Sustainability-Linked Bonds: Coming of Age

The sustainable bond marketFootnote1 is growing quickly, exceeding $1 trillion in issuance and total volume last year (source: Bloomberg New Energy Finance), as investors increasingly look to align their financial goals with international sustainability benchmarks such as the Paris Agreement and UN Sustainable Development Goals (SDGs).

We believe that the experience accumulated so far thanks to this rapid rise in issuance provides an opportunity for issuers to include more relevant and ambitious sustainability targets and enhance bond characteristics.

Unlike traditional green, social, or sustainability use-of-proceeds bonds, which fund specific projects dedicated to environmental or social utility, sustainability-linked bonds (SLBs) typically are not directly linked to the financing of particular projects. Instead, they fund the operations of issuers that explicitly link sustainability objectives across their business with financing conditions. For example, if an issuer fails to meet its firmwide greenhouse gas emissions reduction target, the coupons on its SLBs would step up to a higher level.

The SLB market has grown significantly since the International Capital Market Association (ICMA) released its Sustainability-Linked Bond Principles in June 2020, a set of voluntary guidelines aimed at improving the transparency and overall integrity of the SLB market.

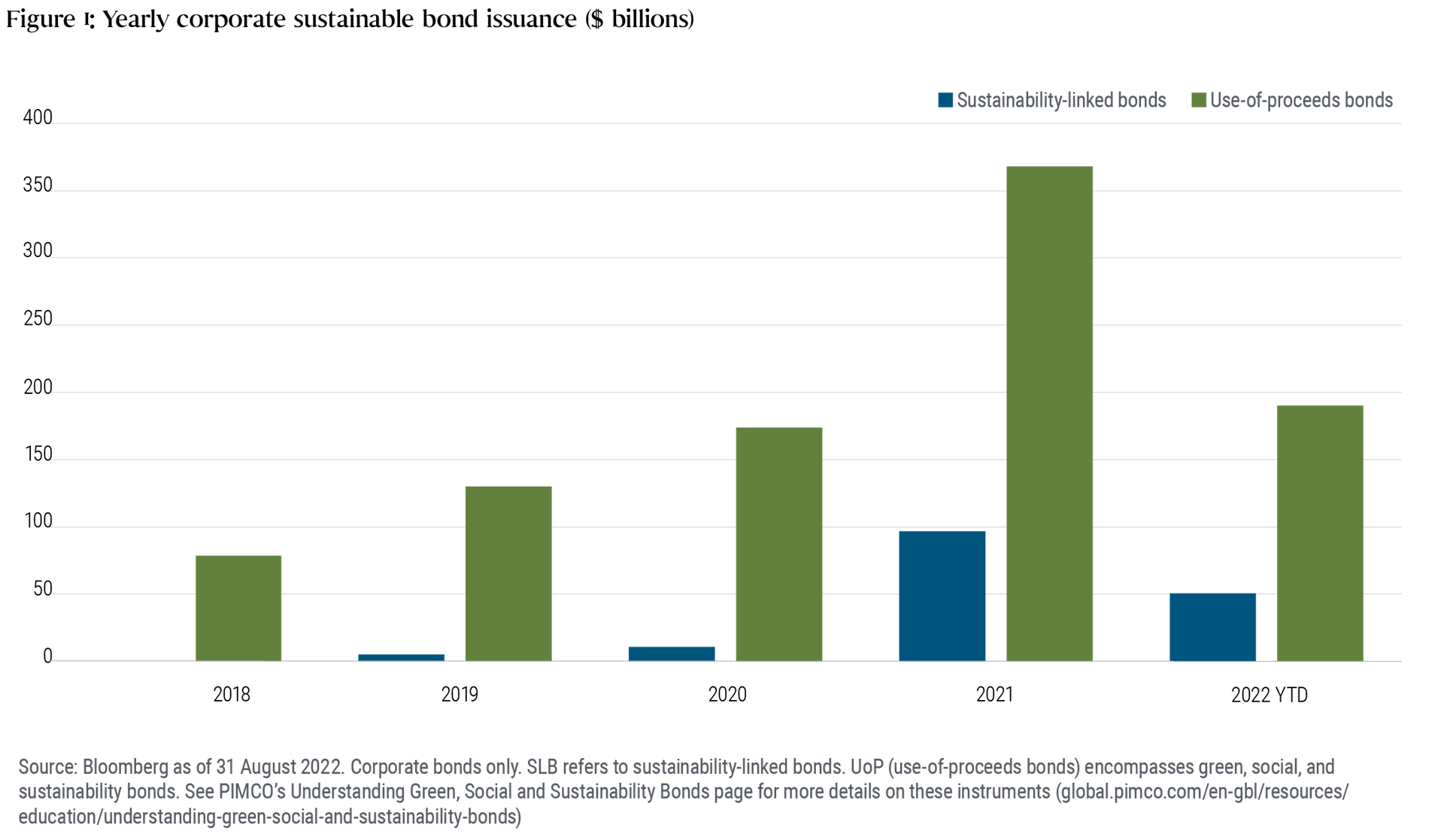

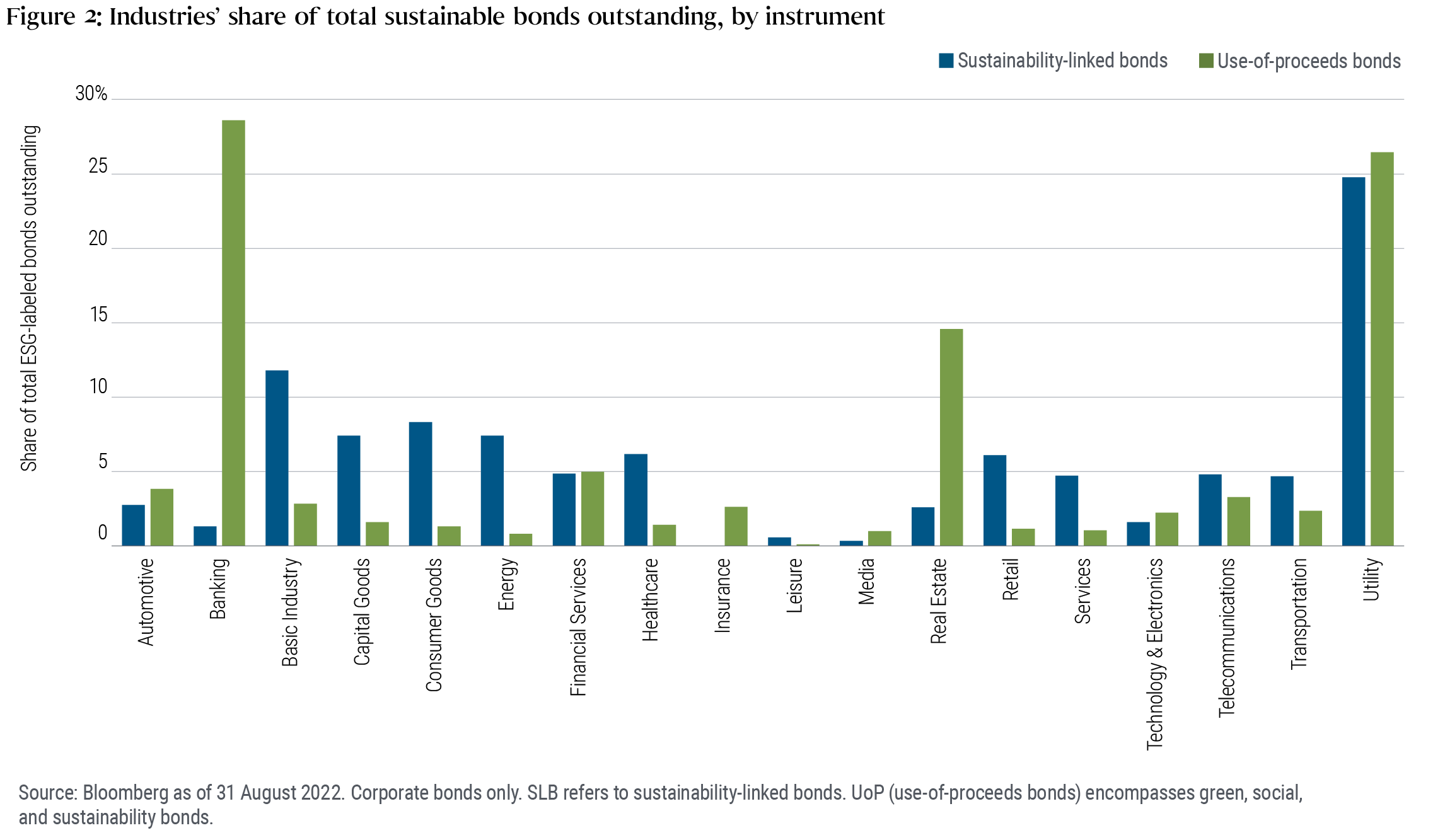

Total issuance of sustainable bonds across all sectors and asset classes rose nearly tenfold in 2021 to $108.3 billion, and increased a further 15% year over year in the first half of 2022 to $54.2 billion, according to Bloomberg New Energy Finance (see Figure 1, which focuses on corporate bonds, the largest segment. Figure 2 shows the share of bonds outstanding by industry).

