Summary

- A disciplined, balanced allocation across assets and regions can help counteract behavioral biases (such as fear or overconfidence) and support more consistent, long-term investment outcomes.

- Systematic equity investing – using diversified factor exposures including value, quality, growth, and momentum – can provide durable sources of excess return potential and help portfolios weather policy shocks and market volatility.

- In multi-asset portfolios, our global outlook favors diversified equity exposure across regions, longer-maturity fixed income in the U.K. and Australia, and high quality securitized credit in the U.S.

In recent months, markets have whipsawed amid changes in trade policy, geopolitical shocks, concerns about fiscal sustainability, challenges to central bank independence, technological advancements, and earnings surprises in both directions. Despite this, stocks and bonds in much of the world are close to where they began the year.

It’s a powerful lesson for investing: While it can be tempting to react to changing headlines or to anticipate policy outcomes, in uncertain times, the risks of market timing and emotional decisions are magnified.

We believe that multi-asset investors are better served by staying balanced and disciplined: analyzing and allocating across assets, regions, and risk factors, and systematically harvesting the risk premium (i.e., compensation for taking on investment risk) inherent in the structure of different markets and asset classes.

In equities, for example, factors such as value, quality, growth, and momentum historically have outperformed broad market indices in a range of environments. In fixed income, we can seek steady above-benchmark returns in several ways: by targeting carry (i.e., yield from a range of bond characteristics), providing market liquidity, seeking risk premia associated with complex markets and situations, and carefully evaluating and selecting credit investments. All these risk premia are “always on” and may provide a cushion to portfolio returns during volatile markets.

A balanced approach helps mitigate behavioral biases

In volatile or uncertain markets, humans’ natural behavioral biases can become more pronounced: Fear, greed, overconfidence, overprecision, recency bias, and herd behavior can lead investors into costly missteps. For example:

- Recency bias can cause investors to anchor their decisions on the inflation and market turbulence experienced during the pandemic, even though the current environment is quite different.

- Overconfidence and overprecision can encourage them to position for a particular base case despite inadequate data, while disregarding other possible outcomes – positive or negative.

- Fear and greed can push investors into mistimed allocation shifts into or out of assets or sectors, even abandoning previously created exit plans and strategies.

A balanced, diversified allocation is one of the simplest ways to overcome these natural biases. In the most straightforward example, an investor with a 60/40 stock/bond portfolio who experiences an equity drawdown would find their portfolio underweight equity, and then they would add back equity risk – countercyclically – to rebalance back to 60/40.

Analogously, our previous Asset Allocation Outlook, “Negative Correlations, Positive Allocations,” discussed how active managers could adjust their stock/bond exposure targets based on changes in market volatility and correlations. The same arguments work for other sources of diversification, including asset classes, regions, and factors.

Across global markets, different regions are displaying a wide range of risk and return trends. This environment can increase the diversification benefit within asset classes, so that investors may benefit from global positions in equity and fixed income.

Maintaining a diversified and balanced portfolio is not at odds with tactical asset allocation timing decisions – that is, targeted moves into or out of positions based on specific developments. However, we believe these tactical exposures should be sized thoughtfully based on conviction and the potential risk/return trade-off. During periods of high policy uncertainty, as we’ve seen this year, the returns from tactical timing may be more volatile.

Harnessing equity factors to seek returns above the benchmark

Within a balanced and diversified approach, investors can take many approaches to seeking attractive returns while navigating risks. In stock markets, the risk premia attached to equity factors such as quality, value, momentum, and growth are well-understood and historically have provided durable sources of excess return over the long run.

PIMCO’s approach to equity factor investing is distinct in a few important ways:

- We use multiple definitions for each of these factors, incorporating where possible additional fundamental or alternative data sources.

- We combine individual factor scores into a consolidated score for each stock, which enables greater transparency.

- We optimize factor portfolios under constraints (e.g., stress tests) to adjust for appropriate risks, including country, region, and industry tilts, as well as tracking error and liquidity limits.

The goal of this approach is, once again, to seek balance and diversification across multiple sources of alpha: ensuring that no factor takes on outsize weight relative to others, capturing upside from country and industry tilts where factor scores are highest.

Compared with single-factor methods, PIMCO’s multidimensional approach may result in more resilient portfolios with more consistent performance, because the propensity for individual factors to experience crashes (common for momentum) or lengthy performance droughts (as with value) can be mitigated. (Learn more about PIMCO’s approach to systematic equity investing in this video.)

