myTDF®: The Next Generation in Target Date Investing

What is myTDF®?

About myTDF®

myTDF® Is Designed To Be...

This is a carousel with individual cards. Use the previous and next buttons to navigate.

For Plan Sponsors

- A broader glide path choice beyond “one size fits all”

- Seamless plan integration and implementation

- Helps to manage costs while delivering a personalized retirement investing experience

For Participants

- A custom glide path designed around up to five personal data points beyond age

- No effort enrollment; all data points come directly from plan record keeperFootnote1

- Relatively low fees mean more savings go toward retirement

Where can I access myTDF®?

myTDF® is available through the following providers, each of which is the sole fiduciary for the investment recommendations made in connection with the below:

| Fiduciary Provider | PTD Service | Recordkeeper |

|---|---|---|

| PIMCO | PIMCO myTDF® | Voya |

| Wilshire | PIMCO Personalized Target Date myTDF® powered by Wilshire | Principal |

| Nexus338 | iGPS® Individualized Glide Path SolutionFootnote1 | Ameritas, Daybright Financial, Sentinel Group |

Personalizing a Participant’s Path to Retirement With myTDF®

myTDF® Scenario 1: Anna

Mid-Career Employee With Low Savings

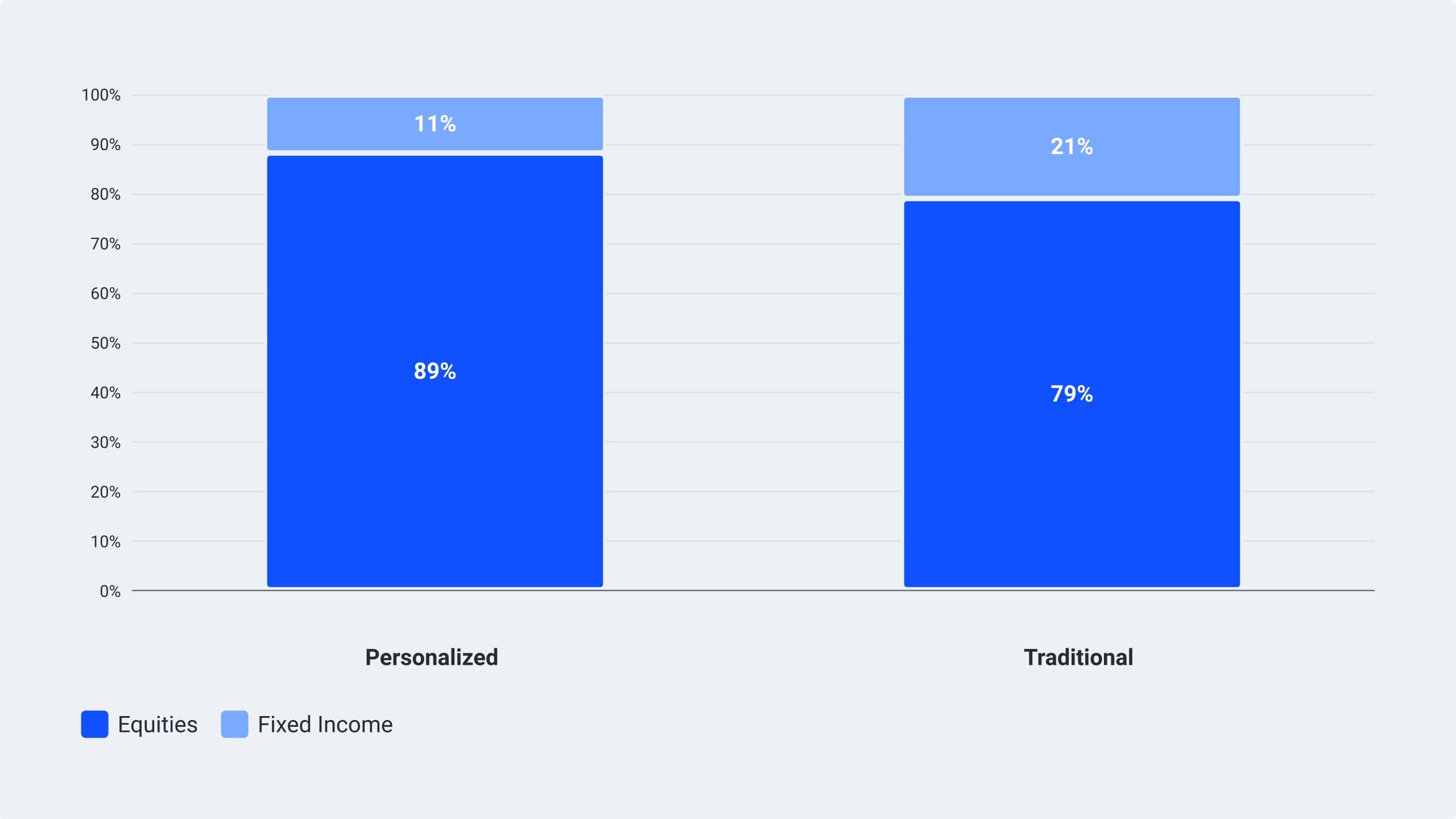

Participant Assumptions: Personalized / Traditional**

Age: 44 / 45

Annual Salary: $62k / $69k

401k Balance: $27k / $110k

Employee contribution: 4% / 11%

Outcome: Anna is a reasonably compensated employee who is anticipated to retire in about 20 years. Anna has limited savings and a below average contribution rate. A personalized approach would allocate Anna to 89% stocks relative to a more conservative approach in a traditional target date.

