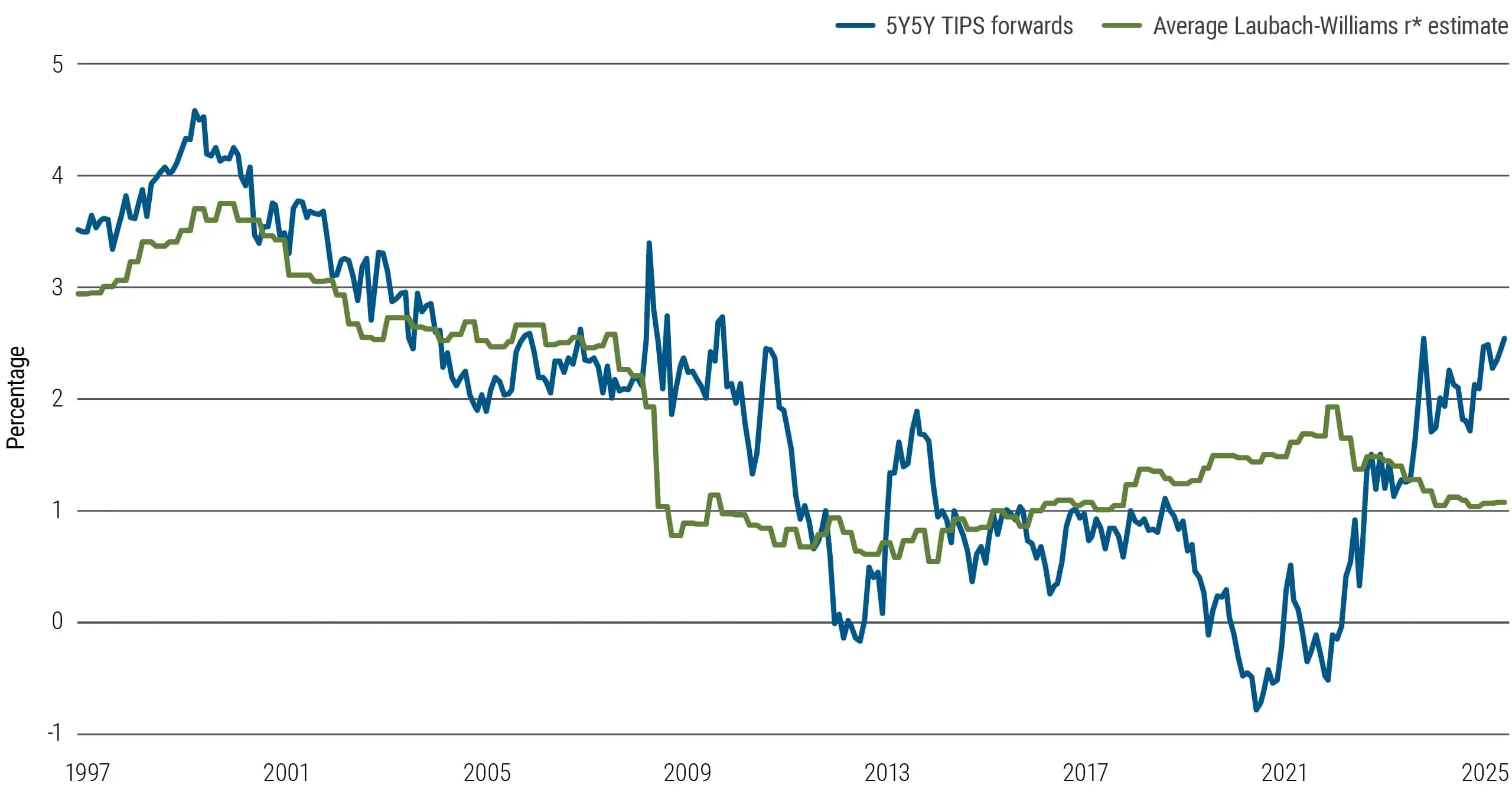

Forward pricing on inflation-linked bonds has diverged from the real neutral rate, reflecting a rising real term premium

