Daniel J. Ivascyn

Latest Insights

This is a carousel with individual cards. Use the previous and next buttons to navigate.

When optimism is priced in, discipline matters. In this cutdown video from our quarterly webcast, Group CIO Dan Ivascyn explains how we avoid overreach in more sensitive areas and focus our income strategy on resilience, flexibility, and selective risk.

Group CIO Dan Ivascyn explores how a globally diversified, relative value approach can help identify resilient opportunities amid AI-related disruption.

We believe today’s mix of attractive starting yields, global economic divergence, and shifting markets create a compelling environment for active fixed income.

Everything’s on the table when PIMCO's Group CIO Dan Ivascyn and host Greg Hall get together, and the latest episode of Accrued Interest is no exception. They cover familiar territory — like the compelling and durable opportunities in bonds — and then branch out into the Fed’s likely next move, a deeper discussion on credit markets, how home bias can ground a portfolio, and even a ski trip without much snow.

From public to private credit, Group CIO Dan Ivascyn breaks down where value has re-emerged – and how disciplined selectivity and embracing complexity can help investors navigate the year ahead.

We see compelling opportunities for fixed income investments amid economic uncertainty and optimistic equity valuations.

Group CIO Dan Ivascyn shares how active management and global diversification continue driving strong bond returns amid credit risks and stretched equity valuations.

Group CIO Dan Ivascyn shares why today’s environment offers compelling opportunities for bond investors. From attractive high-quality yields to the potential benefits of locking in rates as cash returns decline, learn why fixed income strategies deserve a closer look now.

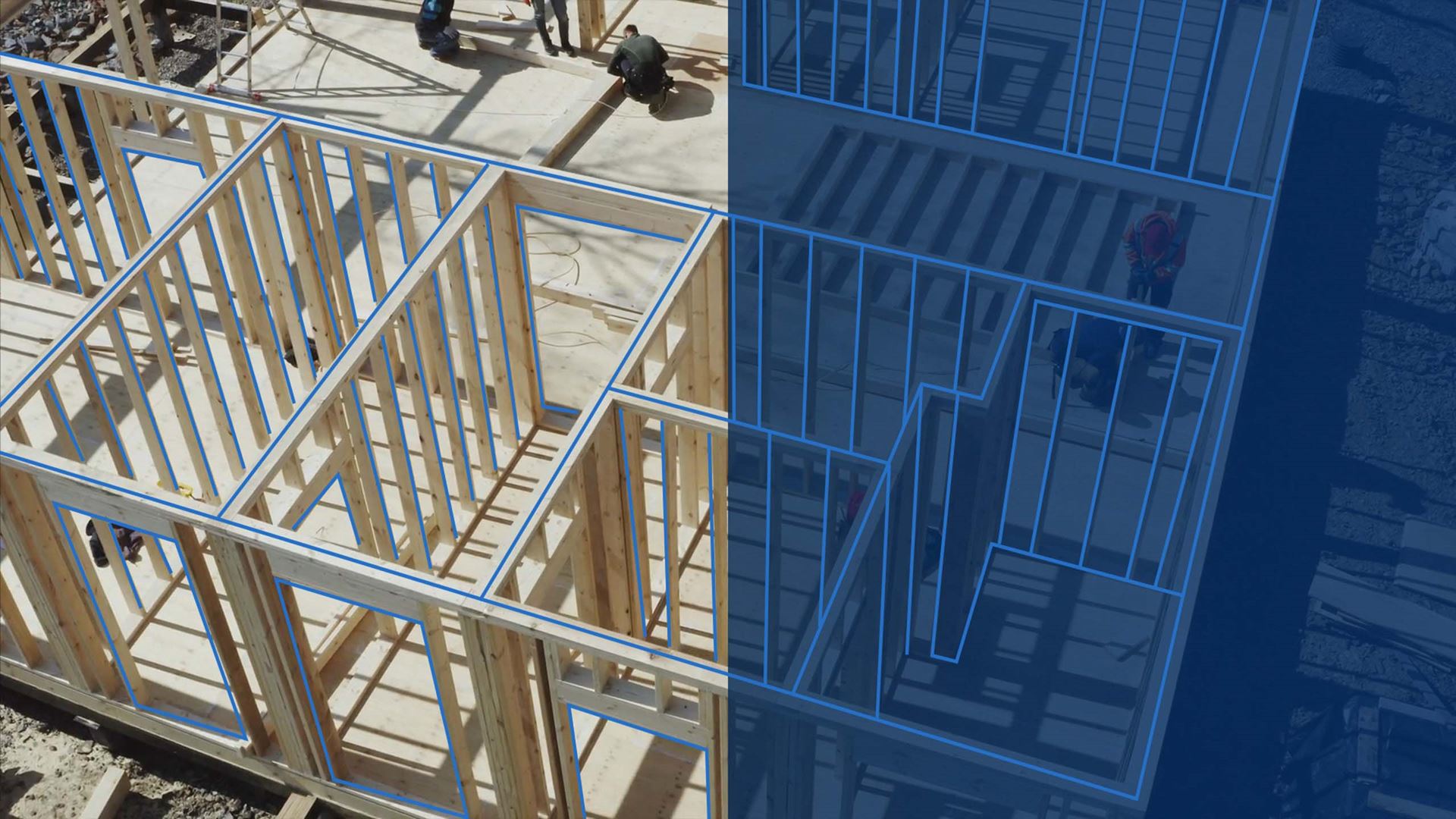

Asset-based finance fuels the real economy – from homes and universities to flights and consumer goods. Backed by tangible assets, it’s a growing opportunity for investors. Discover how PIMCO’s scale, data, and dual-market lens unlock strategic value in ABF.

Group CIO Dan Ivascyn discusses how investors should examine liquidity and economic sensitivity across public and private markets.

Group CIO Dan Ivascyn discusses valuation advantages, U.S. dollar dynamics, and why alpha opportunities remain plentiful in a globally diversified, flexible approach.

Group CIO Dan Ivascyn discusses how looming Federal Reserve interest rate cuts and continued policy uncertainty are shaping PIMCO’s investment playbook at a time of abundant fixed income opportunities.