Target Date Solutions

Two Distinct Approaches to Target Dates

At PIMCO, we strive to help investors reach their financial goals with stability and confidence. Our Target Date Funds are designed to pursue attractive returns and steady income while minimizing volatility through strategic diversification -- to help bolster investor confidence in their path to retirement.

Recognizing the unique needs of each plan sponsor and their participants, PIMCO proudly offers two distinct approaches to target date investing.

This is a carousel with individual cards. Use the previous and next buttons to navigate.

RealPath® Blend

RealPath® Blend

Seeks to Provide a Smoother Ride to Retirement

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Building Retirement Savings

- Allocates roughly 95% of portfolio to equities in furthest dated vintages to help maximize the balances of the youngest participants.

- Equity allocations aim to be well diversified, with less U.S. home market bias and greater exposure to non-U.S. and emerging markets.

Defending Retirement Wealth

- Seeks to preserve retirement wealth as a participant progresses to mid-career.

- Glide path employs robust diversification across equities, fixed income and inflation-hedging assets in seeking to balance growth with capital preservation.

Supporting Retirement Income

- For participants nearing and entering retirement, it tilts more toward capital preservation while focusing on generating consistent income for retirees.1

- Increases exposure to real assets and diversified fixed income exposures, tapping into the full global opportunity set.

Blending the Best of Both Worlds

- Active where it matters, passive where it saves – Powered by PIMCO and Vanguard*

- Delivering value for 50+ years with PIMCO’s fixed income resources, and explicit downside risk management

- Individual outcome focused emphasizing income and diversification, with a disciplined annual review

Fund Details

| Fund Name | Ticker (Inst'l Class) |

Years To Retirement | Vehicle | Class |

|---|---|---|---|---|

| REALPATH® Blend Income Fund | PBRNX | In Retirement | Mutual Fund | Multi Asset |

| REALPATH® Blend 2030 Fund | PBPNX | About 5 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2035 Fund | PDGZX | About 10 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2040 Fund | PVPNX | About 15 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2045 Fund | PVQNX | About 20 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2050 Fund | PPQZX | About 25 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2055 Fund | PRQZX | About 30 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2060 Fund | PRBMX | About 35 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2065 Fund | PBLIX | About 40 years | Mutual Fund | Multi Asset |

| REALPATH® Blend 2070 Fund | PAJDX | About 45 years | Mutual Fund | Multi Asset |

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Explore why target date funds are increasingly repurposed for retirement income and how to assess their effectiveness in supporting retirees.

myTDF represents an evolution of traditional target-date funds by incorporating up to five demographic factors beyond age in seeking to deliver a more personalized default asset allocation with the same ease as traditional TDFs.

Target date funds provide an asset allocation that changes over time based on the average participant’s savings profile, which can lead to suboptimal outcomes. myTDF® takes the simplicity of TDFs and adds the power of auto-personalization so that plan fiduciaries can seek to more closely align a participant's allocations with their individual circumstances.

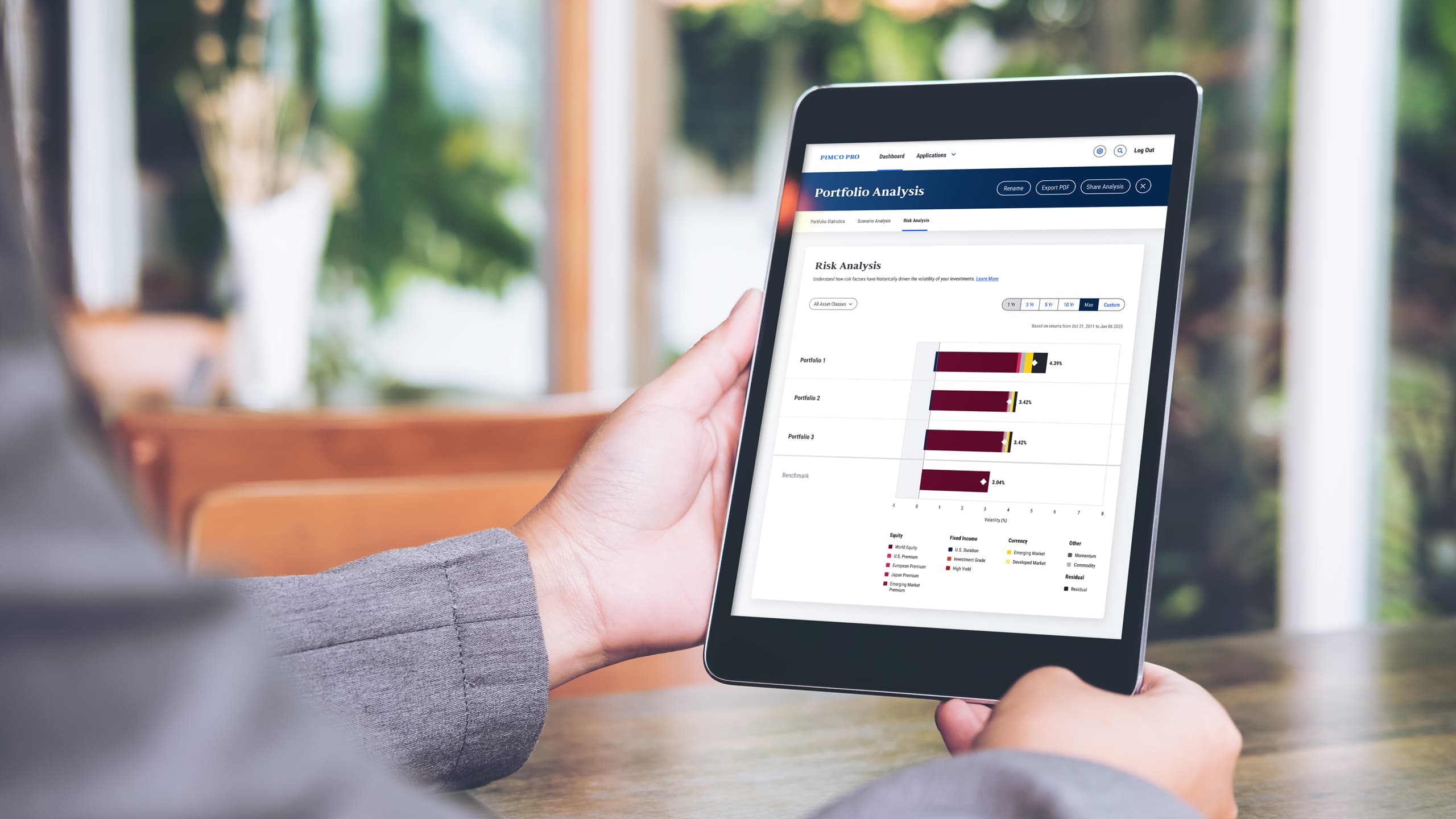

Target Date Analysis at Your Fingertips