Risk premia in oil – transitory for now

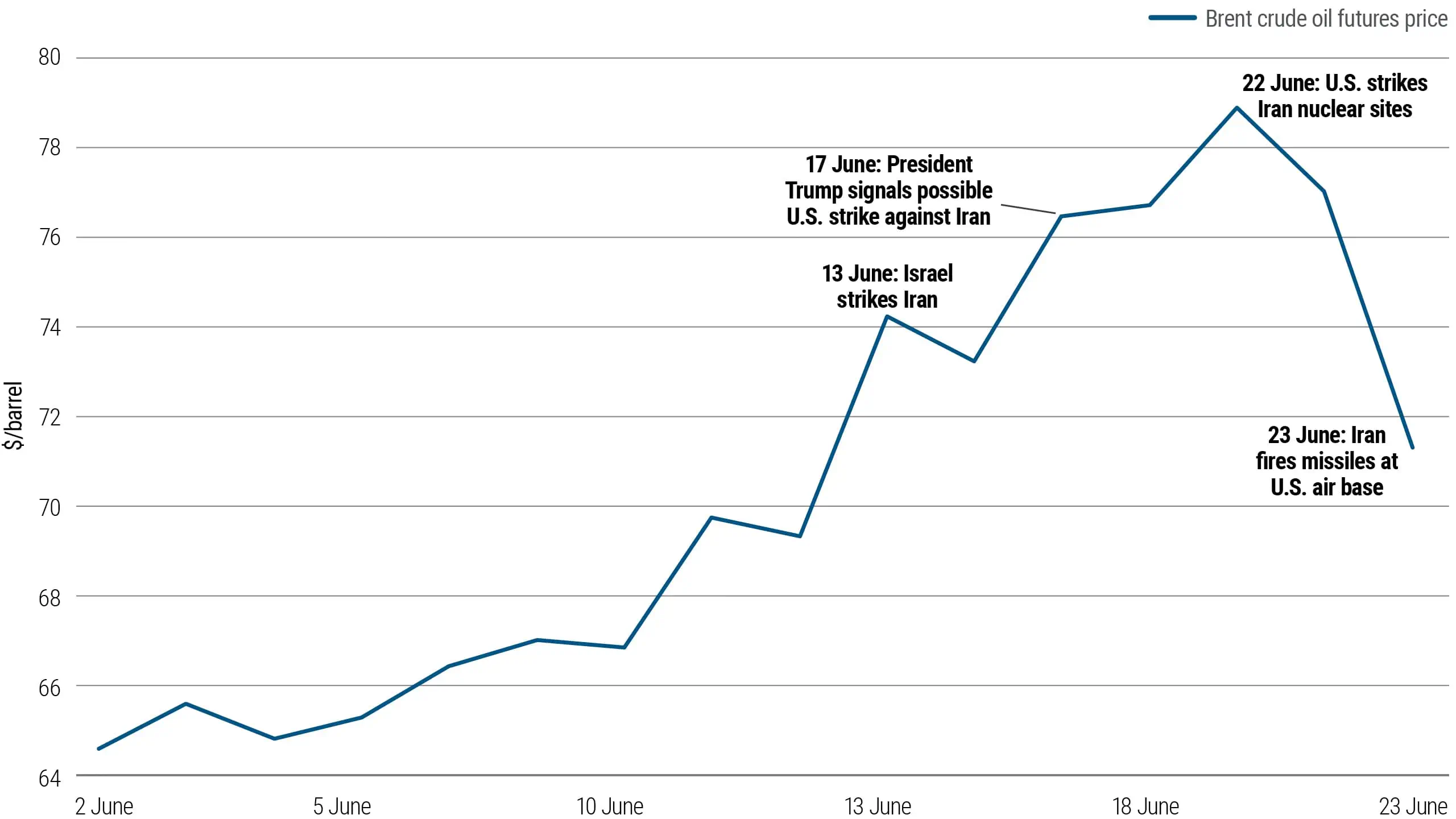

In the weeks leading up to last month’s Israeli and U.S. strikes on Iran, oil prices climbed – not due to actual supply disruptions, but in response to a geopolitical risk premium. Fears of a potential closure of the Strait of Hormuz drove market anxiety, though those concerns ultimately didn’t materialize. Iran’s muted response helped ease tensions, and the risk premium quickly unwound.

That said, the situation remains fluid. Ongoing concerns about Iran’s uranium stockpiles – and the possibility of further Israeli action – mean the geopolitical backdrop remains a source of potential volatility.