Recent rate volatility has left investors demanding clarity on the direction of yields and what fair compensation for risk-taking should be; but searching for answers when current environments do not seem to align with prior trends can be challenging. Over the past 25 years, the 5-year, 5-year forward Treasury inflation-protected securities (TIPS) yield has closely tracked the Federal Reserve’s estimate of the real neutral interest rate. That rate – commonly referred to as r* – is the estimated neutral or natural real interest rate that neither hinders nor stimulates economic growth, employment, and inflation. The close relationship between these two measurements reflects market confidence in the Fed’s long-term economic outlook.

However, in recent years, the 5Y5Y TIPS forward yield has risen above r*, suggesting that investors expect real interest rates to be higher over the medium term than the Fed’s benchmark, signaling in part a higher real term premium.

5Y5Y TIPS forwards vs. r*

Source: Bloomberg, PIMCO as of 2 June 2025. Past performance is not a guarantee or a reliable indicator of future results.

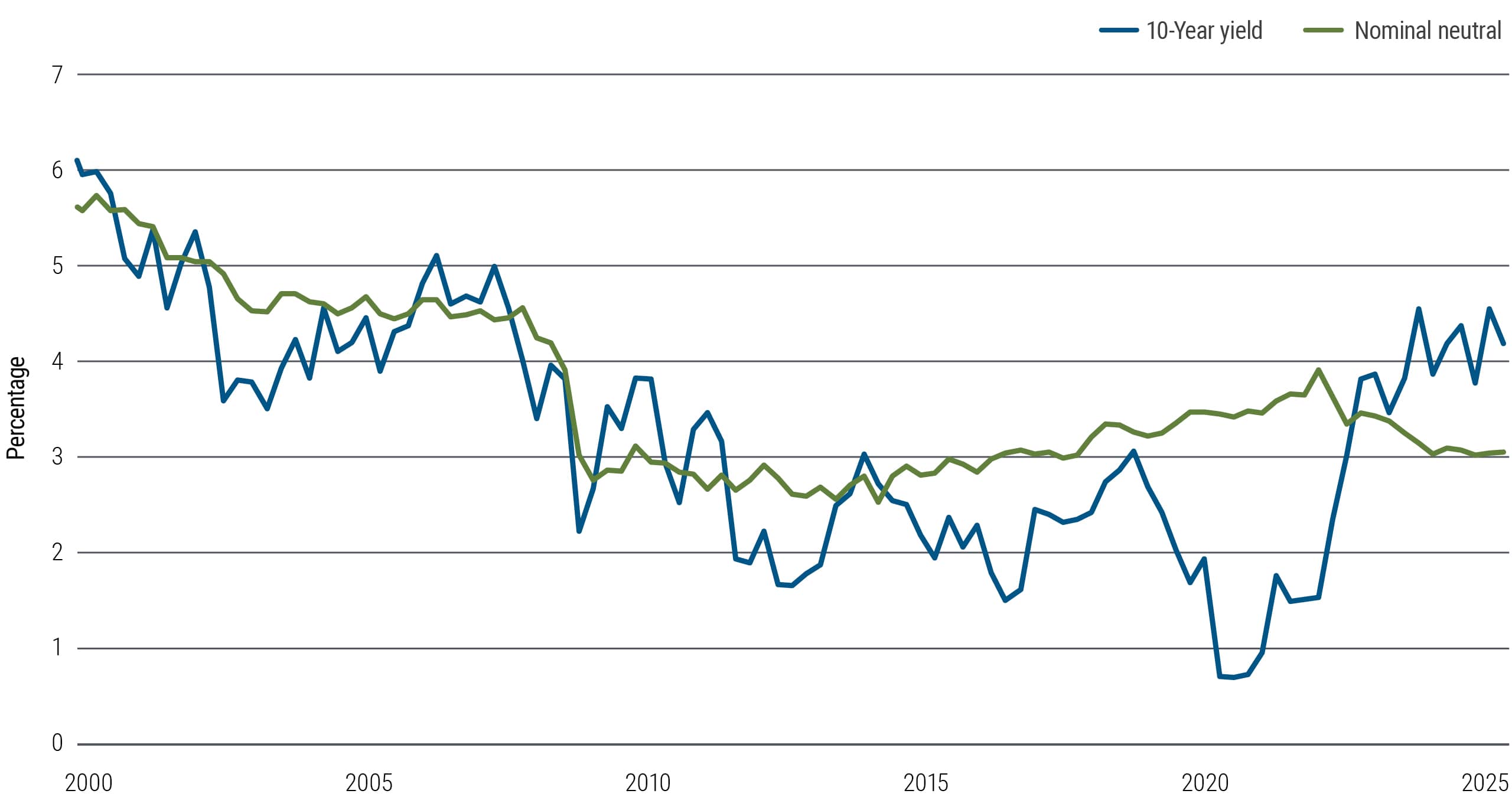

Likewise for 10-year U.S. Treasury yields relative to nominal neutral

A similar trend is evident in the 10-year U.S. Treasury yield, which for decades remained anchored near the Fed’s nominal neutral rate.

Since 2021, however, the 10-year yield has risen while the neutral rate has fallen. In essence, investors are demanding higher returns for taking on the risks of longer-term borrowing along a steeper yield curve, especially in a world of challenging debt and deficit dynamics.

The rise in long-term yields could have broad implications, increasing borrowing costs for businesses and consumers and potentially hampering economic activity if sustained.

With this fragmenting environment in the backdrop, how should we think about valuing fair term premium?

10-Year yield vs. nominal neutral

Source: Bloomberg, PIMCO as of 2 June 2025

"Nominal Neutral" is defined as 2 plus the average of the Laubach-Williams and Holston-Laubach-Williams r* estimates. Past performance is not a guarantee or a reliable indicator of future results.

