Introducing The Next Generation in Target Date Investing, myTDF®

Target Date Analysis at Your Fingertips

How Can PIMCO Help You?

Disclosures

1 No engagement is required on behalf of the participant when myTDF is the QDIA, and auto-enrollment is utilized.

myTDF® is a defined contribution or defined benefit plan solution that allows a plan participant to personalize their target date fund allocation across multiple vintages based on participant inputs using PIMCO proprietary funds.

myTDF® is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.

myTDF is offered by Pacific Investment Management Company LLC, a registered investment adviser, and is intended for citizens and legal residents of the United States and its territories. Investment advice generated by myTDF is based on information provided and limited to the investment options available in the defined contribution or defined benefit plan. Projections and other information regarding the likelihood of various retirement income and/or investment outcomes are hypothetical in nature, do not reflect actual results, and are not guarantees of future results. Results may vary with each use and over time. myTDF may be covered by one or more U.S. or international patents.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Diversification does not ensure against loss.

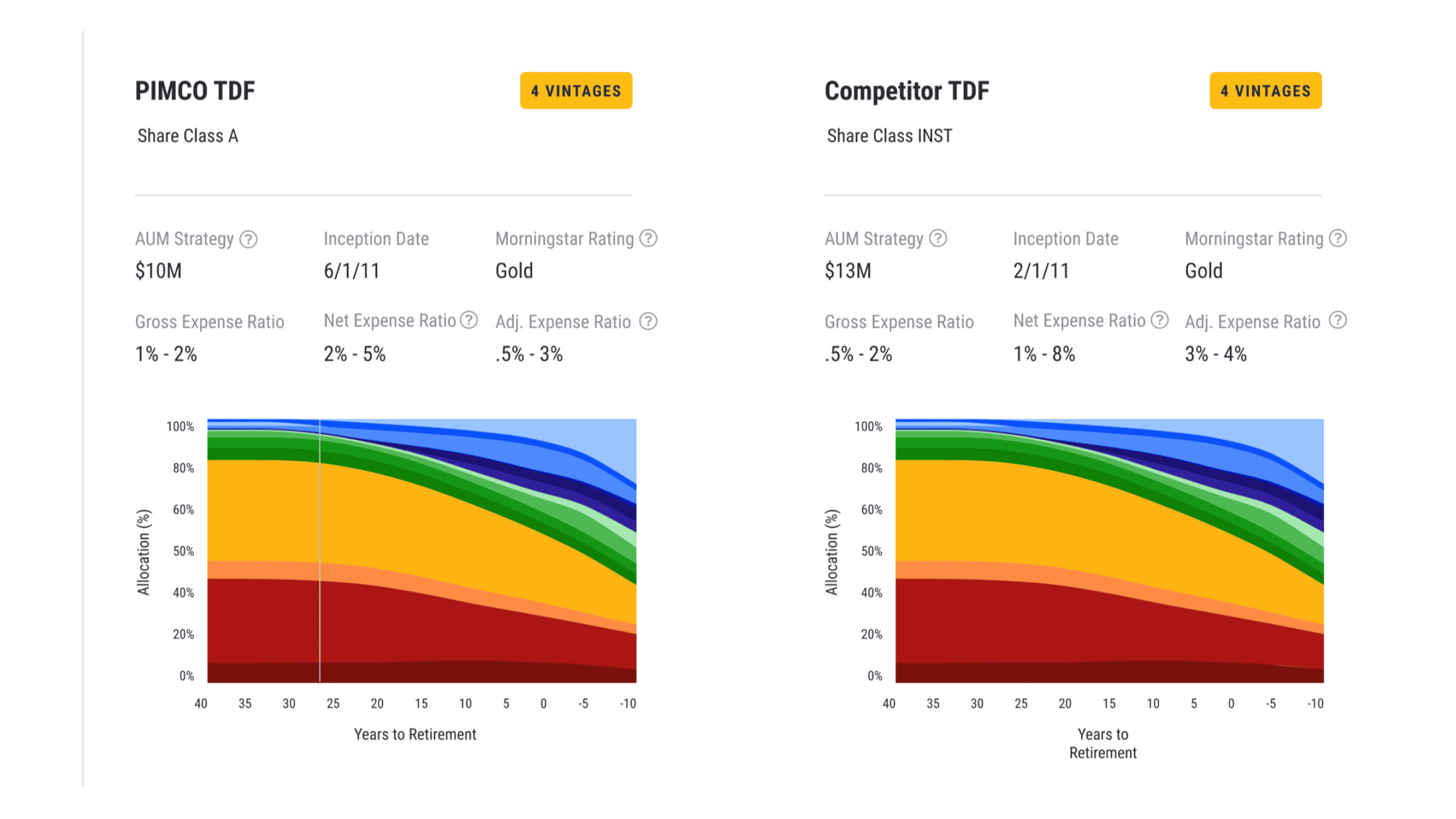

Glide path is the asset allocation within a target-date strategy (also known as a lifecycle or target maturity strategy) that adjusts over time as the participant's age increases and their time horizon to retirement shortens. The basis of the glide path is to reduce the portfolio risk as the participant's time horizon decreases. Typically, younger participants with a longer time horizon to retirement have sufficient time to recover from market losses, their investment risk level is higher, and they are able to make larger contributions (depending on various factors such as salary, savings, account balance, etc.). Generally, older participants and eligible retirees have a shorter time horizon to retirement, and their investment risk level declines as preserving income wealth becomes more important.

Target Date Funds are designed to provide investors with a retirement solution tailored to the time when they expect to retire or plan to start withdrawing money (the "target date"). Target Date Funds will gradually shift their emphasis from more aggressive investments to more conservative ones based on their target dates. Target Date Funds invest in other funds and instruments based on a long-term asset allocation glide path developed by PIMCO, and performance is subject to underlying investment weightings, which will change over time. An investment in a Target Date Fund does not eliminate the need for an investor to determine whether a Fund is appropriate for his or her financial situation. An investment in a Fund is not guaranteed. Investors may experience losses, including losses near, at, or after the target date, and there is no guarantee that a Fund will provide adequate income at and through retirement.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.

CMR2024-0401-3483503