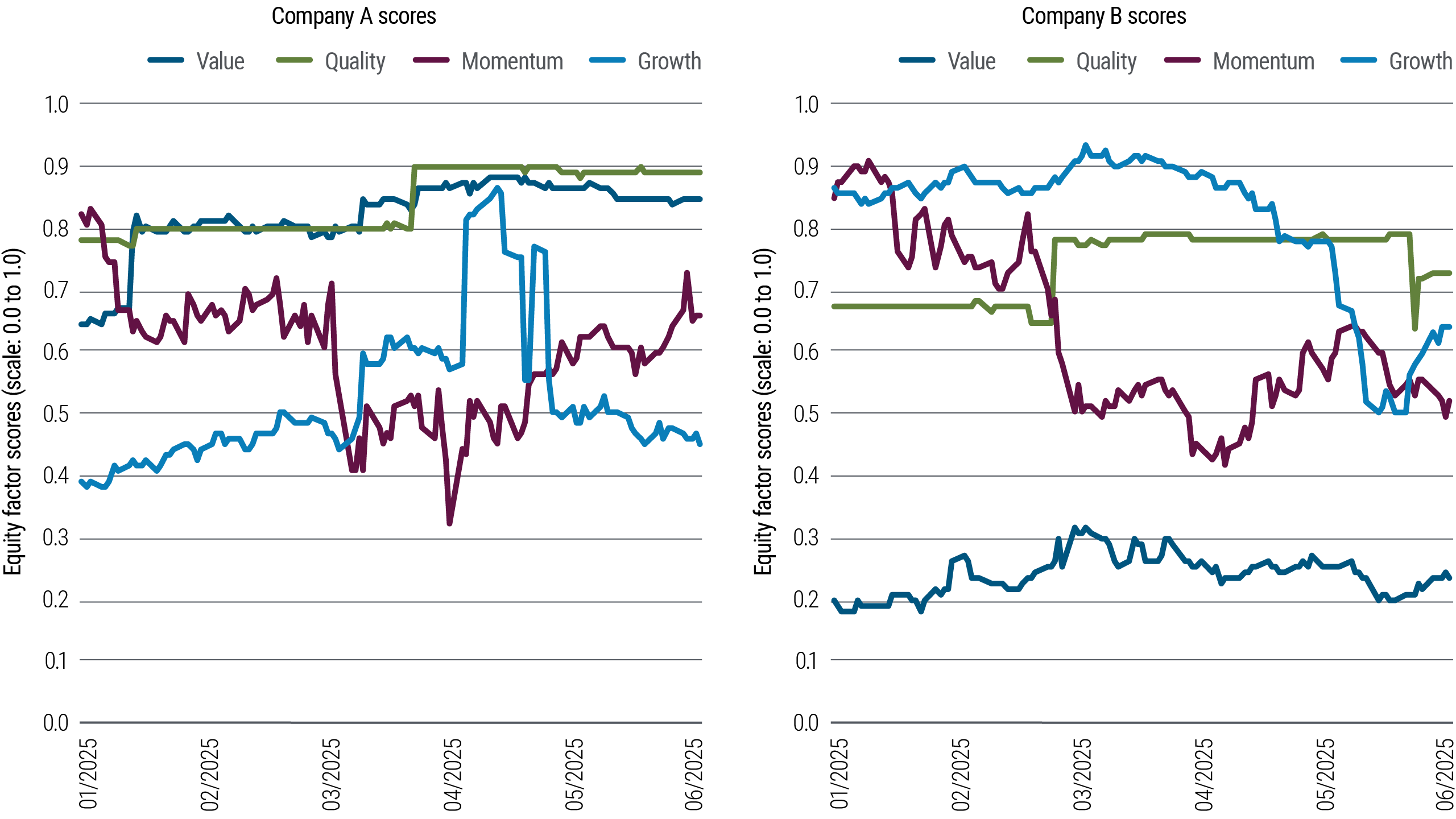

Even though PIMCO takes a quantitative approach, it is not a black box strategy, because the component factor scores for any stock in the portfolio are transparent and can be readily understood (see Figure 1). The quantitative approach serves to manage the risks of behavioral bias and emotion, setting up the necessary discipline to successfully navigate unusual environments – such as those this year.

The last few months demonstrate how equity factors can respond to policy shifts. Tariffs affect different individual companies in very different ways depending on their domicile and international trade exposure. Companies may also face second-order tariff effects if their suppliers or customers see tariff-driven price increases or shortages.

