Retirement Income

Secure Tomorrow, Today:

PIMCO’s Retirement Income Strategies

We're committed to helping you build retirement plans that secure the financial futures of participants, with an income-focused approach that seeks to balance the joys of today with security for tomorrow.

Options that generate high and consistent income are attractive to retirees as behavioral research shows participants prefer to preserve principal and primarily spend income.

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Flexibility and Control

Growth and Preservation

Steady Income Streams

Income Strategy

**BrightScope, 31 December 2025

***Income/yield is not guaranteed and may fluctuate

Retirement Tier Option

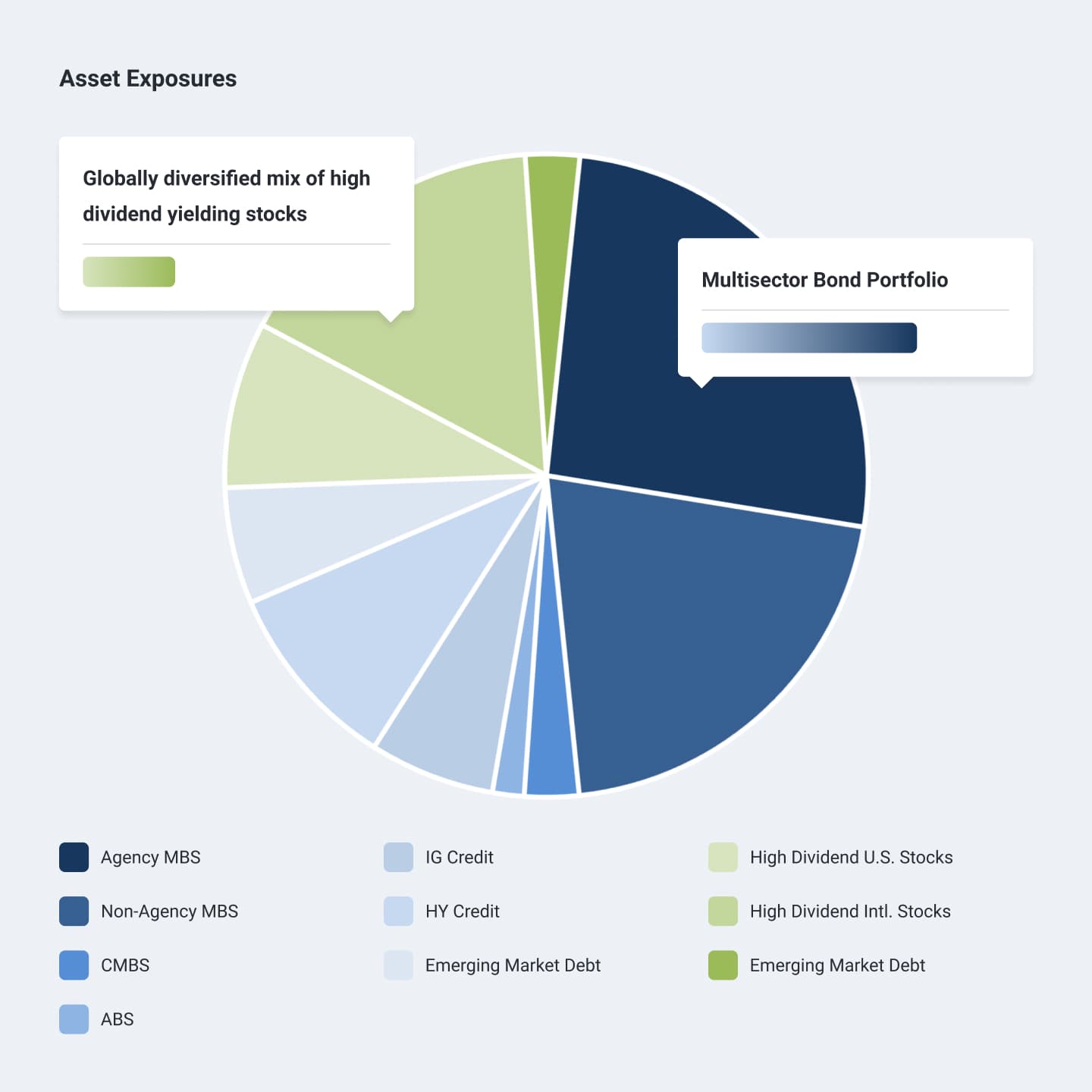

Designed to seek consistent, attractive income for participants in retirement, PIMCO Income Strategy takes a flexible, multisector approach to investing in the global fixed income markets:

- Liquid strategy seeks the best opportunities in any market environment.

