Equities at PIMCO

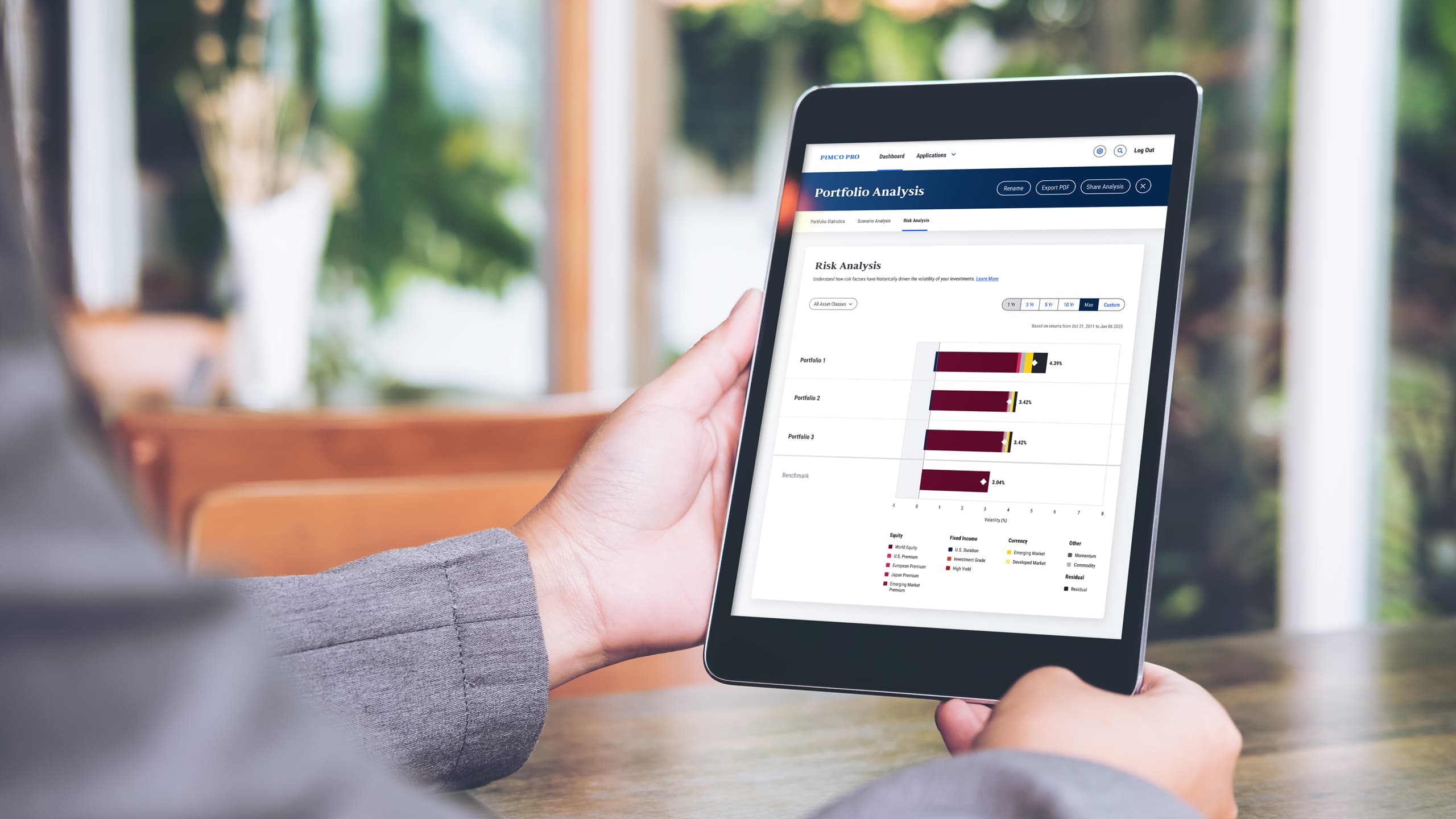

Diversifying Portfolios is Easy with Pro

How Can PIMCO Help You?

