We Believe

- Tighter financial conditions will likely cool inflation and lead to a recession across developed markets, which should be modest but not painless as unemployment will probably rise.

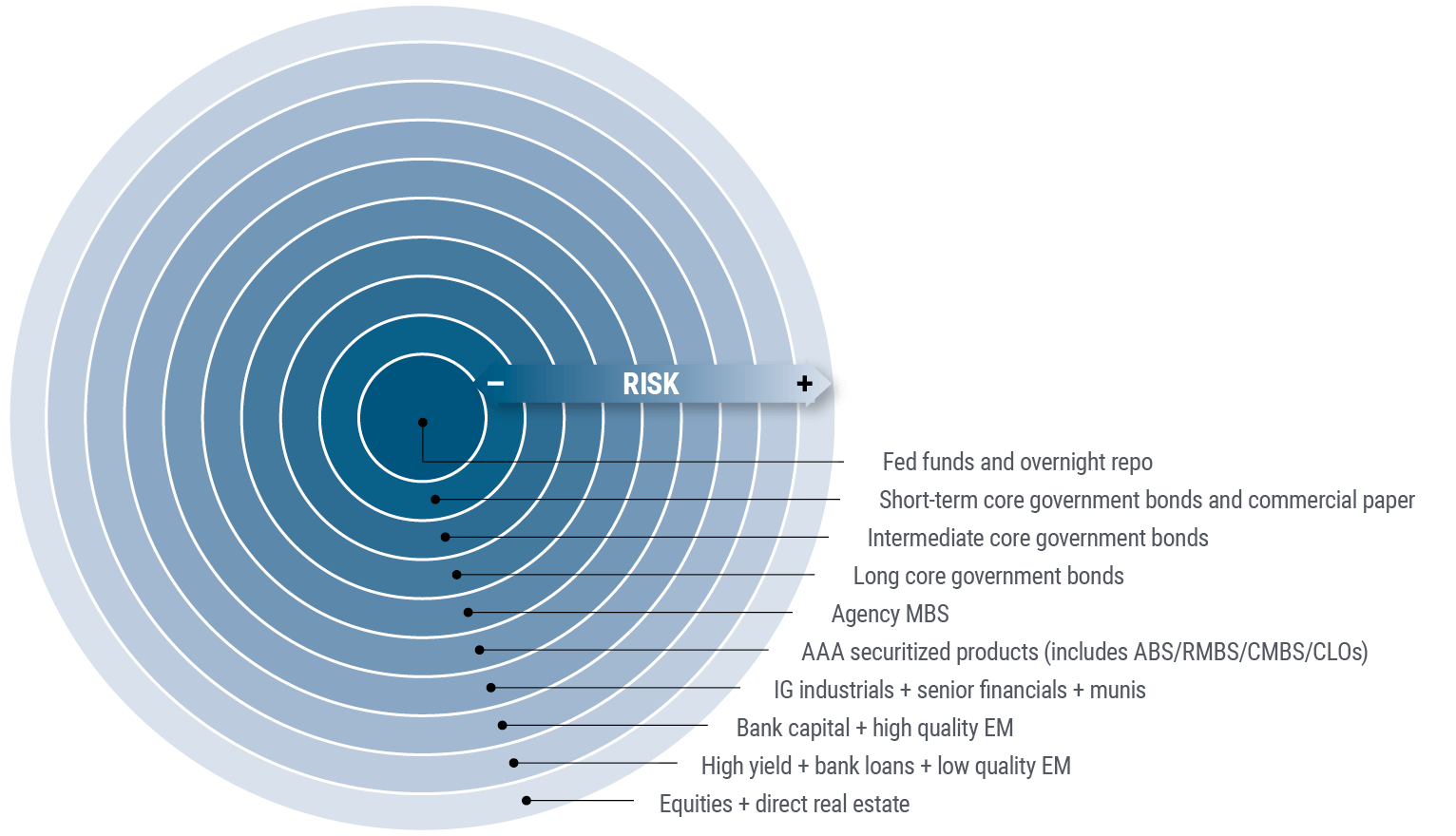

- Bonds are alluring again, with improved yields and lower expected volatility on the highest-quality assets at the center of our concentric circles investment framework.