myTDF® Scenario 2: Juan

Seasoned, Late Career Employee With Meaningful Expected Retirement Savings

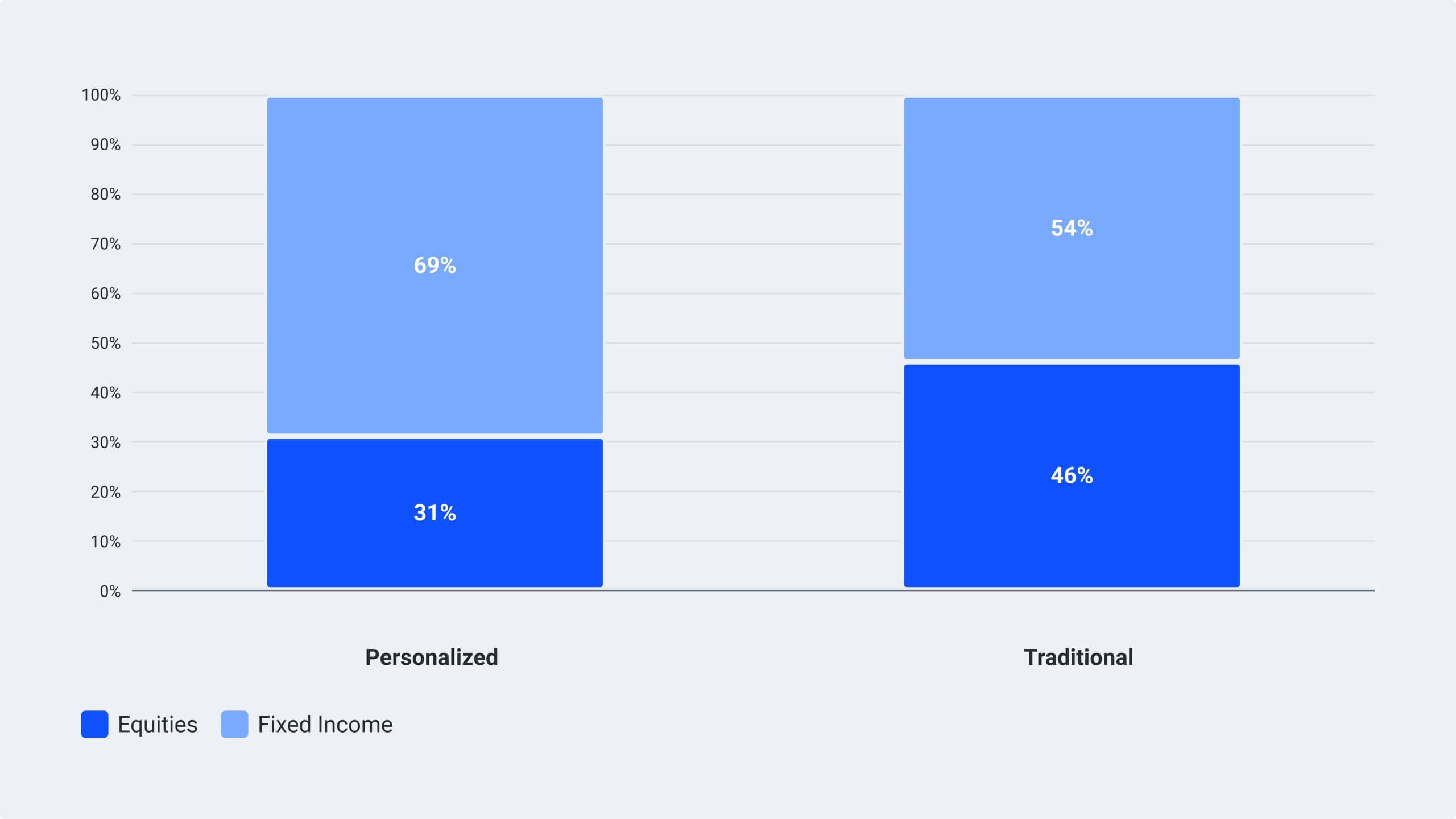

Participant Assumptions: Personalized / Traditional**

Age: 44 / 45

Annual Salary: $200k / $70k

401k Balance: $27k / $110k

Employee contribution: 13% / 13%

Outcome: Juan is a highly-compensated, seasoned employee that has accumulated a significant 401k balance. Given his strong retirement prospects, a personalized approach would allocate Juan to lower equity exposure of 31% relative to a traditional approach of 46% stocks.

