We Believe

- History suggests the lagged economic effects of tighter central bank policy are arriving on schedule, but any eventual normalizing or even easing of policy will still likely require inflation to decline further.

- Volatility in the banking sector has raised the prospect of a significant tightening of credit conditions, particularly in the U.S., and therefore the risk of a sooner and deeper recession.

- At current yield levels, bonds can provide an attractive balance between income generation and cushion against downside economic risks, while market dislocations are creating pockets of value.

For investors, times of uncertainty can underscore the importance of a cautious approach.

Central banks’ efforts to fight inflation by sharply raising interest rates have contributed to recent volatility across the financial sector, as the effects of tighter monetary policy filter into markets and the economy with a lag. Peak policy rates are now likely to be lower than markets previously were pricing. But normalizing monetary policy, and then eventually easing, will take more time and need inflation to decline closer to target levels. In the meantime, unemployment is likely to rise.

We discussed the latest opportunities and risks across the economic and investment landscape at PIMCO’s Cyclical Forum in March in Newport Beach (for more on our forums, please visit PIMCO’s Investment Process webpage). We also spoke about how geopolitical risks could affect our outlook with PIMCO Global Advisory Board member Michèle Flournoy, an expert in U.S. defense policy and national security issues. We have continued our conversations amid the unfolding challenges in the banking sector and arrived at three main economic themes for our six- to 12-month horizon, which we review in the next section.

The recent U.S. bank failures set off a wave of deposit outflows and a response from regulators to stem the contagion. In Europe, the stress led to the demise of Credit Suisse and a seismic shock to the broader European banking system. These shocks are likely to slow credit growth by making banks less eager to lend, pull forward any recession, and raise the risk of a somewhat deeper downturn.

While our forums take place quarterly, the recent turmoil is a reminder that markets don’t operate on a predictable schedule. We use our forums to look beyond day-to-day market noise to see bigger-picture themes. But we apply our collaborative, nimble approach to investing each day. Our latest discussions have reinforced the importance of the cautious view on risk-taking that has informed our model portfolios for the past few forum cycles.

Broadly, we believe bonds continue to look attractive at current yield levels, offering a balance between income generation and cushion against economic downside scenarios. We prefer higher-quality, more liquid investments and are avoiding lower-quality, more economically sensitive areas, such as lower-rated floating-rate corporate credit, that are most exposed to the effects of tighter monetary policy. We are starting to see more attractive opportunities in newer deals within private markets, but prices of existing assets have been slower to adjust compared with public markets, and forced deleveraging is likely in a world of higher funding rates.

Economic outlook: From hiking path to turning point

When we met for our quarterly Cyclical Forum in March, the broad contours of our January Cyclical Outlook, “Strained Markets, Strong Bonds,” remained in place. That included expectations for modest recessions across developed markets (DM) as the effects of tighter monetary policy played out. We also discussed how new developments, including China’s faster reopening, Europe’s fading energy shock, and positive data revisions in the U.S. could contribute to a near-term reacceleration in real GDP growth.

Within days, however, the run on Silicon Valley Bank (SVB) in the U.S. and Credit Suisse in Europe cast a new shadow over the outlook. While these banks’ situations were unique, their problems were also symptomatic of broader fragilities in the sector stemming from tight monetary policy. The magnitude of the ultimate macroeconomic impact of these events remains uncertain, but the impetus is clearly negative.

Bearing these uncertainties in mind, we carried on our discussions and developed several conclusions regarding the six- to 12-month outlook.

Risks of sooner, deeper recession have risen

Bank failures, wider elevated volatility in bank stocks, rising cost of capital, and ongoing potential for deposit flight from more fragile small and midsize U.S. banks (SMBs) raise the prospect of a significant tightening of credit conditions, particularly in the U.S. – and therefore the risk of a sooner and deeper recession.

Monetary policy works through lags. This episode reveals that tighter financial conditions are having an increasing effect on the banking sector, and by extension on economic activity, demand, and eventually inflation.