- Invests in higher quality assets to build resiliency and reduce volatility. and higher yielding assets to generate attractive income.

- Flexibility to go where the opportunities are, as market conditions change.

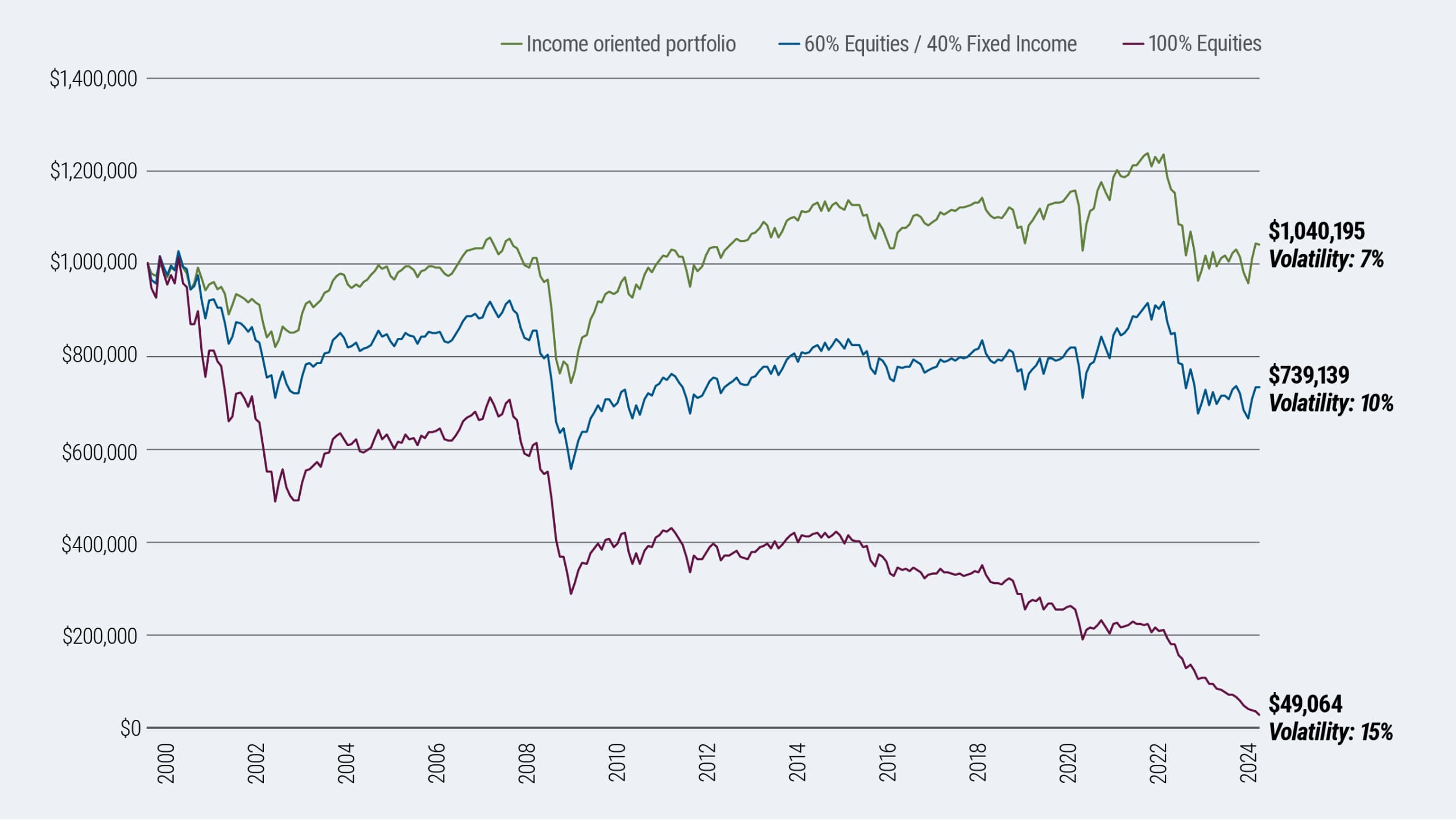

Hypothetical participant experience if $40,000 withdrawn annually*

Diverse Portfolio That Goes Where The Opportunities Are

PIMCO Income Strategy Portfolio Breakdown (% Gross Market Value)

