Amid constantly changing economic conditions, investors may benefit from knowing the factors driving inflation, its impact on their portfolios, and steps to consider as the investment landscape shifts.

What is inflation?

As an economy grows, businesses and consumers spend more money on goods and services. In the growth stage of an economic cycle, demand typically outstrips the supply of goods, and producers can raise their prices. As a result, the rate of inflation increases.

Inflation is a sustained rise in overall price levels. Moderate inflation is associated with economic growth, while high inflation can signal an overheated economy.

If economic growth accelerates very rapidly, demand grows even faster and producers may raise prices continually. Supply constraints can also drive prices higher absent any material change in demand. An upward price spiral, sometimes called “runaway inflation” or “hyperinflation,” can result.

In the United States, the inflation syndrome has often been described as “too many dollars chasing too few goods.” In other words, as spending outpaces the production of goods and services, the supply of dollars in an economy exceeds the amount needed for financial transactions. The result is that the purchasing power of a dollar declines.

How is inflation measured?

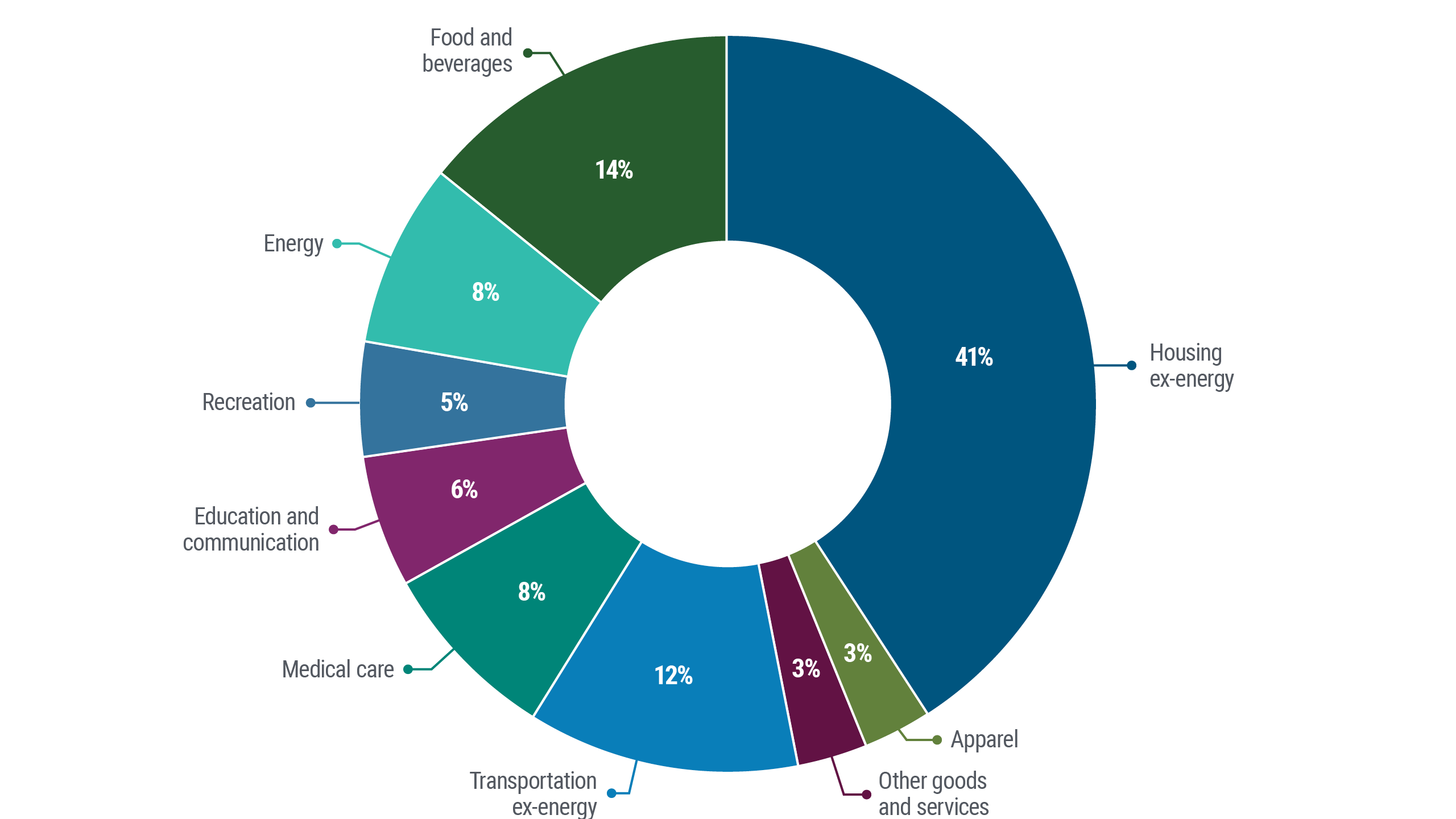

When economists and central banks try to discern the rate of inflation, they generally focus on “core inflation.” Core inflation excludes food and energy prices, which are subject to sharp, short-term price swings, and could give a misleading picture of long-term inflation trends.

