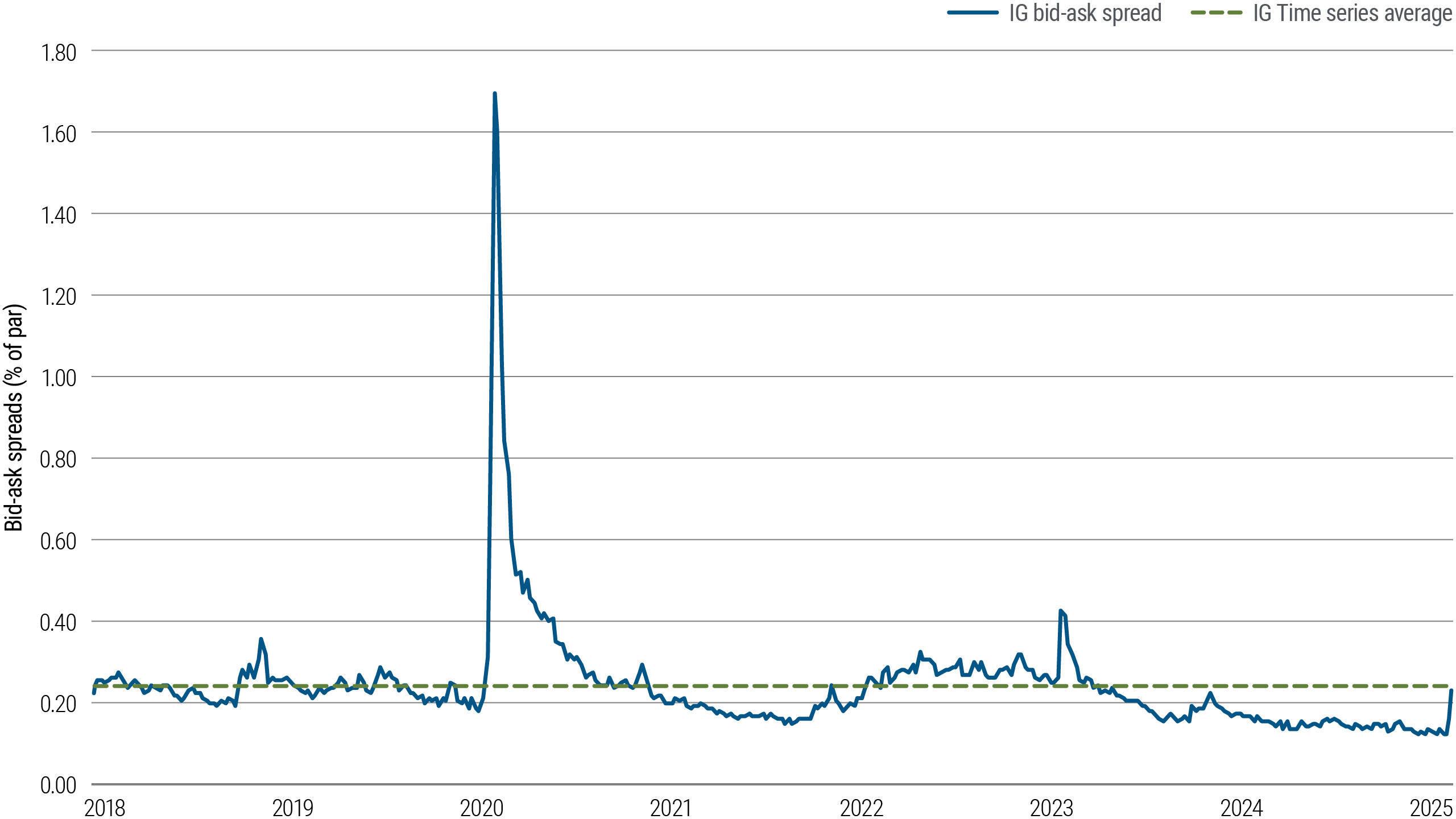

Bid-Ask Spreads Indicate No Significant Stress in Public Credit Market Liquidity

Recent Treasury sell-offs have sparked premature and unwarranted concerns about public fixed income valuations and liquidity, particularly in public credit.

Despite the volatility induced by recent tariff announcements, bond liquidity remains robust, with no material signs of stress in public IG credit.