Oil prices experienced significant volatility

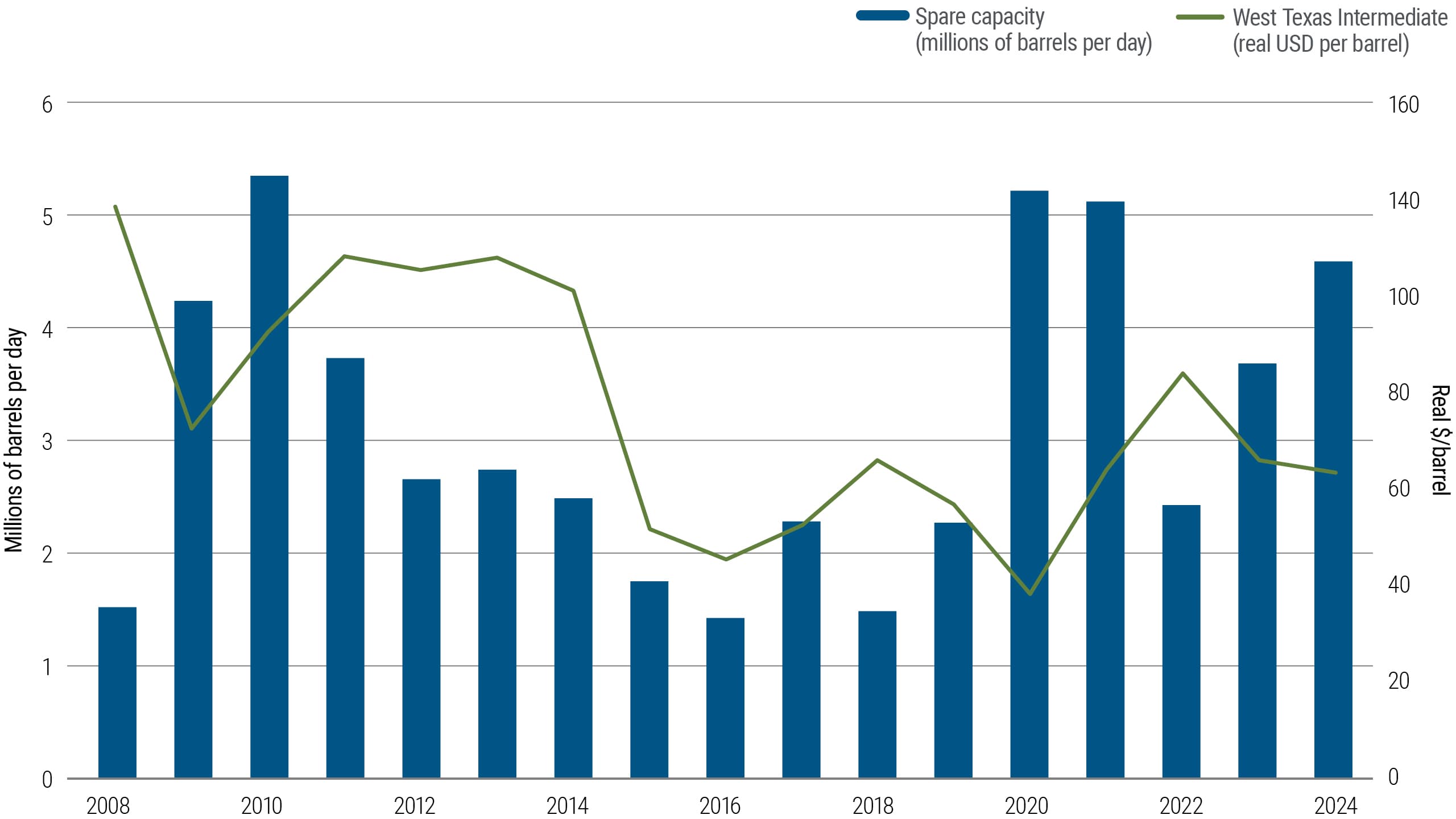

OPEC spare capacity – A stabilizing force

If tensions in the Middle East re-escalate and Iranian oil supply is disrupted, we could see another spike in oil prices.

But there are key stabilizers in place: U.S. shale producers can ramp up output given enough time, and OPEC currently holds significant spare production capacity. While that spare capacity remains largely tied up in regions recently impacted by conflict – limiting its near-term ability to reassure markets – it could serve as a longer-term stabilizer for supply dynamics.

These structural buffers may limit both the duration and the magnitude of any price rally.