Disclosures

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information are contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative. Click here for a complete list of the PIMCO Funds prospectuses and summary prospectuses. Please read them carefully before you invest or send money.

Past performance is not a guarantee or a reliable indicator of future results.

Investments made by a Fund and the results achieved by a Fund are not expected to be the same as those made by any other PIMCO-advised Fund, including those with a similar name, investment objective or policies. A new or smaller Fund’s performance may not represent how the Fund is expected to or may perform in the long-term. New Funds have limited operating histories for investors to evaluate and new and smaller Funds may not attract sufficient assets to achieve investment and trading efficiencies. A Fund may be forced to sell a comparatively large portion of its portfolio to meet significant shareholder redemptions for cash, or hold a comparatively large portion of its portfolio in cash due to significant share purchases for cash, in each case when the Fund otherwise would not seek to do so, which may adversely affect performance.

PIMCO RAFI ESG U.S. Exchange-Traded Fund (RAFE) is a smart beta exchange-traded fund (ETF) that seeks to provide total return that closely corresponds, before fees and expenses, to the total return of the RAFI ESG US Index. The RAFI ESG US Index is a long-only, smart beta index that seeks to achieve the dual objectives of social responsibility and long-horizon outperformance of the broad market. Please see the Fund's prospectus for more detailed information related to its investment objectives, investment strategies and its index's approach to ESG.

A word about risk:

Absolute return portfolios may not fully participate in strong positive market rallies. Equities may decline in value due to both real and perceived general market, economic, and industry conditions. Investing in the bond market is subject to certain risks including the risk that fixed income securities will decline in value because of changes in interest rates; the risk that fund shares could trade at prices other than the net asset value; and the risk that the manager's investment decisions might not produce the desired results. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market's perception of issuer creditworthiness; while generally supported by some form of government or private guarantee, there is no assurance that private guarantors will meet their obligations. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Environmental, Social and Governance Investing Risk is the risk that, because the Underlying Index may select or exclude securities of certain issuers for reasons other than performance, the Fund's performance will differ from funds that do not utilize an ESG investing strategy. ESG investing is qualitative and subjective by nature, and there is no guarantee that the factors utilized by the Index Provider or any judgment exercised by the Index Provider in constructing the Underlying Index will reflect the opinions of any particular investor. For risks related to a specific fund, please refer to the Fund's prospectus or summary prospectus if available.

Exchange Traded Funds ("ETF") are afforded certain exemptions from the Investment Company Act. The exemptions allow, among other things, for individual shares to trade on the secondary market. Individual shares cannot be directly purchased from or redeemed by the ETF. Purchases and redemptions directly with ETFs are only accomplished through creation unit aggregations or "baskets" of shares. Shares of an ETF, traded on the secondary market, are bought and sold at market price (not NAV). Brokerage commissions will reduce returns. Investment policies, management fees and other information can be found in the individual ETF's prospectus.

Different fund types (e.g. ETFs, open-ended investment companies) and fund share classes are subject to different fees and expenses (which may affect performance). They may also have different minimum investment requirements and be entitled to different services.

Buying or selling ETF shares on an exchange may require the payment of fees, such as brokerage commissions, and other fees to financial intermediaries. In addition, an investor may incur costs attributed to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask) when buying or selling shares in the secondary market (the bid-ask spread). Due to the costs inherent in buying or selling Fund shares, frequent trading may detract significantly from investment returns. Investment in Fund shares may not be advisable for investors who expect to engage in frequent trading.

Premium/Discount is the difference between the market price and NAV expressed as a percentage of NAV.

Current holdings are subject to risk. Holdings are subject to change at any time. An investment in an ETF involves risk, including the loss of principal. Investment return, price, yield and Net Asset Value (NAV) will fluctuate with changes in market conditions. Investments may be worth more or less than the original cost when redeemed.

ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for PIMCO ETF shares will develop or be maintained, or that their listing will continue or remain unchanged.

The Smart beta ETFs use an indexing approach and may be affected by a general decline in market segments or asset classes relating to its Underlying Index. The Fund invests in securities and instruments included in, or representative of, its Underlying Index regardless of the investment merits of the Underlying Index.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

CMR2024-0313-3446363