When Optimism Is Priced In: Investment Opportunities in the AI Era

-

View From the Investment Committee

Starting Valuations Fuel 2025 Bond Performance, 2026 Potential

You Face Challenges. We See Possibilities.

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Featured Insights

This is a carousel with individual cards. Use the previous and next buttons to navigate.

When optimism is priced in, discipline matters. In this cutdown video from our quarterly webcast, Group CIO Dan Ivascyn explains how we avoid overreach in more sensitive areas and focus our income strategy on resilience, flexibility, and selective risk.

What a stronger political mandate means — and doesn’t mean — for growth, inflation and financial markets

Kevin Warsh, a respected and experienced policymaker and investor, has been nominated as the next U.S. Federal Reserve chair.

Marc Seidner, CIO non-traditional strategies, explains why it isn’t “too late” for bonds.

Policy support is helping narrow mortgage spreads, and valuations remain historically attractive. Portfolio manager Dan Hyman discusses the opportunity across agency mortgage backed securities (MBS), which offer high quality, liquid exposure with defensive traits and compelling income potential.

Reevaluating passive bond allocations – which have historically underperformed active strategies – may open the door to improved investment outcomes.

With the policy rate in neutral territory, the Fed embraces data dependence – and faces a delicate balancing act in 2026.

Marc Seidner, CIO of Non-traditional Strategies, explores opportunities across equities, bonds, credit, and commodities that have the potential to offer investors resilience and diversification.

Josh Anderson, Portfolio Manager, shares how PIMCO’s flexible, multi-sector Income Strategy helps investors pursue resilient returns in today’s shifting market landscape.

Group CIO Dan Ivascyn shares why today’s environment offers compelling opportunities for bond investors. From attractive high-quality yields to the potential benefits of locking in rates as cash returns decline, learn why fixed income strategies deserve a closer look now.

Investors have poured into gold – but they may also see compelling benefits from a broad-based commodity allocation.

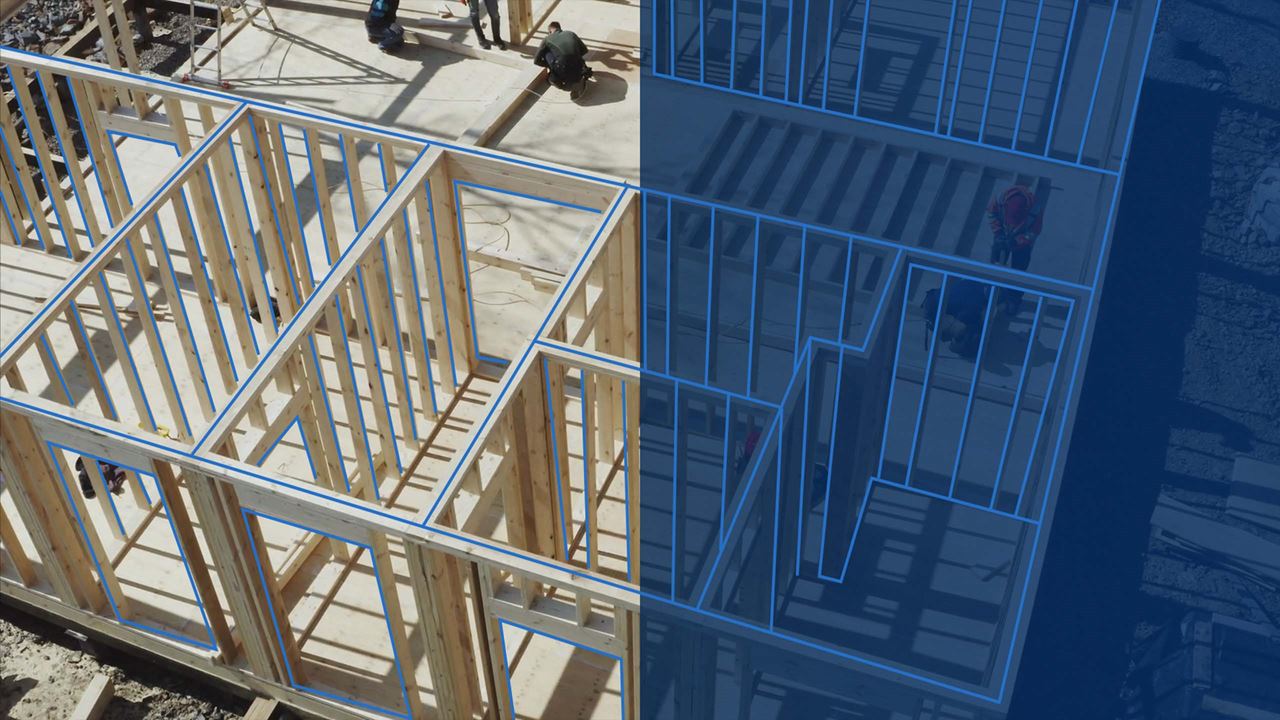

Asset-based finance fuels the real economy – from homes and universities to flights and consumer goods. Backed by tangible assets, it’s a growing opportunity for investors. Discover how PIMCO’s scale, data, and dual-market lens unlock strategic value in ABF.