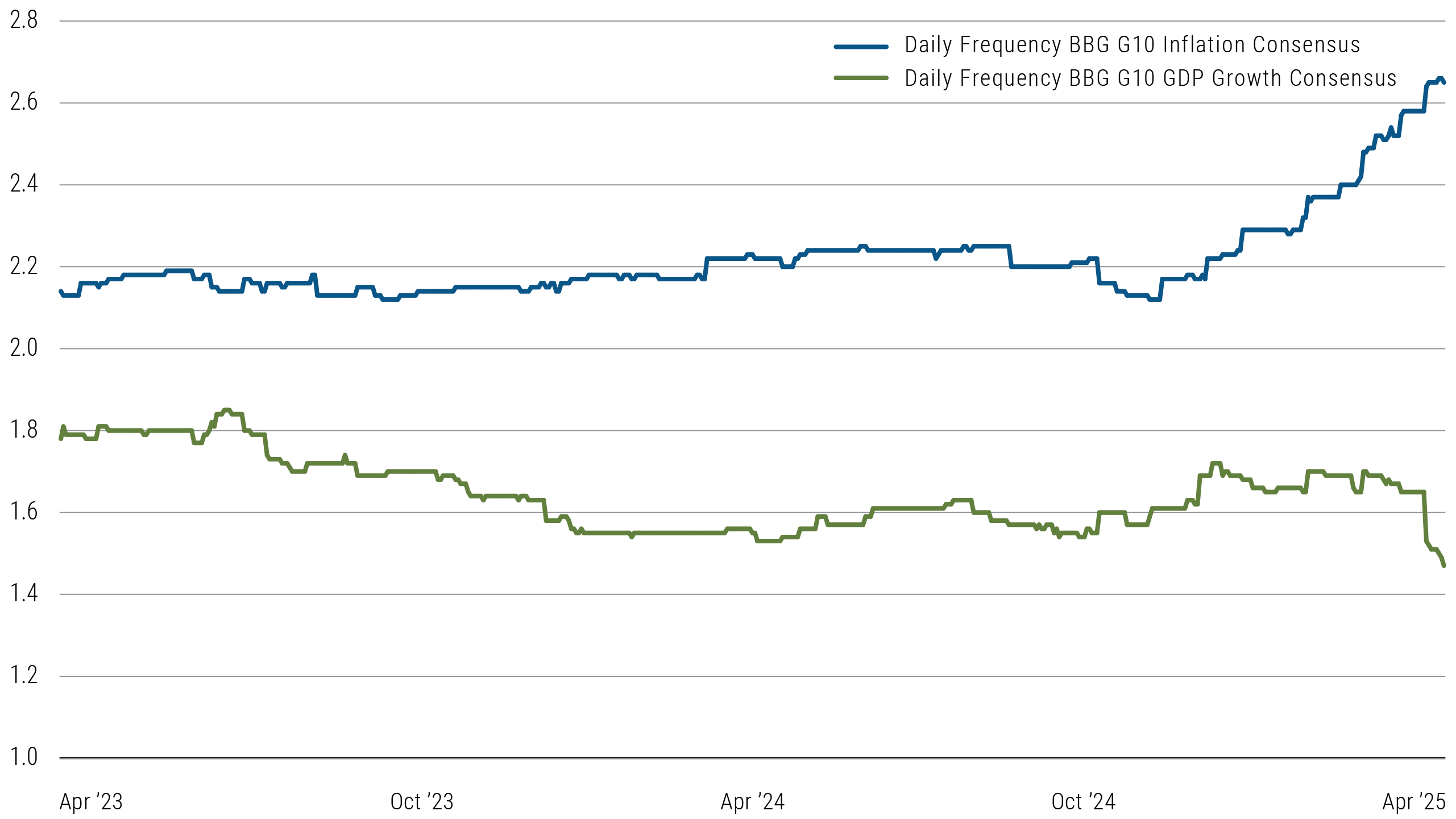

Macro instability drives consensus views on weaker growth, higher inflation

Policy choices are roiling markets and shaking confidence among consumers and businesses.

The consensus outlook for G-10 developed economies has shifted sharply toward lower growth—or even contraction—amid significant inflationary pressure.

Is a widespread bout of stagflation on the horizon? And how can central banks manage the competing risks to growth, employment, and price stability?