- We are cautious in more economically sensitive areas of financial markets, while equities have become less attractive amid higher interest rates.

After facing difficulties on all fronts in 2022, investors should be rewarded with more opportunities in the year ahead, even as the global economy confronts headwinds.

We expect a modest recession in 2023 across developed markets as central banks continue to battle inflation, yet uncertainties remain. We discussed these and other factors at PIMCO’s Cyclical Forum in December in Newport Beach, arriving at three key economic themes heading into 2023, which we review in the next section.

Any recession could further challenge riskier assets such as equities and lower-quality corporate credit. But we believe the repricing across financial markets in 2022 has improved prospects for returns elsewhere, particularly in bonds. We are focusing on high quality fixed income sectors that offer more attractive yields than they have in several years.

In our concentric circles framework, where risk increases toward the outer rings, we are prioritizing investments nearest the core for 2023. Rather than taking greater risks to chase incremental returns, we’re seeking to make portfolios resilient, targeting investments that should be able to withstand even a more significant downturn. In other words, we’re expecting a mild recession but preparing in case of something deeper.

Economic outlook: Waiting on recession

Since our October Cyclical Outlook, “Prevailing Under Pressure,” economic activity has been more resilient than expected, while inflation has remained elevated. However, the outlook – as measured by surveys of business leaders and purchasing managers – has deteriorated, as banks have tightened credit conditions, industrial order books have waned, and consumers have depleted elevated savings. Financial conditions also remain tight as central banks raised market expectations for the level of policy rates, while crystalizing what’s priced in with actual hikes.

As a result, some kind of recession over the next 12 months still appears likely across developed markets (DM). Unlike other modern recessions, where rate hikes in anticipation of inflation triggered broader market stress, this recession and rising unemployment could be the cost of returning inflation to target levels. Our baseline view is that recessions in 2023 will be modest, although we are preparing for a range of possible outcomes.

We would emphasize three themes heading into 2023:

1) Inflation is likely to moderate, and risks to the inflation outlook appear more balanced.

Supply constraints, related first to the pandemic and later to the war in Ukraine, together with a stimulus-induced demand surge and an acceleration in unit labor costs, have all added to inflation. However, now that most price adjustments appear to be behind us, some of this inflation is likely to fade away with little central bank help.

For example, the 40% and 50% increase in U.S. used car and global energy prices, respectively, contributed 4 percentage points to U.S. headline inflation in 2022. If those prices just stabilize, U.S. headline consumer price index (CPI) inflation could fall from about 8% to 4% (annualized) relatively quickly, in our view.