Credit growth is likely to slow. The failures are characteristic of bigger problems at SMBs (in the case of SVB) that spilled over into the European banking sector, with Credit Suisse uniquely vulnerable given its profitability challenges and the fact that it was in the middle of a large restructuring process.

In the U.S., sizable portfolio losses relative to Common Equity Tier 1 capital, deposit outflows, and shrinking net interest margins are all pressuring SMBs, which are essential to credit growth. In 2022, SMBs accounted for around 30% of new credit to U.S. companies and households, according to the U.S. Federal Reserve Board. That source of lending is likely to slow, perhaps substantially, as SMBs shift focus toward managing liquidity amid higher funding costs and likely more stringent application of bank regulations. Larger banks that must comply with more extensive Dodd-Frank regulations are unlikely to fill the gap in smaller-scale and potentially riskier small business lending.

In Europe, the manner in which Swiss regulators orchestrated the takeover of Credit Suisse by UBS – a weekend emergency law change that erased the value of the Additional Tier 1 (AT1) bonds before the equity – raises questions about the role of AT1 instruments and their position within the capital structure that will likely raise the cost of capital for the broader banking industry. Regulators in the euro area, the U.K., and elsewhere have since stated publicly that they would not follow the Swiss regulators’ approach, but the Credit Suisse episode is a worrying precedent that could fundamentally change the European bank funding model.

Recent events will likely lead to a mild recession, in the case of the U.S., and act as yet another headwind that could very well pull Europe into recession as well. Since banks – even large, so-called national champion banks with substantial Common Equity Tier 1 capital buffers – could suffer from a crisis of confidence, we believe the risk of a deeper recession has surely gone up.

Still, there are good reasons to believe that this is not 2008. Households still have excess savings, aggregate corporate debt-to-GDP ratios appear manageable with interest-to-income ratios still low, and so far bank losses generally have emanated from rising interest rates, which reduce the value of long-duration assets, not from risky lending or credit defaults. The largest U.S. systemically important banks, which are subject to regular liquidity and capital stress tests, are still financially sound and have been the beneficiary of deposit outflows at smaller banks.

Central banks: Less tightening, but slower easing

All of this means central banks likely need to do less heavy lifting to get the same result: tighter financial conditions, which slow credit growth, demand, and eventually inflation. However, not tightening further is distinct from normalizing or even easing policy, which we still believe will require inflation falling toward central bank targets.

Previously, we’ve said that going from 8% to 4% inflation in the U.S. should be relatively easy, but going from 4% to 2% would require more time, as “stickier” categories related to wage inflation were likely to moderate more slowly and in response to weakening labor markets. We continue to expect core U.S. consumer price index (CPI) inflation to end 2023 at around 3%, still above the 2% inflation target of the U.S. Federal Reserve (Fed), while European inflation is still likely to end the year higher.

Wages, which are less flexible than prices, have generally lagged behind the price level adjustment. In past cycles, wage inflation only begins to materially decelerate one year after the start of a recession.

Last October, in our Cyclical Outlook, “Prevailing Under Pressure,” we argued that recession was likely in 2023 as a result of central banks’ aggressive moves to fight inflation. Our view was based on a historical analysis across 70 years and 14 developed economies, which suggests the economic effects of central bank tightening could become more apparent by mid-2023. According to this analysis, historically, the output gap has tended to deteriorate 1.5 to 2 years after the start of a hiking cycle, and recession and unemployment increases have tended to begin around 2 to 2.5 years out. This cycle appears to be evolving broadly in line with this historical timeline.

Recent developments likely mean that the Fed is close to being finished – or perhaps already done – hiking with its policy rate just below 5%. Yet any actions to cut rates are likely to depend on how the trade-off between financial stability and inflation risks evolves. Since inflation is still likely to moderate only slowly, any actions to normalize or even ease policy are also likely to come with a lag.

