Trying to Make Apple Juice From Oranges: The Problem With Comparing Market Pricing and Fed Projections

While the U.S. Federal Reserve (Fed) appears to be nearing a point where it considers pausing its interest rate hiking cycle, market participants are already pricing in the timing and magnitude of future rate cuts. Specifically, the market appears to be pricing in cuts to the Fed’s short-term policy rate starting in the second half of this year and continuing into 2024 and beyond, with tradable forward rates going from just under 5% by mid-2023 to about 3% in only 18 months’ time.

This pricing is garnering attention from market participants and pundits alike, fostering a debate about what type of economic outcome – namely a hard or soft landing – the market is pricing in. The resulting assumptions can feed into the pricing of different asset classes, creating significant implications for investors.

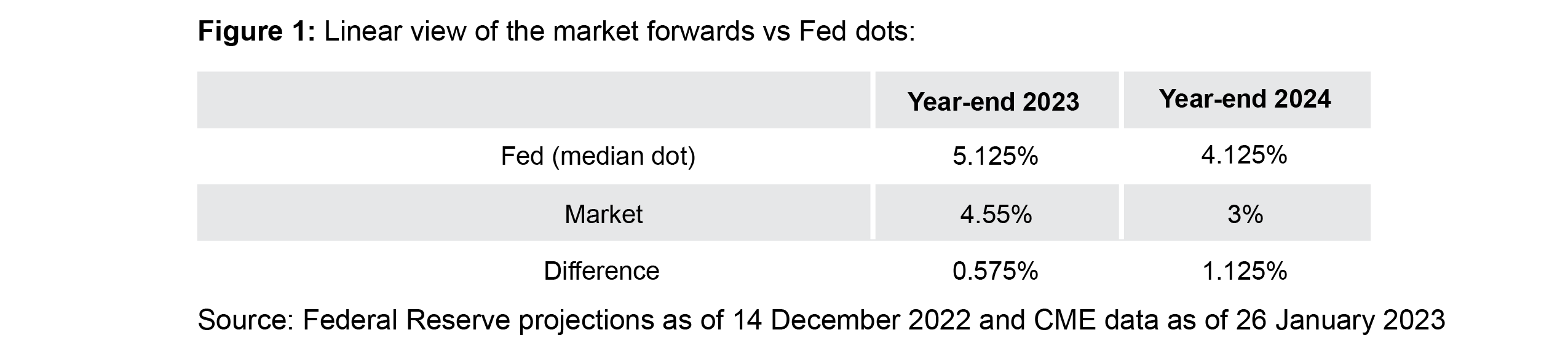

So what to make of the discrepancy between forwards, one of the most closely watched market rates that price in future interest rate expectations, and the Fed’s own projections (see Figure 1)? Does the market really disagree with the Fed by more than a full percentage point when it comes to where rates will be next year?

We’d like to caution against the false sense of precision that market-based rates can provide, and to suggest that the answer is much more nuanced. Notably, a forward rate should not be viewed as a standalone expectation of where short-term rates will be. Rather, it is probability-weighted.

Dots vs. markets

Each quarter, the Fed’s policy-setting committee publishes a chart, known as the dot plot, summarizing individual members’ projections for the federal funds rate. Each dot distills one member’s range of possibilities into a single, most likely point. However, each dot does nothing to illustrate that member’s entire possible range of outcomes, therefore conveying a higher level of confidence in any given point.

The closely watched median dot, which plots at 4.125% for year-end 2024 as of the most recent chart released in December, represents the median point of all members’ projections – each of which, again, is a distilled representation of a range of most likely outcomes.

The median is expressed as a single figure, yet the range of individual members’ dots for year-end 2024 spans 2.625 percentage points, from 3% to 5.625%. This range is important, as it shows substantial uncertainty even within the Fed itself. This uncertainty should also be taken into consideration when considering market pricing.

Looking strictly at forward rates can give an oversimplified view, whereby the market is or is not pricing this or that outcome. This can be shortsighted, as the market is made up of countless participants, each with a unique view on a potential range of outcomes. A forward rate is not necessarily the market’s singular expectation of the future, but rather a rate derived from a range of probability-weighted outcomes.