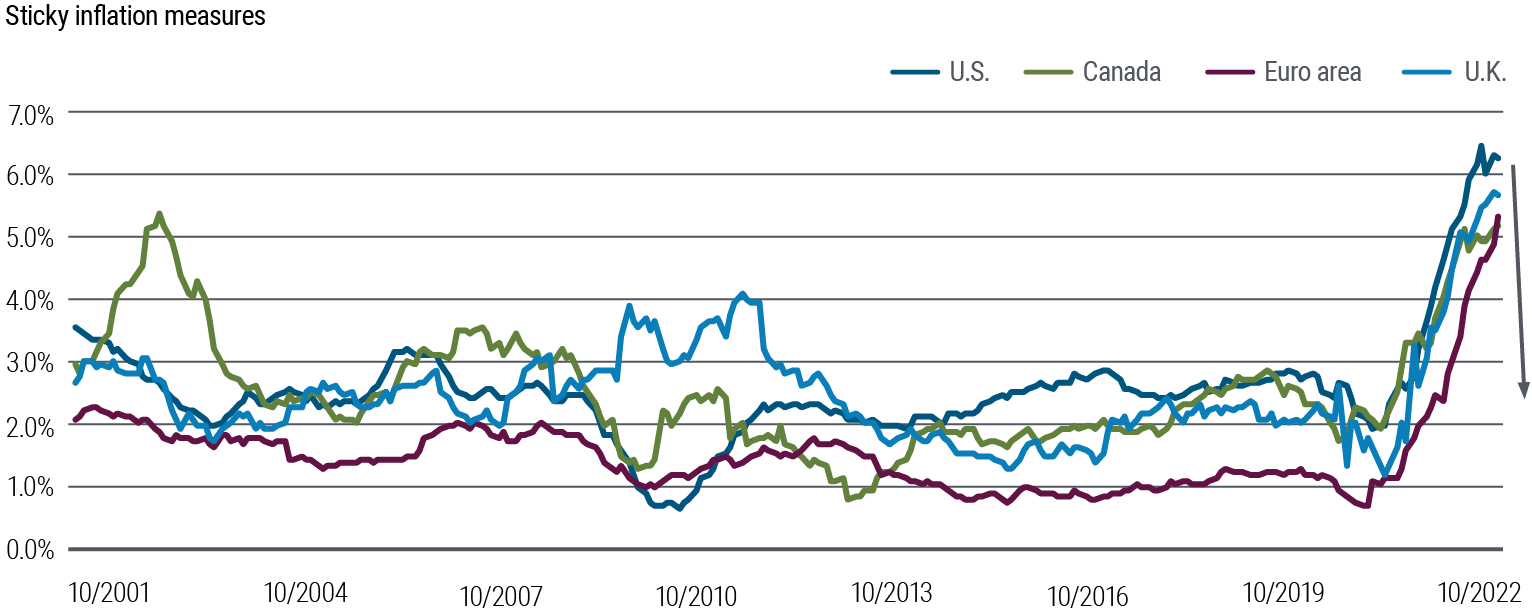

Going from 4% to 2% would take more time, as the “stickier” categories may be slow to moderate (see Figure 1). Tight labor markets across DM have elevated wage and unit labor cost inflation. Shelter and rental inflation are expected to only gradually moderate.

The faster-than-expected economic reopening in China could quicken the easing of supply-chain disruptions. We believe consumption, especially in services, will drive that reopening, limiting any pressure on global goods inflation.