Inflationary lags are likely longer in the euro area, likely keeping the European Central Bank (ECB) hiking beyond the Fed. European inflation has trailed the U.S. by around two quarters for prices and longer for wages. Higher gas prices, a weaker currency, and a less flexible labor market are likely to support a lengthier period of elevated European inflation. As a result, we believe a 3.5%–4% terminal ECB policy rate looks reasonable.

Finally, regions that are less reliant on longer-duration, fixed-rate mortgages to finance home purchases, such as Canada, New Zealand, and Australia, are less affected by the issues plaguing U.S. regional banks. The transmission of monetary policy there is working by increasing household costs through higher direct rate pass-through. Still, New Zealand and Australia’s reliance on external funding, and Canada’s strong trading ties with the U.S., raise the risk of spillovers. The Japanese economy, meanwhile, stands out as relatively insulated, and we continue to expect the Bank of Japan will move away from its yield curve control policy.

Fiscal policy and regulation: Focus on moral hazard?

Given still-high inflation, elevated government debt, and a widespread belief that the pandemic response caused the current inflationary environment, additional bank stress and rising recessionary risks are unlikely to be met with another large fiscal response, unless the economic implications are clear and severe. Policy responses are likely to be lagged and less aggressive.

This is especially true in the U.S., where political pressure could increase the stringency of the Fed’s implementation of bank regulations, particularly outside of the largest systemically important banks, limiting lending. The Fed could also tighten regulatory standards on the large regional banks where it can.

Furthermore, in the divided U.S. government, the hurdle is likely high for Congress to preemptively enact legislation (even if temporary) to restore confidence in the banking sector, such as by raising Federal Deposit Insurance Corporation (FDIC) insurance caps. Although if additional small banks should fail, we expect the FDIC and the Fed would invoke the systemic risk exception to create a program that insures the deposits of those banks.

While fiscal policy has been somewhat easier in Europe and the U.K. – in an effort to shield businesses and households from higher energy prices and to respond to the U.S. Inflation Reduction Act’s green subsidies – elevated inflation and government debt are also likely to limit any fiscal response there.

Investment implications: Proceed with caution

Uncertain environments tend to be good for fixed income, particularly after last year’s broad market repricing pushed current yield levels – historically a strong indicator of returns – much higher. We believe bonds are poised to exhibit more of their traditional qualities of diversification and capital preservation, with the potential for upside price performance in the event of further economic deterioration.

In this current environment, and particularly given the banking sector challenges, we want to be careful in overall risk positioning.

When uncertainty and volatility go up, liquidity – or the depth of trading in markets – tends to go down, and liquidity has deteriorated in recent weeks. We’ve been prioritizing liquidity more than usual in our strategies, focusing on more easily tradeable investments and preserving dry powder to seek to take advantage of opportunities that may arise from market dislocations.