So while short-term volatility is likely, we continue to expect oil prices to revert to the $60s range after any temporary spikes.

OPEC spare capacity

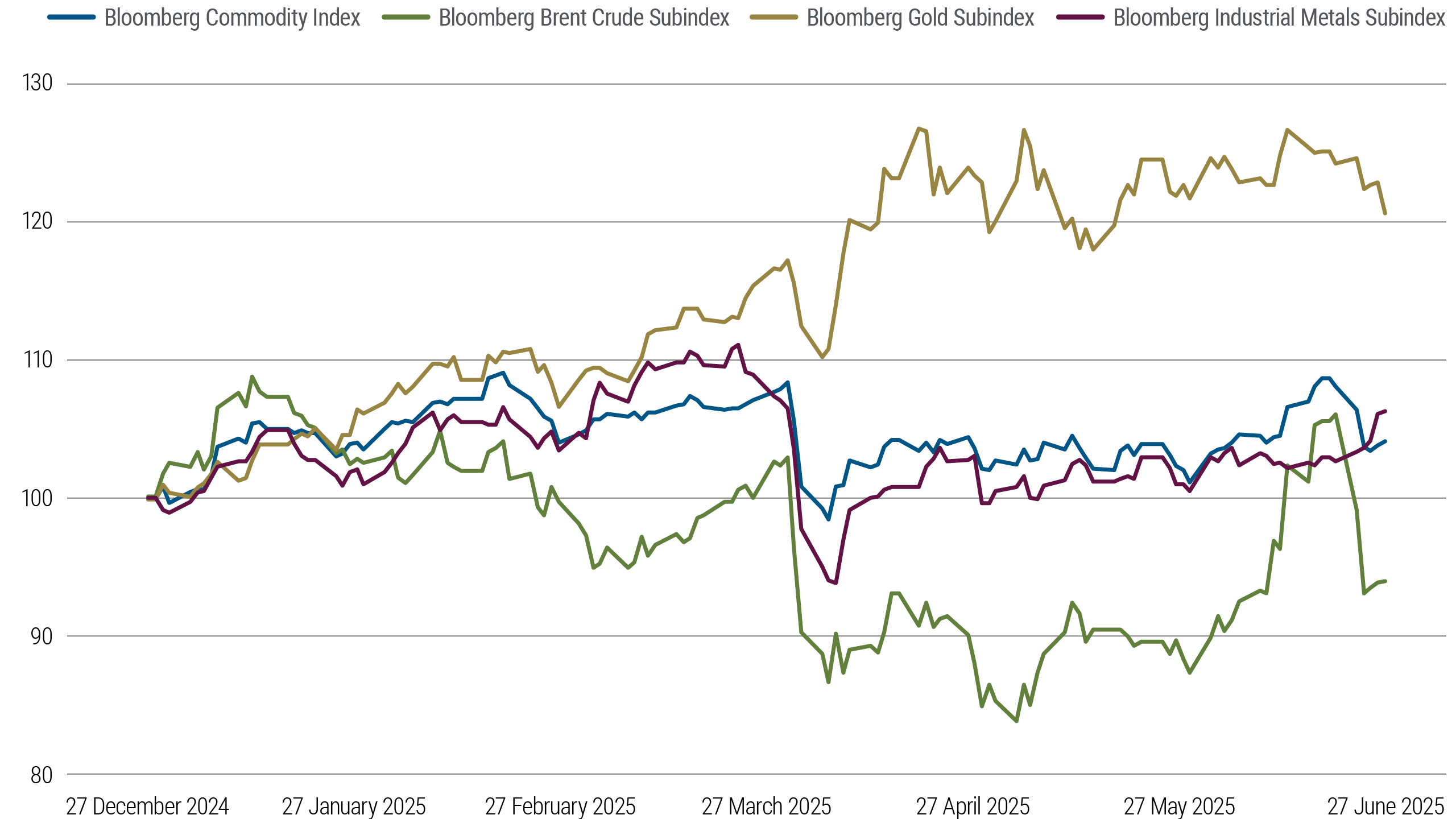

Broader commodities show resilience as investors seek inflation hedges

While oil has experienced notable volatility, the broader commodity complex has remained remarkably steady this year.

Gold prices continue to climb, supported by sustained central bank buying and ongoing de-dollarization efforts.

Base metals have also held firm, showing resilience even in the face of tariff-related growth concerns.

Investors, recognizing their portfolios were underexposed to real assets and more vulnerable to inflation than expected, have renewed interest in gold and broader commodities.