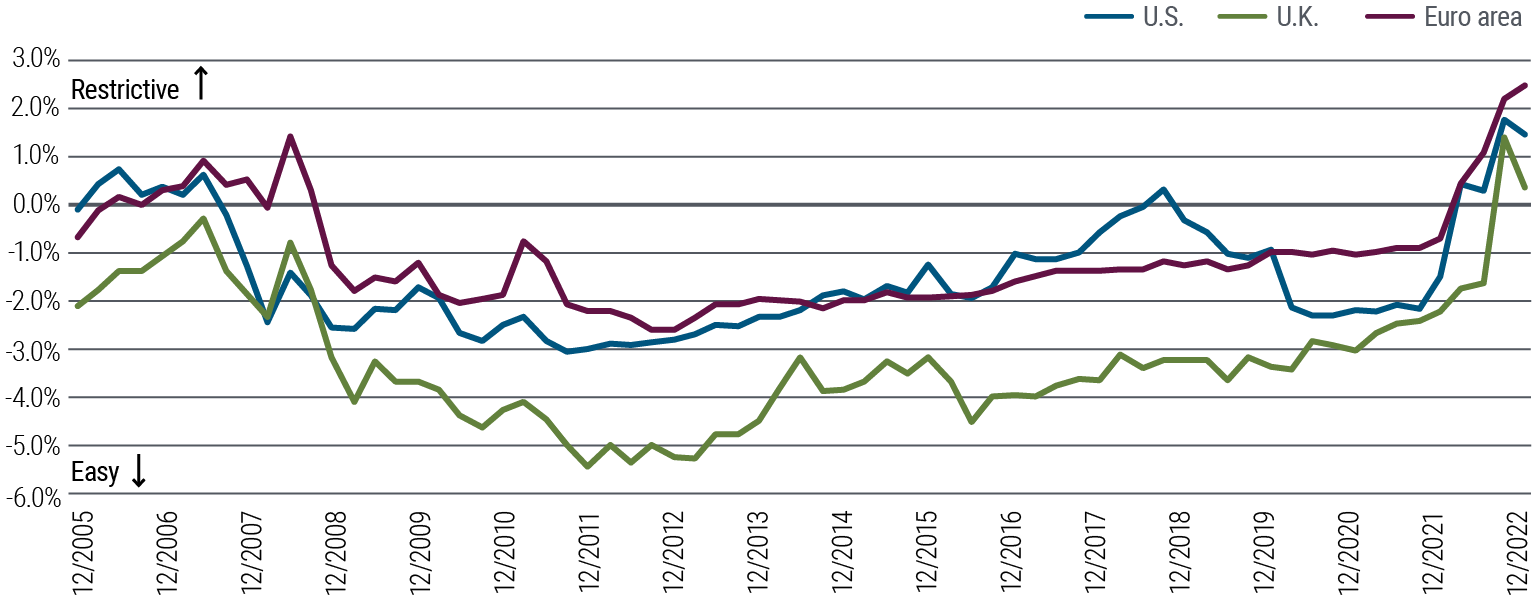

2) Central banks are closer to holding policy at restrictive levels as opposed to getting policy to restrictive levels.

Monetary policy has likely already reached restrictive levels in several major economies – see Figure 2. While nominal DM overnight rates are still below inflation, that is likely to change as inflation moderates and central banks reach points where they pause their hiking cycles.

We think the U.S. Federal Reserve (Fed) may need to reach a roughly 5% nominal federal funds rate, which is already largely priced into markets and reflected in the Fed’s own projections.

Estimates put the real neutral interest rate in Europe well below other DM rates, suggesting the European Central Bank (ECB) has less work to do. We think a 3% rate, or slightly higher, where the ECB pauses is a reasonable estimate, given the euro area is likely close to if not already in a recession, and that inflation may peak in the fourth quarter of 2022 or early 2023.

The Bank of England and Bank of Canada are likely targeting nominal rates somewhere between the ECB and the Fed. Estimates of their real neutral rates are above that in Europe.

Overall, DM central banks have already largely realigned market pricing with the need for restrictive policy and have achieved this relatively quickly, with little additional market stress or contagion. The pace of tightening according to our financial conditions index (which includes rates, equity, credit, and foreign exchange) has mirrored that during the 2008 global financial crisis, with little deterioration in market functioning and without a sudden stop in credit markets, which could result in a more severe economic outcome.

While we expect DM central banks to continue to hike for the next quarter or so, before holding policy in restrictive territory, the trade-off they face will eventually change. Today, with low unemployment and elevated inflation, restrictive policy is needed. As 2023 progresses, inflation moderates, and unemployment rises, the need for restrictive policy will get less clear.

Since the U.S. appears to be leading DM inflationary trends, and inflation could fall faster in the U.S. than elsewhere, the Fed may be the first central bank to discuss cutting rates in the second half of 2023.

3) Shallow recessions won’t be completely painless.

As tighter financial conditions cool inflation over time (monetary policy works through lags), the mechanism won’t be painless for the real economy, since it largely works through weakening the labor market.

Using data spanning back to the 1960s across 14 developed markets, we estimate the increase in unemployment needed to moderate inflation. We find central banks could need to increase the unemployment rate by around 0.7 percentage points to bring inflation down by 1 percentage point. By that measure, U.S. unemployment may have to increase to around 5%, from 3.5% in December, to moderate the sticky inflation over time.

The U.S. labor market is one of the tightest across DM, and consequentially unit labor cost inflation is well above both DM peers and levels consistent with the Fed’s 2% long-term inflation goal. Similar measures in other regions are also elevated. In the European Union and U.K., unit labor cost inflation is running around 4% year-over-year, while Canada’s is slightly higher. Unemployment likely will need to rise across these regions as well.

Bottom line: Recession likely, but soft landing plausible

The U.K., which is likely already in a recession, appears to be leading the DM downturn. We expect the euro area to follow, and the U.S. and Canada to slip into recession later in the first half of 2023. Euro area and U.K. inflation appear to be following the U.S. with a lag. We expect euro area and U.K. headline inflation to peak just above 10% in the fourth quarter of 2022, while U.S. CPI inflation likely peaked near 9% in mid-2022.

Japan stands out as relatively more resilient, with expected growth at or slightly above trend, as the relaxation of economic restrictions helps offset global headwinds. Core rates of Japanese inflation have firmed, increasing the likelihood that the Bank of Japan further alters its yield curve control framework, following the first adjustment announced in late December after our Cyclical Forum.