There are several regularly reported measures of inflation that investors can use to track inflation. The U.S. Consumer Price Index (CPI) is a widely followed economic indicator, as it reflects retail prices of goods and services including housing costs, transportation, and healthcare. The Federal Reserve prefers to emphasize the Personal Consumption Expenditures (PCE) Price Index. This is because the PCE covers a wider range of expenditures than the CPI. The official measure of inflation of consumer prices in the United Kingdom is the CPI or the Harmonized Index of Consumer Prices (HICP). In the eurozone, the main measure used is also called the HICP.

What causes inflation?

Economists do not always agree on what spurs inflation at any given time, but in general they bucket the factors into two different types: cost-push inflation and demand-pull inflation.

Rising commodity prices are an example of cost-push inflation because when commodities rise in price, the costs of basic goods and services generally increase.

Demand-pull inflation occurs when aggregate demand in an economy rises too quickly. This can occur if a central bank rapidly increases the money supply without a corresponding increase in the production of goods and service. Demand outstrips supply, leading to an increase in prices.

Cost-push inflation in context

Both higher oil prices and currency depreciation have previously caused cost-push inflation.

Examples of higher oil prices and how they may affect the economy:

- Higher oil prices have driven price increases across sectors of the global economy.

- In 2020-2022, oil inventories have hit low levels, causing prices to rise amid surging COVID-19 reopening demand and lagging supply.

- Rising oil prices take money out of the pockets of consumers and businesses.

- Economists view oil-price hikes as a “tax” that can affect economic conditions.

Supply Chain Disruptions:

- Supply chains worldwide drastically slowed following the emergence of the coronavirus in early 2020 due to disruptions in shipping and labor.

- This has caused shortages in materials and, in turn, higher prices for goods.

How can inflation be controlled?

Central banks, including the U.S. Federal Reserve, European Central Bank, the Bank of Japan and the Bank of England attempt to control inflation by regulating the pace of economic activity. They usually try to influence economic activity by raising and lowering short-term interest rates.

Central banks’ management of the money supply in their home regions is known as monetary policy. Raising and lowering interest rates is the most common way of implementing monetary policy.

However, a central bank can also tighten or relax banks’ reserve requirements. Banks must hold a percentage of their deposits with the central bank or as cash on hand. Raising the reserve requirements restricts banks’ lending capacity, thus slowing economic activity, while easing reserve requirements generally stimulates economic activity.

A government at times will attempt to fight inflation through fiscal policy. The government can attempt to fight inflation by raising taxes or reducing spending, thereby putting a damper on economic activity; conversely, it can combat deflation with tax cuts and increased spending designed to stimulate economic activity.

How does inflation affect investment returns?

Inflation poses a “stealth” threat to investors because it chips away at real savings and investment returns. Most investors aim to increase their long-term purchasing power. Inflation puts this goal at risk because investment returns must first keep up with the rate of inflation in order to increase real purchasing power.

For example, an investment that returns 2% before inflation in an environment of 3% inflation will actually produce a negative return (−1%) when adjusted for inflation.

Also, importantly, changes in the inflation rate can have a different impact on various asset classes. For example, historically stocks and nominal fixed income have exhibited a negative response to upside surprises in inflation. This may result in a positive stock / bond correlation during periods of higher inflation and challenge traditional diversification. In contrast, real assets like commodities and Treasury Inflation-Protected Securities (TIPS), display a positive sensitivity historically.

What may inflation mean for investors?

Very high inflation tends to have a negative impact on assets such as stocks and bonds. Maintaining a constant allocation to inflation-hedging assets can help investors cushion their portfolios against unexpected spikes.

What steps can investors take to mitigate inflation’s impact on portfolios?

During rising inflation environments, investors may want to consider inflation-mitigating assets. It is also important to consider the core tenets of investing in all economic conditions: maintain a well-diversified portfolio, rebalance regularly, and ensure investments remain aligned with long-term goals.