Overall, the Bloomberg Commodity Index has delivered strong returns – demonstrating that a diversified commodity basket has the potential to help weather sector-specific shocks and contribute to portfolio stability.

Growth of $100 for commodities

Commodities as strong portfolio diversifiers

This diversification potential was also seen during the inflation spike in 2021–2022, when both stock and bond markets were challenged.

Commodities, however, maintained low correlations to both asset classes.

They have not only helped diversify portfolio risk but also enhanced inflation sensitivity – which we believe could make them a valuable option for strategic allocation in today’s environment of persistent inflation uncertainty.

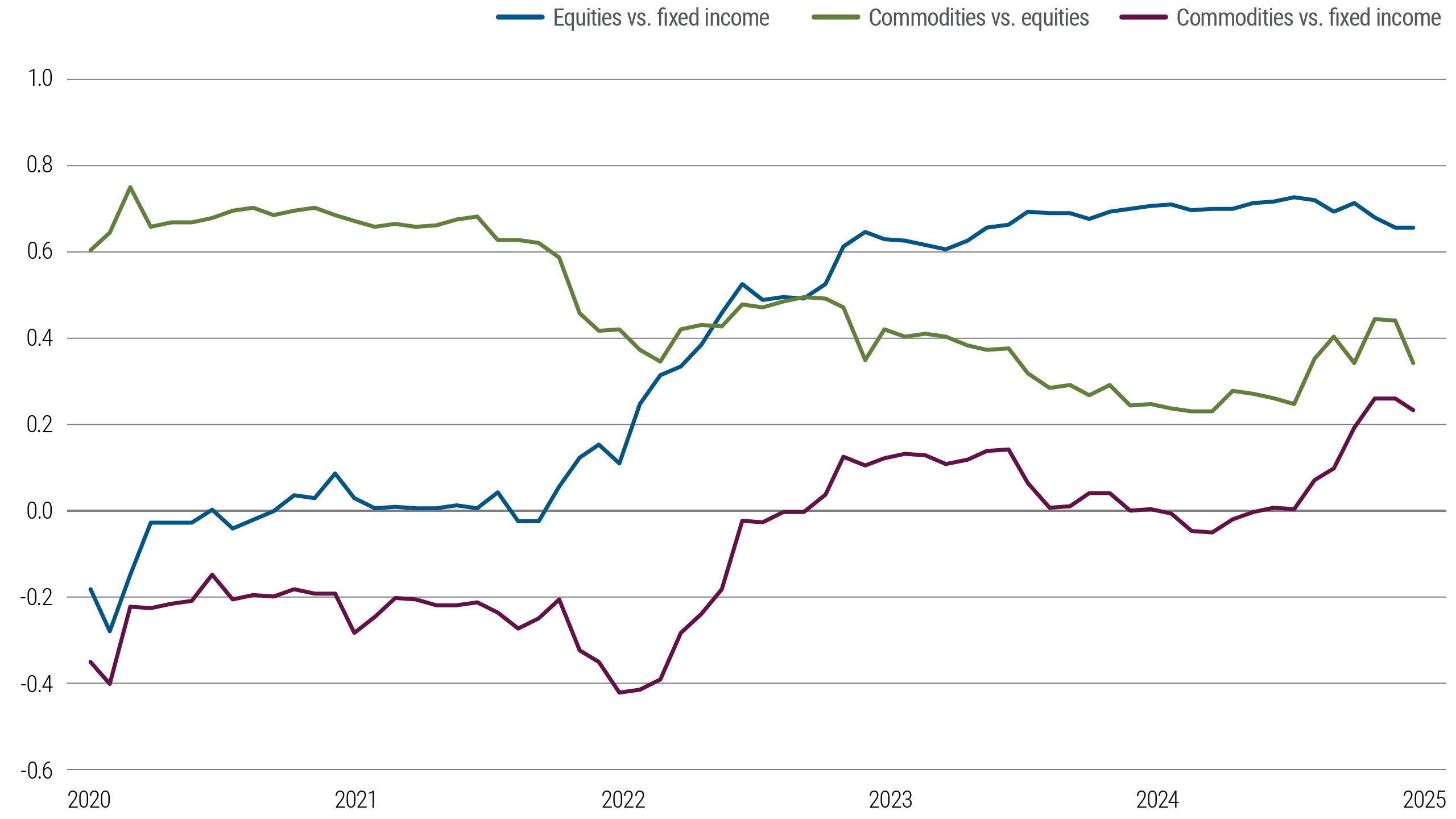

Rolling 3-year correlations