Consensus Growth vs. Inflation

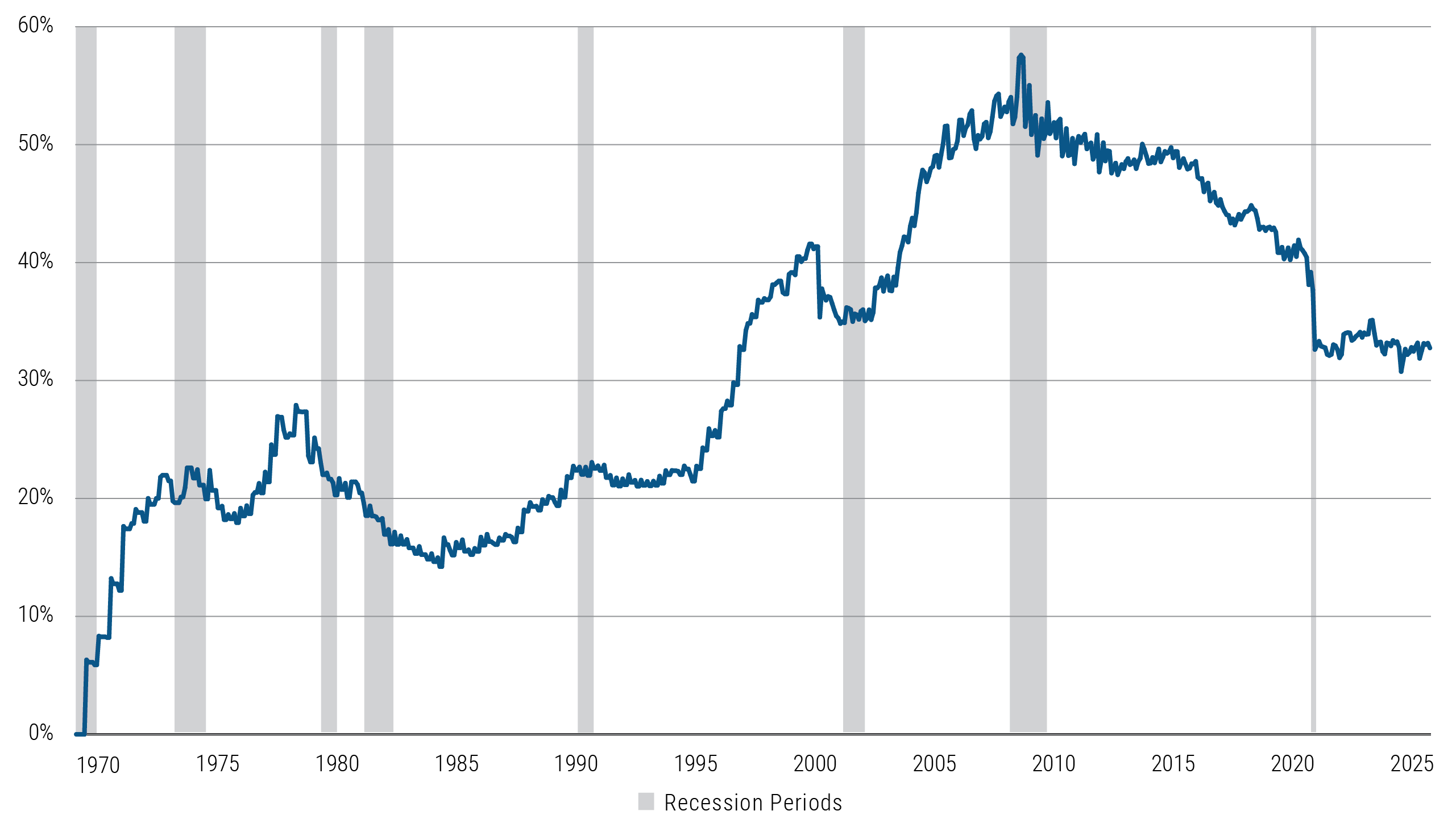

Foreign investors’ share of U.S. debt could decline further

To compound stagflation concerns, U.S. Treasury issues have not been absorbed at the same pace by foreign investors since 2014.

This long-term trend could be further exacerbated by countries that face recent tariff announcements while holding large amounts of Treasuries—uncertainty could subject foreign investors to further slow or cease buying Treasuries.