As is typical during periods of heightened volatility, public credit (IG) bid-ask spreads have widened—a trend that has historically, at times, indicated a more challenging environment for liquidity. However, current spreads remain well within their long-term average range and are below the peaks seen during 2022’s volatility.

Investment grade (IG) bid-ask spread

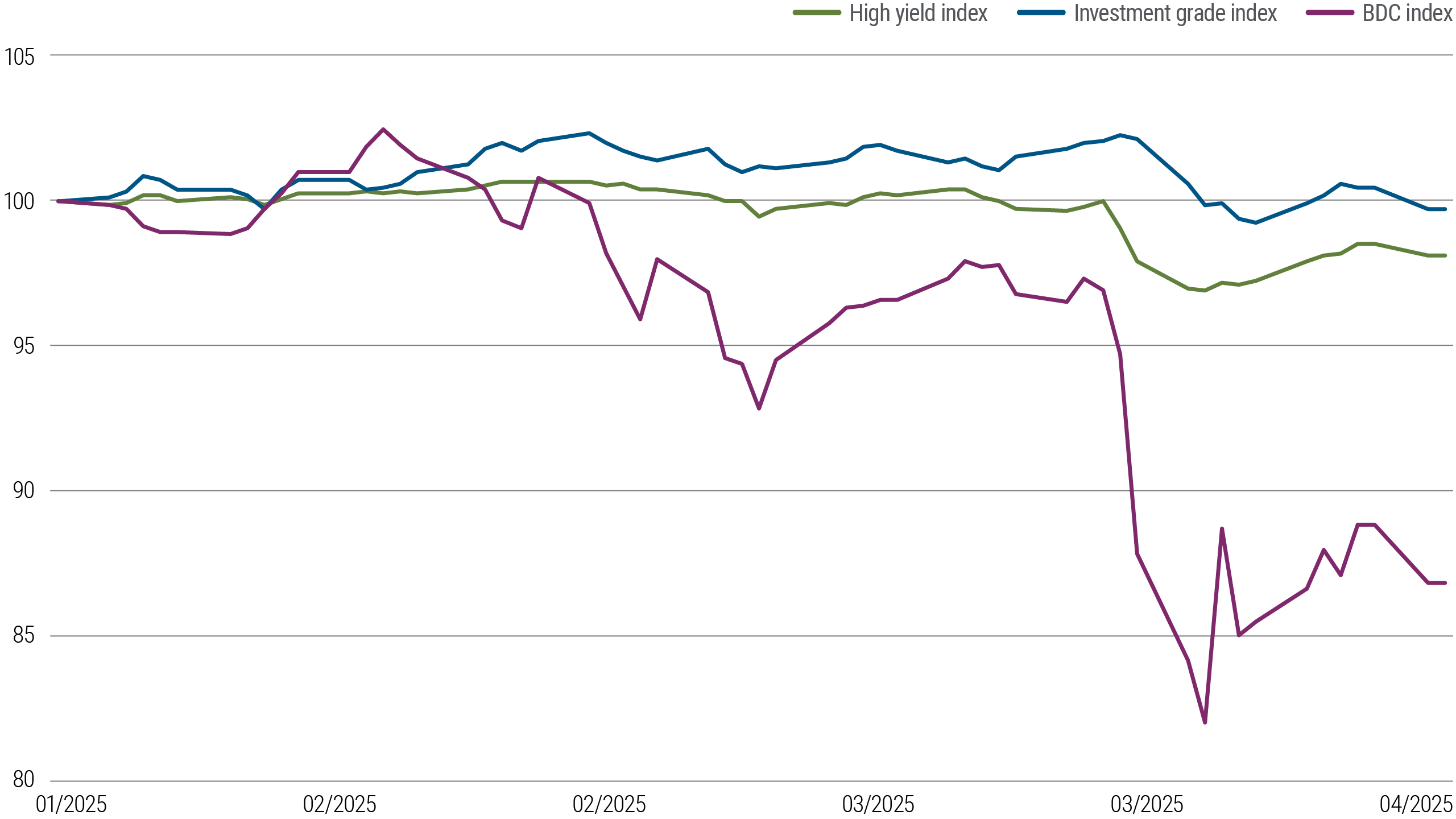

Public Credit Remained Relatively Stable While Tradeable BDCs Plunged

