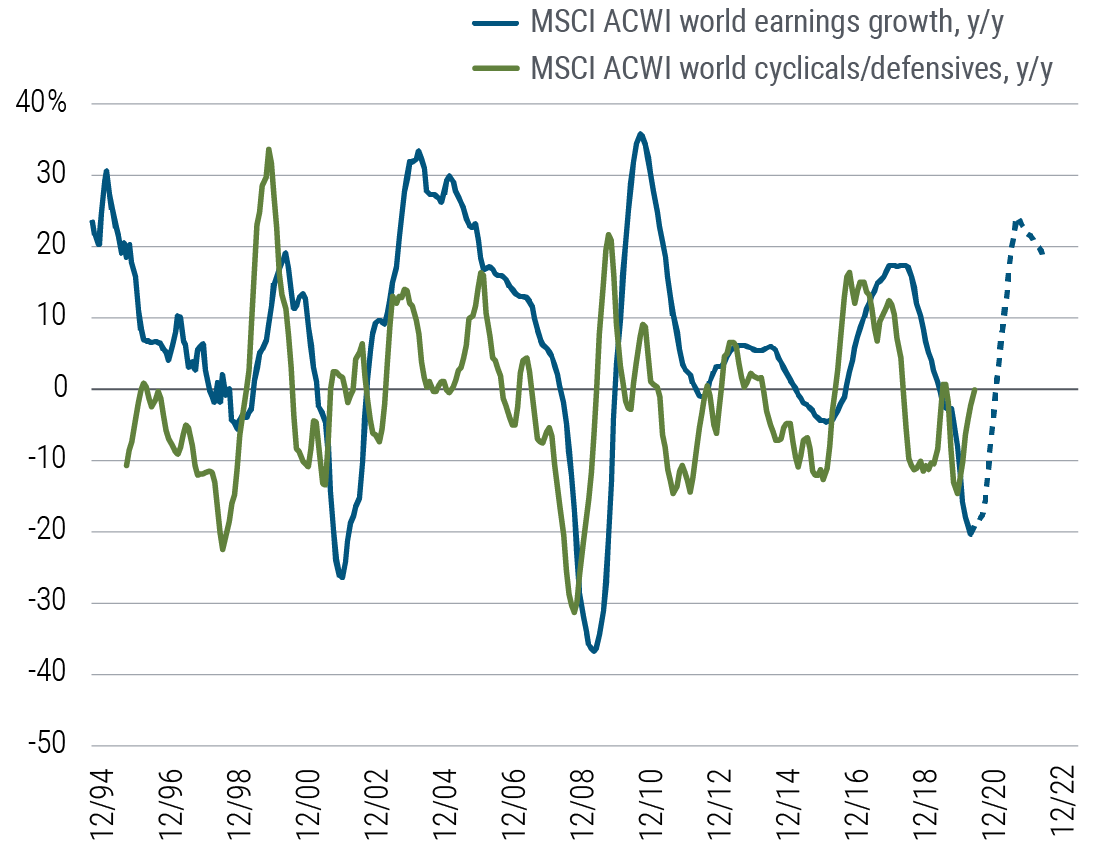

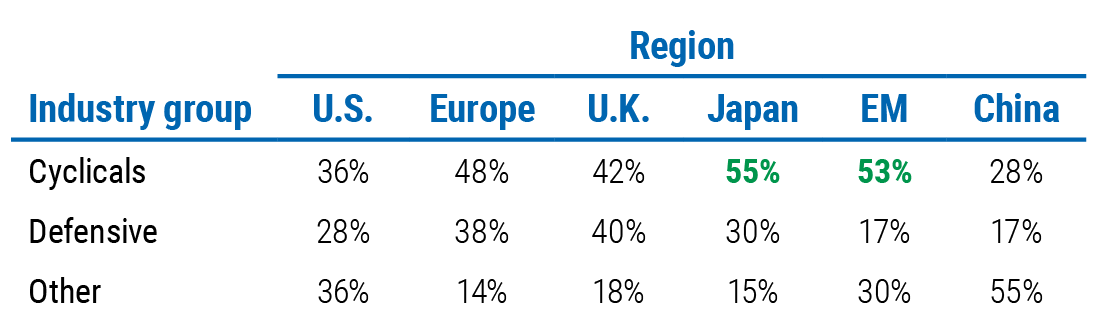

The recovery in activity and ongoing improvement in corporate profits should be supportive for a rebound in cyclically sensitive assets (see Figure 3), which have meaningfully lagged market leaders like big tech since the market bottom in March. We actively seek opportunities to capitalize on this theme, but we remain highly selective on where we obtain the desired cyclical exposure. The global manufacturing recovery should bolster sectors such as industrials, materials, and semiconductors. Focused fiscal stimulus efforts and healing in the labor market should aid personal savings and consumption, benefiting the housing and consumer durables sectors. However, we remain cautious on transportation and hospitality, which could face earnings challenges for several years. From a regional perspective, we expect cyclically oriented equities – such as in Japan and select emerging markets – to benefit as the recovery continues in 2021 (see Figure 4).

In addition to increasing our exposure to cyclical risk, we continue to seek opportunities in sectors that may benefit from longer-term disruption, as we expect significant investment and higher demand in these areas over the next several years. These sectors include technology companies, which are supported by strong fundamentals and stand to benefit further from secular trends accelerated by COVID. The U.S. and China remain dominant players in the global technology sector, and therefore remain a focus, but we are also looking to take advantage of themes playing out in other regions, such as green energy in Europe and automation in Japan.

Credit themes

Credit spreads have tightened meaningfully since March and April, and while we believe credit is less attractive than equities on a relative basis, we see pockets of opportunity in certain segments.