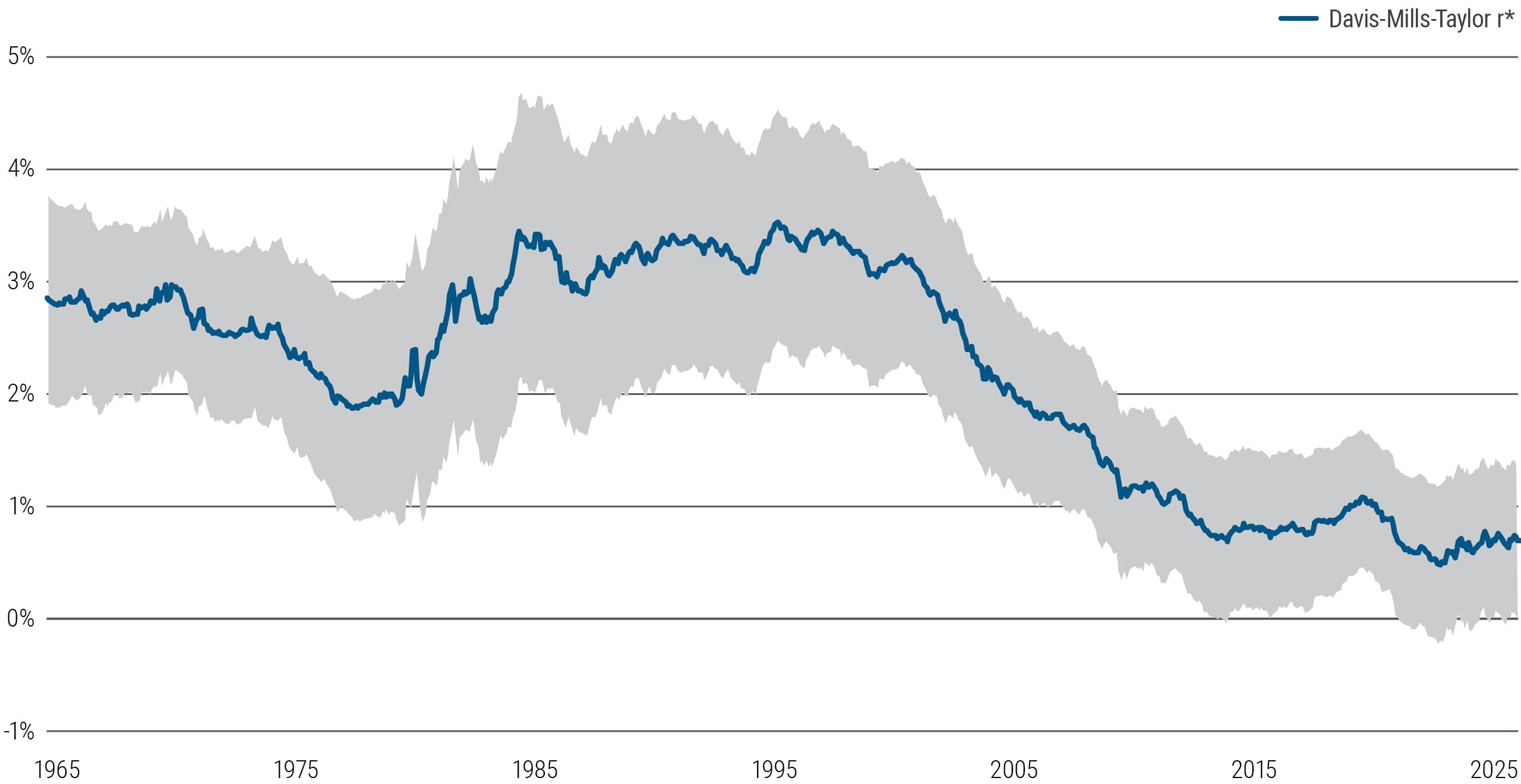

Despite heightened risks, estimated r* continues to run near 1%

The answer lies in the relationship between r* and term premium.

Despite these upward moves in nominal yields, the underlying real neutral rate (r*) has remained relatively steady, even declining slightly in recent years. This stability suggests that the fundamental drivers of economic growth and productivity have not dramatically changed.

Nominal bond yields can be thought of as the sum of expected average short-term real interest rates plus a term premium — the extra yield investors demand for holding longer-term bonds. The steady real neutral rate implies that much of the recent increase in nominal yields is driven by changes in the term premium rather than shifts in the core economic fundamentals.

Measures of U.S. r*

Source: Davis, Mills, et. at Journal of International Economics, Federal Reserve, Bloomberg, PIMCO as of 2 June 2025

Shaded area is 25th to 75th percentile range of estimates from Davis Mills r*.