Total return drawdowns

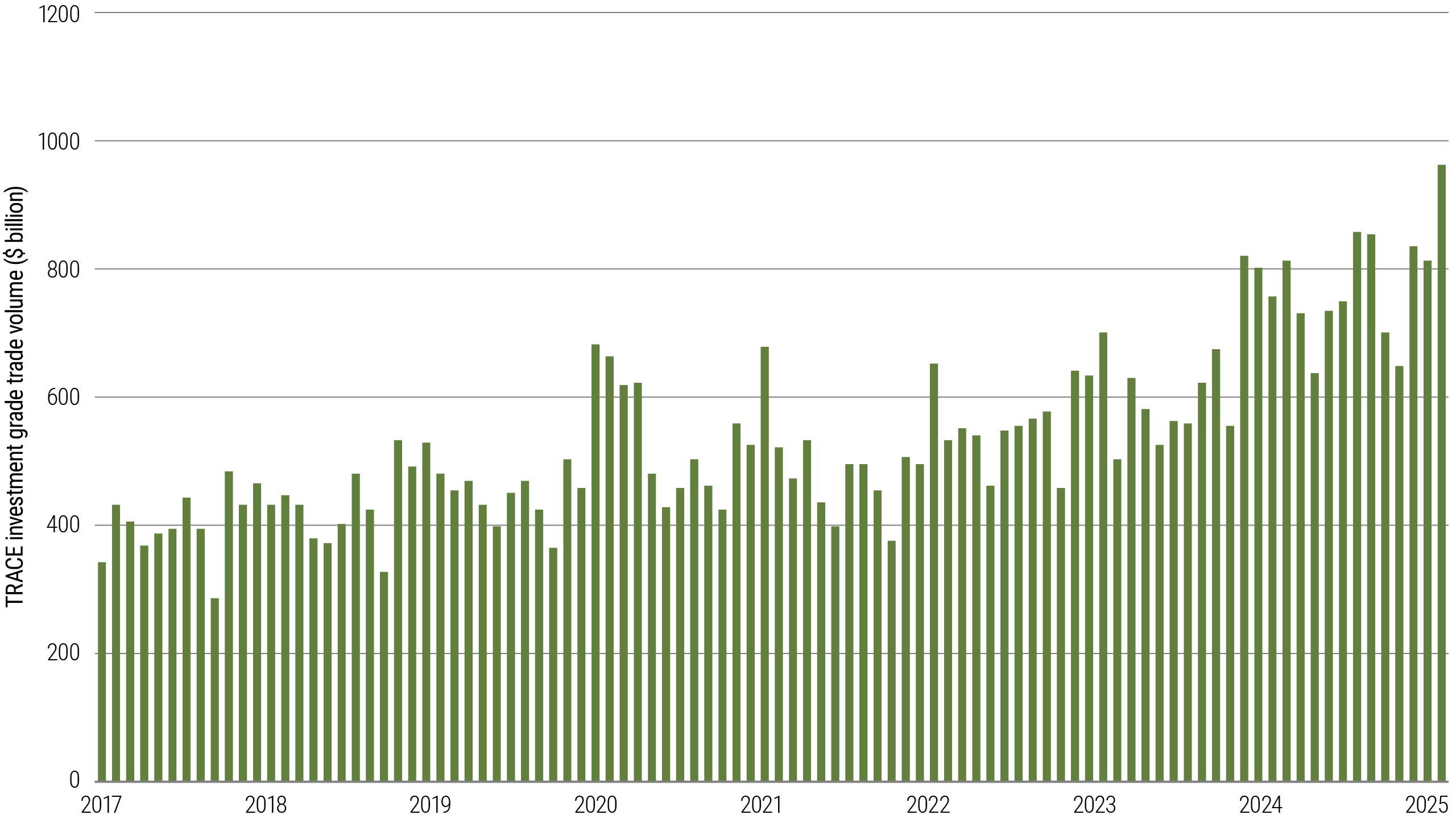

Public Credit Trading Volumes Remain Robust

Investment grade corporate (IGC) bond markets remain highly liquid, trading at tens of billions of dollars per day.

High trading volumes, along with low bid-ask spreads and stable prices have provided investors with a strong liquidity layer in their portfolios, especially relative to equities, which have seen meaningfully higher volatility.