Within corporate credit, sectors are recovering at different paces depending on how the pandemic affected them. We are cautious on high yield credit, especially in areas that might face funding needs in the second COVID wave, but we see value in higher-quality investment grade issuers and sectors. We continue to favor housing-related credits (mainly in the U.S.) given strong fundamentals: The housing market has been resilient through the COVID shock, as initial conditions were strong with low leverage and healthy consumer balance sheets, and the sector has benefited from low interest rates, loss mitigation policies, and tight inventories. U.S. mortgage bonds continue to price in some uncertainty about future delinquency and forbearance effects, and non-agency mortgage-backed securities did not receive any explicit Fed support, so we are finding attractively priced opportunities in these areas. In emerging market credit, we see attractive opportunities but prefer to take exposure in more liquid instruments.

Overall within our multi-asset portfolios, we favor a modest overweight to risk assets – both equities and credit. Valuations appear rich on an absolute basis, but low interest rates, policy support, and profit growth improvement should be supportive over the cyclical horizon. Additionally, the low yield environment could act as a tailwind for risk assets through increased demand from investors who face a tough choice between increasing risk and reducing their return objectives.

Key risks, and diversifiers

While we are positioning to benefit from a cyclical recovery, it remains critical to build portfolios that can withstand a range of economic scenarios. The major near-term risk is that virus containment efforts hinder the economic recovery. If cases continue to surge, governments could face tough choices about reinstituting or extending lockdown measures. Furthermore, while progress on the development of a vaccine has been heralded, the timeline for mass production and distribution remains unknown.