Following the U.S. tariff announcement on 2 April 2025, equity markets sold off broadly and indiscriminately, creating clear opportunities for risk premia investors such as PIMCO to reposition portfolios:

- Leveraging updated earnings forecasts from global bottomup equity analysts to enhance the growth factor.

- Harnessing momentum signals through analysis of price movements in cross-border firms and their supply chains, including domestic suppliers and customers likely to absorb cost pressures.

- Spotting undervalued companies by identifying firms whose prices have declined more than peers after adjusting for sector and regional differences.

- Focusing on quality exposure by targeting resilient firms poised to outperform if policy changes or other developments trigger an economic downturn.

During this volatile year, our systematic equity approach, combined with business cycle data and awareness of investment biases (specifically home country bias), helped PIMCO underweight U.S. equities versus rest-of-world equities, rather than chase the familiar U.S. mega-cap returns of the past decade. Our quantitative framework helped steer us away from overreacting or overtrading amid the market turmoil. Staying the course, maintaining balance – these are informed investment decisions, not inertia, amid significant uncertainty.

Subsequent pauses and pivots in tariff policy – and the related market volatility – highlight how the ability to harness these equity factor risk premia could be crucial to investing amid persistent policy uncertainty.

Asset allocation views: finding balance amid uncertainty

The country and sector tilts that emerge from a systematic risk premium approach are one of the inputs into PIMCO’s longstanding forum process. At these regular Cyclical and Secular Forums, rigorous debate among investment professionals from around the world informs both our top-down macro outlook and bottom-up investment positioning. (For our near-term views, please read our latest Cyclical Outlook, “Seeking Stability,” and for a look at trends over the next five years, read the Secular Outlook, “The Fragmentation Era.”)

Insights from our measured analysis of equity markets and factors help refine our forum discussions on the business cycle and the implied high-level asset allocations. In addition, the analysis includes quantitative economic and business cycle trackers, internal surveys, and high-frequency data sources.