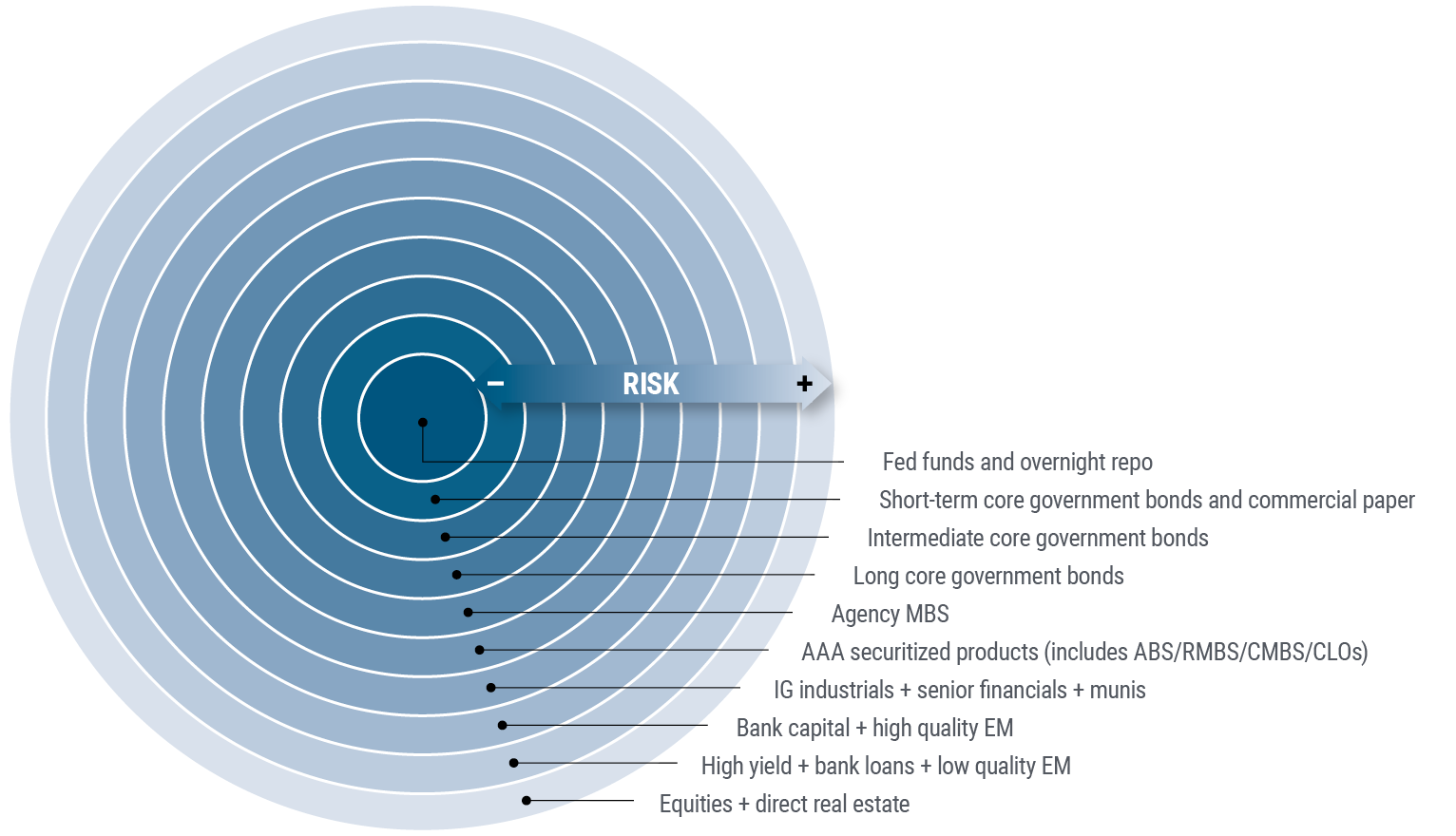

Our longstanding concentric circles investment framework, written on the whiteboard in our Investment Committee room, continues to reflect a cautious approach. The framework (see Figure 1) starts in the middle with the relatively lower-risk short-term and intermediate interest rates, moving out to U.S. agency mortgage-backed securities (MBS) and investment grade corporate credit in the middle rings, to the riskier outer bands with equities and real estate. We continue to prioritize inner-ring investments in the current environment.

Central bank policy remains a crucial driver. Changing the price of borrowing at the epicenter creates ripples that expand outward. We see policy-related volatility going down this year as we approach the end of tightening cycles. That contrasts with last year, which saw a large repricing for the Fed and other major central bank rates.

We continue to expect a yield range of about 3.25% to 4.25% for the 10-year U.S. Treasury note in our baseline cyclical view, and broader ranges across other scenarios, with a potential bias to shift the range lower given increased economic and financial sector risks.

Prioritizing strong bonds

Depending on an investor’s objectives, there are attractive opportunities in short-term, cash-equivalent investments today given relatively elevated yields near the front end of the curve. Cash may not be subject to the same volatility as other investments. But unlike longer-term bonds, cash won’t provide the same diversification properties and ability to generate total return through price appreciation if yields fall further, as has occurred in prior recessions. Cash rates can also be fleeting, with the risk that yields may be lower when short-term holdings mature and cash needs to be reinvested.