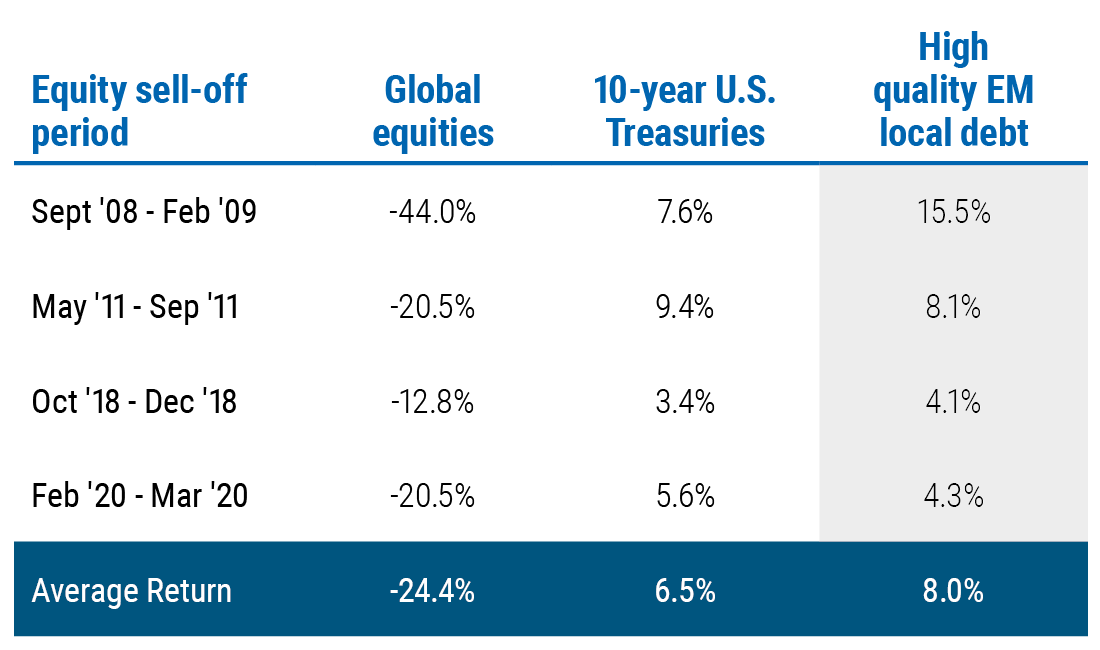

We believe high quality duration (government bonds) will continue to be a reliable source of diversification against a growth shock despite yields at historically low levels. U.S. Treasuries have more room to rally than most developed market government bonds and are likely to remain the flight-to-quality asset of choice, so we remain overweight in our multi-asset portfolios. We also favor select emerging market government bonds, including Peru and China, which offer yield advantage and have tended to perform well during risk-off events, as another portfolio diversifier (see Figure 5).

Another potential risk is an inflation surprise. Our expectation is that inflation globally will remain subdued in the near term as the effects of the pandemic – weaker consumer demand, lower energy prices, and higher unemployment – keep the price of goods in check. However, large fiscal injections, climbing government debt, and accommodative central banks could lead to higher inflation in a post-COVID world (see Figure 6). While the future monetary and fiscal policy mix will be a critical factor in determining the longer-term path of inflation, we believe the risks are skewed to the upside.

This dynamic has led to attractive valuations for many inflation-linked assets, and we believe it is a good time to add inflation hedges to multi-asset portfolios. We are focused on assets that can serve as both an inflation hedge and a diversifier in a scenario of weakening economic conditions. This includes inflation-linked bonds, which offer a direct inflation hedge but also benefit if real rates fall. We also believe gold provides a good store of value over the long term with a low correlation to traditional risk assets. (We discuss gold valuations in this recent blog post.) We are avoiding more growth-sensitive real assets – such as energy commodities – given our expectations for a gradual economic recovery with meaningful downside risks and low or negative real yields for years to come.

Final thoughts

As communities and investors alike eagerly anticipate the end of a historic year, many are hoping for calmer waters ahead in 2021. At PIMCO, we expect the global economic recovery to continue in 2021. Our base case is that the pace of the recovery will be gradual, but the trajectory of the pandemic and the magnitude of additional policy support for fragile economies have the potential to stall or accelerate the recovery.

In this environment, we are expressing a risk-on view in multi-asset portfolios with a preference for equities over other risk assets. We have increased exposure to cyclically oriented sectors and regions that have potential to benefit as economic activity picks up, while continuing to focus on industries where technological advancements are likely to lead to disruption over the secular horizon.

We see two primary risks to our positioning – lower growth and higher inflation – and we are focused on hedging against these. We believe traditional fixed income should continue to provide a reliable source of diversification against a growth shock, but low rates and the risk of an inflation shock necessitate broadening the menu of diversifiers.

We believe investors should consider building portfolios that can benefit from smoother waters in 2021, but also should embed sufficient diversification to be able to withstand the choppy patches that may arise.