Foreign Holdings of U.S. Treasury Securities as a Share of Outstanding Public Debt

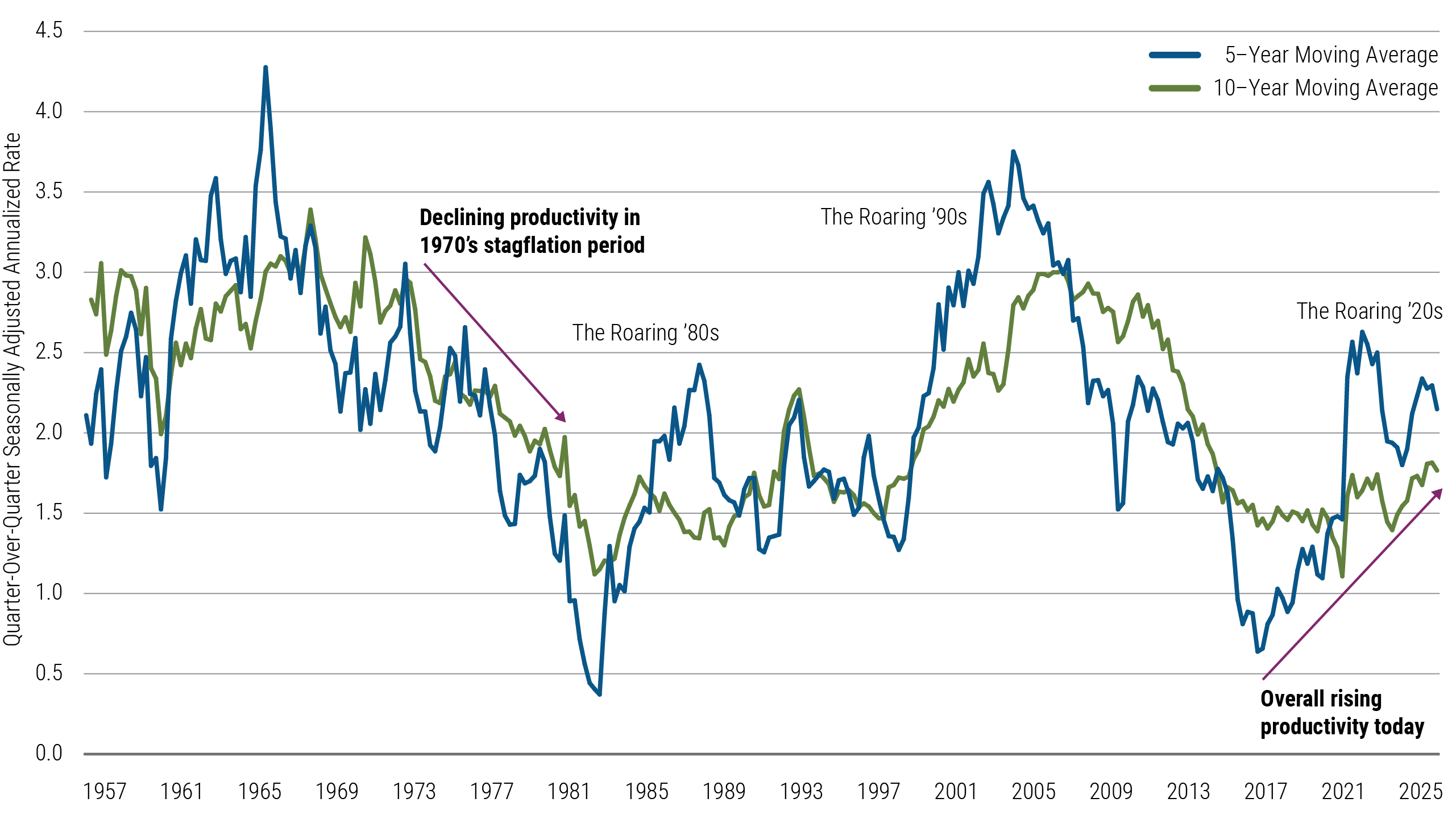

U.S. labor productivity appears resilient amid stagflationary pressure

Even so, unlike the stagflation period of the 1970s that saw a large drop in U.S. labor productivity partly attributed to the energy crisis, U.S. labor productivity has held up fairly well.

Looking ahead, productive labor markets could help balance—to some degree—the inflationary pressures and trade-related uncertainty likely to hinder U.S. economic growth and activity.

U.S. Labor Output Per Hour Growth