Sustainable Investing

How We Engage

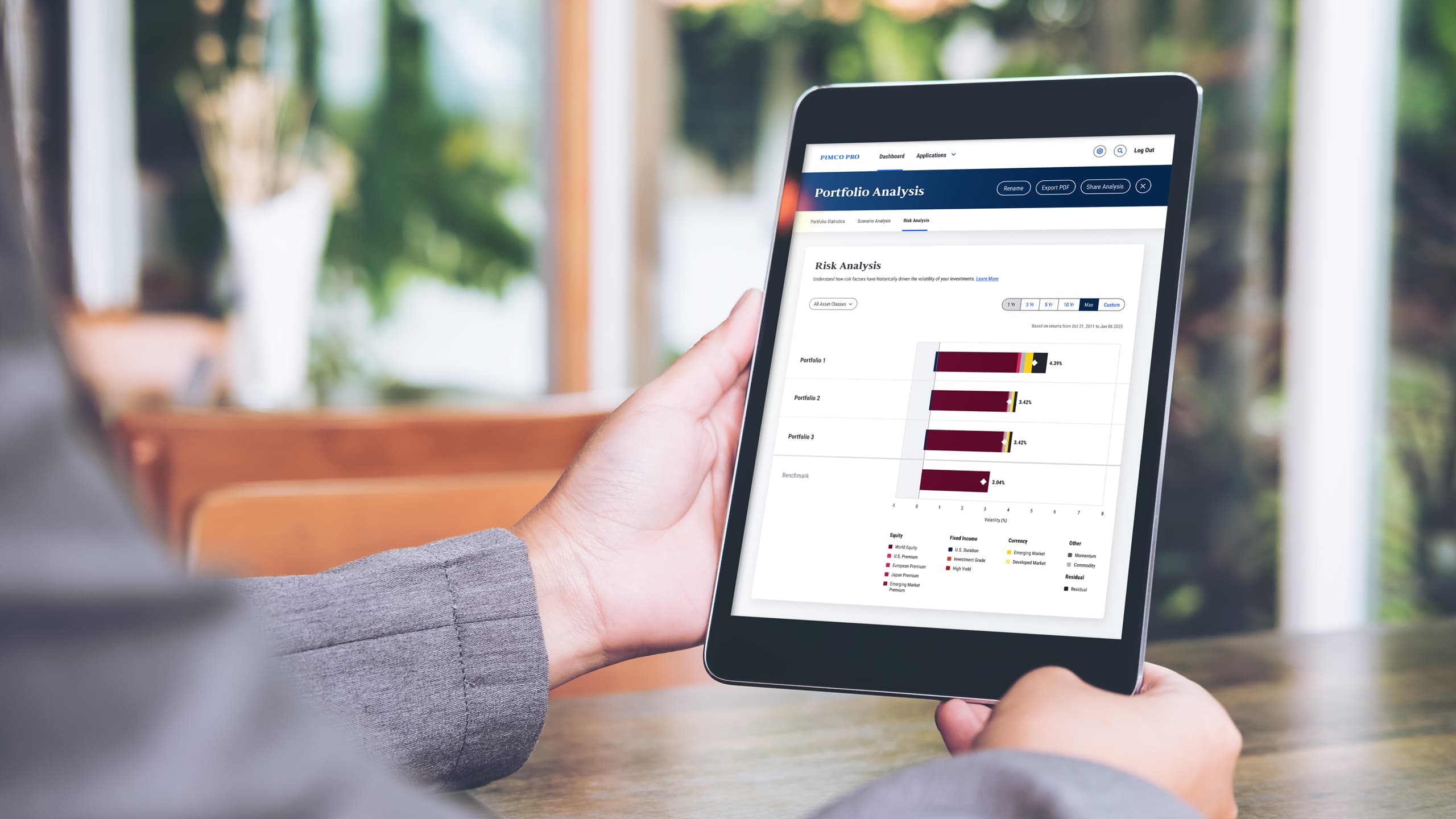

Diversifying Portfolios is Easy with Pro

How Can PIMCO Help You?

Disclosures

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

Sustainable Strategies are strategies with client-driven sustainability requirements. For these strategies, PIMCO actively incorporates sustainability principles (i.e. excluding issuers fundamentally misaligned with sustainability factors, evaluating issuers using proprietary and independent ESG scoring) consistent with those strategies and guidelines. Further information is available in PIMCO’s Sustainable Investment Policy Statement. For information about funds that follow sustainability strategies and guidelines, please refer to the fund’s prospectus for more detailed information related to its investment objectives, investment strategies, and approach to sustainable investment.

ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by PIMCO or any judgment exercised by PIMCO will reflect the opinions of any particular investor, and the factors utilized by PIMCO may differ from the factors that any particular investor considers relevant in evaluating an issuer’s ESG practices. In evaluating an issuer, PIMCO is dependent upon information and data obtained through voluntary or third-party reporting that may be incomplete, inaccurate or unavailable, or present conflicting information and data with respect to an issuer, which in each case could cause PIMCO to incorrectly assess an issuer’s business practices with respect to its ESG practices. Socially responsible norms differ by region, and an issuer’s ESG practices or PIMCO’s assessment of an issuer’s ESG practices may change over time. There is no standardized industry definition or certification for certain ESG categories, for example “green bonds”; as such, the inclusion of securities in these statistics involves PIMCO’s subjectivity and discretion. There is no assurance that the ESG investing strategy or techniques employed will be successful. Past performance is not a guarantee or reliable indicator of future results.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.

CMR2025-0513-4499026