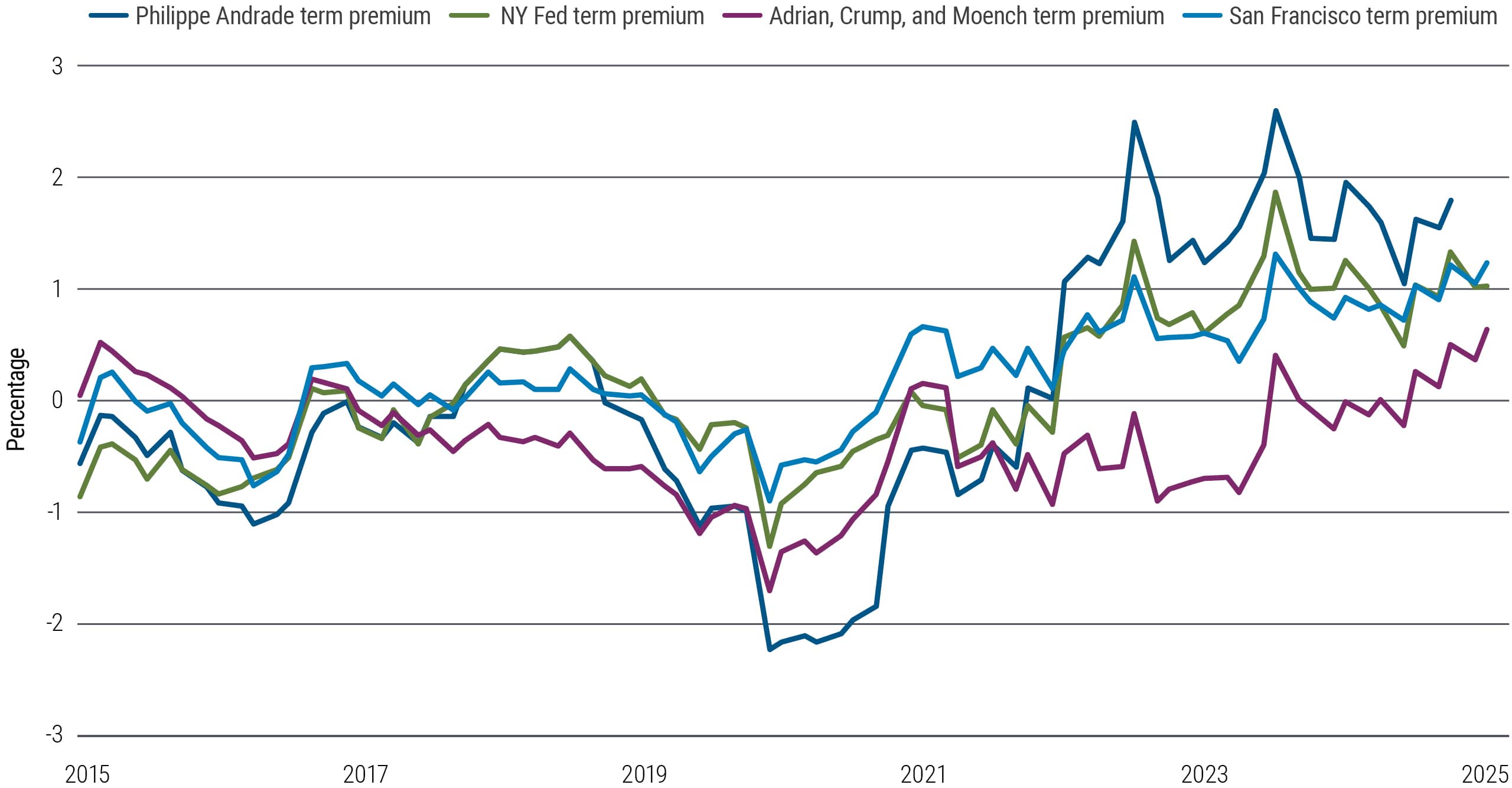

Strategic duration positioning can help counter the gradual rise of term premium

Indeed, the term premium has surged close to a 10-year high, reflecting heightened investor demand for compensation against risks such as inflation volatility, interest rate uncertainty, policy-related risks, and potential liquidity constraints in bond markets.

However, this is not a sudden or isolated event indicating market disruption; the multi-year rise in term premium suggests an orderly repricing of risk, which active portfolio management can help navigate. In particular, a fall in short term interest rates and a rising term premium signals that investors can look to lock in compelling yields over the intermediate term.

As we’re already beginning to see, economic cycles in this world are going to be amplified. Financial markets are going to be volatile. For an active investor, such environments are a playground for credit selection and strategic duration positioning opportunities.

All term premium calculations (frequency of NY Fed survey)

Source: Bloomberg, Haver Analytics, Federal Reserve, PIMCO as of 2 June 2025