Glossary

- Duration: A measure of the sensitivity of the price of a bond to a change in interest rates

- Maturity: The number of years left until a bond repays its principal to investors

- Yield: The income return or interest received from a bond

- Coupon: The interest payments a bondholder receives until the bond matures

- Call features: The terms and conditions in which the bond can be called or "retired" early by the issuer

What is a bond’s duration?

Duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. These many factors are calculated into one number that measures how sensitive a bond’s value may be to interest rate changes.

How investors use duration

Generally, the higher a bond’s duration, the more its value will fall as interest rates rise, because when rates go up, bond values fall and vice versa. If an investor expects interest rates to fall during the course of the time the bond is held, a bond with a longer duration would be appealing because the bond’s value would increase more than comparable bonds with shorter durations.

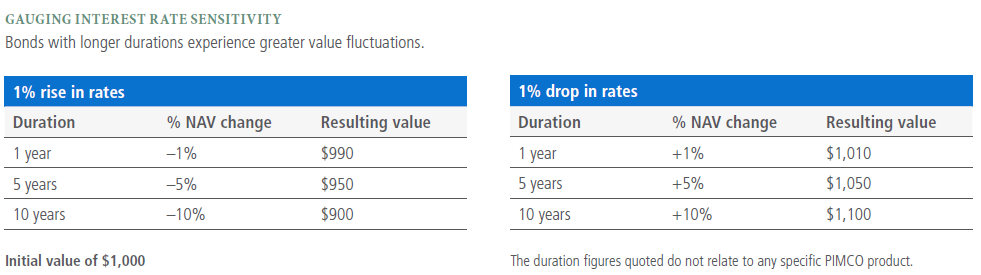

As the table below shows, the shorter a bond’s duration, the less volatile it is likely to be. For example, a bond with a one-year duration would only lose 1% in value if rates were to rise by 1%. In contrast, a bond with a duration of 10 years would lose 10% if rates were to rise by that same 1%. Conversely, if rates fell by 1%, bonds with a longer duration would gain more while those with a shorter duration would gain less.

Risk-averse investors, or those concerned about wide fluctuations in the principal value of their bond holdings, should consider a bond strategy with a very short duration. Investors who are more comfortable with these fluctuations, or who are confident that interest rates will fall, should look for a longer duration.

Limitations of duration

While duration can be an extremely useful analytical tool, it is not a complete measure of bond risk. For example, duration does not tell you anything about the credit quality of a bond or bond strategy. This can be particularly important with lower-rated securities (such as high yield bonds), which tend to react as much, if not more, to investor concerns about the stability of the issuing company as they do to changes in interest rates.

Another limitation to using duration when evaluating a bond strategy is that its average duration may change as the bonds within the portfolio mature and interest rates change. So the duration at the time of purchase may not be accurate after the portfolio’s holdings have been adjusted. Concerned investors should regularly check their bond strategy’s average duration to avoid surprises, or invest in strategies that are actively managed to maintain a set average duration range.

How portfolio managers use duration

While duration does have limitations, it can be an extremely useful tool for building bond portfolios and managing risk. As a portfolio manager’s interest rate outlook changes, he or she can adjust the portfolio’s average duration (by adjusting the holdings in the portfolio) to coincide with the forecast.

These adjustments can be made either for the portfolio as a whole or for a particular sector within the portfolio. So, if the manager expects interest rates to fall, the average duration of the portfolio could be lengthened in order to get the maximum benefit from the change. On the other hand, if a manager’s outlook indicates that interest rates will be increasing, he or she could shorten the portfolio’s average duration, moving it closer to zero, to minimize the negative effect on values.

In contrast to the more typical positive duration, a “negative” duration strategy can be employed by a manager with a very high conviction that interest rates will rise to both protect the portfolio and potentially enhance returns. A portfolio with a negative duration will increase in value when interest rates rise, barring other impacts.

PIMCO and duration

Because interest rate expectations have a significant impact on bond values, PIMCO devotes considerable effort trying to anticipate global economic and political trends that may influence the direction of interest rates. That long-term outlook is then translated into a general duration range for our portfolios, with short-term adjustments made, as necessary, within that range. In addition to interest rates, we also apply duration measurements to determine bond value sensitivity to shifts in other factors, such as yield curve and bond spreads.