More Than an Income Provider, an Income Expert.

Income Should Be Predictable Even When Markets Aren’t

Our income strategies give your clients access to our experienced and skilled investment team and the global resources of an investment leader.

PIMCO Income Fund | PIMIX

- INST

- USD

PIMCO Low Duration Income Fund | PFIIX

- INST

- USD

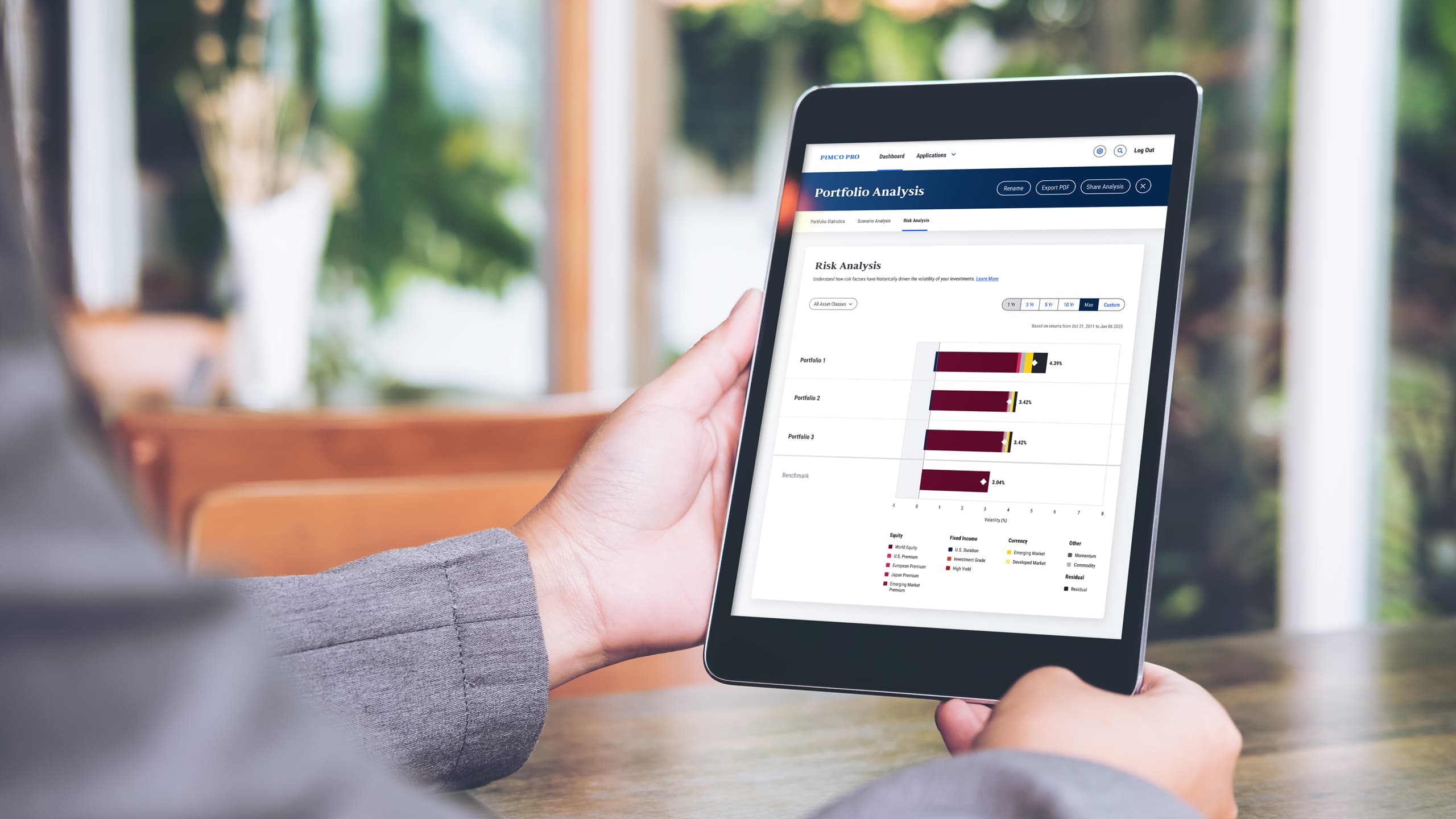

Diversifying Portfolios is Easy with Pro

How Can PIMCO Help You?

Disclosures

1 The PIMCO Income Fund has issued a dividend distribution for each month since inception. No guarantee is being made that a future dividend will be issued.Return to content

2 Monthly Morningstar Rankings: 1Yr. 28 out of 386 3Yrs. 98 out of 368 5Yrs. 46 out of 339 10 Yrs. 21 out of 260 Morningstar Ranking for the Morningstar Multisector Bond category as of 30 September 2025 for the Institutional Class Shares; other classes may have different performance characteristics. The Morningstar Rankings are calculated by Morningstar and are based on the total return performance, with distributions reinvested and operating expenses deducted. Morningstar does not take into account sales charges. Past rankings are no guarantee of future rankings.Return to content

3 Alfred Murata and Daniel J. Ivascyn received the Morningstar Fixed Income Fund Manager of the Year award (2013). The Morningstar Fixed Income Fund Manager of the Year award is based on the strength of the manager, performance, strategy and firm's stewardship.Return to content

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative. Click here for a complete list of the PIMCO Funds prospectuses and summary prospectuses. Please read them carefully before you invest or send money.

Past performance is not a guarantee or a reliable indicator of future results.

Investments made by a Fund and the results achieved by a Fund are not expected to be the same as those made by any other PIMCO-advised Fund, including those with a similar name, investment objective or policies. A new or smaller Fund’s performance may not represent how the Fund is expected to or may perform in the long-term. New Funds have limited operating histories for investors to evaluate and new and smaller Funds may not attract sufficient assets to achieve investment and trading efficiencies. A Fund may be forced to sell a comparatively large portion of its portfolio to meet significant shareholder redemptions for cash, or hold a comparatively large portion of its portfolio in cash due to significant share purchases for cash, in each case when the Fund otherwise would not seek to do so, which may adversely affect performance.

It is important to note that differences exist between the fund’s daily internal accounting records, the fund’s financial statements prepared in accordance with U.S. GAAP, and recordkeeping practices under income tax regulations. It is possible that the fund may not issue a Section 19 Notice in situations where the fund’s financial statements prepared later and in accordance with U.S. GAAP and/or the final tax character of those distributions might later report that the sources of those distributions included capital gains and/or a return of capital. Please see the fund’s most recent shareholder report for more details.

Although the Fund may seek to maintain stable distributions, the Fund’s distribution rates may be affected by numerous factors, including but not limited to changes in realized and projected market returns, fluctuations in market interest rates, Fund performance, and other factors. There can be no assurance that a change in market conditions or other factors will not result in a change in the Fund’s distribution rate or that the rate will be sustainable in the future.

For instance, during periods of low or declining interest rates, the Fund’s distributable income and dividend levels may decline for many reasons. For example, the Fund may have to deploy uninvested assets (whether from purchases of Fund shares, proceeds from matured, traded or called debt obligations or other sources) in new, lower yielding instruments. Additionally, payments from certain instruments that may be held by the Fund (such as variable and floating rate securities) may be negatively impacted by declining interest rates, which may also lead to a decline in the Fund’s distributable income and dividend levels.

A word about risk: Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for information purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

CMR2025-0303-4286561