Beginning 31 October 2023 chart displays exposures in Gross Market Value (GMV%). GMV% is calculated differently than Percent Market Value (PMV%), which is the portfolio’s official sector reporting. GMV% does not include the notional value of swap exposures and excludes reverse repos from its calculation. *“Government Related” includes nominal and inflation-protected Treasuries, agencies and FDIC-guaranteed and government-guaranteed corporate securities from the U.S., Japan, United Kingdom, Australia, Canada, and European Union. *"Government-Related" excludes any interest rate linked derivatives used to manage the fund’s duration exposure in the United States. Derivative instruments includes interest rate swaps, futures, and swap options. "ABS" contains traditional ABS, CLOs and CDOs. “Other” contains municipal securities and preferred stock or common stock obtained through restructuring opportunities.

Prior to October 2023 sector exposures were reported in terms of percent bond exposure (PBE%), which is defined as the market exposure inclusive of notional values. PBE% shows exposure to a given sector divided by the total assets of the portfolio and does not utilize a derivative offset bucket like PMV%. Additionally, prior to October 2023, the "Government-Related“ and "Non-U.S. Developed“ buckets excluded any interest rate linked derivatives used to manage our duration exposure in the following countries: the U.S., Japan, United Kingdom, Australia, Canada, and European Union (ex-peripheral countries defined as Italy, Spain, Cyprus, Malta, Portugal, and Greece). Portfolio structure is subject to change without notice and may not be representative of current or future allocations.

Information displayed is derived from a representative account included within the PIMCO Income Composite. The representative account was chosen because it is considered to be the largest and most representative of the strategy. No guarantee is being made that the structure or actual account holdings of any account will be the same or that similar returns will be achieved.

The PIMCO Income Composite includes all discretionary, USD-based fixed income portfolios managed to the PIMCO Income Strategy, which seeks to maintain a high and consistent level of income by investing in a broad array of fixed income sectors and utilizing income efficient implementation strategies. PIMCO's Income Strategy invests in a multi-sector portfolio of fixed income instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts or swap agreements. The average portfolio duration normally varies from zero to eight years based on PIMCO's market forecasts. Portfolios may purchase or sell securities on a when-issued, delayed delivery or forward commitment basis and may engage in short sales. Principal risks of the strategy include interest rate, duration, currency, credit, economic and political, and derivative instruments risk. Investing in derivatives could lose more than the amount invested. Entering into short sales includes the potential for loss of more money than the actual cost of the investment, and the risk that the third party to the short sale may fail to honor its contract terms, causing a loss to the portfolio. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political changes, which may be enhanced when investing in emerging markets.

PIMCO Balanced Retirement Income Strategy (PBRI)

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Consistent Income

Principle Preservation

Optimize Cost & Yield

This is a carousel with individual cards. Use the previous and next buttons to navigate.

What Retirees Want

• Steady income

• Control Over Assets

What PBRI Seeks To Provide

• Participant withdrawal flexibility (no annuity contracts/lock-ups)