One could look at current market pricing and determine that the Fed is going to raise rates to about 4.9% by mid-year 2023 and then cut by about 200 basis points (bps), or two full percentage points, in the subsequent 18 months, based on what the probability-weighted averages show.

We think that is a narrow interpretation of what the market is displaying. Solely looking at the forward points offers no information about the distribution and market confidence around those points.

Options and distributions

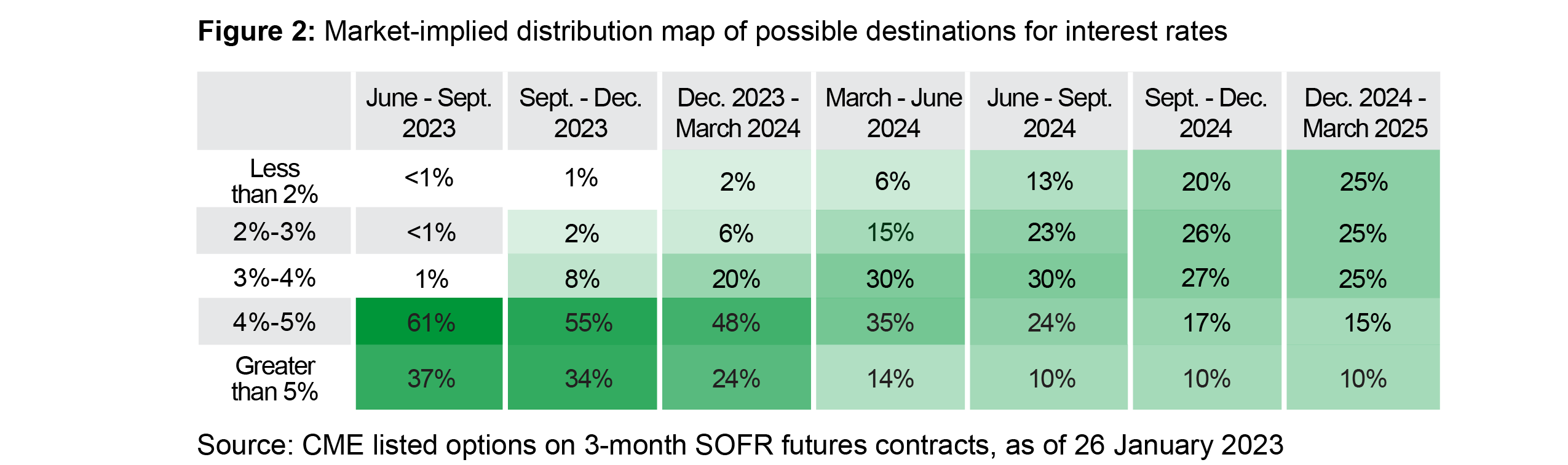

Extending the market pricing inputs to include options prices can paint a more robust picture of what the market is truly expecting. Figure 2 uses CME-listed options on three-month Secured Overnight Financing Rate (SOFR) futures contracts to build a distribution map of outcomes.

This isn’t a perfect comparison, given SOFR is not the same as the fed funds rate – it’s a three-month borrowing gauge rather than a six-week measure, and futures (and options on futures) liquidity isn’t as deep as it has been in the past. Yet it can still provide valuable insight into the market’s confidence around the forward points, as the use of SOFR options offers more reliable pricing, while options on fed funds futures have negligible volume and open interest.

We find two initial main takeaways from this distribution map:

- The market is displaying a fair amount of confidence that the Fed won’t spend a significant amount of time holding rates above 5%, if at all – in fact, the market is pricing about a 70% chance that the policy rate is below the Fed’s median projection of 4.125% by year-end 2024.

- The range of likely and even possible outcomes drifts meaningfully wider as you get into 2024 and beyond.

As investors perceive that the Fed is approaching a peak in its policy rate, it is typical for the market to start pricing in subsequent rate cuts. The pricing of the severity and timing of those cuts will evolve with incoming data.

In determining the market’s expectations, we think it’s prudent to look beyond just the forward rates. Although forward rates are actively tradable, they alone don’t paint the full picture of market expectations. Understanding the uncertainty around specific forward points can help frame a more robust narrative.

Mike Cudzil is a generalist portfolio manager and Tim Crowley is a portfolio manager on the U.S. rates desk, both in the Newport Beach office.

Featured Participants

Disclosures

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.