myTDF® Scenario 3: Janet

Retired Employee With Significant Retirement Savings

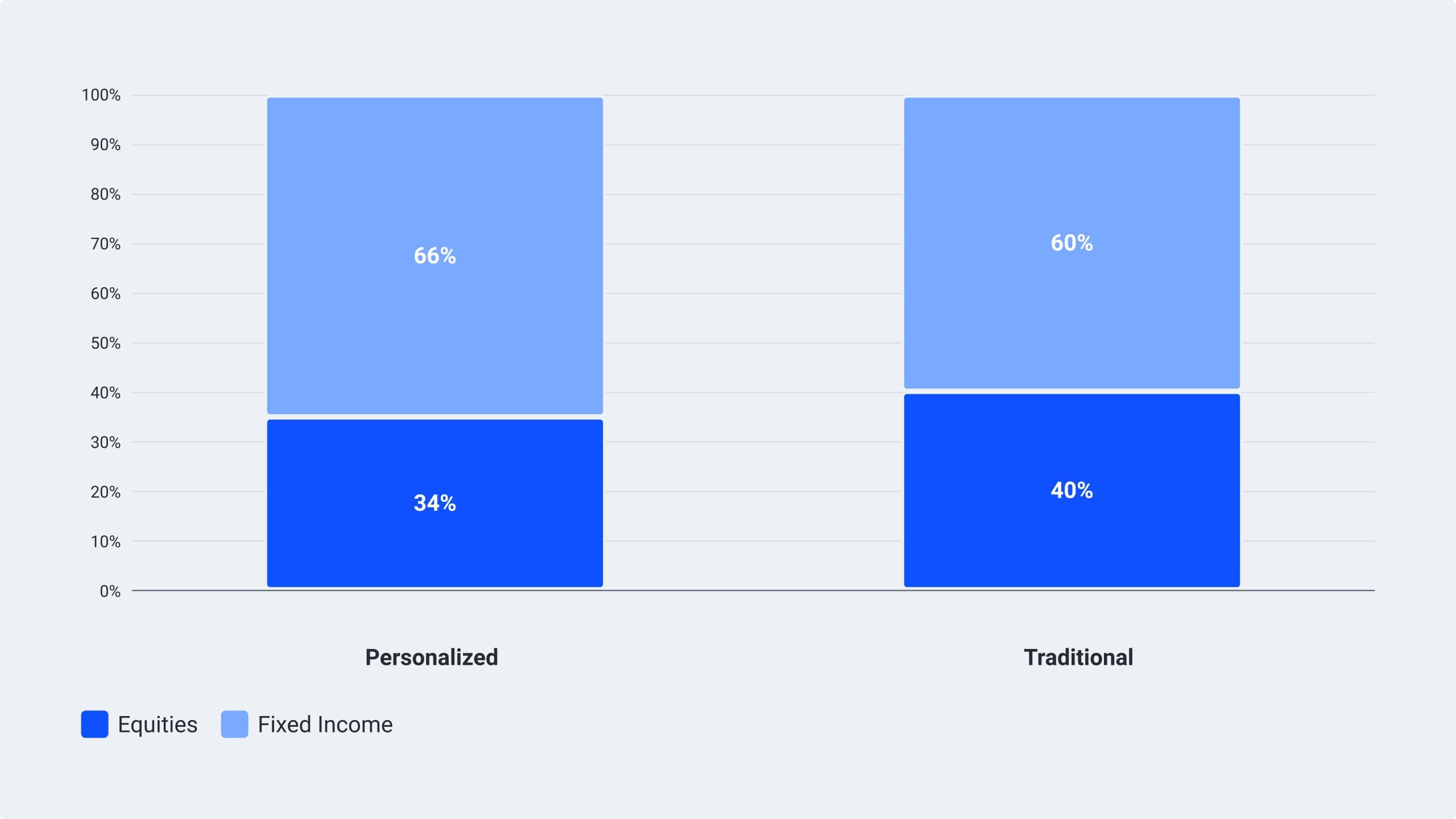

Participant Assumptions: Personalized / Traditional**

Age: 68 / 70

Annual Salary: $95k / $70k

401k Balance: $419k / $255k

Employee contribution: 12% / 13%

Outcome: Janet recently retired and over her career was able to accumulate a large retirement nest egg. Given this healthy balance, a “through” approach with lower equity exposure may be more appropriate relative to a traditional approach with a static 40% equity allocation in retirement.

This is a carousel with individual cards. Use the previous and next buttons to navigate.

myTDF represents an evolution of traditional target-date funds by incorporating up to five demographic factors beyond age in seeking to deliver a more personalized default asset allocation with the same ease as traditional TDFs.

Target date funds provide an asset allocation that changes over time based on the average participant’s savings profile, which can lead to suboptimal outcomes. myTDF® takes the simplicity of TDFs and adds the power of auto-personalization so that plan fiduciaries can seek to more closely align a participant's allocations with their individual circumstances.

Explore why target date funds are increasingly repurposed for retirement income and how to assess their effectiveness in supporting retirees.

Target Date Analysis at Your Fingertips