Equities at PIMCO

Explore PIMCO's Equity Strategies

RAE (Systematic Value)

PIMCO RAE US Fund | PKAIX

- INST

- USD

PIMCO RAE US Small Fund | PMJIX

- INST

- USD

PIMCO RAE Emerging Markets Fund | PEIFX

- INST

- USD

StockPLUS® Suite

PIMCO StocksPLUS® International Fund (U.S. Dollar-Hedged) | PISIX

- INST

- USD

PIMCO StocksPLUS® Absolute Return Fund | PSPTX

- INST

- USD

PIMCO StocksPLUS® Fund | PSTKX

- INST

- USD

Smart Beta ETFs

PIMCO RAFI Dynamic Multi-Factor U.S. Equity ETF | MFUS

- USETF

- USD

PIMCO RAFI Dynamic Multi-Factor International Equity ETF | MFDX

- USETF

- USD

PIMCO RAFI Dynamic Multi-Factor Emerging Markets Equity ETF | MFEM

- USETF

- USD

PIMCO RAFI ESG U.S. ETF | RAFE

- USETF

- USD

PIMCO Equities: Move Beyond the Traditional Approach

This is a carousel with individual cards. Use the previous and next buttons to navigate.

Time-Tested Experience

Award Winning Suite

Array of Strategies

1Best Group over 3 Years Large Equity (2019, 2013, 2012, 2011, 2010). Lipper Asset Class Group Awards are awarded to eligible fund family groups and not individual funds. The Lipper Fund Best Group over 3 Years Large Equity award recognizes funds that have delivered consistently strong risk-adjusted performance, relative to peers. From Lipper Fund Awards from Refinitiv, ©2024 Refinitiv. All rights reserved. Used under license.

This is a carousel with individual cards. Use the previous and next buttons to navigate.

What a stronger political mandate means — and doesn’t mean — for growth, inflation and financial markets

Kevin Warsh, a respected and experienced policymaker and investor, has been nominated as the next U.S. Federal Reserve chair.

Marc Seidner, CIO non-traditional strategies, explains why it isn’t “too late” for bonds.

Policy support is helping narrow mortgage spreads, and valuations remain historically attractive. Portfolio manager Dan Hyman discusses the opportunity across agency mortgage backed securities (MBS), which offer high quality, liquid exposure with defensive traits and compelling income potential.

With the policy rate in neutral territory, the Fed embraces data dependence – and faces a delicate balancing act in 2026.

Reevaluating passive bond allocations – which have historically underperformed active strategies – may open the door to improved investment outcomes.

Marc Seidner, CIO of Non-traditional Strategies, explores opportunities across equities, bonds, credit, and commodities that have the potential to offer investors resilience and diversification.

Investors have poured into gold – but they may also see compelling benefits from a broad-based commodity allocation.

The path of U.S. monetary policy from here likely depends heavily on labor market developments.

Explore how today’s real estate market offers a rare combination of high yields, risk mitigation, and upside potential. PIMCO experts break down what’s changed in real estate lending, what remains resilient, and how active management is redefining success in both equity and credit strategies.

There’s a transformation underway in credit markets: from bank syndication to hybrid structures led by asset managers. Discover how duration risk, asset-liability mismatches, and demand for yield are creating high-quality credit opportunities and what it means for portfolio construction.

See why we believe commercial real estate debt stands out for value and stability in today’s market.

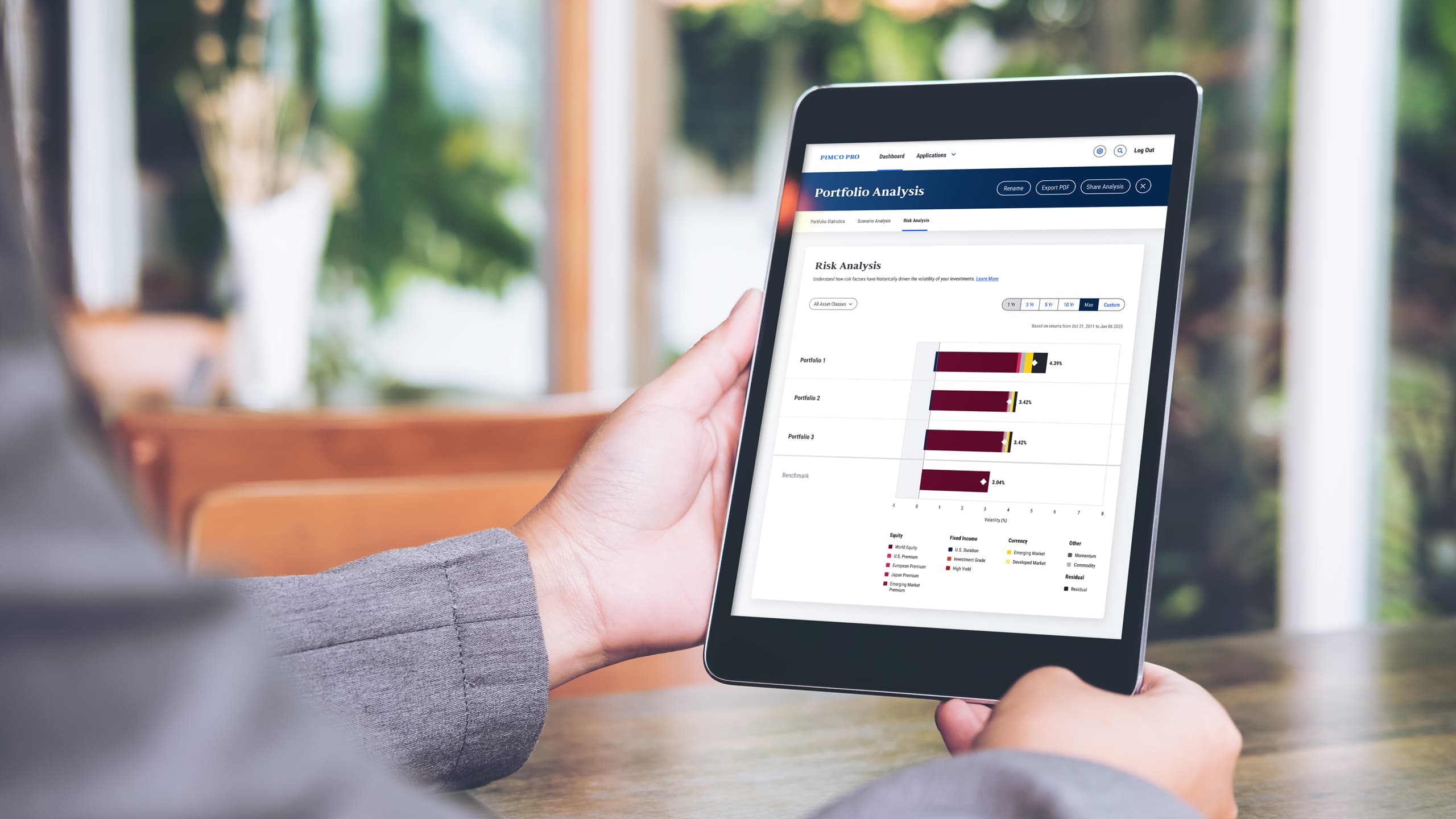

Diversifying Portfolios is Easy with Pro