Investors hold cash in traditional savings vehicles for a variety of reasons, such as short-term liquidity needs, capital preservation, and market volatility concerns. However, keeping too much cash in a portfolio may result in missed opportunities for higher total return.

A liquidity-tiering strategy may help investors gauge how much cash they may actually need in their portfolios based on their goals and objectives, and how much they should consider allocating to higher-returning short-duration strategies.

Understanding the Liquidity Tiering Strategy

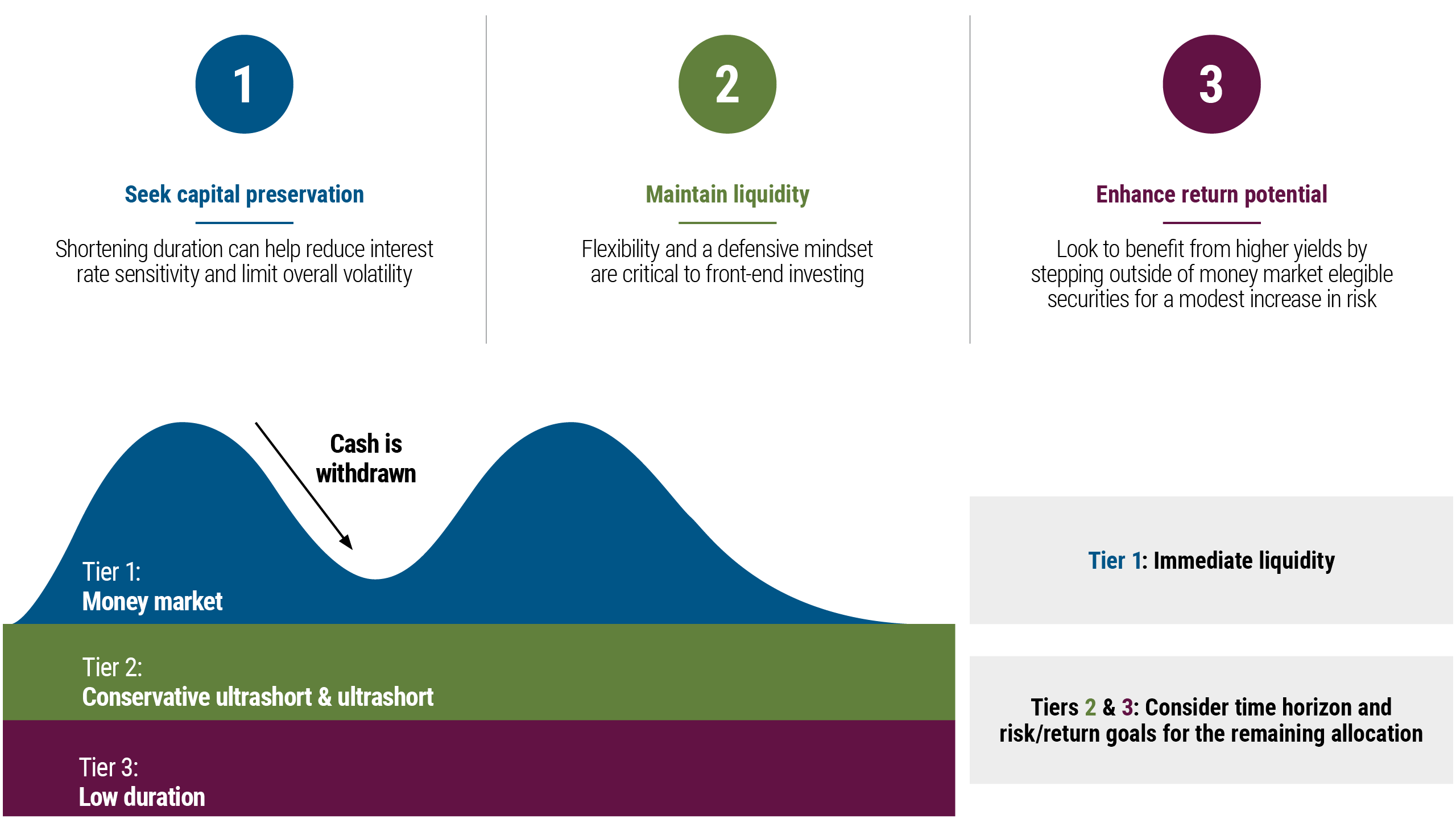

Many investors hold more cash than they may need in traditional savings vehicles to meet their objectives. This is why dividing cash into tiers may help investors make the most of their cash allocation, as shown in the chart below.

The liquidity-tiering strategy illustration highlights the cash allocation building blocks and the approximate size of each, based on an investor’s goals.

- Tier 1: Consisting of traditional cash, such as money market funds and bank deposits, this tier tends to be the smallest and is generally reserved for immediate cash needs and daily expenditures.

- Tier 2: Consisting of ultrashort holdings, this tier can be used as a semi-permanent asset allocation. In this tier, investors may consider actively managed ultrashort strategies to enhance their return potential versus traditional cash strategies.

- Tier 3: This tier is often the largest of the three tiers and is typically used for excess liquidity and long-term spending needs. In this tier, dedicated return drivers, like low duration core bond funds, can help investors seek to outpace inflation and preserve purchasing power over the long term.

Both Tier 2 and Tier 3 come with an escalating modest degree of additional risk versus traditional cash investments.

Implications for Investors

Volatility can be worrisome, but rather than sitting on the sidelines by over-allocating to cash, investors should consider moving slightly up the risk-reward spectrum with a tiered approach.

Allocating to diversified, actively managed ultrashort bond strategies in Tier 2 can help enhance return potential while maintaining an attractive liquidity profile.

Additionally, sticking with return drivers in Tier 3, such as actively managed low duration core bond strategies with a global opportunity set, can help diversify equity risk and potentially generate the returns needed for longer-term spending needs.

By adopting a tiered liquidity strategy, investors can better align their cash allocations with their financial goals, balancing the need for liquidity with the potential for higher returns.