Fiscal policy is likely to be muted, despite economic weakness, with much less impact on the 2023 outlook in the U.S. and Canada. Fiscal support packages in Europe and the U.K. to offset higher energy costs aren’t likely enough to stave off recession.

Macro uncertainty is still high and there are risks. Linkages between real economies and global markets, coupled with the fastest pace of financial conditions tightening in decades, elevate the risk of accidents, contagion, and credit market disruption.

Yet there is still a plausible path to a soft landing as labor hoarding amid still-scarce supply, as well as moderating inflation, reaccelerate real income growth. Consumer and business balance sheets are strong, with elevated cash reserves, while pandemic-related supply constraints created large order backlogs, pent-up demand, and margin expansion, which are all likely to support business activity. China’s reopening may also provide a tailwind to the global economy.

Investment implications: Bonds are back

We continue to see a strong case for investing in bonds, after yields reset higher in 2022 and with an economic downturn looking likely in 2023. Fixed income markets today can offer broad opportunities to build resilient portfolios with the potential for both attractive returns and mitigation against downside risks.

While our baseline is a modest recession and moderating inflation, our Investment Committee (IC) discussions focused on the wide range of plausible scenarios and asset price returns in those scenarios. For example, corporate credit could perform well in a very mild recession. Although we expect disinflation, U.S. Treasury Inflation-Protected Securities (TIPS) could perform well given uncertainty over where core inflation settles versus current pricing.

In this environment, we want to be careful in overall risk positioning and keep dry powder to allow us to add risk to portfolios in the event of notable new information on the outlook or significant market moves.

Even with the range of scenarios, uncertainty over the outlook for the Fed should be much lower in 2023. This led us to focus on the concentric circles investment framework, which we have used over the years and remains written on the whiteboard in our IC room (see Figure 3).

The framework starts with the relative lower risk in the middle in short-term and intermediate interest rates, moving out to U.S. agency mortgage-backed securities (MBS) and investment grade corporate credit in the middle rings, to the riskier outer bands with equities and real estate.

This is more than an empirical observation on the correlation of risk and return; it is a statement on cause and effect – with central bank policy a crucial driver. Changing the price of borrowing at the center creates ripples that change the prices of risk assets in the outer circles. Asset prices at the edge also depend on investor animal spirits, and on confidence in policymakers and their policies.

When PIMCO introduced these concentric circles years ago, the focus was on central banks’ success in reflating the economy after the global financial crisis. Today, the focus is on the ability to reduce inflation. If the Fed and other central banks can convince investors that the center will hold, then assets at the center should perform well. And – sequentially – this should feed into improved returns at the outer edges.

But in the event there is a loss of confidence on inflation, and central banks are forced to raise rates more than expected, this will have negative consequences for the outer circles.

Core bond strategies

The repricing of the front end of the yield curve over the past 12 months has boosted the allure of short-dated bonds at the center of the concentric circles.

U.S. core bond funds offer starting yields at about 5.5%Footnote1 , which rises for funds with a larger credit component. This is attractive given our baseline outlook, and these funds’ more favorable risk profile may offer additional downside mitigation versus outer-circle assets in the event of worse outcomes.

Overall, we do not expect to make large changes in current positioning based on the outlook and valuations. Rather, we are focused on identifying asymmetric trades across the range of plausible scenarios to complement current positioning.

We expect a yield range of about 3.25% to 4.25% for the 10-year U.S. Treasury in our baseline, and broader ranges across scenarios for 2023, with a view of being neutral on duration – a gauge of interest rate risk – or having a tactical underweight position at current levels.

TIPS pricing suggests high confidence in the Fed’s anti-inflation credibility and could provide a reasonably priced cushion against more adverse inflation scenarios.

Mortgage-backed securities (MBS)

We retain a positive view on U.S. agency MBS. These are high quality, AAA rated assets with relatively attractive spreads that are inner-core, bend-but-not-break securitiesFootnote2 . An expected decline in interest rate volatility would support MBS.

Public and private credit and structured products

Our views on credit and structured products are little changed since our October outlook, strongly favoring up-in-quality and up-in-liquidity positioning in core portfolios.