IGC monthly trading volume

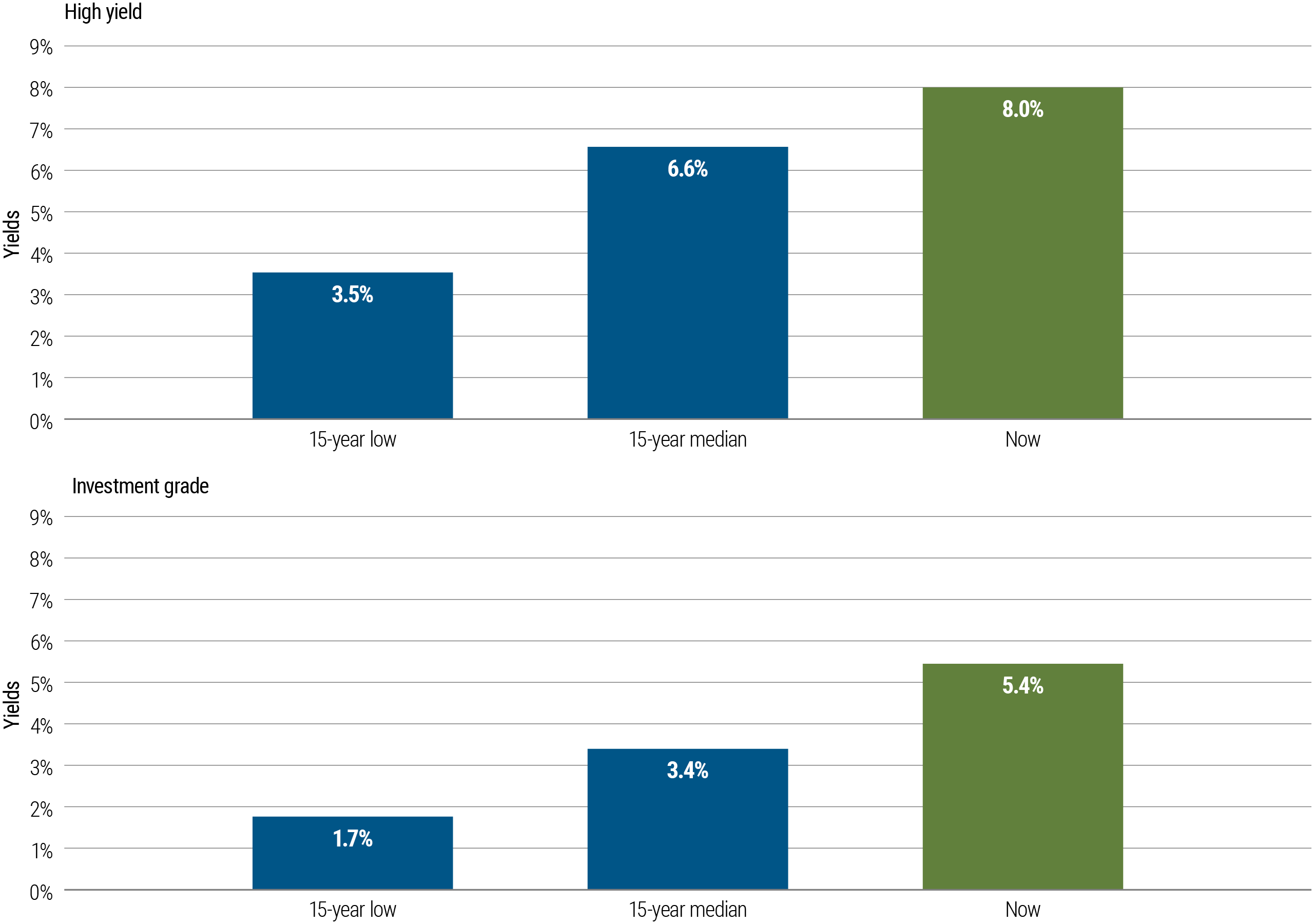

Public Credit Yields Look Especially Attractive Today

Current yields in high-quality fixed income are not only stable in comparison to the high volatility of tradeable BDCs and equities, they are also particularly attractive compared to their historical levels. Investors may not only achieve equity-like returns without having to take up the associated volatility, but also maintain high liquidity levels without sacrificing quality.

Yield comparisons to historical levels