• Simplicity of allocating to mutual funds and ETFs

• Cost efficiency4

Equity Allocation

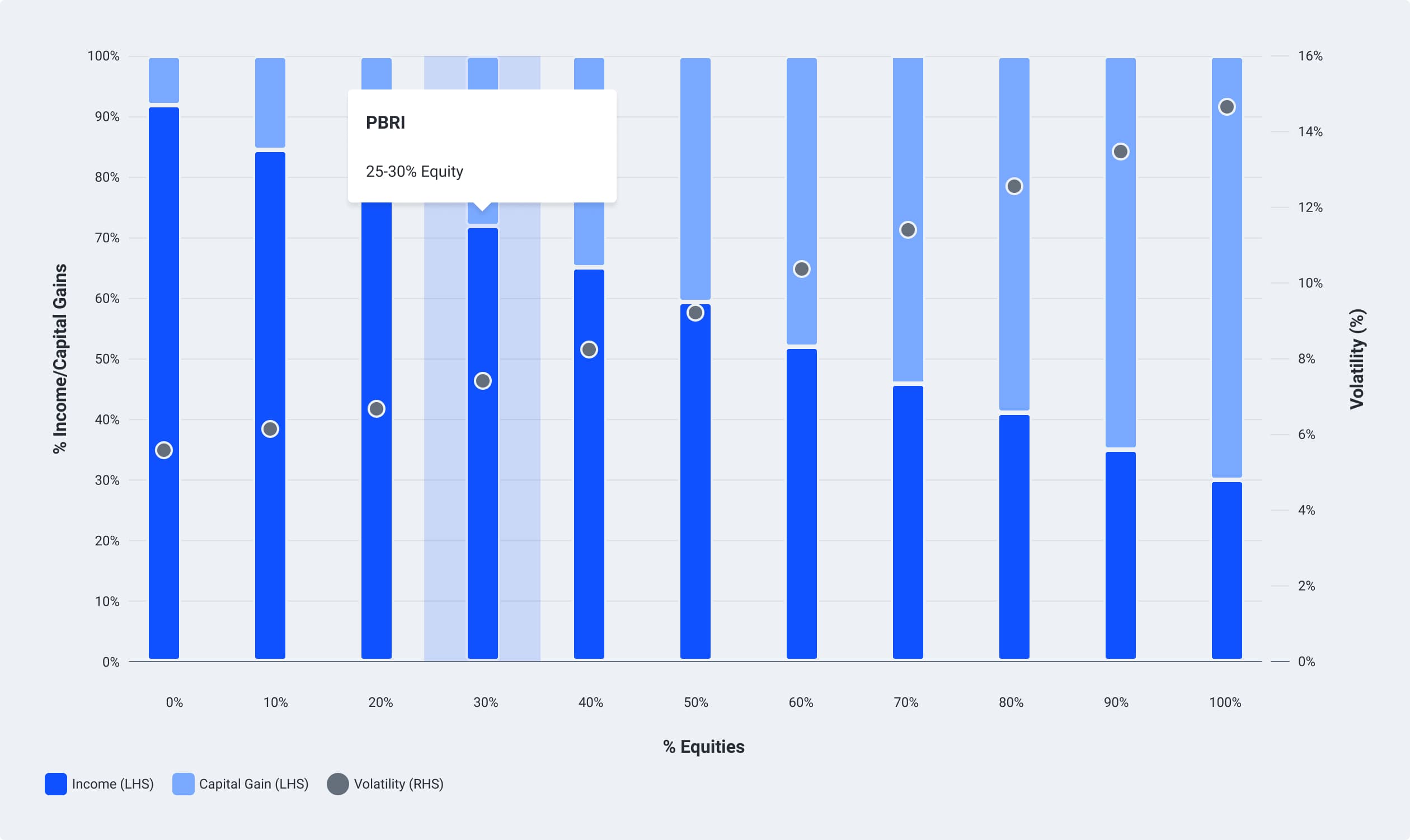

For indices, return (income/capital gain) estimates are based on the product of risk factor exposures and projected risk factor premia. The projections of risk factor premia rely on historical data, valuation metrics and qualitative inputs from senior PIMCO investment professionals.

For illustrative purposes only. Figure is not indicative of the past or future results of any PIMCO product or strategy. There is no assurance that the stated results will be achieved. SOURCE: PIMCO and Bloomberg. Data from 31 January 2001–28 February 2020. The fixed income portion of the portfolio is comprised of 25% each in MBS, IG Credit, HY, and EM. We varied the allocation between the fixed income portfolio and equities to determine the impact on income level and risk. Index proxies are as follows: IG corp, Bloomberg US Corporate Index; MBS, Bloomberg US MBS Index; HY corp, Bloomberg HY Index; EM hard, Bloomberg EM USD Aggregate Index; The equities portion of the portfolio is comprised of 50% each in U.S. equities, S&P 500 Index; Int’l equities (DMEQ), MSCI EAFE Index.

A Combination of PIMCO’s Active Fixed Income and Vanguard’s Passive Equity3

PBRI is broadly diversified to support retirement income.

More to Know

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Explore why target date funds are increasingly repurposed for retirement income and how to assess their effectiveness in supporting retirees.

myTDF represents an evolution of traditional target-date funds by incorporating up to five demographic factors beyond age in seeking to deliver a more personalized default asset allocation with the same ease as traditional TDFs.

Target date funds provide an asset allocation that changes over time based on the average participant’s savings profile, which can lead to suboptimal outcomes. myTDF® takes the simplicity of TDFs and adds the power of auto-personalization so that plan fiduciaries can seek to more closely align a participant's allocations with their individual circumstances.