Benefits of sustainability-linked bonds

Sustainability-linked bonds may motivate businesses to improve their sustainability performance, which for environmentally sensitive sectors typically means reducing greenhouse gas emissions and other externalities. They may also:

- Motivate issuers to set targets aligned with global benchmarks, in particular the Paris Agreement on climate changeFootnote2 and the UN SDGs

- Enable more issuers to access ESG-labeled bond markets, including those with lower direct capital expenditures that would qualify as green expenses

- Allow investors to diversify across geography, bond maturity, industry, or bond rating

PIMCO’s role in strengthening the credibility of the SLB market, and next steps

While the ICMA’s guiding principles have improved the SLB market’s credibility by encouraging more transparent disclosure and reporting, we believe there is still room for improvement given that a number of debatable practices continue to pose challenges for investors. These include bond structures perceived as misrepresenting the positive environmental impact of SLBs or issuers’ degree of commitment to advancing sustainability issues, a practice that may be associated with “greenwashing.” Such practices may overshadow examples of quality SLBs and sustainability targets. For example, in many cases, deals have included ESG metrics only for direct greenhouse gas emissions even if the vast majority of the issuer’s overall emissions are indirect and other sustainability metrics, such as water, pollution, waste, safety, or health, are more relevant for the issuer’s industry.

This year, the ICMA updated the illustrative KPI registry and the Q&A related to SLBs, which complement the Sustainability-Linked Bond Principles, to clarify in particular the key performance indicators (KPIs, the credibility of the targets, coupon step-up, and structures that SLB issuers should use). Importantly, PIMCO is a coordinator of the SLB working group and a contributor to the guidance documents.

PIMCO is also an elected member of the ICMA Green Bond Principles and Social Sustainable Bond Principles Executive Committee, whose goal is to uphold the credibility of the market and engage policymakers on sustainable bonds.

Therefore, in addition to ICMA’s Sustainability-Linked Bond Principles and its guidance documents (as noted in PIMCO’s Best Practice Guidance for Corporate Sustainable Bond Issuance and PIMCO’s Best Practice Guidance for Sovereign Sustainable Bond Issuance), we highlight possibilities for issuers to bolster SLB structures:

- Introduce shorter trigger dates for evaluating whether a KPI target has been met in recognition of the need for near-term progress on climate action in particular

- Build milestones into their Sustainability Performance Targets (SPT) and provide legal documentation to demonstrate progress throughout the life of the bond (e.g., ensuring the issuer’s most recent and ambitious KPI and SPT targets will automatically apply to all outstanding bonds using the same KPI and SPT definition)

- Provide external verification of the historical performance for KPIs prior to issuance, along with the KPI calculation methods and data quality based on recognized standards (e.g., Food Loss and Waste Protocol, and the Oil and Gas Methane Partnership for methane emissions)

- Follow practices in line with typical covenants for bonds not labeled as sustainable to facilitate the mainstreaming of the instrument and its connection with credible and ambitious targets (e.g., meaningful and commensurate coupon step-up rather than charitable donations, and inclusion of material and relevant metrics based on recognized sector materiality matrices. This involves incorporating broader KPIs than greenhouse gas emissions where applicable)

We believe SLBs sit well alongside the well-established use-of-proceeds markets, and we will continue to evaluate new deals based on our proprietary evaluation framework for ESG-labeled debt while partnering with issuers to support best practices. Most encouraging for us is the increasingly wide set of issuers choosing to issue SLBs. While clear progress has taken place, the room for improvement is undeniable.

Featured Participants

Disclosures

PIMCO is committed to the integration of Environmental, Social and Governance ("ESG") factors into our broad research process and engaging with issuers on sustainability factors and our climate change investment analysis. At PIMCO, we define ESG integration as the consistent consideration of material ESG factors into our investment research process, which may include, but are not limited to, climate change risks, diversity, inclusion and social equality, regulatory risks, human capital management, and others. Further information is available in PIMCO’s Environmental, Social and Governance (ESG) Investment Policy Statement.

With respect to comingled funds with sustainability objectives (“ESG-dedicated funds”), we have built on PIMCO’s 50-year core investment processes and utilize three guiding principles: Exclude, Evaluate and Engage. In this way, PIMCO’s ESG-dedicated funds seek to deliver attractive returns while also seeking to achieve positive ESG outcomes through its investments. Please see each ESG-dedicated fund’s prospectus for more detailed information related to its investment objectives, investment strategies and approach to ESG.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by PIMCO or any judgment exercised by PIMCO will reflect the opinions of any particular investor, and the factors utilized by PIMCO may differ from the factors that any particular investor considers relevant in evaluating an issuer’s ESG practices. In evaluating an issuer, PIMCO is dependent upon information and data obtained through voluntary or third-party reporting that may be incomplete, inaccurate or unavailable, or present conflicting information and data with respect to an issuer, which in each case could cause PIMCO to incorrectly assess an issuer’s business practices with respect to its ESG practices. Socially responsible norms differ by region, and an issuer’s ESG practices or PIMCO’s assessment of an issuer’s ESG practices may change over time. There is no standardized industry definition or certification for certain ESG categories, for example “green bonds”; as such, the inclusion of securities in these statistics involves PIMCO’s subjectivity and discretion. There is no assurance that the ESG investing strategy or techniques employed will be successful. Past performance is not a guarantee or reliable indicator of future results.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.