FRAUD WARNING:

For more information,

click here.

Investment Strategies

Fixed Income Models

PIMCO's fixed income models offer multiple use-cases to address different client objectives related to defensive assets, and cater to capital preservation, portfolio diversification and income generation.

Diversify and Grow: Explore Our Allocations

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Pair with Equities

Turnkey fixed income solution to utilise within multi-asset portfolio.

Deliver Income

Standalone allocation to generate an attractive distribution to meet spending needs.

Anchor Fixed Income Holding

Core fixed income allocation complemented with favoured satellite positions.

Model Allocations

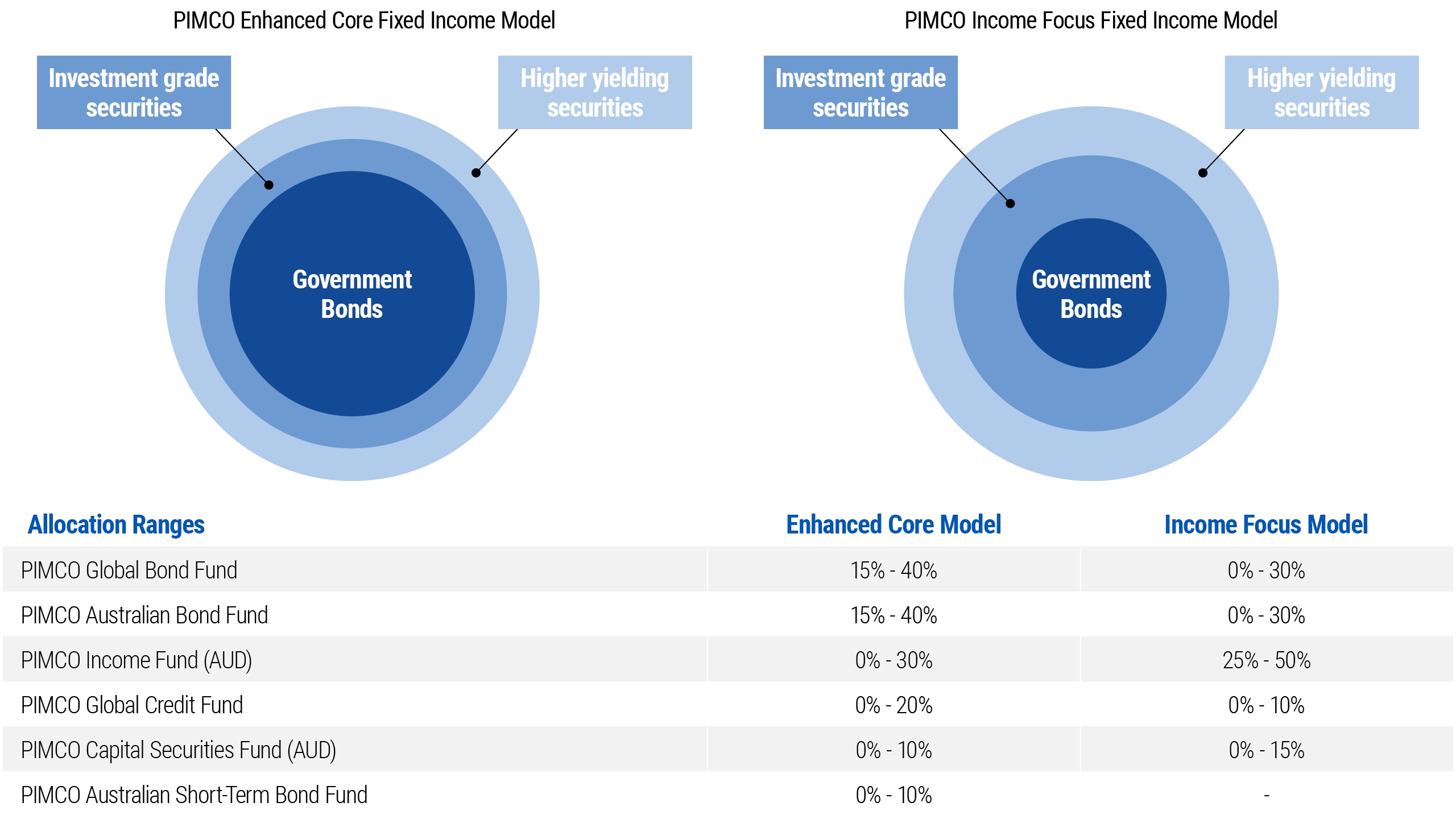

PIMCO's Fixed Income Model Portfolio Approach

PIMCO's fixed income model portfolios are a product of PIMCO's extensive experience in active fixed income management, developed over 50 years of managing assets for clients, combined with our proprietary quantitative and risk analytics capabilities.

Fixed Income Models Allocations

As of 30 June 2025. Indicative asset allocations and ranges for each model are illustrated above for guidance. Actual allocations may vary. There is no assurance that an account managed to a Model will achieve its investment objectives or that the stated results will be achieved. Model statistics are based on the weighted Fund allocation within each model portfolio.

All Documents

-

-

Designed for investors seeking returns above cash including regular income and portfolio diversification.

-

Designed for investors seeking returns above cash including regular income and some portfolio diversification.

-

Available On Macquarie Platforms

This is a carousel with individual cards. Use the previous and next buttons to navigate.