The banking sector stress reinforces our cautious approach toward corporate credit, particularly lower-rated areas such as senior secured bank loans. These are floating-rate loans to lower-rated companies, which must pay more interest as the Fed has raised rates. That puts strain on those companies, particularly in a weakening economy.

Recent volatility could be a preview of what’s ahead for more economically sensitive parts of credit markets. We prefer index exposure via derivative instruments over generic individual issuer exposure based on valuation and liquidity. We aim to limit exposure to weak business models and companies and sectors vulnerable to higher interest rates. We retain a preference for structured, securitized products backed by collateral assets.

Within the financial sector, broad-based weakening in preferred shares and bank capital securities has made some of the senior issues from stronger banks look more attractive. Large global banks hold substantial capital and could benefit from the challenges facing smaller lenders. Valuation and the greater certainty of the senior debt’s place in the capital structure reinforces our bias for senior debt over subordinated issues. At the same time, the shock to the AT1 market may help create opportunity in the strongest issuers – especially if European regulators can take concrete steps to differentiate the eurozone and U.K. market from the challenged Swiss market.

We believe U.S. agency mortgage-backed securities remain attractive, particularly after spreads have widened lately. There may be technical pressures as the Fed lets agency MBS roll off its balance sheet. But these securities are typically very liquid and backed by a U.S. government or U.S. agency guarantee, providing resilience and downside risk mitigation, while prices can benefit from a complexity premium.

Public and private debt

For some months, we have said it makes sense to focus on public credit markets now, where the price marks are up to date, and shift attention to private markets later, when marks become more realistic. Given their rapid growth over the past decade, private markets could face continued strain, which may be worse in the event of a harder economic landing. In recent weeks, the gap between public and private valuations has only widened.

While the stock of these assets remains mispriced, the flow of new deals across private markets is beginning to look more attractive. We are increasingly prepared to deploy capital as opportunities arise.

We are seeing opportunities in areas where bank de-risking and reduced credit availability will likely have a pronounced effect. PIMCO has a history of partnering with banks to help solve their balance sheet problems, both in the U.S. and abroad. As regulatory and balance-sheet-related pressures increase, we expect that a broad range of lenders will look to recapitalize their businesses and will be more constrained in their ability to originate new loans even to the highest-quality borrowers.

The commercial real estate (CRE) sector may face further challenges, but we would stress that not all CRE is the same. We aim to stay in senior parts of the capital structure, in diversified deals. We differentiate that from lower-quality, single-asset or mezzanine-level risk, which we aim to avoid.

Bottom line

We believe it’s important to remain cautious in this environment, seeking higher-quality, more liquid, and resilient investments. Later this year, if the economic outlook reaches a point of greater clarity, accompanied by a repricing of economically sensitive market sectors, it could be time to go on the offensive.

Powered by Ideas, Tested by Decades

About our forums

Honed over more than 50 years and tested in virtually every market environment, PIMCO’s investment process is anchored by our Secular and Cyclical Economic Forums. Four times a year, our investment professionals from around the world gather to discuss and debate the state of the global markets and economy and identify the trends that we believe will have important investment implications.

At the Secular Forum, held annually, we focus on the outlook for the next five years, allowing us to position portfolios to benefit from structural changes and trends in the global economy. Because we believe diverse ideas produce better investment results, we invite distinguished guest speakers – Nobel laureate economists, policymakers, investors, and historians – who bring valuable, multidimensional perspectives to our discussions. We also welcome the active participation of the PIMCO Global Advisory Board, a team of world-renowned experts on economic and political issues.

At the Cyclical Forum, held three times a year, we focus on the outlook for the next six to 12 months, analyzing business cycle dynamics across major developed and emerging market economies with an eye toward identifying potential changes in monetary and fiscal policies, market risk premiums, and relative valuations that drive portfolio positioning.