We are particularly cautious in more economically sensitive market areas, especially investments that will bear the brunt of any monetary policy overshoots. One example is floating rate, senior secured bank loans, where our credit team sees material downgrade and default risk even at current policy rate levels. There will still be attractive, resilient companies in this sector, but investors should be cautious.

Given heightened uncertainty, our analyst team will be even more proactive in downgrading names on any forward indicators of credit deterioration.

Private credit markets, which can be slower to reprice than public markets, may be at risk of further declines in the short term. But a patient approach can set aside capital to take advantage of opportunities in the months and years ahead.

Currencies and emerging markets (EM)

We favor the U.S. dollar, euro, and British pound as funding currencies for long positions in G-10, and EM currencies where we see cyclical tailwinds and valuation advantage. As we get greater confidence on the outlook for the Fed and the economy, there will likely be a good case to increase U.S. dollar short positions.

In Japan, we have been underweight duration in many portfolios, anticipating the adjustment in the Bank of Japan’s yield-curve-control regime. We expect to maintain these underweights, given the potential for further such adjustments. This reinforces the case for being overweight the Japanese yen, which we see as cheap in our valuation models and a position we would expect to benefit in a deeper-than-anticipated recession.

We are also underweight interest rate risk in China, where the skew is toward higher yields given the country’s reopening.

Despite unprecedented global shocks, EM countries have been resilient. High real rates buffer risks from further Fed hikes and the effects of the U.S. dollar. China’s reopening provides a tailwind, and we believe the inflation peak has passed.

EM valuations screen as historically cheap. Still, much depends on the Fed’s ability to tame inflation and China’s ability to reactivate economic activity. EM appears poised to perform well down the road, but we remain cautious until the monetary policy outlook becomes clearer.

Commodities

The outlook for commodities remains constructive, with support from underinvestment in hydrocarbon production and power assets, low petroleum inventories, and depleted agriculture stocks. The greatest 2023 catalyst will likely be the reemergence of demand from China. The primary headwind is deceleration in DM demand amid tightening financial conditions.

The past two years have underscored commodities’ diversification benefits. With forward markets already discounting a sequential decline in prices, the opportunity cost for owning inflation hedges such as commodities is very low.

Asset allocation and equities

Equities have become less attractive amid higher interest rates and recession risk. Higher bond yields have precipitated a move from a “TINA” market (where “there is no alternative” to equities) to one in which appealing alternatives exist.

As the equity risk premium (ERP) has compressed and the earnings yield has lagged behind the move higher in rates, equities appear richly priced. Our models show a much lower recession probability is priced into the S&P 500 than macro indicators suggest, while earnings per share (EPS) estimates appear overly optimistic (for more, see our latest Asset Allocation Outlook, “Risk-Off, Yield-On”).

A change to our underweight position would require stabilization in rates, an ERP reflective of recession, and lower earnings expectations. Until these criteria are met, we favor defensive sectors and quality companies with reasonable valuations, clean balance sheets, and resilient growth prospects.

2 "Bend-but-not-break" refers to credits that PIMCO would not expect to default in a credit-stressed environment.Return to content

Powered by Ideas, Tested by Decades

About our forums

Honed over more than 50 years and tested in virtually every market environment, PIMCO’s investment process is anchored by our Secular and Cyclical Economic Forums. Four times a year, our investment professionals from around the world gather to discuss and debate the state of the global markets and economy and identify the trends that we believe will have important investment implications.

At the Secular Forum, held annually, we focus on the outlook for the next five years, allowing us to position portfolios to benefit from structural changes and trends in the global economy. Because we believe diverse ideas produce better investment results, we invite distinguished guest speakers – Nobel laureate economists, policymakers, investors, and historians – who bring valuable, multidimensional perspectives to our discussions. We also welcome the active participation of the PIMCO Global Advisory Board, a team of world-renowned experts on economic and political issues.

At the Cyclical Forum, held three times a year, we focus on the outlook for the next six to 12 months, analyzing business cycle dynamics across major developed and emerging market economies with an eye toward identifying potential changes in monetary and fiscal policies, market risk premiums, and relative valuations that drive portfolio positioning.