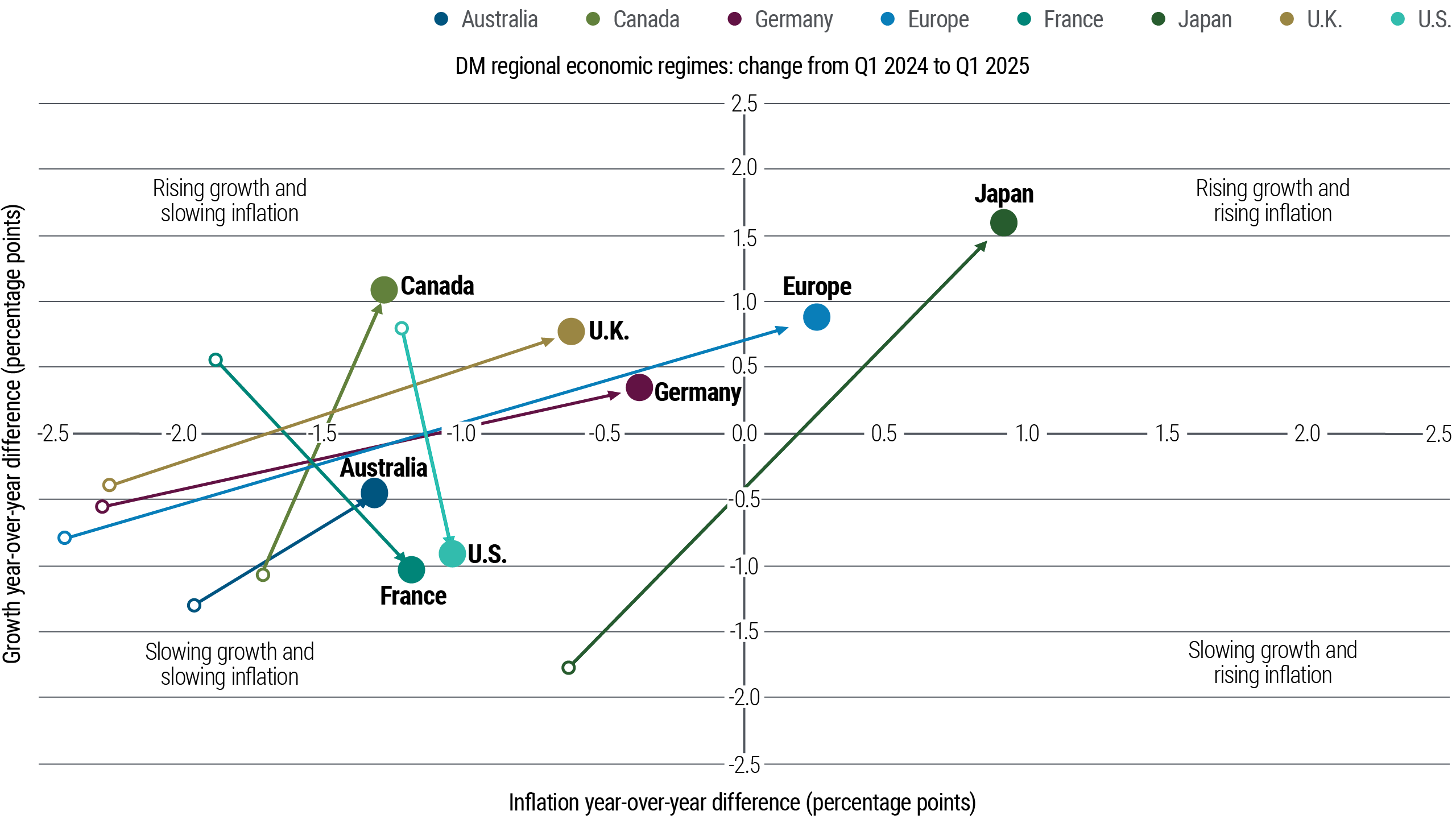

The effects of trade and fiscal policy shifts are not yet clear in the macro data, and the policies themselves are evolving rapidly. All the same, it is clear that U.S. exceptionalism is fading: Our business cycle trackers show a slowing pace of growth that contrasts the reacceleration taking place in most other developed market economies (see Figure 2).

For equity positioning, this macro outlook (which is consistent with the equity factor model) suggests more neutral exposures to the U.S. and an increased focus on Europe and Asia, where valuations appear more attractive. The prospect of fiscal expansion and improved policy coordination in Europe has already begun to boost local equity market momentum.

In addition, we believe that some longer-term equity themes remain in play: For example, AI technology is speeding forward, with more real world use cases that could boost productivity over time. That said, AI still requires vast investment that has not slowed despite competition from efficient Chinese models.

AI is also driving sharp growth in energy demand, which in turn is boosting research in cost-effective renewable technology and driving gains for innovative utility companies.

In fixed income, rising yields represent an increasingly attractive proposition for high quality fixed income, but this is tempered by volatility in longer-maturity U.S. Treasuries amid the potential for higher fiscal deficits. Fortunately, higher rates and positive real yields globally enable better diversification of longer-term fixed income allocations into other regions such as the U.K. and Australia, where inflation is relatively contained and there is limited need to issue sovereigns to fund higher government spending.

Corporate credit spreads above like-maturity sovereign bonds are still tight, in many cases not offering adequate compensation for risk, in our view. Therefore, we still prefer to take credit exposures through high quality securitized credit, such as bonds exposed to the housing market and to the U.S. consumer (read our recent PM Chartbook on the U.S. consumer). U.S. agency mortgage-backed securities (MBS) remain attractive, and spreads have widened even beyond those of investment grade corporate bonds (watch our latest video on agency MBS).

Growing dispersions among currencies have increased opportunities for earning attractive yields, and we maintain positions in stable, higher-yielding currencies as an additional source of potential return.

The U.S. dollar, despite its recent decline, isn’t likely to lose its status as the world’s reserve currency in the foreseeable future. But dollar bear markets are possible, over both the short and long term. A gradual shift away from the U.S. dollar could continue as global portfolios rebalance at the margin to more diversified allocations in risk assets.

Finally, risk-averse investors can look to take advantage of periods of relative market calm to add inexpensive risk hedges or trend-following overlays, along with active drawdown mitigation approaches, to improve the risk/return profile of a broader portfolio.

Key takeaways: Focus on enduring principles

Policy-related uncertainty in the U.S. is likely to remain elevated for some time. Rather than expending energy (and portfolio risk budget) on efforts to predict any particular outcome or to time shifts in the correlation patterns among asset classes, we believe investors should remain focused on the elements of investing that have not changed: diversification, balance, quality, flexibility, steady exposures to multiple sources of potential return, and careful risk management. Over time, the only certainty is change.